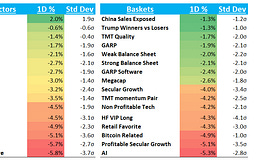

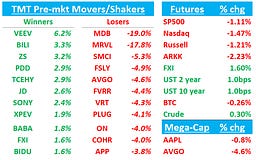

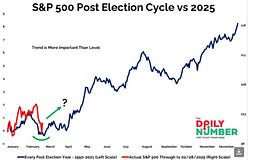

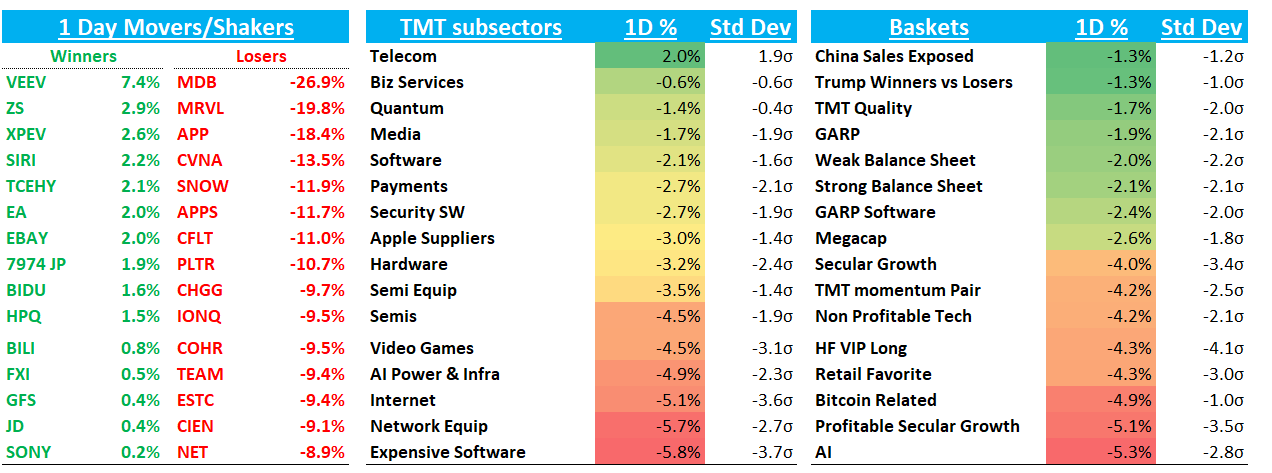

Another big red day as QQQs -2.75% (dn 10% from highs), SPY -1.7%, SOX -4.5%, and ARKK -4.6%. yields were mixed with 2 year sliding 4bps while 10 year remained flat while Fed expects stayed steady at 75bps worth of cuts. Why the sell off? In tech, MRVL -20% and MDB -27% prints didn’t help; on the macro front more uncertainty around trade ware and more signs of slowing growth with Challenger report showing a massive spike in layoffs last month. All eyes on NFP before the open tomorrow - the QQQs are currently pricing in close to a 2% move, which is more than what was expected for the election and just goes to show how impt the print is.

又是一个大幅下跌的日子,QQQ 下跌 2.75%(从高点下跌 10%),SPY 下跌 1.7%,SOX 下跌 4.5%,ARKK 下跌 4.6%。收益率表现不一,2 年期国债收益率下滑 4 个基点,而 10 年期国债收益率保持平稳,同时美联储预期仍维持在 75 个基点的降息幅度。为何出现抛售?在科技板块,MRVL 下跌 20%和 MDB 下跌 27%的表现并未起到积极作用;在宏观层面,贸易战的不确定性增加,且更多迹象显示增长放缓,Challenger 报告显示上个月裁员人数大幅飙升。所有人都在关注明天开盘前的非农就业数据(NFP)——QQQ 目前定价接近 2%的波动,这比选举时的预期还要大,这也显示出该数据的重要性。

Won’t do a full recap today as on a day like today a lot of moves explained more by de-grossing/flows rather than any fundamental reason. To try to place a fundamental reason on many things misses the forest for the trees as they say. We’ll point out a few things that stood out:

今天不会进行完整的回顾,因为在像今天这样的日子里,很多变动更多地是由去杠杆化/资金流动而非任何基本面原因所解释的。试图为许多事情寻找基本面原因,就像人们常说的那样,只见树木不见森林。我们会指出一些突出的点:

APP -18%: Didn’t see anything specific. It’s an over-crowded longs where generalists confidence has been shaken and easy one to sell in one’s portfolio when de-grossing. Possibility of SP500 add tomorrow although:

APP -18%:没有看到任何具体原因。这是一个过度拥挤的多头仓位,通才们的信心已经动摇,在减仓时很容易在投资组合中卖出。不过,明天有可能被纳入 SP500。

META: -4.3% despite a positive mention at Cleveland saying Q1 spending tracking ahead of partner expects on strong ROI, recovery in brand, and success with Adv+ although tailwinds from TikTok likely moderating

META: -4.3%,尽管在克利夫兰被正面提及,称 Q1 支出因强劲的 ROI、品牌复苏和 Adv+的成功而超出合作伙伴预期,尽管来自 TikTok 的顺风可能正在减弱。ABNB -5.5% underperforming other travel names as Yipit downticked on the weekly data

ABNB -5.5% 表现逊于其他旅游股,因 Yipit 周度数据下滑EBAY +2% one of the few green names on my screen

EBAY +2% 我屏幕上为数不多的绿色名字之一MDB -26% as no one is in the mood for guidance games and weaker FY guide/margins took stock down…cloud names hit on the miss: SNOW -12% now back well below earnings; CFLT -11%; ESTC -10%; DDOG -3%

MDB -26%,因为没有人有心情玩指引游戏,较弱的财年指引/利润率导致股价下跌……云服务公司因业绩未达预期而受挫:SNOW -12%,现已远低于盈利水平;CFLT -11%;ESTC -10%;DDOG -3%MRVL -20% after missing Q1 #s as AI semis continue to get sold regardless of how print looks (we think in a normal market, stock would likely have been down 5-10%, maybe even less given it was down 15% YTD heading in and we thought co did a decent job confirming AMZN growth through CY27. But that’s like saying “If my Grandmother had wheels she would have been a bike")

MRVL -20%,因 Q1 财报未达预期,尽管财报表现如何,AI 半导体股票继续被抛售(我们认为在正常市场中,股票可能下跌 5-10%,甚至更少,因为年初至今已下跌 15%,且我们认为公司在确认 AMZN 增长至 CY27 方面做得不错。但这就像说“如果我的祖母有轮子,她就会是一辆自行车”)。CRDO -10% more follow through form yesterday

CRDO -10% 昨日继续下跌AI names didn’t fare well although Altman sounded positive about GPU demand at MS TMT: NVDA -6% sitting at $110 again; MU -5%; AMD - 2.8%; VST -10%; CLS -10%

AI 股表现不佳,尽管 Altman 对 MS TMT 的 GPU 需求持乐观态度:NVDA 下跌 6%,再次跌至$110;MU 下跌 5%;AMD 下跌 2.8%;VST 下跌 10%;CLS 下跌 10%。

CVNA -13%: All I saw was this:

CVNA -13%:我所看到的只有这个:

TSLA -6% as Baird made it a fresh top pick. Post-mkt got an ug at Cowen. TheFly:

TSLA -6%,因 Baird 将其列为新的首选股。盘后 Cowen 给出 ug 评级。TheFly:

TD Cowen upgraded Tesla to Buy from Hold with a price target of $388, up from $180, after assuming coverage of the name. The firm sees merits in both the bull the bear case for the stock, but ultimately comes out "tactically bullish" given the recent share price pullback coming "ahead of several potentially consequential catalysts this year." Tesla's "potentially game-changing level catalysts" across electric vehicles, autonomous vehicles and robotics are robust enough to tilt the stock's risk/reward favorably with the shares pulling back meaningfully from recent highs, the analyst tells investors in a research note.

TD Cowen 将特斯拉评级从持有上调至买入,目标价从 180 美元上调至 388 美元,原因是该公司开始覆盖该股票。该机构认为特斯拉股票的多头和空头观点都有其道理,但最终得出“战术性看涨”的结论,因为近期股价回调出现在“今年几个可能具有重大影响的催化剂之前”。分析师在研究报告中告诉投资者,特斯拉在电动汽车、自动驾驶汽车和机器人领域的“可能改变游戏规则的催化剂”足够强大,足以在股价从近期高点显著回调的情况下,使股票的风险/回报向有利方向倾斜。

AAPL flat AAPL 持平