Elon’s Orbit

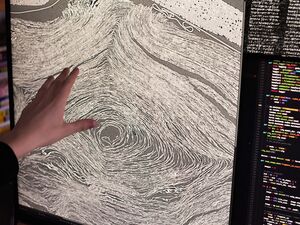

Musk’s galaxy of companies is under threat as Tesla spirals. These people keep the system running.

May 29th 2024

Tesla Inc. is a company in disarray. Layoffs are mounting. Morale is shattered. Its stock is cratering and sales are anemic. And, some investors say, it’s got a distracted leader at the helm.

Elon Musk runs five other companies in addition to the world’s largest electric car maker: SpaceX, the biggest privately held rocket and satellite provider; X, the social media site formerly known as Twitter; the Boring Co. tunnel company; brain-machine startup Neuralink; and artificial intelligence venture xAI.

Musk oversees more than 130,000 people around the world under what has morphed into Elon Inc., a shape-shifting conglomerate where few people have traditional titles but everyone knows exactly to whom they ultimately answer. While Musk burns brightly at the center of his corporate universe, a less visible coterie of consultants, fixers, board and family members orbits around him. Musk relies on this inner circle to handle urgent tasks across his stable of companies, though it’s often unclear how and when they are getting paid.

When times were good, many investors looked past the complexities of one person simultaneously running several companies. But now, there’s trouble brewing everywhere in Elon Inc. Tesla has gone from being a high-flying stock to one of the year’s worst performers. SpaceX’s Starlink business has come under scrutiny as a growing black market for its terminals takes its internet service to US foes like Sudan and Yemen. Meanwhile, Musk was recently deposed as part of an arbitration case related to Twitter layoffs.

Musk’s personal wealth dropped by roughly $27 billion this year through May 28, according to the Bloomberg Billionaires Index. He stands to lose even more of his fortune unless Tesla’s board is able to navigate its way around a judge voiding the unprecedented pay package directors arranged for him six years ago.

“It’s a very high-wire act for a part-time CEO with conflicting interests,” said Ivan Frishberg, the chief sustainability officer for Amalgamated Bank, which owns roughly 600,000 Tesla shares and recently penned a letter opposing Musk’s pay. “In the case of Tesla, the performance over the last year and the departures of key members of the executive team all suggest that this is not going to plan and that investors face increasing risk.”

The 52-year-old billionaire’s distractions are at the center of a fight for investors to re-approve his $56 billion pay package from 2018 at Tesla’s annual shareholder meeting in June. The payout was struck down in January after a Delaware Chancery Court judge ruled that the largest compensation package in US history wasn’t in the best interests of shareholders.

Musk, as well as others named in this story, didn’t respond to queries from Bloomberg.

- Jared Birchall: Elon Musk's Fixer Is Quietly Tending the World's Biggest Fortune

- Musk Pay Judge Slams 'Supine' Tesla Board. Here's Who Signed Off

- Larry Ellison's Lanai Isn't for You—or the People Who Live There

- Elon Musk's Starlink Terminals Are Falling Into the Wrong Hands

- Neuralink's First Patient Describes Living With a Brain Implant

Read More

Double Dip

Musk has become one of the richest people on the planet by making big bets in industries others shunned. He’s run toward risks, and he claims he spent countless hours sleeping on factory floors, crafting a management style that has drawn equal parts awe and ire.

But Musk has another secret to simultaneously running six disparate companies: He double dips.

Since 2015, Tesla and SpaceX have shared a vice president of materials engineering, Charles Kuehmann. When Tesla’s Autopilot software team needed help, SpaceX’s then-VP of software, Jinnah Hosein, jumped in to pull double duty and run the team temporarily. In 2020, Musk directed Tesla management to send their “smartest micro grid designer with a bunch of Powerpacks” to SpaceX, as Delaware Chancery Court Judge Kathaleen St. J. McCormick noted in her opinion.

One of Musk’s most senior employees at Tesla, Omead Afshar, who helped lead the electric vehicle maker’s Gigafactory project in Texas, also showed up in a senior role at SpaceX. And Shivon Zilis, director of operations and special projects at Neuralink, worked on AI projects at Tesla. She is also the mother of some of Musk’s children.

His money manager, Jared Birchall, is listed on incorporation documents as an executive officer of Neuralink despite his multiple roles as a fundraiser for SpaceX investment. He also advises on X’s business dealings and runs Musk’s nonprofit foundation.

“Musk regularly uses Tesla resources to address projects at other companies he owns,” McCormick said in the ruling striking down Musk’s pay package.

Antonio Gracias, a SpaceX board member and former Tesla director, has raked in billions of dollars personally and for his firm, according to the Delaware court decision. Ira Ehrenpreis, a venture capitalist who chairs Tesla’s compensation committee, has not only made hundreds of millions of dollars via his direct investments in Tesla and SpaceX, but has used his ties to Elon Inc. to raise money for his own firm.

Most Likely to Succeed? Biggest Class Clown? Listen to the latest episode of Bloomberg's Elon Inc. podcast for a closer look inside Elon's orbit. Subscribe to Elon, Inc. on on Apple , Spotify , iHeart and the Bloomberg Terminal.

Twitter Deal

Musk’s penchant for deploying resources across his empire was perhaps most starkly on display when he bought Twitter for $44 billion.

When he showed up at the social media site’s San Francisco headquarters in October 2022, he brought along Gracias, who helped carry out companywide layoffs. Steve Davis, president of Musk’s tunneling business, was so focused on slashing the site’s expenses that he moved his family into the company’s offices. Musk’s longtime attorney, Alex Spiro, advised the legal and policy teams. Birchall was there, too, overseeing the company’s business and executive transition.

Musk fired Twitter’s executive team and cut thousands of jobs, sometimes replacing them with employees from his other businesses. Droves of engineers from Tesla and SpaceX showed up to review Twitter’s code and help manage the engineering team. SpaceX’s human resources department was tapped to help plan the staff cuts. It’s unclear whether these people got paid for their work at the site, which Musk referred to as “voluntary.”

In late 2023, X CEO Linda Yaccarino said the social media site wasn’t a standalone business, but rather “part of a constellation of companies.” X made approximately $200,000 in advertising revenue from Tesla, according to the automaker’s proxy. The ads are meant to boost car sales, but they also help support the social network as it struggles to keep its biggest advertisers.

Musk’s bet is that operating his many ventures as part of one big universe can help improve the credibility of each of the businesses. A slide deck that recently circulated among some prospective xAI investors listed X and Tesla as strategic partners, seeking to highlight a major selling point: access to the “Muskonomy,” a term increasingly used in reference to his array of companies.

While it’s easy to see why Musk’s smaller companies can benefit from access to Tesla’s resources, the advantages are becoming less clear to the EV maker’s investors. “The amount of time Musk spent on the Twitter acquisition was undoubtedly a concern at Tesla,” the Delaware judge said in her ruling. Those worries are only rising.

New from Bloomberg: Get the Business of Space newsletter, a weekly look at the inside stories of investments beyond Earth.

With assistance from Alex Graves, Jack Wild, Jack Witzig, Tom Maloney, Sarah McBride, Loren Grush, Craig Trudell

Edited by Shelly Banjo, Jillian Ward and Catherine Larkin

Photos: Bloomberg(3)