TMTB Morning Wrap

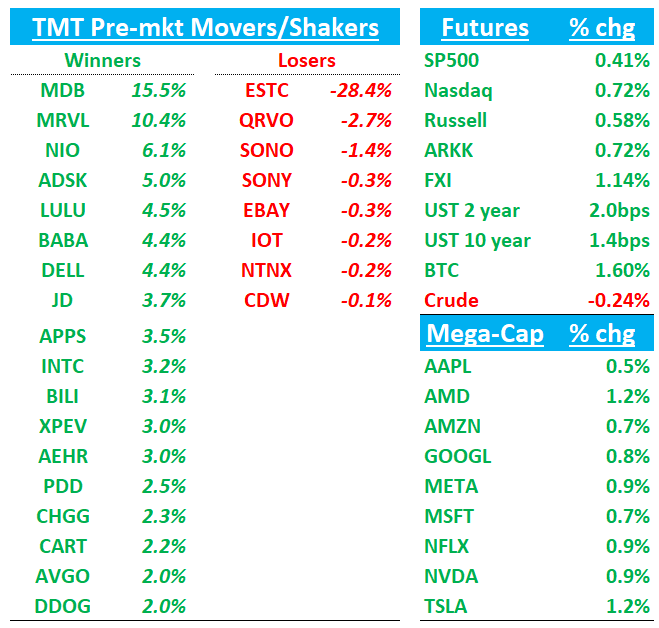

Good morning. QQQs +80bps on the back of some better TMT earnings last night. and ahead of PCE print at 8:30am. BTC flat / yields flat /China +1.2% on some better regulatory news surrounding BABA. We’ll hit news/research first, then EPS recaps, then other news…Let’s get to it…

BABA: Alibaba Wins Beijing’s Approval in End to Years-Long Scrutiny

Alibaba Group Holding Ltd. has secured the endorsement of China’s antitrust watchdog more than three years after a landmark probe into its online behavior, suggesting Beijing is keen to signal its support for the country’s giant internet sector.

China’s e-commerce leader has ceased the monopolistic practices that prompted an investigation more than three years ago, the State Administration for Market Regulation said in a statement. It stopped forcing exclusive arrangements on merchants, improved services for shoppers and fostered competition among online platforms, the agency said

The official endorsement coincides with growing calls of support from Beijing for private firms and the technology industry, a chorus that’s grown louder as the country struggles to escape a post-Covid economic funk. Government officials have since 2023 signaled a softening in stance toward the private sector compared with 2020 and 2021, when a plethora of agencies launched regulatory crackdowns to curb the power of China’s internet leaders and their billionaire founders.

NFLX: Pivotal Research raises PT to street high $900 from $800 at

Pivotal says it is raising its already Street-high price target driven by a move to a year-end 2025 target from 2024 previously and an increase in its medium- and long-term global subscriber forecasts to 384M by 2023 versus 370M previously. The higher subscriber forecast reflects on-going strong business momentum and a still relatively small share of the ultimate global opportunity, saying Netflix is "clearly the dominant paid global streaming player for the foreseeable future.”

INTC: Intel Weighs Options Including Foundry Split to Stem Losses

Intel Corp. is working with investment bankers to help navigate the most difficult period in its 56-year history, according to people familiar with the matter.

The company is discussing various scenarios, including a split of its product-design and manufacturing businesses, as well as which factory projects might potentially be scrapped, said the people, who asked not to be identified because the deliberations are private.

Morgan Stanley and Goldman Sachs Group Inc., Intel’s longtime bankers, have been providing advice on the possibilities, which could also include potential M&A, the people said. The discussions have only grown more urgent since the Santa Clara, California-based company delivered a grim earnings report this month, which sent the shares plunging to their lowest level since 2013

CRWD: Crowdstrike upgraded to Buy from Hold at HSBC

TheFly:

HSBC upgraded Crowdstrike to Buy from Hold with a price target of $339, up from $302. The firm says that with the financial impact of the July 19 global IT outage incident "now known, we think that the bad news is behind us." While CrowdStrike lowered its guidance, it still implies a strong sales growth of 23% year-over-year in the next two quarters, almost twice the expected growth rates of other security companies, the analyst tells investors in a research note. HSBC thinks Crowdstrike's long-term growth prospects remain intact. The company has exposure to some of the fastest growing markets in the security industry and its native-artificial intelligence design gives it a structural competitive advantage, the firm contends.

META: Meta’s AI Assistant Wins Millions of Users in Challenge to ChatGPT

Meta Platforms CEO Mark Zuckerberg wants his company’s artificial intelligence assistant, Meta AI, to be the world’s “most used AI assistant” by the end of this year, eclipsing OpenAI’s ChatGPT.

He seems to be making progress. In early August, less than a year after its debut, Meta AI had at least 400 million monthly active users and 40 million daily active users, according to two current employees.

The numbers reflect Meta’s efforts to push its assistant to the more than 3 billion people who use at least one of its apps daily, as well as through a stand-alone website for the assistant and a voice assistant for its Ray-Ban smart glasses. Being able to tap that huge user base is a key advantage for large technology companies looking to seize some of the spotlight from ChatGPT.

AMZN: Ask Claude? Amazon turns to Anthropic's AI for Alexa revamp

Amazon's revamped Alexa due for release in October ahead of the U.S. holiday season will be powered primarily by Anthropic's Claude artificial intelligence models, rather than its own AI, five people familiar with the matter told Reuters.

Amazon plans to charge $5 to $10 a month for its new "Remarkable" version of Alexa as it will use powerful generative AI to answer complex queries, while still offering the "Classic" voice assistant for free, Reuters reported in June.

EPS Recaps (DELL, MRVL, MDB, ESTC)

DELL +4%: AI strength drives beat with improving ISG margins…Q3 EPS weaker, but FY guide raised

AI server demand was $3.2B (+82% q/q) vs $3B bogey+ AI Orders were up 21% q/q resulting in $3.85B backlog - a bit of a miss on the backlog as bulls wanted > $4B, but company said pipeline is “several multiples” of the backlog, which now appears to be $11-$13B, up from $8-10B last q.

ISG margins 11% vs street at 10.7% — at least 11% is what bulls wanted to see.

PCs were weaker with channel inventories which remain elevated, particularly in consumer.

Bulls will point to strength in AI pipeline and better margins while bears will harp on Q3 guide downside and FY25 EPS guide which points to a very steep sequential ramp in ISG profitability in FY Q4.

Fox Advisors upgrades on 3 major points:

(1) Margin concerns on AI optimized servers, we thought overblown into the print, are being put to rest. In fact, AI-server margins likely rise going forward as DELL starts recognizing an increasing amount of high margin deferred service/support revenues and realizes more price premiums for its global footprint and value-added rack services (design, validation, testing); (2) AI-server sales are broadening out more quickly to Tier 2 cloud service providers and enterprises that can generate higher margin. This is after AI-servers went from zero to a $12B+ sales run rate in a year (undervalued by the Street); (3) Dell’s highest margin “core” storage sales (+12% YoY based on proprietary IP) look to be on a steady recovery mode after some FQ1 disappointments given a fifth QoQ increase of traditional servers (a key leading indicator) and competitive data points.

Q3 Rev Guide $25B (+10%y/y,-2%q/q vs seasonal +0%), inline with street.

Q3 EPS guide $2 +/- 10c below street $2.17

FY25 Rev $95.5-98.5B, $97B midpoint compared to street estimate of $96.4B FY25 FY25 EPS $7.80 +/- 25c vs street $7.78 (+/- 0.25) vs prior revenue guide of 93.5-97.5B and prior EPS guide $7.65

DELL RESULTS: Q2

- Infrastructure Solutions Group net revenue $11.65B, +38% y/y, EST $10.58B

- Servers and Networking revenue $7.67B, +80% y/y, EST $5.96B

- Storage revenue $3.97B, -5.1% y/y, EST $4.09B

- ADJ EPS $1.89 vs. $1.74 y/y, EST $1.71

- Total net revenue $25.03B, +9.1% y/y, EST $24.12B

- Client Solutions Group net revenue $12.41B, -4.1% y/y, EST $12.53B

- Commercial revenue $10.56B vs. $10.55B y/y, EST $10.65B

- Consumer revenue $1.86B, -22% y/y, EST $2.02B

- ADJ operating income $2.03B, +2.9% y/y, EST $1.85B

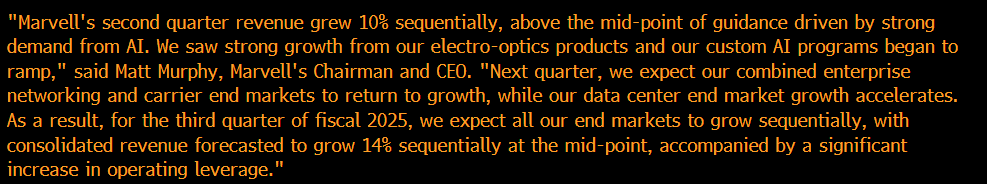

MRVL +11%: Strength in Legacy + AIs drives strong rebound…Mgmt confident in exceeding prior AI targets

Looking like MRVL might be the first semi to bounce back to 52wk highs…

MS put it well:

Even as curmudgeons on valuation (in part due to high stock comp), the after hours move seems justified, as nearly every business has turned the corner, management seems very bullish, and there is significant operating leverage as revenue growth persists (even with gross margins under some pressure).

MRVL sees FY25 AI revenue to be significantly greater than the original $1.5bn outlook driven by both optics and custom silicon. Mgmt commentary also sounded positive on businesses turning:

Bulls will say biz turned and AI will now begin to ramp and $3 in EPS seems v feasible with operating leverage, while bears will point to rising GM concerns as faster than anticipated AI custom silicon ramp could pressure GMs further in FY26 and FY27.

Citi opened a "90-day positive catalyst watch" on shares of Marvell Technology heading into the firm's Global TMT Conference where it will host a fireside chat with the company's CEO Matt Murphy on September 4. The analyst expects management to "sound constructive" on artificial intelligence growth exceeding prior AI sales targets. Marvell should take advantage of "robust" AI investments to "swiftly scale" its AI application-specific integrated circuits business across four projects with two ramping now, one in 2025, and one in 2026, the analyst tells investors in a research note. The firm says Marvell shares typically outperform when all its end markets move in the same direction.

Q2 Results:

- ADJ EPS $0.30 vs. $0.33 y/y, EST $0.29

- Net revenue $1.27B, -5.1% y/y, EST $1.25B

- Data center revenue $880.9M, +92% y/y, EST $890.3M

- Consumer revenue $88.9M, -47% y/y, EST $82.5M

- Carrier infrastructure Revenue $75.9M, -72% y/y, EST $74.5M

- Enterprise networking Revenue $151.0M, -54% y/y, EST $157.8M

- Automotive/industrial Revenue $76.2M, -31% y/y, EST $78.1M

- ADJ gross margin 61.9% vs. EST 62%

Q3 Guidance:

July Q guided to $1.45B at midpoint (+14% q/q) vs street at $1.41B

GM guided to 61% below street at 61.3%

EPS guided to 40c bs street at 38c

MDB +15%: Very solid Q3 guide above bogeys/street - Q2 total revs slightly below bogey but above street (3.5% slightly higher than last q, but below previous qs). Atlas inline while FY much better.

FY taken up by $35M which is more than Q2 beat ($13M) and Q3 raise ($14M) combined, pointing to mgmt confidence in ramp in 2H.

Atlas came in at 27% roughly in line with bogeys of 27-28%; however, on a normalized basis (excluding the $40-million impact of unused credits), BAML estimates 31% growth down only slightly from 32%, reflecting the lighter consumption activity cited in Q1. Mgmt attributed better consumption to broadbased workload growth across MDB’s cohorts, including FY24. Atlas guidance for Q3 assumes less QoQ seasonal improvement compared to last year as they continue to operate under the assumption that weaker than typical seasonal patterns (similar to what was seen in Q1) to continue.

EA biz also outperformed and new business was strong, which course corrected the “operational” issues from the previous quarter. No change to EA multiyear headwind assumption, the improved guidance driven more by incremental increase in overall volume of EA deals and ACV. The uptake for Vector and stream processing feel really good but still nothing material to revenue contribution

Bulls will say this biz is back on track, Atlas will re-accelerate back to mid 30s, and mgmt commentary + demand trends are now getting better. Bears will continue to harp on valuation (10x sales)

MDB 2025 F/Y GUIDANCE

- Guides revenue $1.92B to $1.93B, saw $1.88B to $1.90B, EST $1.9B

- Guides ADJ EPS $2.33 to $2.47, saw $2.15 to $2.30, EST $2.33

GUIDANCE: Q3

- Guides ADJ EPS $0.65 to $0.68, EST $0.61

- Guides revenue $493.0M to $497.0M, EST $479.2M

RESULTS: Q2

- ADJ EPS $0.70 vs. $0.93 y/y, EST $0.49

- Revenue $478.1M, +13% y/y, EST $462.4M

- Subscription revenue $463.8M

- Service revenue $14.3M

- Cash and cash equivalents $1.29B vs. $607.2M y/y, EST $825.6M

- Loss per share $0.74 vs. loss/shr $0.53 y/y

ESTC -27%: Sales execution challenges drive lowered FY guide

Q1 was better but execution missteps when implementing GTM changes in May led to deal slippage that caused the company to lower its FY25 top line guidance, which was lowered by 2%, implying a low teens rev growth rate exiting the year. Not good for a company that was viewed as an AI beneficiary and more of a mid to high teens grower. Mgmt also cited EMEA demand softness for the guide down.

BAML downgrades this morning saying risks are now elevated from disruption in the sales organization due to issues experienced during a strategic sales realignment, the analyst tells investors in a research note. The firm still believes that Elastic is disruptive and a long-term share gainer in gen-AI, search, observability, and security, but it argues that rightsizing sales execution missteps can take several quarters and views the the risk/reward as balanced until data shows that "the issues are firmly behind."

Details:

Q1 revs of $347.4M, 1% above street

Q2 Revs guided to $353-$355M vs street at $361M

Q2 OPM 13% above 11.5% street

Q2 EPS 37-39c above street at 33c

FY guide lowered to $1,436-$1,144M (+14% growth at midpt) down from $1,468-$1,480…street was at $1,477 and buyside closer to $1,500M

Other News

Acer/ AI PCs: Acer aims to boost AI PCs to 40% of shipments next year – Nikkei

NXPI: board approves additional $2B authorization to its existing share repurchase program

OpenAI: OpenAI says ChatGPT usage has doubled since last year…ChatGPT now has >200M weekly actively users while ~92% of the Fortune 500 are using its products – Axios

UBER: Uber Plans to Step Up Fight With Larger Rival Kakao in Korea – Bloomberg