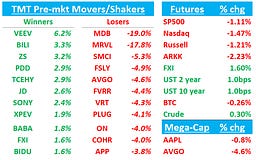

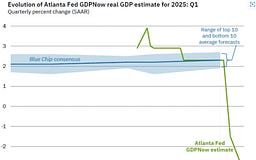

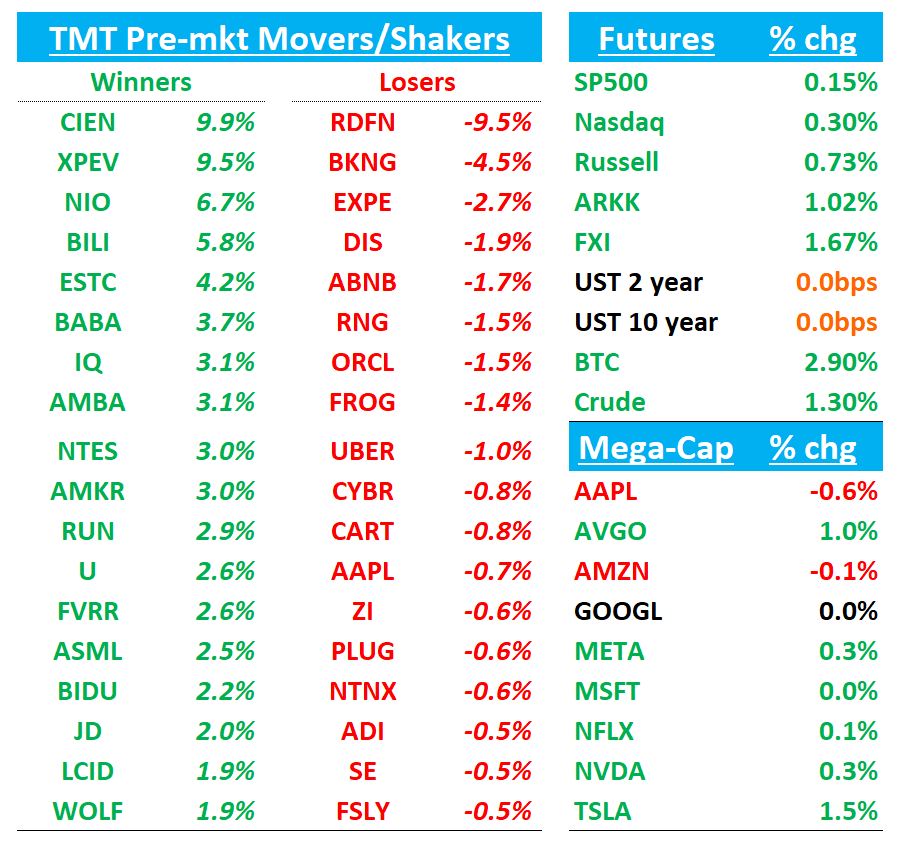

Good morning. QQQs +30bps after being down 70bps post-close at one point. BTC +2.5% popping back above $80k. China +1.6%. Yields flat.

早上好。QQQs 上涨 30 个基点,此前盘后一度下跌 70 个基点。BTC 上涨 2.5%,重回 8 万美元上方。中国上涨 1.6%。收益率持平。

ORCL + CIEN recap first then onto to News + Research. Let’s get to it…

ORCL + CIEN 先回顾一下,然后转到新闻+研究。我们开始吧…

ORCL -1%: Strong bookings overshadow mostly disappointing quarter…investors want to see backlog translate to revenue

ORCL -1%:强劲的订单量掩盖了多数令人失望的季度表现……投资者希望看到积压订单转化为收入

RPO stole the show +62% (accel from 50% last q) to $130B up from $97B last q (street at $103B, bogeys at $110B, and most bullish bogeys at $120B). $33B increase bigger than any prior six month increase. None of this includes any RPO from Stargate: “And we do expect Stargate, our first large Stargate contract fairly soon.”

RPO 表现抢眼,增长 62%(较上季度的 50%加速),达到 1300 亿美元,上季度为 970 亿美元(市场预期为 1030 亿美元,目标值为 1100 亿美元,最乐观目标值为 1200 亿美元)。330 亿美元的增长超过了之前任何六个月的增幅。这些数据均未包含来自 Stargate 的任何 RPO:“我们确实预计很快会签署我们的第一份大型 Stargate 合同。”

Co said that as backlog turns to revenue, revs should continue to accelerate from 6% in FY24 to 8% in FY25, to a projected 15% in FY26 and 20% in FY27 (street was at 13% / 15% before tonight)

Co 公司表示,随着积压订单转化为收入,预计收入增速将从 2024 财年的 6%持续提升至 2025 财年的 8%,进而达到 2026 财年预期的 15%和 2027 财年的 20%(此前市场预期为 13%/15%)

- OPM beat at 44% vs 43.6%

- OPM 超预期,达到 44%,而预期为 43.6%

However, rest of the quarter was subpar:

然而,本季度剩余时间表现不佳:

- Revs missed at $14.13B vs $14.39, decelerating to 6% vs 9% last q

- 收入未达预期,为 141.3 亿美元,对比预期 143.9 亿美元,增速放缓至 6%,上季度为 9%

- IaaS 51% cc y/y, down from 52% last q (bogeys 53%+)

- IaaS 同比增长 51%,较上季度的 52%有所下降(目标为 53%以上)

- SaaS 11%% y/y inline 11% last q

- SaaS 11% 同比符合 11% 上季度

Bulls will say that huge RPO beat is a massive accel and doesn’t include any Stargate revs and forward revenue guidance is significantly above street and the co continues to sound very bullish around demand. The co also said that component delays which have slowed cloud capacity expansion will ease in Q1 FY ‘26 as power capacity growth is expected to 2x in CY25 and 3x by FY26 and help drive better OCI revs going forward. Bulls will also say that ORCL has evolved into a strategic cloud provider with 101 cloud regions, more than any other hyperscaler and the co addresses a massive TAM of close to ~500B from infrastructure.

多头会说,巨大的 RPO 超预期是一个巨大的加速,并不包括任何 Stargate 收入,而前瞻性收入指引显著高于市场预期,公司继续对需求持非常乐观的态度。公司还表示,组件延迟减缓了云容量扩张,但将在 FY26 年第一季度缓解,因为预计 CY25 年电力容量增长将翻倍,到 FY26 年将增长三倍,有助于推动未来 OCI 收入增长。多头还会说,ORCL 已发展成为拥有 101 个云区域的战略云提供商,超过任何其他超大规模企业,公司从基础设施方面应对着接近 5000 亿美元的巨大 TAM。

Bears will say co has missed top line in 7 out of the last 9 quarters and doesn’t deserve the benefit of the doubt, IaaS came in light, May Q guide was light on revs/EPS, and investors are unsure whether the revenue translated for backlog will be margin dilutive or accretive and ramping capex will weigh on gross/operating margins going fwd. Some investors worry that ORCL’s OCI is predominantly AI training and AI training rev is low margin / short-term revs; as Bernstein put it, bears will say “Oracle is offering AI training capacity that Microsoft does not want and that once global AI training capacity increases Oracle’s AI training revenue will be hurt.” (Bernstein disagrees as they think ORCL hw architecture is different/more flexible than competitors")

空头会指出公司在过去九个季度中有七个季度的营收未达预期,因此不应给予其怀疑的余地,IaaS 表现平平,五月季度的营收/EPS 指引也较为保守,投资者不确定积压订单转化为收入后会对利润率产生稀释还是增厚效应,同时不断增加的资本支出将给未来的毛利率/运营利润率带来压力。一些投资者担忧 ORCL 的 OCI 业务主要依赖 AI 训练,而 AI 训练收入利润率低且具有短期性;正如 Bernstein 所言,空头会认为“Oracle 提供的 AI 训练能力是微软所不需要的,一旦全球 AI 训练能力提升,Oracle 的 AI 训练收入将受到损害。”(Bernstein 持不同意见,他们认为 ORCL 的硬件架构与竞争对手不同且更具灵活性。)

We think both sides have fair points and think ORCL likely remains a show-me story for now (on revs and margins). We do like the r/r here though:

我们认为双方的观点都很有道理,并认为 ORCL 目前可能仍是一个需要证明其收入与利润率增长的故事。不过,我们确实喜欢这里的风险回报比。

We still think co can do close to $8 in EPS in CY26 and think 22-23x is the right multiple, which is at the very high end of where stock traded at before OCI took hold and would mean $175-$185. Our dnside is $135 which is 20x CY25 street EPS of $6.70. So below $150, our base case $30 up and $15 down, which is 2:1. If stock got down to $145, then r/r begins to get more juicy at $10 down (<10% downside), $40 up (30% upside). That’s also good resistance from previous breakout back in Sept.

我们仍认为公司能够在 CY26 实现接近 8 美元的每股收益,并认为 22-23 倍是合适的市盈率,这处于 OCI 生效前股票交易区间的最高端,意味着股价将达到 175-185 美元。我们的下行风险是 135 美元,即 20 倍 CY25 市场普遍预期的 6.70 美元每股收益。因此,在 150 美元以下,我们的基本情况是上涨 30 美元,下跌 15 美元,比例为 2:1。如果股价跌至 145 美元,那么风险回报比开始变得更加诱人,下跌 10 美元(小于 10%的下行风险),上涨 40 美元(30%的上行空间)。这也是去年 9 月突破时的良好阻力位。

CIEN +9%: Solid Q1 with revs, EBITDA and margins beating.

CIEN +9%:第一季度表现强劲,收入、EBITDA 和利润率均超预期。

PR: “As the global leader in high-speed connectivity, we are incredibly well positioned to benefit from the global investment in networks to scale for cloud and AI. As a result, we are very confident in our ability to deliver in fiscal year 2025 and beyond.”

PR:“作为高速连接领域的全球领导者,我们极有优势从全球对云和 AI 扩展的网络投资中获益。因此,我们对在 2025 财年及之后实现目标充满信心。”

Guide on the call 通话指南

CIEN RESULTS: Q1 CIEN 业绩:第一季度

- ADJ EPS $0.64 vs. $0.66 y/y, EST $0.41

- 调整后每股收益(ADJ EPS)为$0.64,去年同期为$0.66,预估值为$0.41

- Revenue $1.07B, +3.3% y/y, EST $1.05B

- 收入 $1.07B,同比增长 +3.3%,预估 $1.05B

- Networking platforms revenue $821.2M, +1.7% y/y, EST $800M

- Networking platforms 营收 8.212 亿美元,同比增长 1.7%,预期 8 亿美元

- Converged Packet Optical revenue $728.0M, +4.6% y/y, EST $723.1M

- 融合分组光传输业务收入$728.0M,同比增长 4.6%,预估$723.1M

- Routing and switching revenue $93.2M, -16% y/y

- 路由和交换业务收入 9320 万美元,同比下降 16%

- Platform software and services revenue $95.1M, +6% y/y, EST $97.1M

- 平台软件和服务收入 $95.1M,同比增长 +6%,预期 $97.1M

- Blue Planet Automation software and services revenue $26.0M, +86% y/y, EST $20.8M

- Blue Planet Automation 软件和服务收入 2600 万美元,同比增长 86%,预期 2080 万美元

- Global Services revenue $130.0M, +2.5% y/y, EST $135.9M

- 全球服务收入 1.3 亿美元,同比增长 2.5%,预估 1.359 亿美元

- Maintenance support and training revenue $74.6M, +0.7% y/y

- 维护支持和培训收入 $74.6M,同比增长 +0.7%

- Installation and deployment revenue $47.7M, +12% y/y, EST $48.1M

- 安装和部署收入 4770 万美元,同比增长 12%,预期 4810 万美元

- Consulting and network design revenue $7.7M, -23% y/y, EST $12.2M

- 咨询和网络设计收入 770 万美元,同比下降 23%,预估 1220 万美元

- ADJ gross margin 44.7% vs. 45.7% y/y, EST 42.1%

- ADJ 毛利率 44.7%,同比 45.7%,预期 42.1%

NEWS/RESEARCH/3P

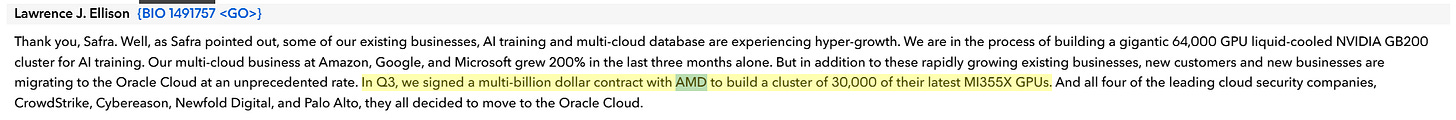

AMD: ORCL said they signed a multi-$B contract to build a 30k cluster of Mi355x GPU. Assuming $2B, that would be ~30% of buyside expects of $7B GPU revs in 2025

AMD:ORCL 表示他们签署了一份价值数十亿美元的合同,用于构建一个包含 30,000 个 Mi355x GPU 的集群。假设合同价值 20 亿美元,这将是买方对 2025 年 70 亿美元 GPU 收入的预期的约 30%。

U: Unity upgraded to Outperform from Market Perform at Citizens JMP

U: Unity 从 Citizens JMP 的 Market Perform 评级升级至 Outperform 评级

Citizens JMP analyst Andrew Boone upgraded Unity to Outperform from Market Perform with a $30 price target. The firm believes the upcoming launch of Vector represents a "significant catalyst" that can drive share gains of the $100B mobile gaming advertising market. With Unity now expecting to be fully live with Vector by the end of Q2, the company is "nearing an inflection point in its high-margin advertising business," the analyst tells investors in a research note. Citizens says combining data assets across Unity's business gives it a unique operating asset to drive performance. While Citizens acknowledge its upgrade is ahead of proof that its new ad models can take share, it believes combining data assets across Unity's business gives it a unique operating asset to drive performance, while EBITDA is now materially higher after right-sizing costs, developer relationships have stabilized, and management's focus narrowed to Unity's most impactful opportunities. According to Citizens, this means Unity's improved and more stable underlying business, creates a higher floor for numbers, regardless of Vector, while the significant optionality of Unity's new ad platform tilts the risk/reward favorably following the most recent technology selloff.

Citizens JMP 分析师 Andrew Boone 将 Unity 评级从市场表现上调至跑赢大盘,目标价为 30 美元。该机构认为即将推出的 Vector 代表了“重要的催化剂”,可以推动 Unity 在 1000 亿美元移动游戏广告市场中的份额增长。随着 Unity 预计将在第二季度末全面上线 Vector,公司“正接近其高利润广告业务的转折点”,分析师在研究报告中告诉投资者。Citizens 表示,整合 Unity 业务中的数据资产为其提供了一个独特的运营资产以推动业绩。尽管 Citizens 承认其评级升级早于新广告模式能够抢占市场份额的证明,但它认为整合 Unity 业务中的数据资产为其提供了一个独特的运营资产以推动业绩,同时 EBITDA 在成本调整后显著提高,开发者关系已稳定,管理层已将重点缩小到 Unity 最具影响力的机会上。 根据 Citizens 的观点,这意味着 Unity 改进且更稳定的基础业务,无论 Vector 如何,都为数字提供了更高的底线,而 Unity 新广告平台的显著可选性在最近的技术抛售后使风险/回报偏向有利方向。

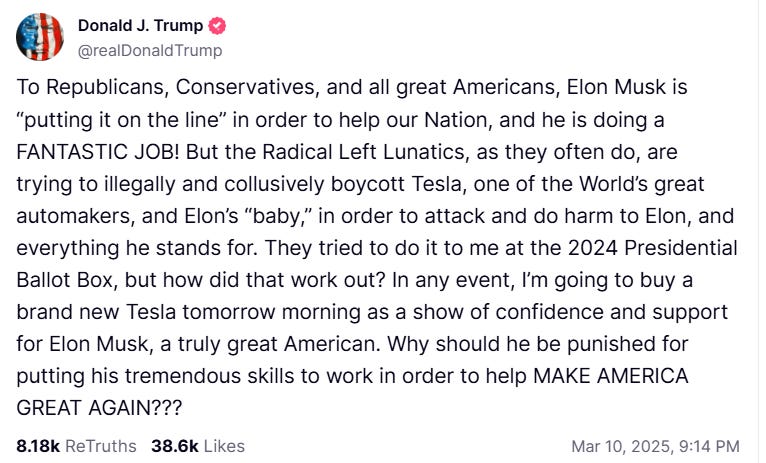

TSLA: Trump tells people that he is buying a TSLA

TSLA: 特朗普告诉人们他正在买入 TSLA

3P Roundup: 3P 综述:

CVNA: 3p Units tracking to 44% QTD vs street at 34%. Still hovering around ~50% in last couple of weeks.

CVNA: 第三季度单位销量跟踪至 44%,市场预期为 34%。过去几周仍徘徊在约 50%左右。

Public Cloud: M-sci says they saw significant GCP capacity in Feb and new cloud compute deployments tracked up significantly m/m in Feb overall.

公共云:M-sci 表示他们在 2 月份看到了显著的 GCP 容量,并且新的云计算部署在 2 月份整体上环比显著增加。

SNAP: Edgewater mixed/positive saying Sponsored Snap rollout is early but accelerating as Legacy DR campaigns showing some signs of improvement although macro still mixed

SNAP:Edgewater 混合/正面评价,表示赞助 Snap 的推出虽处于早期阶段但正在加速,同时传统 DR 活动显示出一些改善迹象,尽管宏观经济环境仍好坏参半

Meta begins testing its first in-house AI training chip

Meta 开始测试其首款自研 AI 训练芯片

NEW YORK, March 11 (Reuters) - Facebook owner Meta (META.O), s testing its first in-house chip for training artificial intelligence systems, a key milestone as it moves to design more of its own custom silicon and reduce reliance on external suppliers like Nvidia (NVDA.O) two sources told Reuters.

纽约,3 月 11 日(路透社)——两位消息人士向路透社透露,Facebook 母公司 Meta(META.O)正在测试其首款自主研发的芯片,用于训练人工智能系统,这是该公司朝着设计更多定制芯片、减少对英伟达(NVDA.O)等外部供应商依赖迈出的关键一步。The world's biggest social media company has begun a small deployment of the chip and plans to ramp up production for wide-scale use if the test goes well, the sources said.

消息人士称,这家全球最大的社交媒体公司已开始小规模部署该芯片,并计划在测试顺利的情况下扩大生产规模,以实现广泛应用。

How ‘inference’ is driving competition to Nvidia’s AI chip dominance

“推理”如何推动竞争挑战 Nvidia 在 AI 芯片领域的霸主地位

FinancialTimes: 金融时报:

Nvidia’s challengers are seizing a new opportunity to crack its dominance of artificial intelligence chips after Chinese start-up DeepSeek accelerated a shift in AI’s computing requirements. DeepSeek’s R1 and other so-called “reasoning” models, such as OpenAI’s o3 and Anthropic’s Claude 3.7, consume more computing resources than previous AI systems at the point when a user makes their request, a process called “inference”.

中国初创企业深度求索加速了人工智能计算需求的转变,英伟达的挑战者们正抓住这一新机会,试图打破其在人工智能芯片领域的统治地位。深度求索的 R1 及其他所谓的“推理”模型,如 OpenAI 的 o3 和 Anthropic 的 Claude 3.7,在用户发出请求时(这一过程称为“推理”)消耗的计算资源远超以往的人工智能系统。

It is here that Nvidia’s competitors — which range from AI chipmaker start-ups such as Cerebras and Groq to custom accelerator processors from Big Tech companies including Google, Amazon, Microsoft and Meta — are focusing their efforts to disrupt the world’s most valuable semiconductor company.

正是在这里,Nvidia 的竞争对手——从 Cerebras 和 Groq 等 AI 芯片初创企业,到包括谷歌、亚马逊、微软和 Meta 在内的科技巨头的定制加速处理器——正集中力量,试图撼动这家全球最有价值的半导体公司。

DAL/AAL: A couple airline neg pre’d - watch EXPE, ABNB, BKNG, etc..

DAL/AAL: 几家航空公司负面新闻预热 - 关注 EXPE, ABNB, BKNG 等..

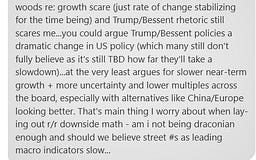

DAL: "outlook impacted by recent reduction in consumer/corporate confidence caused by increased macro uncertainty, driving softness in Domestic demand. Premium, Int'l & loyalty revs growth trends are consistent w/expectations." Feb saw shift in GDP sentiment/output and consumer confidence coming down a bit, corp & consumer spending started to stall....

DAL:“由于宏观经济不确定性增加导致消费者/企业信心近期下降,展望受到影响,导致国内需求疲软。高端、国际及忠诚度收入增长趋势与预期一致。”2 月份 GDP 情绪/产出出现转变,消费者信心略有下降,企业和消费者支出开始停滞……

American Airlines $AAL now expects a Q1 adjusted loss of $0.60-$0.80 per share, worse than its prior forecast of $0.20-$0.40. The airline cited concerns over tariff pressures and government spending uncertainties weighing on travel demand.

美国航空($AAL)现预计第一季度调整后每股亏损为 0.60 至 0.80 美元,较此前预测的 0.20 至 0.40 美元更为严重。该公司指出,关税压力和政府支出不确定性对旅行需求造成了负面影响。

RDDT: Reddit 'extremely attractive' after 50% stock price decline, says Loop Capital

RDDT:Loop Capital 表示,Reddit 股价下跌 50%后“极具吸引力”

TheFly:

Loop Capital keeps a Buy rating and $210 price target on Reddit (RDDT) while noting that after an "excessive" 50% decline in one month, the stock is "extremely attractive". The company's growth in ARPU should be driven by better ad tools, eventually a product matching Meta's (META) Advantage+, advertising on more surfaces including a larger ad load on the comments page and potentially search advertising, and the auction dynamics from bringing more advertisers onto the platform, the analyst tells investors in a research note. Loop adds it is projecting a 36% revenue growth and 87% EBITDA growth this year.

Loop Capital 维持对 Reddit(RDDT)的买入评级和 210 美元的目标价,同时指出,在股价一个月内“过度”下跌 50%后,该股“极具吸引力”。分析师在给投资者的研究报告中表示,公司 ARPU 的增长应得益于更好的广告工具,最终推出与 Meta(META)Advantage+相匹配的产品,在包括评论页更多广告位在内的更多界面投放广告,以及潜在的搜索广告,以及通过吸引更多广告商加入平台带来的拍卖动态。Loop 补充称,预计今年收入将增长 36%,EBITDA 增长 87%。

SPX: Citi cuts U.S equities with exceptionalism 'at least pausing'

SPX:花旗下调美国股票评级,称其“至少暂时”失去独特性

Citi strategists downgraded U.S equities to neutral from overweight, which it had been since October 2023, while upgrading China to overweight from neutral. U.S. "exceptionalism is at least pausing," the strategists tell investors in a research note. The firm believes the news flow from the U.S. economy is likely to undershoot the rest of the world in coming months. "At least tactically, U.S. exceptionalism is therefore unlikely to roar back," Citi predicts. It thinks China stocks screen well, even after the recent rally.

花旗策略师将美国股市评级从增持下调至中性,自 2023 年 10 月以来一直为增持,同时将中国股市评级从中性上调至增持。策略师在研究报告中告诉投资者,美国的“例外主义至少正在暂停”。该公司认为,未来几个月美国经济的消息流可能会落后于世界其他地区。“至少从战术上讲,因此美国的例外主义不太可能卷土重来,”花旗预测。它认为中国股票表现良好,即使在最近的反弹之后也是如此。

COIN: Mizuho cuts Coinbase target, calls 30% pullback overdone

COIN:瑞穗下调 Coinbase 目标价,称 30%的回调过度

Mizuho lowered the firm's price target on Coinbase to $217 from $280 and keeps a Neutral rating on the shares. The firm says that since its last model update on February 20, the price of bitcoin has fallen from $98,000 to $79,000 and Coinbase shares are down 30%. While some multiple compression is warranted due to lower multiples across technology, the move in Coinbase shares is overdone, the analyst tells investors in a research note. Mizuho believes the stock should trade closer to $217. While it sees some upside from here, it remains Neutral given the longer-term risk of pricing pressure from increased competition across the crypto trading space. Mizuho cites lower market multiples for the target cut.

瑞穗银行将 Coinbase 的目标股价从 280 美元下调至 217 美元,并维持对该股的“中性”评级。该机构表示,自 2 月 20 日上次模型更新以来,比特币价格已从 98,000 美元跌至 79,000 美元,Coinbase 股价下跌了 30%。分析师在给投资者的研究报告中指出,尽管由于科技股整体估值下降,一定程度的倍数压缩是合理的,但 Coinbase 股价的跌幅过大。瑞穗银行认为该股应更接近 217 美元交易。尽管其认为当前价位存在一定的上涨空间,但考虑到加密交易领域竞争加剧带来的长期定价压力风险,仍维持“中性”评级。瑞穗银行将目标股价下调归因于市场整体估值的降低。

NOW: Mizuho reiterates outperform though lowers PT to $1,100 from $1,210 after M&A

NOW: 瑞穗重申优于大盘评级,但在并购后将目标价从$1,210 下调至$1,100

In Mizuho's view, Moveworks is an attractive asset that improves NOW's already industry-leading AI positioning, albeit at a significant price (likely north of 20x current ARR). Mizuho also notes that NOW disclosed surpassing $200M in Pro Plus ACV in Q4, exceeding its Q4 estimate by >10%, and this should ease some concerns about lack of disclosure last quarter. More broadly, Mizuho reiterate that NOW remains very well-positioned for high growth over the next few years, fueled by ongoing demand for workflow automation, strong cross-sell opportunities, and AI monetization.

在 Mizuho 看来,Moveworks 是一项颇具吸引力的资产,它提升了 NOW 本已处于行业领先地位的人工智能定位,尽管价格不菲(可能超过当前 ARR 的 20 倍)。Mizuho 还指出,NOW 在第四季度披露其 Pro Plus ACV 突破 2 亿美元,超出其第四季度预期超过 10%,这应能缓解上季度因信息披露不足引发的部分担忧。更广泛地说,Mizuho 重申,NOW 在未来几年内仍将保持高速增长的有利地位,这得益于对工作流自动化的持续需求、强大的交叉销售机会以及人工智能的货币化。

AMD: February notebook shipments in line with estimates, says Citi

AMD:花旗称 2 月笔记本出货量符合预期

Citi analyst Christopher Danely says February notebook shipments increased 6% month-over-month, in line with its expectations given normal seasonality and a low comparison base. The firm is expecting PC units to increase 4% year-over-year in 2025 and maintains Neutral ratings on both AMD (AMD) and Intel (INTC). Citi is worried there could be an inventory build in PC central processing units.

花旗分析师 Christopher Danely 表示,2 月份笔记本出货量环比增长 6%,符合其基于正常季节性因素和较低比较基数的预期。该公司预计 2025 年 PC 出货量将同比增长 4%,并维持对 AMD (AMD)和英特尔(INTC)的中性评级。花旗担心 PC 中央处理器可能会出现库存积压。

US Small-Business Optimism Retreats as More Shift to Price Hikes

美国小企业乐观情绪回落,因更多企业转向涨价

Bloomberg: 彭博社:

US small-business optimism fell to a four-month low in February and a gauge of uncertainty neared a record high as business owners grew uneasy about tariffs.

美国 2 月小企业乐观情绪降至四个月低点,由于企业主对关税感到不安,不确定性指标接近历史高点。The National Federation of Independent Business optimism index declined 2.1 points to 100.7 last month. Seven of the 10 components that make up the overall index weakened, led by the steepest slide in the economic outlook since March 2022.

全美独立企业联盟(NFIB)的乐观指数上月下降了 2.1 点,至 100.7。构成整体指数的 10 个成分中有 7 个走弱,其中经济前景自 2022 年 3 月以来出现最大幅度的下滑。The share of owners who said it is a good to expand declined by the most since April 2020 and a gauge of capital spending plans matched an almost five-year low.

表示扩张是件好事的业主比例下降幅度为 2020 年 4 月以来最大,而资本支出计划指标则接近五年低点。While more businesses indicated a pause in investment as they assess Trump administration policies, the share of firms that raised prices increased by the most since April 2021. The largest share in nearly a year said they are planning to boost prices in coming months.

随着更多企业表示在评估特朗普政府政策期间暂停投资,自 2021 年 4 月以来,提高价格的企业比例增幅最大。近一年来最大比例的企业表示,他们计划在未来几个月内提高价格。

BABA: Alibaba Accio search engine surpasses 1M users

BABA: 阿里巴巴 Accio 搜索引擎用户突破 100 万

Alibaba announced that its artificial intelligence-driven business-to-business search engine, Accio, has surpassed 1M users within five months of launch. To further empower small and medium-sized enterprises, two new features-Business Research and Deep Search-are now available, offering AI-driven solutions for market entry and global sourcing.

阿里巴巴宣布其人工智能驱动的 B2B 搜索引擎 Accio 在推出五个月内用户数已突破 100 万。为进一步赋能中小企业,现推出两项新功能——商业研究和深度搜索,提供 AI 驱动的市场进入和全球采购解决方案。

UBER: Downgraded at KGI and Fox Advisors (haven’t heard of either broker and don’t have either note)

UBER:在 KGI 和 Fox Advisors 被下调评级(没听说过这两家券商,也没有相关报告)

SPOT: Spotify resumed with Neutral from Sell at Redburn Atlantic

SPOT: Spotify 恢复评级,Redburn Atlantic 从卖出调至中性

Redburn Atlantic analyst Ed Vyvyan upgraded Spotify to Neutral from Sell with a price target of $545, up from $230, after resuming coverage of the name. The firm expects "more to come" from audiobooks and Spotify's super-premium tiering, but believes the share price already reflects an "optimistic" near-term outlook. Redburn has weaker average revenue per user growth expectations versus the Street, given a more cautious view on the near-term impact of Music Pro, the analyst tells investors in a research note. Redburn's forecasts place US c2-3% below consensus EBIT from FY25 to FY28E. This is largely driven by weaker ARPU growth expectations than the Street, given (Redburn suspects) its more cautious view on the near-term impact of Music Pro.

Redburn Atlantic 分析师 Ed Vyvyan 在恢复对 Spotify 的覆盖后,将其评级从卖出上调至中性,目标价从 230 美元上调至 545 美元。该公司预计有声读物和 Spotify 的超级会员层级将带来“更多增长”,但认为股价已经反映了“乐观”的近期前景。Redburn 对每用户平均收入增长的预期较市场更为保守,原因是其对 Music Pro 近期影响的看法更为谨慎,分析师在研究报告中对投资者表示。Redburn 的预测显示,从 2025 财年到 2028 财年,美国的 EBIT 将比市场共识低 2-3%。这主要是由于 Redburn 对 ARPU 增长的预期较市场更为保守,因为(Redburn 怀疑)其对 Music Pro 近期影响的看法更为谨慎。

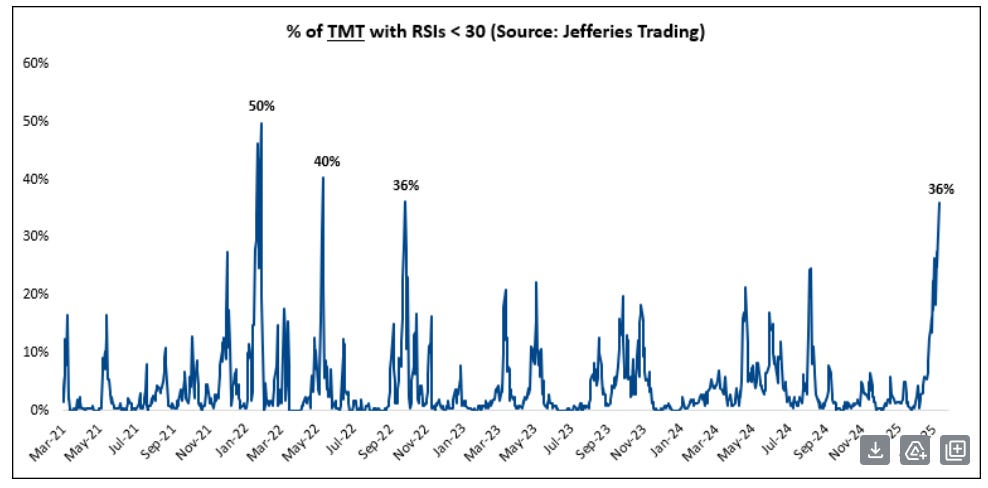

From Jefferies: 来自 Jefferies:

OTHER NEWS 其他新闻

AAPL: Apple Readies Dramatic Software Overhaul for iPhone, iPad and Mac – Bloomberg

AAPL: 苹果准备对 iPhone、iPad 和 Mac 进行重大软件改革 – 彭博社AMZN, DeepSeek: AWS announced the availability of DeepSeek-R1 as a fully managed, serverless LLM in Amazon Bedrock; AWS is the first CSP to deliver the fully managed model

AMZN, DeepSeek: AWS 宣布在 Amazon Bedrock 中提供 DeepSeek-R1 作为完全托管的无服务器LLM;AWS 是首个提供完全托管模型的 CSPCOIN: secures registration in India

COIN: 在印度成功注册CoreWeave: ahead of its upcoming IPO, CoreWeave signed a $11.9B/5Y deal w/ OpenAI – Reuters

CoreWeave:在即将进行的 IPO 之前,CoreWeave 与 OpenAI 签署了一项 119 亿美元/5 年的协议——路透社MSFT: to hold a 50th anniversary and Copilot event on 4/4/25 – The Verge

MSFT:将于 4/4/25 举办 50 周年纪念及 Copilot 活动 – The VergeNAND, Semicap: NAND Prices on the Rise: Micron and SanDisk Lead in April, with Samsung, SK hynix Likely to Follow – link

NAND, Semicap: NAND 价格上涨:美光和 SanDisk 领跑四月,三星和 SK 海力士或将跟进 – linkServers: global server shipments will grow 2.3% YoY to 15.24mn units in 2025, driven by high-end AI servers – Digitimes

服务器:2025 年全球服务器出货量将同比增长 2.3%,达到 1524 万台,主要受高端 AI 服务器推动——DigitimesT: reaffirmed FY25 guidance and delivery of multi-year outlook ahead of CFO’s shareholder update at DB Conf (h/t Bofa)

T: 重申了 FY25 指引,并在 DB 会议上 CFO 向股东更新前提供了多年展望的交付(感谢 Bofa)