TMTB Morning Wrap

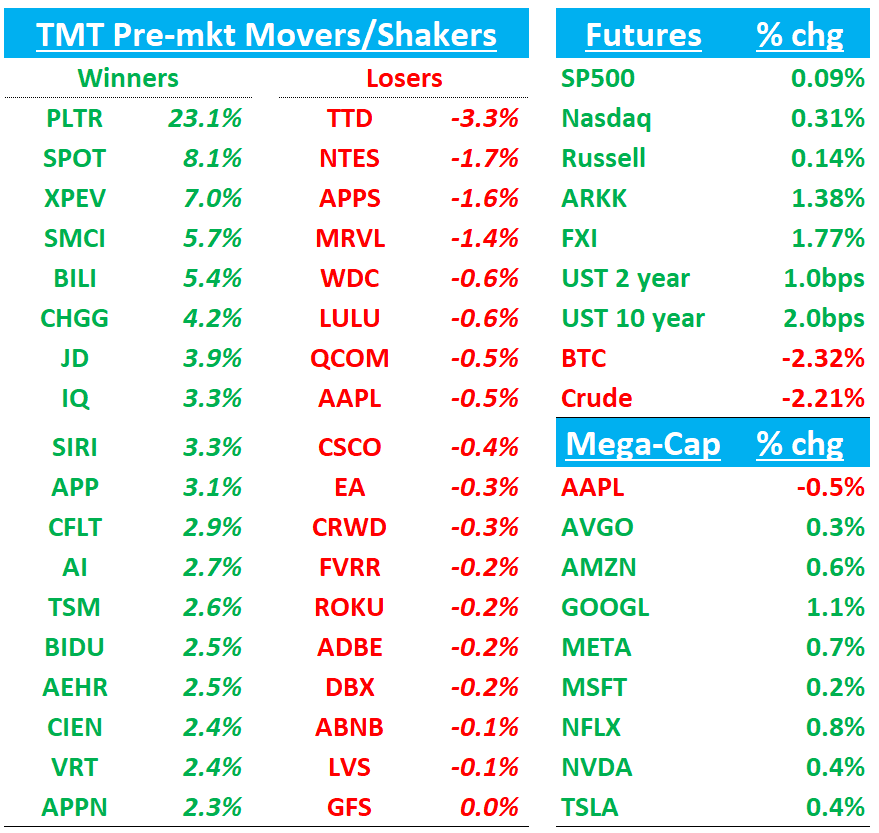

Good morning. QQQs +20bps. BTC -2.3% dipping below $100k as it continues to churn. Treasuries seeing modest selling pressure, w yields +1-2bps across the curve. Yesterday, Trump capitulated on Mexico/Canada tariff threats with both being deferred for 30 days while China didn’t have any luck and the 10% increase went into effect at midnight. China announced some retaliatory measures that will be implemented on 2/10. (trump and Xi supposed to hold talks in next 1-3 days). China +2% early.

We put out an earnings cheat sheet last night here

Let’s get to it…

PLTR +22%: Massive Beat and Raise and continued acceleration

The #s here speak to themselves - acceleration in gov’t and commercial on tougher comps. Really good guidance, implying another accel going forward and in ‘25. Kudos to Karp and co.

Revs beat by 6.6%, vs average beat of ~3% last few quarters and biggest beat since Q4’20

Revenue accelerated to 36% from 305 on a 3 ppts tougher comp.

Gov’t Revs accelerated to 40% from 33%

Commercial Revs re-accelerated to 31% from 26.5%

Q1 Rev guide: 36% growth. Given cadence of beats, means we likely get another accel close to 40% next q.

2025 revenue guidance of 31% Y/Y was also well above and an acceleration from ‘24’s 29% growth rate.

2025 Operating profit guide well above at $1.55B to $1.57B, EST $1.37B

Bulls will point to the #s and acceleration. Bears will continue to harp on Valuation

Morgan Stanley throws in the towel and upgrades to Hold

Despite an "ultra premium" valuation, Morgan Stanley sees a lack of downside catalysts for the shares over the next four quarters, the analyst tells investors in a research note. The firm says that given the strength of Palantir's outlook, it was wrong to expect slowing growth below the 30% level due to the tougher compares in 2025. "This leaves us with valuation as the primary remaining concern," Morgan Stanley contends. The analyst still thinks Palantir's long-term return outlook "screens unattractive" with the shares trading at 120-times estimated 2026 free cash flow, but says the company's revenue is poised to grow 30%-plus in 2025 and that its "powerful" artificial intelligence story that is resonating in the market. As such, Morgan Stanley sees a lack of fundamental catalysts for the shares to re-rate lower over next several quarters. (h/t TheFly)

Karp from SH letter:

"Our early insights into the commoditization of large language models have evolved from theory to fact"

"We have been preparing for this moment diligently for more than twenty years.

A certain indifference to the doubts and opinions of others, to the shiny and fashionable thing, was absolutely required.

But our patience, and what some would fairly describe as our disregard for the received wisdom, has been rewarded.

Our results, the admittedly vulgar metric by which a market often unsure of what it wants to reward attempts to assess value in this world, have now surpassed even our most ambitious expectations.

We still remember the quizzical looks of potential early investors when we attempted to explain that we were building enterprise software—at a time when the floodgates of Silicon Valley had opened to fund consumer trinkets, online shopping websites, and other quite forgettable experiments in sating the needs of the late capitalist mind…

"I think the real lesson, the more profound one is that we are at war with China. We are in an AI arms race...we have to realize that the AI race is winner-take-all and it's going to be a whole of nation effort...in order for us as a nation to win"

On DOGE, CTO:

" I think DOGE is going to bring meritocracy and transparency to government and that's exactly what our commercial business is...I think the work that we've done in government, it's deeply operational, it's deeply valuable, and we're pretty excited about exceptional engineers getting in there under the hood and being able to see that for a change."

PLTR GUIDANCE: Q1

- Guides revenue $858M to $862M, EST $802.9M

- Guides ADJ operating profit $354M to $358M, EST $300.4M

F/Y GUIDANCE

- Guides revenue $3.74B to $3.76B, EST $3.54B

- Guides ADJ operating profit

- Guides ADJ free cash flow $1.5B to $1.7B

- Guides US Commercial revenue above $1.08B

RESULTS: Q4

- Revenue $827.5M, +36% y/y, EST $775.9M

- Operating profit $11.0M, -83% y/y, EST $84.8M

- EPS $0.03 vs. $0.04 y/y

- Cash and cash equivalents $2.10B vs. $831.0M y/y, EST $1.18B

- ADJ operating profit $372.5M, +78% y/y, EST $309.6M

- ADJ EPS $0.14 vs. $0.08 y/y, EST $0.11

- ADJ EBITDA $379.5M, +75% y/y, EST $314.3M

- ADJ free cash flow $517.4M, +70% y/y

- ADJ operating margin 45% vs. 34% y/y, EST 39.6%

PYPL -6%: Decent Q4 but stock reversed as branded checkout growth 6% vs buyside 7-8% (M/VA saw acceleration so expects were higher)

4% gross profit growth.

Q1/FY Guide look slightly above as well.

15B buyback authorization (they plan to repurchase $6B of shares in 2025, or about 6.6% of the market cap

Call still ongoing, but bears will question why PYPL is significantly undergrowing e-comm in a quarter where everyone else accelerated. They’ll also harp on weak branded growth and saying BT repricing blew up branded button driving share loss and call out increased competition from SHOP and AAPL Pay going forward..

PYPL F/Y GUIDANCE

- Guides ADJ EPS $4.95 to $5.10, EST $4.89

- Guides transaction margin dollars $15.2B to $15.4B, EST $15.07B

- Guides free cash flow $6B to $7B, EST $6.61B

- Guides capital expenditure about $1B

GUIDANCE: Q1

- Guides ADJ EPS $1.15 to $1.17, EST $1.14

- Guides transaction margin dollars $3.6B to $3.65B, EST $3.59B

RESULTS: Q4

- ADJ EPS $1.19 vs. $1.14 y/y, EST $1.13

- Total payment volume $437.84B, +6.8% y/y, EST $436.74B

- Transaction margin dollars $3.94B, +7.2% y/y, EST $3.78B

- Payment transactions 6.62B, -2.6% y/y, EST 7.22B

- Active customer accounts 434M, +1.9% y/y, EST 433.07M

- Net revenue $8.37B, +4.2% y/y, EST $8.27B

- Transaction revenue $7.59B, +4.2% y/y, EST $7.54B

- Other value added services revenue $778M, +4.7% y/y, EST $748.3M

- US net revenue $4.73B, +2% y/y, EST $4.69B

- International net revenue $3.63B, +7.3% y/y, EST $3.59B

- ADJ operating income $1.50B, +2.3% y/y, EST $1.43B

- ADJ operating margin 18% vs. 18.3% y/y, EST 18.3%

- Total operating expenses $6.93B, +10% y/y, EST $6.89B

- ADJ free cash flow $2.10B vs. $774M y/y, EST $1.55B

SPOT +8%: Better premium subs/MAUs and better GMs; Q1 EBIT guide well above

Prem subs at 265M vs street at 260M (11M paid net adds vs buyside closer to 8.5-9M)

GM at 32.2% vs street at 31.8%, and in line with buyside

Q4 MAU growth accelerated to 12% vs 11% in Q3

Q1 Prem Subs guide 265M, about 5M higher than sellside and 2M higher than buyside heading in. 2M net adds slightly lower but overall # higher

EBIT guide: 548M vs street at 460M

"Looking into 2025, we view the business as well positioned to deliver another year of continued growth and improving margins as we reinvest to support our long-term potential."

SPOT GUIDANCE: Q1

- Guides monthly active users 678M, EST 677.61M

- Guides operating income EU548M, EST EU460.1M

- Guides revenue EU4.2B, EST EU4.18B

- Guides total premium subscribers 265M, EST 259.27M

- Guides gross margin 31.5%, EST 31.2%

RESULTS: Q4

- Operating income EU477M

- Revenue EU4.24B, EST EU4.16B

- Premium revenue EU3.71B, EST EU3.65B

- Gross margin 32.2%, EST 31.8%

- Monthly active users 675M, EST 664.94M

- Total premium subscribers 263M, EST 259.99M

- Ad-supported MAUs 425M, EST 417.94M

- Average rev. per user EU4.85, EST EU4.75

- EPS EU1.76

NXPI +2%: Q4 Beat, Q1 Guide slightly below street but in line with bogeys

Seasonality guided down -MSD q/q, which is a bit worse than seasonal, but about inline with buyside

GM guide 56.3% at midpoint, slightly below street at 56.9%.

Auto strength was offset by weakness in Industrial and IOT.

Call ongoing….

GUIDANCE: Q1

- Guides ADJ EPS $2.39 to $2.79, EST $2.69

- Guides revenue $2.73B to $2.93B, EST $2.92B

- Guides EPS $1.75 to $2.14, EST $2.1

NXPI RESULTS: Q4

- ADJ EPS $3.18 vs. $3.71 y/y, EST $3.14

- EPS $1.93 vs. $2.68 y/y

- Revenue $3.11B, -9.1% y/y, EST $3.1B

- Automotive revenue $1.79B, -5.7% y/y, EST $1.74B

- Industrial & IoT revenue $516M, -22% y/y, EST $533M

- Mobile revenue $396M, -2.5% y/y, EST $397.2M

- Communications Infrastructure & Other revenue $409M, -10% y/y, EST $429.6M

- ADJ gross margin 57.5% vs. 58.7% y/y, EST 57.5%

- ADJ operating income $1.07B, -13% y/y, EST $1.06B

- ADJ operating margin 34.2% vs. 35.6% y/y, EST 34.2%

- R&D expenses $612.0M, -6% y/y, EST $573.9M

- Inventory $2.36B, +10% y/y, EST $2.14B

- Capital expenditure $130.0M, -26% y/y, EST $177.6M

- ADJ free cash flow $292M, -70% y/y, EST $866.9M

NEWS/RESEARCH

3P Roundup:

TTD: Clev saying Q4 in line (softer brand spend and weak budget flush) and CTV market growth likely decels in 2025 as Q1 starting slow

ROKU: Clev saying Q4 finished weaker / Q1 starting weaker on weaker brand spend / CPM pressure. Yipit out more positive saying Q4 could see a decent sized beat and raised their estimates.

DASH: M-sci raises GOV estimates further ahead of street and says Q1 on track to o/p

CVNA: Hearing Yip saying last week units ~40% y/y, roughly inline with prev week

EXPE: M-sci saying Q1TD volumes pacing ahead of Q4 and improved from exit rate in Dec

MRVL: JPM Asia out saying AIchip will be sole vendor for n3 AI ASIC project for a US CSP offering back-end design and packaging deign, with AWS handling front-end design and IP sourcing on its own.

JNPR: Juniper upgraded to Outperform from In Line at Evercore ISI

ISI is upgrading JNPR to Outperform from In Line as it thinks there are two potential scenarios for Juniper going forward, with both resulting in upside to the current share price. 1) HPE is successful in their bid for JNPR and JNPR shareholders will end-up with $40/share (15% upside). 2) HPE loses the DOJ trial, JNPR is an independent company and in that scenario it thinks there are a host of fundamental levers that would make JNPR a good stock in 2025 networking recovery, MIST share gains, cloud ramps (xAI and more) + margin expansion. ISI thinks you could see an upside scenario where JNPR gets to $2.50 of EPS potential in CY25 and on a mid/high teens valuation the stock works in the low $40 range. NET/NET: ISI thinks for investors with some duration and patience to go through the DOJ/HPE litigation there is an opportunity to see upside on JNPR stock

(Out Yesterday) NVDA: MS Asis lowered 2025 GB200 NVL72 forecast to 20-25k vs 30-35k based on moderating MSFT capex growth

This was out yesterday, but passing along for those that didn’t see.

MS Asia said GB200 ramp slower than expected with yield issues around Biance board being an incremental bottleneck, calling out chips mounted unevenly onto PCB, resulting in worse heat dissipation via cola plate than expected.

MS thinks MSFT capex reduction could suggest $30-35B impact to GB200 supply chain although some of this this is demand shifting to FB300 from GB200 as CoWoS builds have gone up in recent weeks.

NVDA: BofA previews positively and re-iterates top pick ahead of NVDA’s Jan Q in Feb.

BofA expects modest beat/inline guidance with lower Q1 margins from Blackwell transition and China restrictions. BofA points to three key positives: Blackwell execution confidence, FY26 datacenter growth outlook (60%+ YoY vs TSMC's 100%+ AI growth forecast), and GTC Conference catalyst (March 17) showcasing GB300, Rubin, and robotics initiatives. BofA notes NVDA trades at attractive 26x CY25E PE versus 25x-59x historical range (39x median).

CRM: Salesforce Cutting 1,000 Roles While Hiring Salespeople for AI

Salesforce Inc. is cutting jobs as its latest fiscal year gets underway, according to a person familiar with the matter, even as the company simultaneously hires workers to sell new artificial intelligence products.

More than 1,000 roles will be affected, according to the person, who asked not to be identified because the information is private. Displaced workers will be able to apply for other jobs internally, the person added.

“Just because we have a hit new product doesn’t mean that we ignore the commitments we’ve made internally and externally as we think about scaling this business,” Chief Operating Officer Brian Millham said when asked about the company’s profit-focus during an event hosted by Barclays Plc in December. “We’re looking across the entire company to say, ‘Where can we get more efficiencies? How can we continue to get fuel for the work that we’re doing to go invest in scale going forward?

RBLX: Roblox price target raised to $80 from $60 at Canaccord

Canaccord raised the firm's price target on Roblox to $80 from $60 and keeps a Buy rating on the shares. The firm previewed its Q4 results saying the ongoing introduction of new tools for creators and developers to better monetize their work has led to higher quality content on Roblox, and this is expected to contribute to another quarter of strong engagement and bookings growth, with management set to introduce standalone advertising revenue guidance for the first time given the growing importance of ads on the platform.

AMZN: Amazon, King of Online Retail, Can’t Seem to Make Its Physical Stores Work

WSJ:

Amazon .com, the largest e-commerce retailer in the U.S., is stumbling in its efforts to compete in the bricks-and-mortar world.

The company in 2018 launched the Amazon Go convenience store, where customers can grab a latte, bagel or turkey sandwich and walk out without waiting in line to pay. Amazon charges them electronically.

But with the Amazon Go store in Woodland Hills, Calif., closing this month, the retailer has shrunk its Go portfolio by about half since early 2023, to 16 stores in four states. Instead, Amazon is focusing on licensing its “Just Walk Out” technology to other retailers.

NIO: JPMorgan downgrades Nio on more conservative 2025 view

JPMorgan downgraded Nio to Neutral from Overweight with a price target of $4.70, down from $7. The company's high-end ET9 sedan should help support margins, but its volume contribution could be limited given a relatively smaller addressable market, the analyst tells investors in a research note. JPMorgan cites its relatively more conservative view on Nio versus the consensus for the downgrade. In 2025, the company's earnings delivery will again play an integral role in the stock's performance, and JPMorgan revised down revenue and earnings estimates, the analyst says.

Other News:

AAPL: Apple is expected to launch iPhone SE 4, iPad 11, M4-powered MacBook Air, M3-powered iPad Air, and smart home display with Apple Intelligence as early as March – TechNews

China/GOOGL: China initiates investigation into Google over alleged violation of its anti-monopoly law – PR

NVDA: Senators urge tougher chip controls to stymie Chinese AI advance – WaPo

SMCI: sets earnings date on Feb 11th

Tech: Trump is expected to name Adam Candeub, a critic of Big Tech, to the role of general counsel for the FCC – Semafor

Nintendo: Nintendo Cuts Earnings, Switch Sales Guidance Amid Profit Slump– WSJ