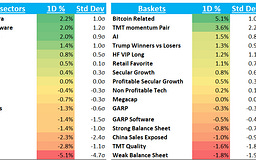

QQQ -24bps - another day, another failed rally in Tech, but today saw a lot more green and dispersion on my screen than the previous couple of days. Spoos underperformed driven by neg pre-announcements from several of the airlines as they were the newest datapoints that Washington uncertainty is already seeping into the economy.

QQQ 下跌 24 个基点——科技股再度反弹失败,但今天我的屏幕上看到的绿色和分散程度比前几天多得多。Spoos 表现不佳,原因是几家航空公司发布了负面预公告,这些是华盛顿不确定性已开始渗透到经济中的最新数据点。

Other neg datapts from companies today:

今日来自公司的其他负面数据点:

DAL -7% said: "outlook impacted by recent reduction in consumer/corporate confidence caused by increased macro uncertainty, driving softness in Domestic demand. Premium, Int'l & loyalty revs growth trends are consistent w/expectations." Feb saw shift in GDP sentiment/output and consumer confidence coming down a bit, corp & consumer spending started to stall....

DAL -7%表示:“近期因宏观经济不确定性增加导致消费者/企业信心下降,影响了前景,导致国内需求疲软。高端、国际及忠诚度收入增长趋势与预期一致。”2 月份 GDP 情绪/产出出现转变,消费者信心略有下降,企业和消费者支出开始停滞……TER -17% after warning that tariff and trade uncertainty is negatively impacting its business causing pushouts and capital budget reviews at customers - Q2 sales now seen flat to down 10% vs Q1 (street was at +7.5% growth) and 2025 revs +5-10% vs street at 14%.

TER 股价下跌 17%,此前公司警告称,关税和贸易不确定性正在对其业务产生负面影响,导致客户推迟订单并重新评估资本预算——预计第二季度销售额与第一季度持平或下降 10%(市场预期为增长 7.5%),2025 年收入增长 5-10%,而市场预期为 14%。VZ -7% warned that gross adds in Q1 would be soft as industry competitive intensity remains elevated. T -5% also didn’t sound great at DB’s TMT conference.

VZ -7%警告称,由于行业竞争激烈,第一季度新增用户数将表现疲软。T -5%在德意志银行的 TMT 会议上也表现不佳。HelloFresh (HFG) -18% guided 2025 down -3-8% y/y vs street +3% y/y citing “weakening consumer confidence in North America” alongside uncertain impact of “potential prolonged tariffs on agricultural and packaging products”

HelloFresh (HFG) -18% 指引 2025 年同比下降 3-8%,而市场预期为同比增长 3%,公司指出“北美消费者信心减弱”以及“农业和包装产品可能长期加征关税的不确定影响”

More tariff news as US/Canada seemed to back away from a tit-for-tat after Ontario suspended its 25% power surcharge although Trump continues to defend his tariff agenda. Next big piece of macro news is CPI tomorrow morning. Treasuries fell as yields climbed 5-6bps across the curve with Fed expects shifting hawkishly and now pricing in 75bps vs 80bps+ yesterday.

美加关税新动态:安大略省暂停 25%电力附加费后,双方似乎避免针锋相对,尽管特朗普继续为其关税议程辩护。下一重要宏观数据为明早的 CPI。国债下跌,收益率全线上涨 5-6 个基点,因市场对美联储的预期转向鹰派,目前定价为 75 个基点,而昨日为 80 个基点以上。

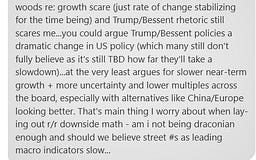

It continues to be a tough market as we’ve seen a big re-adjustment in priors re: growth/macro/policy narrative over the last month. I know it’s felt longer for many, but it’s happened in a very compressed period of time: as more $’s have flowed into multi managers, everyone else has been programmed to act faster now as well.

市场依然艰难,因为过去一个月里,我们对增长/宏观/政策叙述的前景进行了大幅重新调整。我知道对许多人来说感觉时间更长,但这一切都在极短的时间内发生:随着更多资金流入多管理人中,其他人也被编程为现在行动得更快。

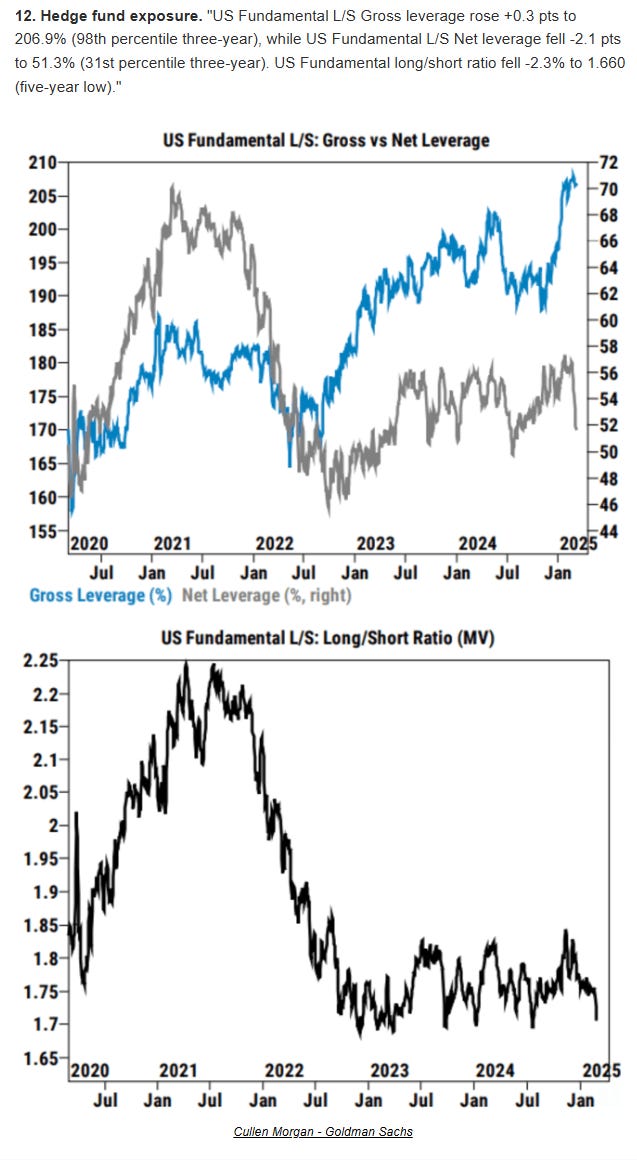

While uncertainty in Washington/tariff likely continues, it’s hard to imagine another large re-thinking of growth priors + de-risking/unwind that has occurred in such a short period of time — the current L/S Momentum (MSZZMOMO) drawdown is nearly inline with the median selloff now at -21%. That’s not to mean it’s all over, but fundamentals will eventually take a front seat again. And in a slowing economy, my experience has been there is a great opportunity for stock picking both long and short, which is good news (although investment time frames get compressed). For now, we remain in low-gross + pnl protection mode looking for tactical opportunities, but as things begin to stabilize and fundamentals take more of a front seat heading into Q1 earnings season, we’ll begin to layer on risk again.

尽管华盛顿/关税方面的不确定性可能持续,但很难想象在如此短的时间内再次出现对增长前景的大规模重新思考+去风险/解杠杆——当前的多空动量(MSZZMOMO)回撤几乎与目前中位数的抛售水平一致,为-21%。这并不意味着一切结束,但基本面最终将再次占据主导地位。在经济增长放缓的情况下,我的经验是,无论是做多还是做空,选股都有很大机会,这是好消息(尽管投资时间框架被压缩)。目前,我们仍处于低总头寸+保护盈利模式,寻找战术机会,但随着情况开始稳定,基本面在第一季度财报季前占据更多主导地位,我们将再次逐步增加风险敞口。

Saw some nice outperformance in AI semis and software today while momentum regained a bit of a bid. Let’s get to the full recap…

今天在 AI 半导体和软件领域看到了一些不错的表现,同时动量也有所回升。让我们进入完整的回顾…

Internet 互联网

RDDT +14% after a brutal stretch where stock was down 50%+ over a few weeks

RDDT +14%,此前该股在几周内暴跌了 50%以上Saw strength in internet favs: NFLX +3%; META +1.3%; AMZN +1%; DASH +3%; CHWY +4%; SPOT +4% as Redburn upgraded from neutral to Buy

互联网热门股表现强劲:NFLX +3%;META +1.3%;AMZN +1%;DASH +3%;CHWY +4%;SPOT +4%,因 Redburn 将其评级从中性上调至买入Travel stocks weak on airlines neg pre’s: UBER -3% (also downgraded at KPI/FOX); EXPE -7%; ABNB -5%; BKNG -2% outperformed given it’s Europe exposure

旅游股因航空公司负面预测走弱:UBER -3%(KPI/FOX 也下调评级);EXPE -7%;ABNB -5%;BKNG -2%因其欧洲业务表现优于大盘TTD - 2.5% back to underperforming as competitive news flow making it an uphill slow for bulls

TTD - 2.5% 重回表现不佳,竞争性新闻流使得多头之路愈发艰难SNAP -2.5% despite some mixed/positive checks at Edgewater saying Sponsored Snap rollout is early but accelerating as Legacy DR campaigns showing some signs of improvement although macro still mixed

SNAP 下跌 2.5%,尽管 Edgewater 的一些混合/正面调查显示,Sponsored Snap 的推出虽处于早期阶段但正在加速,同时 Legacy DR 广告活动显示出一些改善迹象,尽管宏观环境仍好坏参半。CVNA +40bps as units continue to track in mid 40s vs street at 34%

CVNA +40 个基点,单位继续在 40 年代中期徘徊,而市场预期为 34%EBAY -4% / ETSY -3% giving back some recent outperformance

EBAY -4% / ETSY -3% 回吐近期部分超额涨幅BABA +5% as Accio search engine surpasses 1M users / Tencent +2%

阿里巴巴(BABA)股价上涨 5%,因 Accio 搜索引擎用户突破 100 万 / 腾讯(Tencent)股价上涨 2%

Semis 半导体

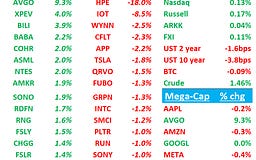

Strength in AI semis: NVDA +1.6%; ANET +2%; AVGO +3%; MRVL +2.2%; VST +5%'; CLS +6%; SMCI +11%

AI 半导体领域表现强劲:NVDA +1.6%;ANET +2%;AVGO +3%;MRVL +2.2%;VST +5%;CLS +6%;SMCI +11%MU +2.2% as DRAM spot/NAND continue to rise

MU 上涨 2.2%,因 DRAM 现货/NAND 价格持续上涨AMD +13bps as ORCL said they had signed $2B contract for Mi355x

AMD +13 个基点,因 ORCL 表示已签署 20 亿美元 Mi355x 合同AI networking strong: CRDO +10%; ALAB +7%

AI 网络强势:CRDO +10%;ALAB +7%

Software 软件

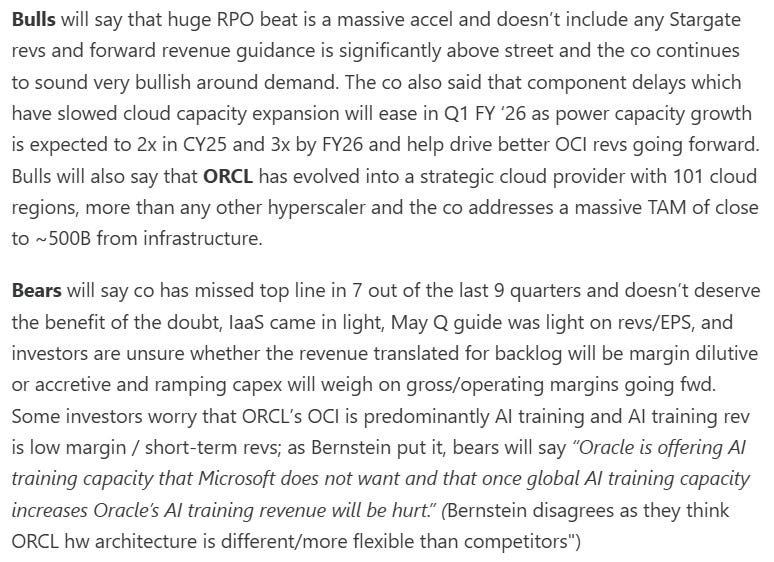

ORCL -3% lots of debate on this one after last nights print. Stock got down to our $140-$145 “juicy” r/r price even though we think stock remains a show-me story for now (on both revs and margins). We covered the bull vs bear debate this morning:

ORCL -3% 昨晚财报发布后,关于该股的讨论颇多。尽管我们认为目前该股在收入和利润率方面仍需证明自己,但股价已跌至我们 140 美元至 145 美元的“诱人”风险/回报区间。今早我们探讨了多头与空头的辩论:

MDB +8.5% another show me story where r/r is very interesting at 5x ev/revs for a likely high teens grower.

MDB +8.5%,又一个展示案例,其风险回报比非常有趣,以 5 倍的企业价值/收入,对应一个可能实现两位数增长的标的。Other outperformers: TEAM +4%; NET +3%; NOW +3%; CFLT +4.5%; CRWD +6.8%; ESTC +7%

其他表现优异者:TEAM +4%;NET +3%;NOW +3%;CFLT +4.5%;CRWD +6.8%;ESTC +7%U -2.5% despite Citizen’s upgrade as investors digest the weak Vector checks from Wells Fargo yesterday

尽管 Citizen 评级上调,U 仍下跌 2.5%,投资者仍在消化昨日富国银行疲软的 Vector 检查结果APP +8% as CEO goes on the road to defend the stock

APP +8%,CEO 亲自上路为股票辩护

Elsewhere 其他地方

TSLA +4% as Trump said he would buy a new TSLA tomorrow

TSLA +4%,因特朗普表示明天将购买一辆新的 TSLACIEN -6% despite strong top line beat driven by Telco. Q2 guide was slightly better than street and inline with expects but pushback on the stock were commentary around “fluid” tariff situation and T commentary around peak capex.

CIEN -6%,尽管 Telco 推动的营收表现强劲。第二季度指引略好于市场预期,符合预期,但对股票的拖累来自对“多变”关税状况的评论以及关于资本支出高峰的 T 评论。AAPL -3% as they announced they would re-tool their software UI

AAPL -3%,因宣布将重新设计其软件用户界面Hardware/networking weaker: HPQ -4.5%; AKAM -4%; CSCO -2%; NTAP -1%

硬件/网络板块疲软:HPQ -4.5%;AKAM -4%;CSCO -2%;NTAP -1%COIN +7% /HOOD +3% on BTC strength

COIN +7% /HOOD +3% 因 BTC 走强