Rich Hong Kong Families Sell Mansions at Discounts to Repay Debt

- Ho Shung Pun’s family sold homes for $250 million in a month

- Owners hammered by slumping property valuations, high rates

Some of Hong Kong’s wealthy families have been caught up in the city’s real estate slump after selling luxury homes and other properties at a loss to pay back loans.

Just in the past month, one debt-laden family disposed of seven properties for $250 million in the prestigious Peak district, with some going for hefty discounts. In April, a family-run company sold its stake in the AIA Central building at a $20 million loss. Another clan that built its fortune in retail sold a shopfront at a 60% loss and had other properties seized by receivers.

In the residential sector alone, about 75% of high-end property transactions — those worth more than $10 million each — in the first half of the year involved financially stressed sellers, according to data from CBRE Group Inc.

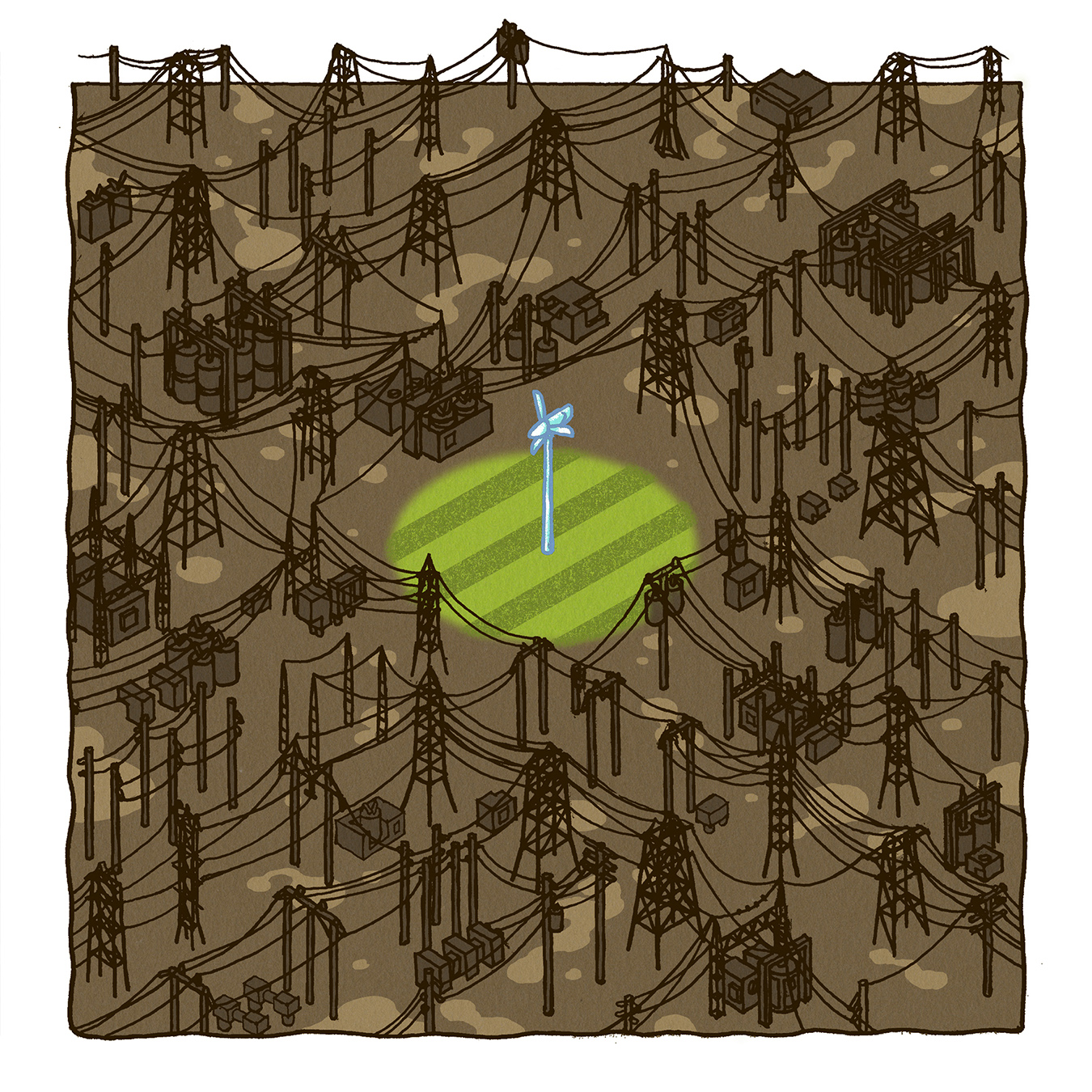

The sales are putting further pressure on Hong Kong’s real estate market, which has been in a downward spiral in the past few years as the financial hub loses its luster. While the owners typically don’t disclose the reasons behind their transactions, some are facing financial pressure as China’s economy slows, interest rates remain high and property values decline.

“There have been quite big changes because for the past 15 years, family owners didn’t bother to sell,” said Reeves Yan, head of capital markets at CBRE Hong Kong. Mansions were usually only sold by developers conducting business, he said. “But now there are a lot of small or medium family owners selling because they are under pressure.”

The most prominent example is the Ho family. Led by Ho Shung Pun, director of 69-year-old real estate investment firm Kowloon Investment Co., the low-profile clan pledged at least 12 of its properties to take out loans amounting to about $350 million, according to calculations by Bloomberg using public filings.

Ho raised a $205 million loan from Gaw Capital last year that was backed by seven luxury residences, according to people familiar with the matter. Four of those properties, located at 46 Plantation Road, were sold in a cash transaction for HK$1.1 billion ($141 million) in July. They went for about half the price of the market peak, according to Savills Plc, which brokered the deal.

The remaining three mansions, on Peak Road, were later sold for $110 million, according to local media. Gaw Capital declined to comment.

In addition, Ho and his nephew Ho Sai Wing borrowed HK$85 million from moneylender X8 Finance at an interest rate of 29% for an initial installment and about 18% for the rest, according to public filings. The family also used a residential property at Happy Valley to borrow HK$200 million from UOB Kay Hian Credit Pte., which is linked to Singapore’s United Overseas Bank Ltd. The bank didn’t respond to requests for comment.

“Some property owners have been encouraged by banks to obtain additional charges on their already mortgaged properties when interest rates were low a few years ago,” said Raymond Ho, executive director of capital markets at Jones Lang LaSalle Inc. in Hong Kong. “However, these property owners are now confronted with the double impact of a property price correction and high interest rates.”

Kowloon Investment didn’t reply to emailed requests for comment. A company representative declined to comment when reporters visited the registered office address in Central. She said that the elder Ho wasn’t in the office and there was no means of contacting him.

Other wealthy families in trouble include that of the late retail magnate Tang Shing Bor, which has been looking to sell real estate worth billions of dollars since 2020. This year, receivers seized at least eight properties owned by the Tangs, including a shopping mall and a hotel, and the family sold a shopfront at a 60% loss in May, according to local media reports.

The son, Tang Yiu Sing, and others were sued by a creditor in July for more than HK$1.1 million in outstanding loan payments, a court filing shows.

Read more: Hong Kong’s Shop King Struggles to Sell Billions in Property

Lai Sun Development Co., which is run by the family of the late industrialist tycoon Lim Por Yen, has been selling properties from residential to retail and commercial. In April, the group offloaded a 10% stake in the AIA Central office for a loss of about HK$154.6 million. The net proceeds were to be used to repay bank loans and provide working capital.

Meanwhile ITC Properties Group Ltd., a developer founded by Charles Chan Kwok Keung, former chairman of Hong Kong’s Television Broadcasts, sold the 30th floor at the Bank of America Tower to repay a loan, it said in an exchange filing in April. The office space went at a HK$4 million loss, it said.

A representative for ITC Properties declined to comment. Lai Sun didn’t reply to emailed requests for comment. A representative for Stan Group, which is led by the younger Tang, didn’t reply to a request for comment.

For the mansion sales, buyers are typically high-net-worth individuals looking for distressed situations at deep discounts, according to brokers. This includes mainland Chinese, who have led some of Hong Kong’s top transactions this year.

More families are likely to offload properties this year as the US Federal Reserve is in no hurry to cut rates, said CBRE’s Yan. That means homeowners could face borrowing rates of more than 5%, higher than the city’s typical rental yield of 3%. Hong Kong’s interest rates follow those in the US because of the local currency’s peg to the greenback.

“You can imagine that if this situation drags longer, more and more owners will face difficulties,” said CBRE’s Yan. “Some of them may default on their interests, get cash flow problems and be forced to sell their property.”

— With assistance from Shawna Kwan