“There is nothing new in Wall Street. There can't be, because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.”

“华尔街没有什么新的。不可能,因为猜测与山丘一样古老。今天股市发生的任何事情都发生了,并将再次发生。”

— Jesse Livermore* -Jesse Livermore*

We are publishing this without a paywall — please feel free to share with friends.

我们在没有付费墙的情况下发布此信息 - 请随时与朋友分享。

INTRODUCTION 介绍

*Long-time readers may be familiar with this Jesse Livermore quote on Markets & Investing — one of my favorites.

*长期的读者可能熟悉市场和投资中的杰西·利弗莫尔(Jesse Livermore)的报价,这是我的最爱之一。

It has never been more relevant.

它从未如此相关。

On Monday, January 27 2025, the Tech world was thrown into chaos after a Chinese hedge-fund released a “game-changing” AI model which supposedly (keyword) cost very little to train and even less to run, compared to leading U.S. AI programs.

2025年1月27日,星期一,技术界在中国对冲基金发布了“改变游戏规则的” AI模型后陷入混乱,据说(关键字)的训练费用很少,而且跑步的费用很小,而与领导美国AI相比程序。

Nvidia, the world’s most valuable company (a crown it gave up on Monday’s rout), suffered its biggest decline since the March 2020 Global Crash, plunging -17% in a single day.

NVIDIA是世界上最有价值的公司(它在周一的溃败中放弃的王冠),自2020年3月全球崩溃以来,其下降幅度最大,一天内下降了-17%。

The table shows it was the ninth biggest one-day decline in Nvidia’s history:

该表显示,这是NVIDIA历史上第九大的一日下降:

Students of Market history will recognize most of these dates as taking place within major Bear Markets or periods of global Panic.

市场历史的学生将认识到大多数这些日期是在主要熊市或全球恐慌时期内发生的。

Which is to say — the violence of Monday’s decline was quite rare.

也就是说 - 周一下降的暴力非常罕见。

And the catchphrase heard ‘round the world was “game-changer”…

流行语听到的“世界各地”是“改变游戏规则的”…

But lost in Monday’s headless-chicken-stampede *as usual*, was the fact that there was nothing game-changing at all:

但是,像往常一样,在周一的无头鸡巴stampede *中迷失了,这是没有什么改变游戏的事实:

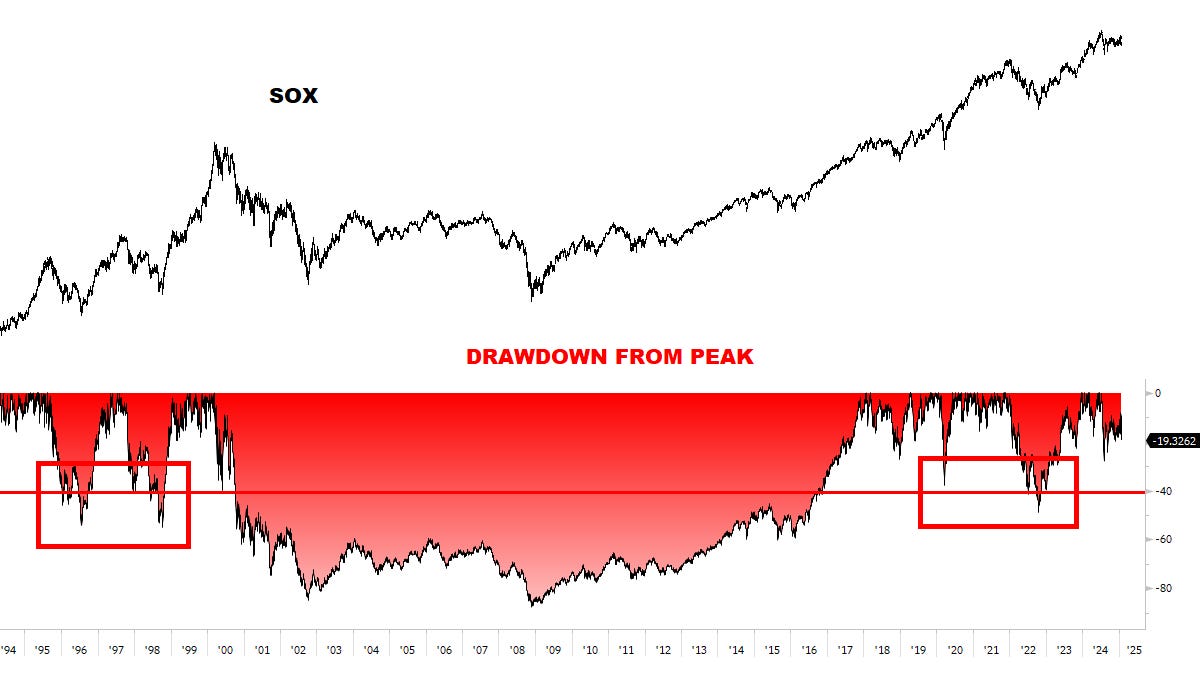

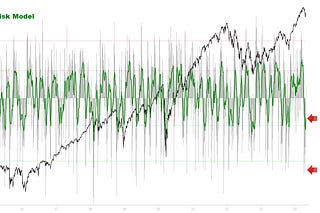

For months, the Market signaled the systematic deterioration and breakdown of the entire Semiconductor group.

几个月来,市场标志着整个半导体组的系统恶化和分解。At every possible opportunity, I carefully reiterated my concerns, flagging key Stocks as they developed plunge sequences — and prices followed through with vertical collapses.

在所有可能的机会中,我仔细地重申了我的担忧,在开发暴跌序列时标记了关键股票,而垂直崩溃的价格随之而来。It was only a matter of time until they came after the leader.

直到他们追随领导者,这只是时间问题。

*Link to October 16 Special Report: “Go Into The Light”.

*链接到10月16日的特别报告:“进入光明”。

Here’s where those Charts stand now:

这些图表现在所处的位置:

Nothing game-changing here — just a major downtrend which still looks to be developing…

这里没有什么改变游戏的 - 只是一个似乎正在发展的重大下降趋势……

As Investors, we should always ask:

作为投资者,我们应该始终询问:

→ Do we want to Buy this dip?

→我们想购买此蘸酱吗?

→ Does the “news of the day” — and all the associated noise and uninformed takes/calls/opinions, change anything?

→“每日新闻”以及所有相关的噪音和无知的噪音都会带来/呼叫/意见,更改任何内容?

My answer to both is: probably not.

我对两者的回答是:可能不是。

NOTHING NEW UNDER THE SUN

阳光下没有什么新的

Some key statistics for context:

上下文的一些关键统计信息:

NVDA made zero gains since June 2024 — nearly eight months.

自2024年6月以来,NVDA取得了零收益,将近八个月。*Then in classic fashion, it was featured in a Barron’s magazine cover in mid-November, near the final Top.

*然后以经典的方式,在11月中旬的Barron杂志封面上展出,在最后的顶部。Semiconductor Stocks (SOX Index, SMH ETF) peaked in July 2024 — nearly seven months ago.

半导体库存(SOX指数,SMH ETF)在2024年7月 - 七个月前达到顶峰。The relative performance of Semiconductors peaked in June 2024 — nearly eight months ago.

半导体的相对性能在2024年6月 - 八个月前达到顶峰。Since peaking in July 2024, SOX/SMH were already down -10% heading into Monday’s open, while the S&P was up +10% over the same period. An astounding underperformance, in what was widely considered the growth driver/investment winner of our age.

自2024年7月达到顶峰以来,SOX/SMH已经下跌-10%进入周一的公开赛,而标准普尔则在同一时期上涨了10%。令人惊讶的表现不佳,被广泛认为是我们时代的增长驱动力/投资冠军。Perhaps worst of all, heading into Monday’s open the average Semiconductor Stock was already down 20% from its 2024 high.

也许最糟糕的是,进入周一的公开赛平均半导体股票已经比其2024年高的20%下降了20%。

Simply superb history lesson. You are a born teacher, MC! Cheers.

Thanks MC! These more "textual" posts are also of great help, and provide insight into your thought processes.