TMTB Morning Wrap

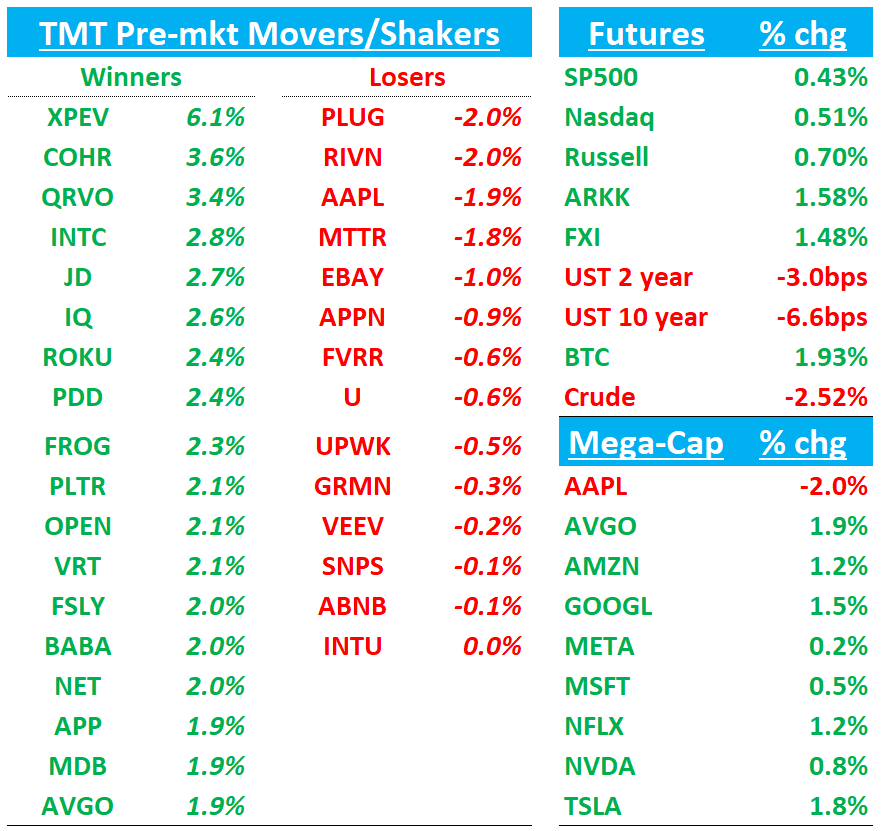

QQQs +50bps as yields are moving lower across the curve today with 10 year down 7bps and 2 year down 3bps. Lots of Trump news yesterday; key ones include: No tariffs on Day 1 (WSJ), but said he plans to impose previously threatened tariffs of as much as 25% on Mexico and Canady by Feb 1. VK knowledge put it well this morning “Remember, if tariffs are just a negotiating tactic, which is the best-case scenario, they need to remain a credible threat, which means Trump will never disavow them or acknowledge a “softer” approach to their implementation.”

On Tiktok, signed an EC instructing attorney general to delay enforcement of the ban for 75 days and suggested the US gov’t should be a half owner of Tiktok’s U.S biz in return for keeping the app alive and said: “If we make a TikTok deal and China doesn’t approve it, we could maybe put tariffs on China.” Alive and kicking still…

Tiktok’s CEO was at the inauguration, as well as Sunday, Zuck, Bezos, Altman, Musk and Cook.

What a difference 4 years makes…

BTC +2% after some crazy meme-coin mania over the weekend as Trump launched his own (Reuters)

We get NFLX tonight (bogeys below) to kick off earnings season…

Lots to get to this morning…

AAPL: Gets a couple downgrades from Jefferies to Sell and Loop to Hold / MS removes from top pick / JPM out negative as well

Jefferies cuts AAPL to Underperform from Hold, target to $200.75 from $211.84. Cites rich valuation at 32x FY25E PE and 15% above DCF value, consensus estimates too high despite recent cuts, muted AI smartphone adoption including Apple Intelligence, and potential iPhone packaging delays. Sees near-term risks in Q1 results/Q2 guide (sees AAPL to miss rev growth guide of 5% in Q1 and guide only to low single digit rev growth in Q2, below street), mid-term headwinds from iPhone 17 sales and limited Apple Intelligence traction through 2025. Jefferies sees 13% downside to shares.

Loop downgrades Apple as supply chain checks point to lower demand: Loop cuts AAPL to Hold from Buy, $230 target. Supply chain checks indicate iPhone demand drop starting in March quarter, significantly worsening in June/September. Analyst's previous bullish structural thesis may play out but not within next nine months

JPM trims AAPL target to $260 from $265, keeps Overweight rating ahead of Q1 results. JPM is more concerned about outlook than quarter, highlighting ongoing China share erosion as product cycle peaks and local subsidies target lower-tier phones. Notes AI features showing weak adoption, suggesting flat unit sales ahead, though sees limited downside given replacement rates at trough levels. Flags strengthening USD as additional near-term challenge

STX/AAPL: MS replaces AAPL with STX as top pick

MS maintains its Overweight rating on Apple with a $273 target, backing the thesis of accelerating device upgrades, stronger gross margins, and steady Services growth. However, MS sees STX offering greater outperformance potential over 3-6 months, with more upside to target despite Apple's recent weakness, driving STX's selection as Top Pick in IT Hardware coverage."

Counterpoint says AAPL'S IPHONE SALES IN CHINA DROP 18% YOY IN HOLIDAY QUARTER. Apple's iPhone sales in China fell 18.2% during the December quarter, slipping to third place in the market, according to Counterpoint Research. Huawei reclaimed the top spot, driven by a 15.5% YoY surge, thanks to its Mate 70 series and mid-range Nova 13 lineup. Apple's new AI-enabled iPhones struggled to maintain momentum, as key features remain unavailable in China while the company seeks a local partner for AI infrastructure. Globally, iPhone sales dipped 5% for the period. China's smartphone market saw its first quarterly decline in 2024 after steady growth earlier in the year.

NFLX Bogeys:(Lots of moving pieces given fx and lack of net add disclosure in 2025)

Q4 Sub Adds: ~13M vs street 9.2M

Q4 Revenue Growth FXN: 17-18% vs street at 17%

Q4 Revenue Growth Reported: 15%

Q4 EBIT: $2.2B, 22% margins in line with guide

Q1 Sub Adds: Street is at 5M but NFLX has said they will stop reporting net adds in 2025

Q1 Revenue Growth FXN: 16%

Q1 Revenue Growth Reported: 13% vs street at 13.5%

FY 25 Revenue Reported guide: miss on fx: 9-11% vs street at 13% (c/c 14% vs 13%)

FY25 Operating Margin: 100bps expansion vs 2024

3P Roundup:

CHWY: Uptick at Yip in weekly data

CPNG: M-sci lowering estimates on softer data (Gmarket competition) and fx headwinds in Dec

META: Edgewater positive says impression value continues to rise bc of better optimization

ALAB: Morgan Stanley downgrades to Hold from Buy at $142 PT

MS downgrades ALAB to EW, citing valuation fully reflects PCIe switch and ASIC growth prospects. While bullish on AI connectivity, MS sees no major catalysts for further re-rating. Expects ALAB to exceed estimates near-term from ASIC content ramps in CY25, but views this as priced in. Notes potential risks from NVDA's Hopper-Blackwell transition and rising competition. MS remains positive on AI story but sees less compelling risk/reward at current levels

TER: MS downgrades to Sell, lowers PT to $117 from $121

MS downgrades TER citing persistent market share losses to Advantest amid test market's shift toward HPC/DRAM from smartphone/NAND segments. Projects 12% revenue CAGR 2024-26, below Street's 21% and company's 13-20% target, viewing ASIC and Apple growth as insufficient to alter competitive dynamics. Expects ASIC test to reach only 6% of market by 2026, while Apple test revenue rises to $450mn but remains below 2020-21 peak levels. MS sets $117 target (15% downside) using 23x FY26 EPS of $5.07 (17% below consensus), applying reduced 20% premium vs historical 40% given market share erosion. Anticipates downward revision to FY25-26 targets in Q4 earnings amid weaker 2024 outlook and tempered growth prospects.

INTC: Intel upgraded to Hold from Reduce at HSBC with $20 PT

HSBC upgrades INTC to Hold from Reduce with $20 target. Views stock as fairly valued following 40% decline from July peak, with IDM 2.0 execution uncertainties and recent management departures now reflected in share price. While HSBC suggests downside appears limited and indicates 'worst seems to be over,' firm remains hesitant on timing of business recovery, citing need for clearer execution evidence.

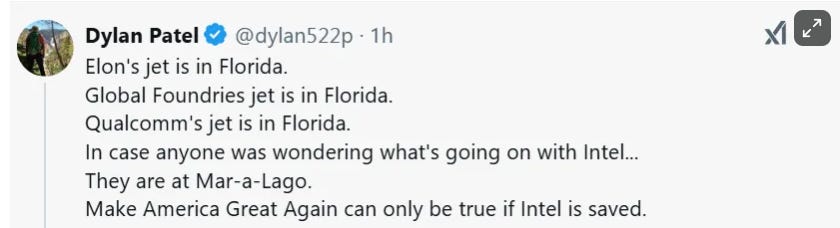

Also more speculation on INTC this weekend:

QRVO: Qorvo upgraded to Overweight from Equal Weight at Morgan Stanley

MS's Moore upgrades QRVO to Overweight from Equal Weight, raises target to $106 from $90. Sees activist involvement driving urgency in margin improvement efforts, potential for $9.50+ sustainable EPS with fundamental changes. Notes activist could unlock additional value through strategic shifts

PANW: Morgan Stanley ups Palo Alto target, sees attractive entry point

MS lifts PANW target to $230 from $223, maintains Overweight rating following recent pullback. MS notes their Channel checks indicate stronger platform deals and market share gains across security categories. MS sees potential for stock to double in 4-5 years driven by expanding platform adoption and multi-category growth. Identifies multiple catalysts including potential Q2 earnings beat, accelerating RPO growth, and upcoming new long-term targets later this year.

FRSH: Wells expects Freshworks to miss 2026 growth targets, downgrades to Underweight

Wells cuts FRSH to Underweight from Equal Weight, lowers target to $13 from $16. Wells Fargo views FRSH positioned unfavorably in mid-market ITSM due to expanding competition and lowest R&D spend among peers. Wells Fargo expects company to miss 2026 growth targets, citing product spread too thin and ITSM growth slowing to market rates

MELI: Raymond James upgrades to Strong Buy from Outperform with $2,250 PT

RAJA upgrades its MELI rating to Strong Buy (from Outperform) reflecting its belief that utilization will improve following fulfillment regionalization investments (more than eight fulfillment centers [FCs] in 2H24) on sustained secular eCom growth (~30% Brazil/Mexcio GMV FX-neutral growth) offsetting macro headwinds (Brazil rate hikes, FX) while maturing credit card vintages are likely to lessen the provisioning headwinds leading a turn in sentiment in possibly the second half of the year, after which estimate revisions could start to head upward. While pressured margins were the story of 2024, RAJA thinks the ROI is clear on fulfillment and credit investments, and it thinks MELI has a strategic, comparative advantage in fintech since it owns 95% of the credit underwriting data and has low-cost CAC via its $50B GMV Marketplace business, ultimately setting up a favorable risk/reward in 2025

WIX: Raymond James upgrades to Strong Buy from Outperfrom and raises PT to $300 from $225

RJ upgrades WIX based on growing confidence in Wix Studio taking market share from WordPress among partners/agencies (amid WP Engine's legal issues). RJ expects this to drive accelerating growth and profits, projecting Partner FCF margins rising from ~0% in 2023 to potential high-teens in 2024. RJ sees path to mid-40s RoF with Partners potentially exceeding 50% of business."

GLW: DB adds to Catalyst Call Buy Idea List with $54 PT

DB adds GLW to Catalyst Call Buy list, seeing upside into March 18 Analyst Day. While Q1 guide likely shows seasonal sales/EPS decline (higher JPY hedge), DB views this as clearing event before constructive Analyst Day. Expects updates on Project Springboard ($3bn revenue upside by 2026E, ahead of plan) and visibility on EPS/FCF growth (DB projects 15% EPS CAGR). Anticipates increased shareholder returns via buybacks and 2025E dividend growth. DB notes GLW only trades at 18.9x 2026E core EPS, ~1x below S&P despite projected 15% EPS CAGR.

Crypto/BTC: Bernstein comments on TRUMP Coin:

Whichever way you see it, we think a new chaotic crypto era is here. The President of America has his own coin. Our view would be to view the event as a signal that a new crypto regulatory era is here to stay and invest in the more valuable parts of the ecosystem. But some may still cringe - it is what it is.

JD: JD.com placed on 'Positive Catalyst Watch' at JPMorgan

JPM's Chang adds JD to 'Positive Catalyst Watch' ahead of Q4, expecting beat on results/2025 guide in March. Notes trade-in policies driving better revenue growth, margins resilient on disciplined spending. Maintains Overweight, $50 target.

META: Meta's Instagram head announces new app called "Edits"

Adam Mosseri, the head of Instagram, wrote in a post on the platform: "Today we're announcing a new app called "Edits" for those of you who are passionate about making videos on your phone. There's a lot going on right now, but no matter what happens, it's our job to provide the best possible tools for creators. Edits is more than a video editing app; it's a full suite of creative tools. There will be a dedicated tab for inspiration, another for keeping track of early ideas, a much higher-quality camera, all the editing tools you'd expect, the ability to share drafts with friends and other creators, and - if you decide to share your videos on Instagram - powerful insights into how those videos perform. You can preorder the app today in the iOS App Store, and it's coming to Android soon. The app won't be available to download until next month, and in the meantime, we're going to work with a handful of video creators to get their feedback and improve the experience."

MNDY: Monday.com price target lowered to $300 from $350 at Jefferies

Jefferies cuts MNDY target to $300 from $350, keeps Buy. Jefferies views fears of FY25 revenue guide at 22-25% (vs consensus 26%+) as too pessimistic given Q4 growth of 33-35%, stable macro, pricing, add-ons, and enterprise traction. Trims estimate to 23% from 26.8%. Maintains MNDY as top mid-cap pick

ROKU: Roku initiated with an Outperform at JMP Securities

JMP initiates ROKU coverage with Outperform rating and $95 target. Views company as well-positioned to benefit from $166B linear TV ad spend migration to connected TV platforms. Highlights multiple catalysts ahead for upward estimate revisions, noting TV remains largest non-digital medium undergoing digital transformation. JMP cites Roku's strong CTV platform positioning while dismissing near-term competitive concerns as exaggerated.

TTD: Trade Desk initiated with an Outperform at JMP Securities

JMP's Condon launches TTD coverage with Outperform rating and $150 target. JMP notes TTD is well positioned to benefit from $166B linear TV advertising spend shifting to connected TV platforms. JMP notes TV remains largest non-digital medium in digital transformation phase. JMP sees multiple catalysts driving estimate revisions in coming quarters, highlighting expected market share gains across open web's growth channels, particularly in CTV space and Google-related opportunities

VST: Vistra resumed with an Outperform at Evercore ISI

Fire from Friday didn’t spread

Evercore ISI resumed coverage of Vistra with an Outperform rating and $202 price target. The firm anticipates Vistra will build on its 2024 momentum, with potential EBITDA and cash flow upside driven by higher power curves and a possible large customer load power supply contract later this year. It believes there is "substantial upside potential" to the company's EBITDA and cash flow from favorable power curves and/or major customer load contracts.

TSLA: Tesla price target raised to $500 from $315 at Piper Sandler

Piper boosts TSLA target significantly to $500 from $315, maintains Overweight rating and positions stock as their #1 buy-and-hold recommendation. Piper notes market increasingly recognizing Tesla's potential in real-world AI applications. However, Piper cautions that this compelling long-term narrative may face near-term pressure as current-year estimates remain highly uncertain and subject to revision

QCOM: Qualcomm placed on 'Positive Catalyst Watch' at JPMorgan

JPM's Chatterjee adds QCOM to 'Positive Catalyst Watch' ahead of earnings and expects favorable Q4/outlook on China smartphone subsidies and potential Samsung share gains

LOGI: Logitech placed on 'Positive Catalyst Watch' at JPMorgan

JPM's Chatterjee adds LOGI to 'Positive Catalyst Watch' ahead of earnings as he projects H2 revenue upside from resilient Peripherals/Gaming demand, driving gross margin expansion and earnings revisions. Maintains Neutral rating.

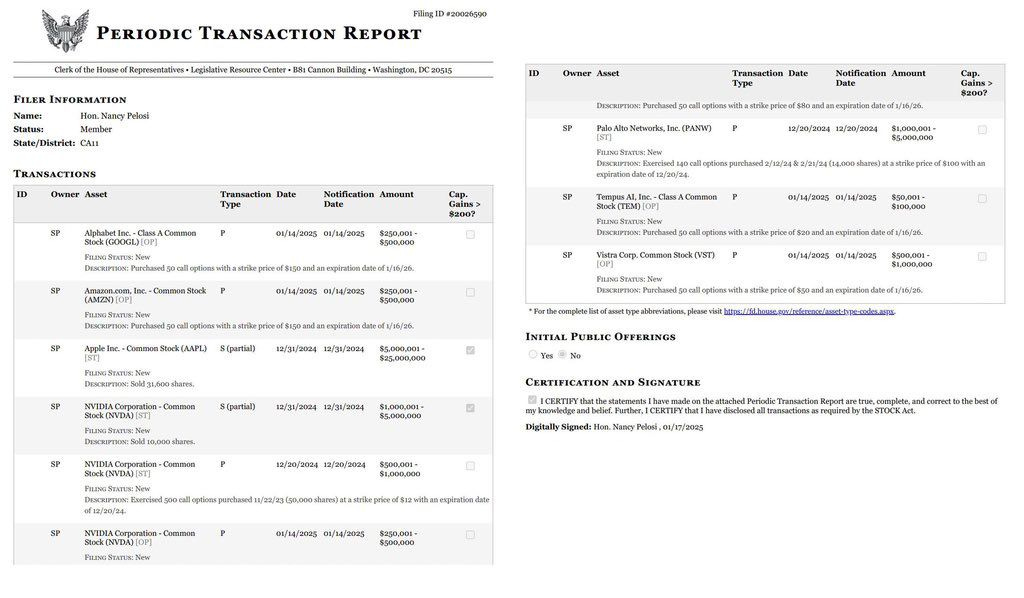

Pelosi new buys - Moving TEM +17% and VST +4% this morning

AFRM: SIG Downgrades to Hold, mainly on valuation

SIG downgrades AFRM to Neutral from Positive, maintains $57 target. Notes BNPL usage growing similar to early debit adoption, but stock has reached target. SIG notes holiday data indicates flat Y/Y BNPL spending share, suggesting GMV likely below consensus.

APP: Lauren Bilk out neg on APP again this morning - link

TTWO: Opco raises PT to $215 from $190, maintains Buy

Opco notes most investors remain on hold for more GTA 6 news directly from Rockstar. Any other issues are unlikely to change investor sentiment or create new debates that can impact the stock. Near term, NBA 2K's healthier Y/Y comp and stronger AAA slate for CY25 suggest that bookings trend will be OK ex-Rockstar. Despite a potentially more competitive year for PC/console gaming, Opco thinks TTWO is relatively more insolated from competition based on its differentiated franchises (Borderlands/Mafia) and genre dominance (NBA/WWE). Opco notes GTA 6 delay is always a possibility, but such concern weighs far less on investors' mind than ever before.

NOW: ServiceNow price target raised to $1,280 from $1,075 at BofA

BofA's Sills lifts NOW target to $1,280 from $1,075, maintains Buy and notes their partner checks indicate Q4 deals tracking in-line to better vs Q3. Sees NOW as AI revenue leader behind MSFT, with runway for market share/growth expansion

Other News:

APP: APP: AppLovin upgraded to Buy from Neutral at Arete

EBAY: Downgraded to sell at Arete

US chip restrictions disrupt Samsung's plan to gain foothold in China – DigiTimes

AAPL: President-elect Trump has spoken with Apple CEO Tim Cook and hinted at a potential investment by the world's most valuable company due to the US election win – NY Post

AAPL: in response to China's trade-in program which officially begins today (1/20), Apple has reduced the prices of a number of iPhone models to below CNY6,000 – Anue

AVGO: Broadcom chief eyes AI opportunity after confronting VMware backlash – FT

DIS: How ‘Mufasa: The Lion King’ Became a Sleeper Hit – NYT

Gen AI: Biden’s Sweeping AI Order Scrapped by Trump in Regulatory Reset– Bloomberg

INTC/UMC: UMC said it is working closely with Intel on its previously announced strategic partnership in Arizona plant, and is already verifying silicon performance for pilot production line in Arizona

MSFT: Microsoft-OpenAI Partnership Raises Antitrust Concerns, FTC Says – Bloomberg

Notebooks: street reportedly expects NB shipments to be above seasonality in 1Q25 thanks to the rollout of new AI PC models and rush orders prompted by tariff concern, likely benefiting brands and ODMs/EMSs – Economic Daily

TSM: TSMC Plants Resume Operation After Earthquake Spurs Evacuation – Bloomberg

Tiktok: TikTok gets reprieve with Trump order but with twist – Reuters – link

Samsung delays 1c DRAM development to 2Q25 amid Nvidia concerns – DigiTimes – link

TikTok: China’s gov’t signaled it is open to a deal that allows TikTok to stay open in the US – WSJ

TikTok: Perplexity AI makes a bid to merge with TikTok U.S – CNBC