QQQs -30bps after another volatile day that saw a 3% trough to peak intraday move just to finish around flat. Potential reasons for the bounce? Zelensky’s apologetic X post could smooth tensions with the White House was cited as well as Europe gearing up to spend big—EU leaders floated an €800 billion defense boost on Tuesday, while German officials greenlit looser debt rules to fund more infrastructure and military projects. And now QQQs +70bps in the aftermarket as we get this news:

QQQs 在经历了又一个波动性较大的一天后下跌了 30 个基点,盘中曾出现 3%的涨跌幅度,最终几乎持平。反弹的潜在原因?泽连斯基在 X 平台上发布的道歉帖子可能缓和了与白宫的紧张关系,同时欧洲准备大举支出——欧盟领导人周二提出了 8000 亿欧元的国防增支计划,而德国官员则批准了更宽松的债务规则,以资助更多的基础设施和军事项目。而现在,随着我们得到这一消息,QQQs 在盘后交易中上涨了 70 个基点:

LUTNICK: TRUMP MAY ROLL BACK CANADA, MEXICO TARIFFS TOMORROW

LUTNICK:特朗普可能明天撤销对加拿大和墨西哥的关税

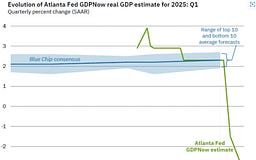

So all it took was less than a day and SP500 down 5% from ATHs for a bit of capitulation on Trump’s part. We have the SOTU tonight. 2 year yields dipped 2bps while the 10 year rose 5bps and fed expects still hover around ~75bps worth of cuts for the year.

因此,特朗普在不到一天的时间里,随着标普 500 指数从历史高点下跌 5%,就出现了些许的屈服。今晚我们还有国情咨文演讲。两年期收益率下降了 2 个基点,而十年期收益率上升了 5 个基点,美联储预期的全年降息幅度仍徘徊在约 75 个基点左右。

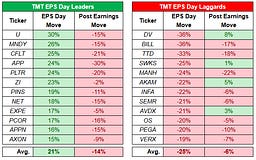

How to trade this market? First and foremost, we continue to be in a protect pnl mode (= low gross) — it’s still early in the year and we think post-Q1 (or when a clearer macro/policy picture emerges) we’ll likely get an easier market to trade so we’ve been sitting on our hands a lot being patient. We continue to be v selective in our add spots. In other words: no need to be a hero. There will tradeable bounces in the market / tactical opportunities in stocks when stars align/tea leaves are there (easier to trade tactical opps if you’re not running a huge book). We saw one Friday, another one day and given news of Trump running back tariffs and coming off an oversold condition will likely have some follow through tomorrow. Then all eyes will shift to NFP on Friday. We continue to think market will remain choppy as policy/growth uncertainty remains with Trump/macro releases continuing to have large outsized impact on the market.

如何在这个市场中交易?首先,我们仍处于保护利润模式(=低总仓位)——现在仍是一年中的早期阶段,我们认为在第一季度之后(或当宏观/政策图景更加清晰时),市场可能会变得更容易交易,因此我们一直在耐心等待。我们在增加仓位时非常挑剔。换句话说:没有必要成为英雄。当条件成熟/有迹象时,市场上会有可交易的反弹/股票中的战术机会(如果你没有持有大量头寸,战术机会更容易交易)。我们在周五看到了一个,另一个在一天内出现,鉴于特朗普重新征收关税的消息以及从超卖状态中恢复,明天可能会有一些后续行动。然后所有人的目光都将转向周五的非农就业报告(NFP)。我们继续认为市场将保持波动,因为政策/增长的不确定性仍然存在,特朗普/宏观发布继续对市场产生巨大的影响。

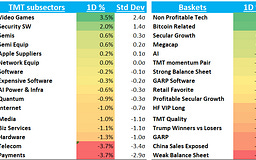

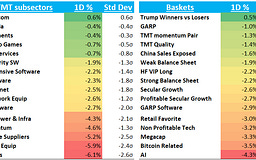

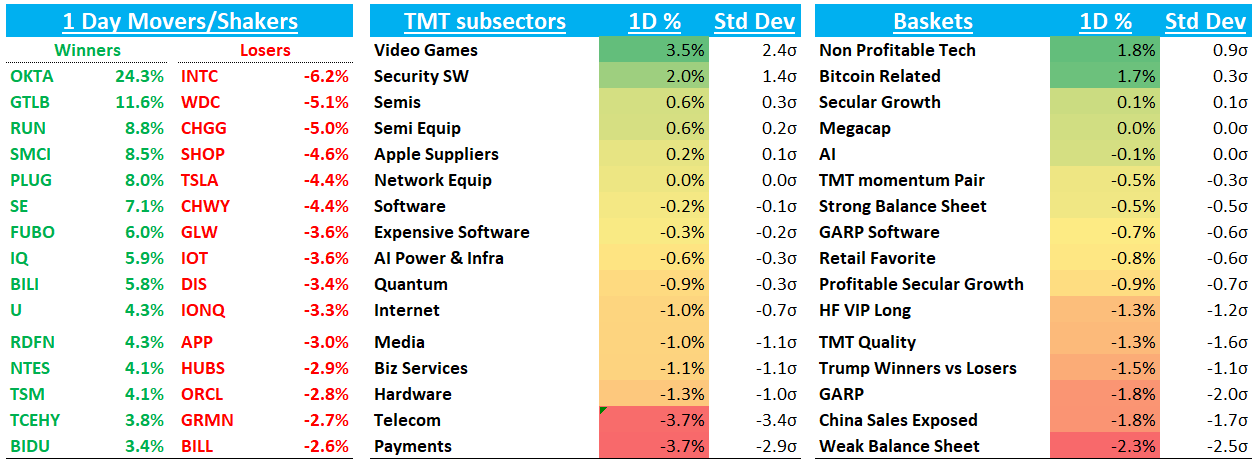

This morning felt like the heaviest de-grossing we’ve seen in Tech so far although even in the early morning OKTA and GTLB which had both reported earnings remained in the green, usually a good intra-day tea leaf of which direction market wants to go. OKTA +24% and GTLB +11.5% both finished the nicely. Non profitable tech and semis led the rally today.

今天早上感觉像是迄今为止在科技领域看到的最严重的去杠杆化,尽管在早盘时段,已经发布财报的 OKTA 和 GTLB 仍然保持上涨,这通常是市场方向的一个良好日内信号。OKTA 上涨 24%,GTLB 上涨 11.5%,两者收盘表现都不错。今天领涨的是非盈利科技股和半导体股。

We’ve been busy with MS TMT Day 2 - we’ll have some summaries out later.

我们一直在忙于 MS TMT 第二天——稍后会发布一些总结。

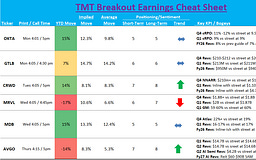

Post-close, CRWD -8%..>NARRR +$224M, seemingly hit bogeys of $210-$220M. Rev guide inline but operating inc guide weaker. Other nitpicks I’m hearing is Q1 guide softer and NNARR actually not as good if you look at it ex Carasoft in Q3

收盘后,CRWD 下跌 8%..>NARRR 增加 2.24 亿美元,似乎达到了 2.1 亿至 2.2 亿美元的目标。收入指引符合预期,但运营收入指引较弱。我听到的其他挑剔之处是 Q1 指引较为疲软,以及如果排除 Q3 的 Carasoft,NNARR 实际上并不如看起来那么好。

$CRWD GUIDANCE: Q1 $CRWD 指引:第一季度

- Guides ADJ operating income $173.1M to $180.0M, EST $219.7M

- 指导 ADJ 运营收入为 1.731 亿美元至 1.800 亿美元,预期为 2.197 亿美元

- Guides revenue $1.10B to $1.11B, EST $1.11B

- 预计收入为 11 亿至 11.1 亿美元,预估为 11.1 亿美元

- Guides ADJ EPS $0.64 to $0.66, EST $0.96

- 指导调整后每股收益(ADJ EPS)为$0.64 至$0.66,预估(EST)为$0.96

2026 F/Y GUIDANCE 2026 财年指引

- Guides revenue $4.74B to $4.81B, EST $4.77B

- 预测收入为 $4.74B 至 $4.81B,预期 $4.77B

- Guides ADJ operating income $944.2M to $985.1M, EST $1.03B

- 指导 ADJ 营业收入为$944.2M 至$985.1M,预期$1.03B

- Guides ADJ EPS $3.33 to $3.45, EST $4.43

- 指导 ADJ 每股收益(EPS)为$3.33 至$3.45,预估为$4.43

RESULTS: Q4 结果:Q4

- Revenue $1.06B, +25% y/y, EST $1.03B

- 收入 $1.06B,同比增长 25%,预期 $1.03B

- Subscription revenue $1.01B, +27% y/y, EST $986.9M

- 订阅收入 $1.01B,同比增长 27%,预估 $986.9M

- Professional services revenue $50.2M, +1.7% y/y, EST $48.5M

- 专业服务收入$50.2M,同比增长 1.7%,预估$48.5M

- ADJ EPS $1.03 vs. $0.95 y/y, EST $0.86

- 调整后每股收益(ADJ EPS)$1.03,去年同期为$0.95,预期为$0.86

- Annual recurring revenue $4.24B, +23% y/y, EST $4.12B

- 年度经常性收入 $4.24B,同比增长 23%,预期 $4.12B

- Net new annual recurring revenue $224.3M, -20% y/y, EST $198M

- 净新增年度经常性收入 $224.3M,同比下降 20%,预估 $198M

- Total stock-based compensation $272.5M, +55% y/y, EST $210.7M

- 总股票薪酬 $272.5M,同比增长 55%,预期 $210.7M

- ADJ operating income $217.3M, +2% y/y, EST $189.2M

- ADJ 营业收入 $217.3M,同比增长 2%,预期 $189.2M

- Free cash flow $239.8M, -15% y/y, EST $215.7

- 自由现金流$239.8M,同比下降 15%,预期$215.7

Let’s get to it… 让我们开始吧…

Internet 互联网

GOOGL +2.4%: CFO didn’t share much new at MS TMT. Co disclosed yesterday it is processing over 5T queries on an annualized basis which shows queries may have grown 20% in each of the past two years, and points to AI appearing to grow the pie. Ross Sandler at Barclays did some math: The 5T figure includes three new AI-related query types (AI overviews covering 1B users, Lens Search at 20B+ monthly, and Circle-to-Search available to 200M+ Android users). When comparing traditional blue-link growth year-over-year, growth could be below 20%. If blue links grew at 10% CAGR, new AI searches would represent over 15% of 2025 queries—explaining why many "open web" ad companies recently missed projections due to reduced downstream search traffic.

GOOGL +2.4%:CFO 在 MS TMT 会议上并未分享太多新信息。公司昨日披露,其每年处理的查询量超过 5 万亿次,这表明过去两年中查询量可能每年增长 20%,并指出 AI 似乎正在扩大市场。巴克莱的 Ross Sandler 进行了一些计算:5 万亿这一数字包括三种新的 AI 相关查询类型(覆盖 10 亿用户的 AI 概览、月均超过 200 亿次的 Lens 搜索,以及面向超过 2 亿 Android 用户的 Circle-to-Search)。如果比较传统蓝链查询的同比增长,增长率可能低于 20%。如果蓝链查询以 10%的复合年增长率增长,到 2025 年,新的 AI 搜索将占查询总量的 15%以上——这解释了为什么许多“开放网络”广告公司最近因下游搜索流量减少而未能达到预期。Housing names strong: RDFN +4%; OPEN +2.5%; Z +20bps although W -8% didn’t fare so well

房地产股表现强劲:RDFN +4%;OPEN +2.5%;Z +20bps,尽管 W -8%表现不佳RBLX +75bps: nice px action there

RBLX +75 个基点:价格走势不错EBAY +2%: one stock that’s seeing some buying following the miss last week

EBAY +2%:上周业绩未达预期后,出现了一些买盘的一只股票ROKU flat despite Moffett upgrading to neutral as they see “beat and raise story” in 2025

ROKU 持平,尽管 Moffett 将其评级上调至中性,因为他们看到了 2025 年的“超越和提升故事”CVNA -2% despite Yipit saying units accel’d to 53% from 50% last week

CVNA -2%,尽管 Yipit 表示单位增速从上周的 50%加速至 53%SHOP -4.5% despite Yipit saying MRR tracking a few ppts above street

SHOP -4.5%,尽管 Yipit 表示 MRR 跟踪略高于市场预期AMZN -60bps another day of underperformance

AMZN -60bps 再次表现不佳UBER +1% as Waymo Austin rides started

UBER +1%,因 Waymo 在奥斯汀的乘车服务启动Ad names weak but didn’t see much: META -2.3%; RDDT - 2%; PINS -1%

广告名称表现疲软但未见大幅波动:META -2.3%;RDDT -2%;PINS -1%China names mixed: BABA -70bps; BIDU +%; JD +1.8%

中国股市名称表现不一:BABA 下跌 70 个基点;BIDU 涨%;JD 上涨 1.8%SE +7% after a nice GMV/Revs/E-comm EBITDA beat

SE 上涨 7%,因 GMV/收入/电商 EBITDA 表现超预期

Semis 半导体

TSM +4% as they sounded good in meetings at MS TMT although looks like Trump Still Considering Tariffs on Taiwanese Chips, Despite $100 Billion TSMC Deal (Wired - out late afternoon)

台积电(TSM)上涨 4%,因在 MS TMT 会议上表现良好,尽管看起来特朗普仍在考虑对台湾芯片征收关税,尽管有 1000 亿美元的台积电交易(Wired - 下午晚些时候发布)NVDA +1.7% a nice bounce after being down 3% in the pre-market hitting the same multiple as the market for a few minutes. MS Asia, Jefferies, and TSM were all out saying no CoWoS cuts at TSM (see today’s morning wrap for more detail)

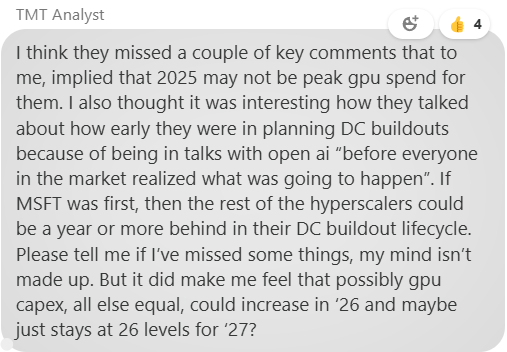

NVDA +1.7%,在盘前下跌 3%后出现不错的反弹,一度与市场达到相同的倍数。MS Asia、Jefferies 和 TSM 均表示 TSM 没有削减 CoWoS(详见今日早盘总结)。Other AI names fared well: ARM +1%; AMD +2.5%; MU +75bps. One TMTB reader came away with a positive take on capex from MSFT’s pres at MS TMT today:

其他 AI 相关股票表现良好:ARM +1%;AMD +2.5%;MU +75bps。一位 TMTB 读者对 MSFT 在 MS TMT 会议上的资本支出持积极看法:

AI networking CRDO +8%; ALAB +3% strong as well. CRDO with a nice print post close as they grew 154% Y/Y in Jan qtr with revs $135M vs est $120M. GM also beat at 63.8% vs est 62%. Guide strong as well: $160 mid point for Apr qtr revs vs est $137M with GM flat at 64% Q/Q and above cons est 62.8%. (h/t Mizuho)

AI networking CRDO +8%;ALAB +3% 同样表现强劲。CRDO 在收盘后发布了一份亮眼的财报,1 月份季度同比增长 154%,收入达到 1.35 亿美元,超过预期的 1.2 亿美元。毛利率也超出预期,达到 63.8%,而预期为 62%。展望同样强劲:4 月份季度的收入中位数为 1.6 亿美元,超过预期的 1.37 亿美元,毛利率环比持平为 64%,高于市场预期的 62.8%。(h/t Mizuho)VST +2% after BAML upgraded to buy

VST +2%,此前 BAML 将其评级上调至买入

Software 软件

OKTA +24% after a better beat across the board, a cRPO acceleration, and getting upgrades at Mizuho and Da Davidson

OKTA +24%,因全面超预期表现、cRPO 加速以及获得 Mizuho 和 Da Davidson 的评级上调GTLB +11% after beating street (roughly inline with bogeys) but OPM/metrics looked good as Q4 had 85 incremental $100k customers wich was the strongest ever. FY26 guide roughly inline with expectations. Nice to see some positive price action on inline/slightly better print

GTLB +11%,超出市场预期(大致符合预期),但 OPM/指标表现良好,第四季度新增了 85 个 10 万美元客户,创下历史新高。FY26 指引大致符合预期。很高兴看到在符合/略好于预期的财报后出现了一些积极的价格走势。APP -3% giving back yesterday’s gains

APP -3%,回吐了昨日的涨幅ORCL -3%

Elsewhere 在其他地方

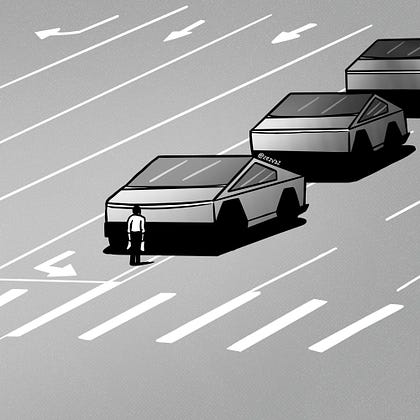

TSLA -4.5% after weak data from China: sold 30,688 China-made EVs in February, down 49.2% YoY and 51.5% from January, per CPCA data

TSLA -4.5%,因中国数据疲软:根据 CPCA 数据,2 月份在中国制造的电动汽车销量为 30,688 辆,同比下降 49.2%,环比下降 51.5%。Fintech week: AFRM -8%; UPST -4%; PYPL -3%; XYZ -5%…Didn’t see any great reason other than XLF (financials) were down 3.5% so could have spilled over

金融科技周:AFRM -8%;UPST -4%;PYPL -3%;XYZ -5%…除了 XLF(金融板块)下跌 3.5%外,没有看到其他明显原因,可能是受到波及。