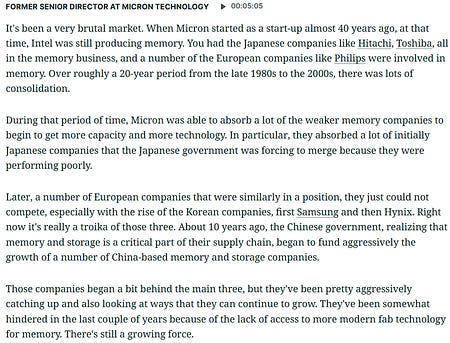

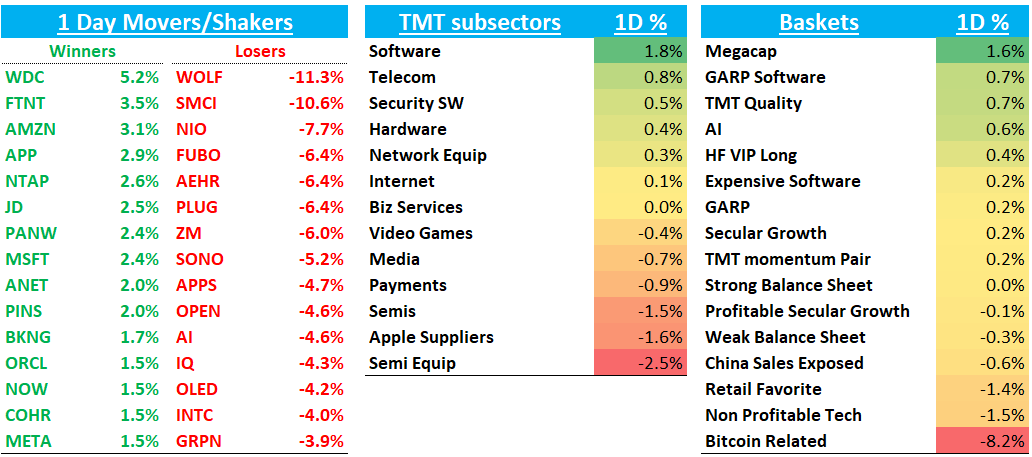

QQQs +60bps with a nice EOD rally . A bit of reversal of the price action yesterday as Megacaps led the way higher and non-profitable tech names declined. Semis continue to lag falling -1.2% and ADI saw some ugly price action going from +7% in the pre to -2% as mgmt talked down industrial recovery. The rest of analog space did the same green to red dance. NVDA +75bps managed to crawl to a positive day but relatively uninspiring price action given it’s down 7-8% in the last two days. Surprisingly, MSFT finally got a bit of a bid today +2% helped by bid to largecaps - didn’t see anything in particular but has a lot of room to catch up to other sw names as has underperformed IGV by 20% over the last few months. Large cap internet also got a bid led by AMZN +3%.

On the macro front, Fed minutes didn’t really change much vs the ongoing status quo and odds of a fed rate hike at 12/18 continue to hover in 50-55% range. Econ data mixed this morning: Case-Shiller shows cooling September home prices, new home sales decline (impacted by October weather), while consumer confidence edged slightly higher m/m. BTC - 3% getting close to $90k bringing down fintech names along with it. China - 50bps. Yields mixed with the 2 year -2bps but the 10 year +2bps. IWM -1% / ARKK -1

We have CRWD DELL WDAY and NTNX post close.

Let’s get to the recap…

Internet

AMZN +3% as BAML was positive on logistics improvements can continue to drive margin improvement. Heard Yip weekly NA retail data also showed a slight uptick now showing ~2 ppts beat although obviously the next month of holiday spending is especially important

Other large cap fared well: GOOGL +1%; NFLX +1%; META +1.6%

PINS +2% / RDDT - 5% —> didn’t hear much on either today

W -6% presumably on weaker housing data although 3p weekly data slightly upticked

UBER -2.7% failed to catch the large cap memo. LYFT - 1.3%

Travel fared well ahead of holiday rush: BKNG +1.7%; EXPE +50bps although ABNB -1% lagged

Semis

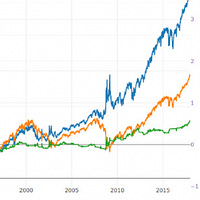

SOX not really looking pretty at the moment:

MRVL/NVDA +75bps eeked out gains

MU -3.5% on a pretty neg note on DRAM pricing by Mizuho’s Asia team. (see our morning note for details)

Other names weak as Trump talked up Chinese tariffs: TSM -1%; ASML - 2%; AMAT -1.5%

Analog names all weak on ADI talking down industrial although commentary around auto and elsewhere seemed fine. Investors just don’t seem to want to park their $ in anything semis right now: ADI -3%; ON -3%; NXPI -2.5%; TXN -1.3%

Software

MSFT +2.2% - been a while since seen some outperformance vs IGV

Other large cap also got a bid similar to internet: NOW +1.5%; ORCL +1.4%; SAP +40bps; CRM +1.3%; ADBE +1% despite some leaked Sora AI vids which shows some nice advancements

APP +3.5% as Jefferies raised tgt to $400 from $270 citing strong e-commerce product pilot feedback, particularly from Snow Agency, indicating Meta-comparable ad spend returns at scale. Their channel checks suggest potential to surpass Google in budget allocation mix by 2025, leading them to raise FY24-28 ad revenue estimates. Checks here continue to sound good and estimates continue to move higher…

ZM -6% giving some back after a roughly inline-ish q

Cloud consumption names digesting recent strength: DDOG - 1.5%; CFLT - 1.7%l MDB - 1.4%

Elsewhere

RIVN -1% after being up 9% on receiving $6.6B commitment from DoE ATVM

Fintech weak on BTC weakness: SQ - 2%; COIN -6%; AFRM - 5%; HOOD - 4%…Watching the $285 breakout level on COIN since it’s been a leader post-trump as a tea leaf that could portend more digestion in post-trump winners. Still too early and just one name (Obviously BTC px more impt and still plenty of room from $70k breakout level)