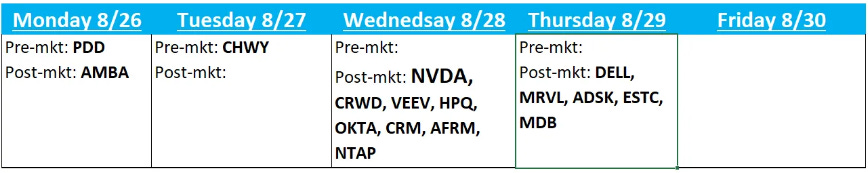

Good morning. Big earnings week for the last week of August, with NVDA the headliner on Wednesday:

ISI also hosting their semis/hardware conference in Chicago early this week.

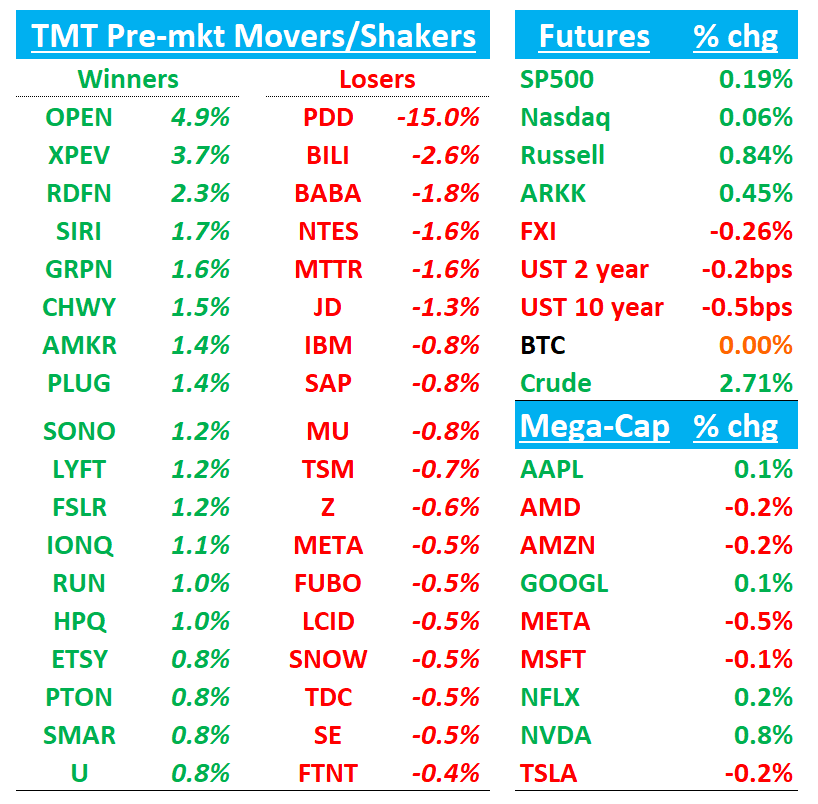

QQQs/yields/BTC flattish. Let’s get to it…

PDD: Looks worse with top line 3% below street although earnings better. Commentary in the PR doesn’t sound good. Call ongoing started at 7:30am est.

From the PR:

"In the past quarter, our revenue growth rate slowed quarter-on-quarter. Looking ahead, revenue growth will inevitably face pressure due to intensified competition and external challenges," said Ms. Jun Liu, VP of Finance of PDD Holdings. "Profitability will also likely to be impacted as we continue to invest resolutely."

Q2 Results:

- ADJ earnings per American depositary receipts 23.24 yuan, EST 20.52 yuan

- Revenue 97.06B yuan, EST 99.99B yuan

- Revenues from online marketing services and others 49.12B yuan, EST 50.5B yuan

- Transaction services revenue 47.94B yuan, EST 50.02B yuan

- ADJ net income 34.43B yuan, EST 30.1B yuan

- Total operating expenses 30.80B yuan, EST 33.1B yuan

- Sales and marketing expense 26.05B yuan, EST 27.9B yuan

- R&D expenses 2.91B yuan, EST 3.49B yuan

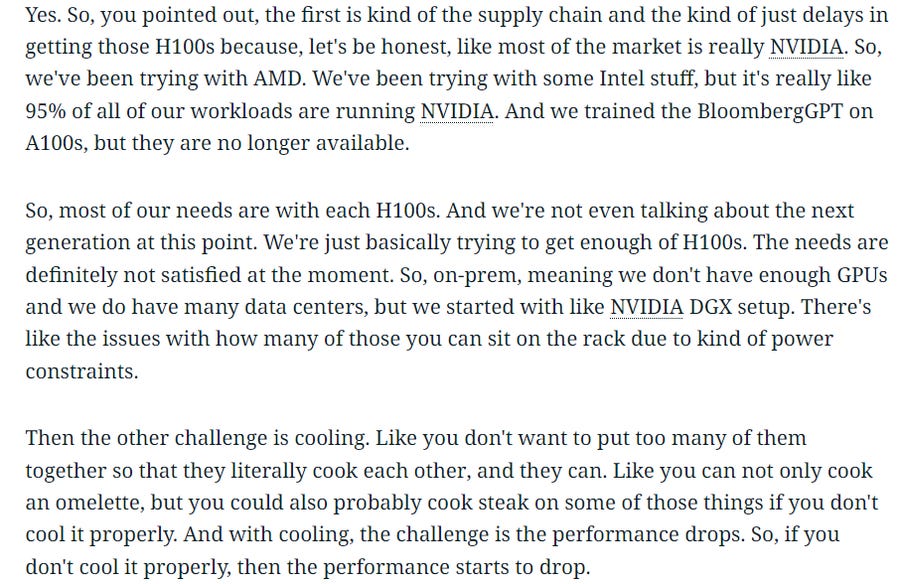

NVDA: Nvidia Blackwell timing delays created a buying opportunity, says Morgan Stanley

TheFly:

Morgan Stanley notes that Nvidia's stock has "largely shrugged off concerns around potential Blackwell delays - correctly so," having created a buying opportunity, as expected, as the market looked through those concerns. The near-term business is strong and the company will still see Blackwell ramp this year, as per initial guidance, adds the analyst in an earnings preview note. While there were some interim Blackwell delays, the firm expects management to characterize that they are still in line for volume this quarter and ramp into fiscal year end and says that shift in timing doesn't matter very much, as supply and customer demand has rapidly pivoted to H200 and H20 demand that remains "robust," adds the analyst, who has an Overweight rating and says Nvidia remains the "Top Pick" in its space.

3p Roundup:

GOOGL: Hearing Yip increased search estimates on the back of improvement in political spend — now only half a ppt below street vs ~2% before.

BABA: Hearing 3p saying GMV stayed resilient over the last 30d

AMZN: Amazon.com price target lowered to $225 from $232 at Wells Fargo as they lower OP inc estimates on greater Kuiper investments

Wells Fargo lowered the firm's price target on Amazon.com to $225 from $232 and keeps an Overweight rating on the shares following a deep dive into the company's Kuiper satellite internet service, which will be available commercially by the end of 2025. WFS notes that heavy upfront costs related to satellite launches, commencing in the second half of 2024, reduce operating income forecasts for Amazon from 2025 through 2027. also citing that The firm saysso unclear synergy with its core operations. It estimates $11B of launch costs as Kuiper deploys 3,236 satellites from 2024 to 2029.

MU: Needham comments on MU’s comments at semi conference

At Needham's 5th Annual Virtual Semiconductor and SemiCap 1x1 Conference, Micron reiterated comments made recently at a competitor's conference that bit shipments across DRAM and NAND would be approximately flat Q/Q in F1Q25 (November) and that gross margin would increase by ~200bps Q/Q in F1Q25. Needham notes the bit shipment commentary is “incrementally more cautious” than guidance given on the F3Q24 (May) earnings call for bit shipments to strengthen modestly in F1Q25 from flat for DRAM and up slightly for NAND in F4Q24 (August). Needham notes that mgmt also stated the company is walking away from near-term deals where pricing is aggressive and that client demand has moderated given inventory builds earlier this year.

INTC: (out late Friday) Intel has hired Morgan Stanley, other advisers for activist defense

CNBC:

Intel is working with advisors including Morgan Stanley to help defend itself against activist investors, according to people familiar with the matter, as CEO Pat Gelsinger attempts to turn around the struggling chipmaker.

While Intel has faced activist pressure in the past, no new campaign has been formally launched and it isn’t clear if an activist investor has been in contact with the company’s board. Morgan Stanley has previously worked with Intel, including in the company’s 2022 spinoff of Mobileye

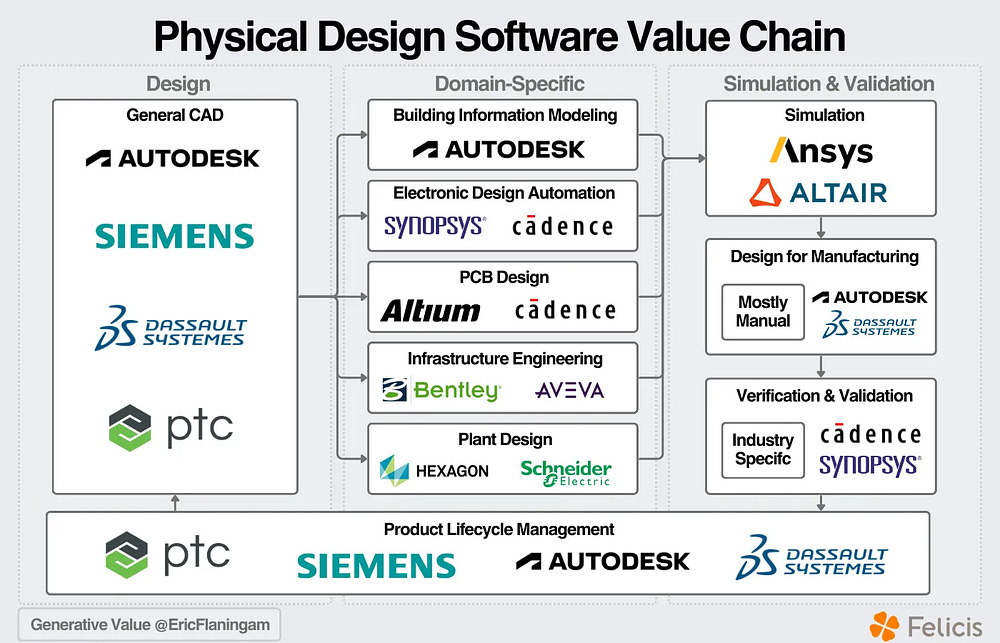

ADSK: Citi and KEYB preview earnings later this week

CITI is raising estimates/TP continuing to see upside to shares via both fundamental + value creation levers. CITI's post Q channel checks leaned positive, with resellers highlighting better growth expectations + pull-forward ahead of the transaction model rollout. While CITI expects strong upside in Q2 to be partially mechanical in nature, it is optimistic on at least a slight full year guidance raise, especially with improving macro data (ABI + DMI). Beyond the demand trends, CITI believes Activist pressure and margin expansion initiatives can drive stronger profitability improvements and serve as a catalyst.

KEYB's FQ2 quarter-end checks were more mixed, but reseller feedback regarding the new billings transaction system had improved compared to its mid-quarter update. With the overall tone of business largely unchanged from prior quarters, KEYB stills expect the Company to post in-line to slightly better FQ2 revenue, and for Autodesk to adjust its FY25 guide to incorporate the billings transition in Europe. Net, KEYB continues to see a compelling margin expansion-led narrative change, and view ADSK as one of its favorite early 2025 ideas.

CRM: Citi and ISI preview the q later this week

CITI heads into CRM's FQ2 results with a relatively balanced view. While partner inputs remain cautious and CITI sees risk of slowing 2H, Q2 estimates look achievable, with slightly more favorable FX de-risking FY25 revenue guidance. CITI sees some risk to consensus FQ3-FY25 CC cRPO estimates given tough comps (AWS megadeal + lapping of price increases) and its cc CRPO estimate is ~1 PT below consensus.

ISI says to expet solid Q2 results but a potential cut to 2H rev/cRPO as macro remains uneven. ISI notes that CRM will be facing a tough cRPO compare in Q3 so seeing cRPO in the 8-9% should not come as a surprise — they believe better margins and a lower 2H bar could raise investor interest post print.

UBER: BAML recaps call with IR

BAML hosted an IR call with investors. BAML notes that Uber emphasized a hybrid autonomous vehicle (AV) strategy, citing current limitations with weather, highways, and parking. They plan to expand partnerships with AV providers, potentially including Waymo. Uber claims their platform can enhance AV asset utilization by 25%, offsetting their 20% revenue take rate. Safety remains a priority, and they are open to integrating AVs across various markets. For growth, BAML mentoins that Uber focuses on New Verticals like Uber For Business and value-oriented options (Moto, Hailables, UberX Share), which expand their market reach and complement public transport in emerging markets. These offerings help mitigate concerns over consumer slowdown, with lower-end services growing faster than high-end in the last quarter.

Other News

AAPL: Apple Targets Sept. 10 Debut for New iPhones, AirPods and Watches – Bloomberg

AAPL: Apple Rethinks Its Movie Strategy After a String of Misses – NYT

AAPL/META: (out Friday) Meta Cancels High-End Mixed-Reality Headset– The Information

ByteDance: Coatue Considers Selling Part of ByteDance Stake as IPO Remains Uncertain – The Information

China Tech: Big Tech in China doubles AI spending despite US restrictions – FinancialTimes

CRWD/MSFT: Microsoft, Cyber Firms to Meet on Fixes After CrowdStrike Crash– Bloomberg

Gen AI: Asia press noting that both US CSPs and Taiwan’s AI server supply chain (Wistron, Wiwynn, Quanta, Inventec, Hon Hai) reportedly all expressed positive views on AI strong demand – Commercial Times (h/t BAML)

IBM: IBM Shuts China R&D Operations in Latest Retreat by U.S. Companies - WSJ

Memory: Asia press reports SK Hynix will announce a closer collaboration w/ TSM & NVDA during Semicon Taiwan in Sept, which is expected to focus on the development of next-gen HBM – Commercial Times (h/t BAML)

NFL: The N.F.L. May Soon Welcome a New Kind of Owner (Private Equity) – NYT

PARA: Edgar Bronfman’s Paramount Plans Include Partnership With Big Tech - Bloomberg

UBER: Dutch DPA fines Uber ~$324M for transferring data to US – PR

XPEV: +5% premarket after CEO insider buy; He Xiaopeng bought 1.4M adss at avg $7.02 each; increases holding to 18.8%

W: Argus downgrades to Hold