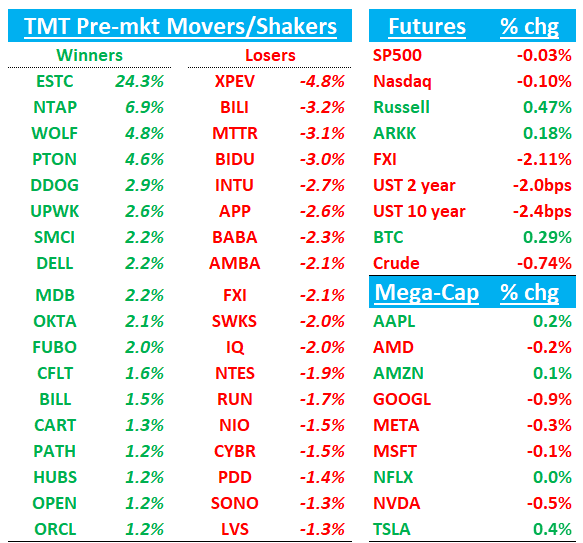

QQQs hovering around flat. Treasuries slightly bid with yields down 2-3bps. Odds of a fed cut continue to be ~55% on 12/18. BTC trying to get close to $100k. China -2%. We’ll cover ESTC NTAP INTU results first then move onto news/research…No EOD Wrap today as I’ll be on the road. Have a great weekend!

ESTC+28%: Strong Cloud driven by stronger consumption, much better billings. CFO leaving seen as a ++

Total Revs $365M vs street at $354M

Cloud revs came in +25% to $169M vs buyside in mid to high 160s (street 166M).

Billings $384M +23% y/y accelerating from +6% last q vs street at $353M

OPM 18% vs guide at 13%

Q2 guide $367-369M vs street at 366M and inline with buyside. OPM 15% vs street at 13.5%.

Another Cloud consumption beat following SNOW earlier this week although this one not as big or clean. Beat driven by accelerated consumption from major customers alongside broad-based strength across enterprise and commercial segments. Sales reorganization benefits materializing, with pipeline creation and progression returning to historical levels. Improved execution led to robust customer commitments, notably in Gen-AI where deal value nearly doubled, including three $1M+ ACV wins.

CFO Janesh is leaving; investors I’m hearing from are viewing that as a big positive as he has a history of rug-pulling and over-promising and under delivering and contributing to the big move this morning.

Bulls will say you get an AI winner with SMID/SMB exposure and takeout potential trading at 6x CY’26 sales and an overhang lifted with CFO leaving.

Bears will say FY guide was only raised slightly and still implies Q4 exit rate of only 11-12% and Q1 commitment shortfall will impact 2H cloud revs as they take months to ramp and that new customer growth remains low. They’ll say 11-12% is pretty uninspiring consider GenAI tailwinds. RPO looked a bit squishy. They’ll say stock is only up this much because of CFO leaving.

We don’t have a strong view but move seems a bit outsized relative to #s although some of it being attributed to CFO leaving, which is fair. We’re uninvolved.

Gets an upgrade at Baird saying significant operational improvements in Q2, marked by strong commitments, consumption trends, and improved win rates, alongside emerging GenAI momentum as reasons for the upgrade. Baird notes quick management response to Q1 challenges through territory stabilization and pipeline discipline has proven effective. Baird also points out GenAI commitments doubled, validating AI search leadership position, while Express Migration strengthens competitive stance against SIEM competitors, saying increased margin guidance and sustainable profitability metrics (Rule-of-30+) support the bull case.

NTAP +6%: Very solid beat and raise

NTAP delivered strong Q2 results ($1.66B/$1.87 vs. street $1.65B/$1.78), showing 6% revenue growth driven by product (+9%) and public cloud (+9%). All-flash array revenue reached $3.8B annualized (+19% YoY). Gross margins remained robust at 72.0% gross/28.6% EBIT. Company raised FY25 guidance to 6% sales growth (from 5%) and $7.30 EPS (+20c).

Mgmt called out strong execution with market share gains and TAM expansion in all-flash arrays, plus sustained public sector strength. Balance sheet concerns easing as memory pre-buying concludes.

Not much for bears to nitpick in the print. Solid down the middle while bulls will say we are still early in upcycle, storage demand increasing according to VAR surveys, margins have more room to expand and NTAP remains an AI inference beneficary.

NTAP 2025 F/Y GUIDANCE

- Guides ADJ EPS $7.20 to $7.40, saw $7 to $7.20, EST $7.11

- Guides net revenue $6.54B to $6.74B, saw $6.48B to $6.68B

- Guides ADJ operating margin 28% to 28.5%, saw 27% to 28%

- Still sees ADJ gross margin 71% to 72%

GUIDANCE: Q3

- Guides net revenue $1.61B to $1.76B, EST $1.68B

- Guides ADJ EPS $1.85 to $1.95, EST $1.85

RESULTS: Q2

- ADJ EPS $1.87 vs. $1.58 y/y, EST $1.78

- Net revenue $1.66B, +6.1% y/y, EST $1.64B

- Hybrid cloud net rev. $1.49B, +5.8% y/y, EST $1.49B

- Product revenue $768M, +8.8% y/y, EST $769.8M

- Support rev. $635M, +1.9% y/y, EST $633.5M

- Public cloud net rev. $168M, +9.1% y/y, EST $164.3M

- ADJ gross margin 72% vs. 72% y/y, EST 71.6%

- EPS $1.42 vs. $1.10 y/y

INTU -3%: Beat driven by Credit karma but overshadowed by light Q2 guide bc of timing issue

They blamed weak guide on seasonal shifts in consumer retail promotions (not expected to affect FY25 just a timin issue). Mgmt highlighted strengthening midmarket momentum, with 42% growth in QBO Advanced/Enterprise offerings. INTU Assist rollout to all QBO customers and Intuit Enterprise Suite launch support upmarket strategy. Desktop revenue declined as expected during subscription model transition but should resume growth next quarter.

Bulls will say to overlook the near-term retail timing shifts and focus on midmarket progress and Intuit Assist adoption as we head into 2025.

INTU GUIDANCE: Q2

- Guides ADJ EPS $2.55 to $2.61, EST $3.23

2025 F/Y GUIDANCE

- Still sees revenue $18.16B to $18.35B, EST $18.26B

RESULTS: Q1

- ADJ EPS $2.50, EST $2.35

- Net revenue $3.28B, EST $3.14B

- R&D expenses $704M, EST $722.6M

- Service revenue $2.89B

- Product and other revenue $394M

3P roundup:

GOOGL: Hearing Yip downticking on GOOGL search saying Q4 tracking inline to slightly below street now

ABNB: As we’ve heard with AirDNA earlier this week, 3p confirming acceleration in nights growth over the last several weeks.

AMZN: Hearing 3p slight downtick in retail data, but still tracking 1-2 ppts above street in NA. Truist also out this morning saying their credit card data shows NA retail tracking slightly ahead of street.

GOOGL: Street coming out saying DOJ remedies worse than expected

We think this combined with the weaker 3p search data this morning puts GOOGL squarely in the funding short camp. Our view on GOOGL over the last year has been to be long when 3p search data is tracking above street as bears face an uphill battle proving the structural/secular risks. But with search tracking inline to below, every headline risk around GenAI search encroaching on GOOGL’s moat becomes even more pronounced, especially with the regulatory overhang.

Wells saying DOJ remedies 'close to worst-case' for Google

Wells Fargo views DOJ's proposed Google search remedies as approaching worst-case scenario, with analyst Gawrelski describing it as a "relatively dramatic ask." While case outlook could shift with upcoming DOJ leadership change, current proposals pose significant risks: behavioral remedies blocking search distribution payments threaten competitive position, while potential Chrome separation could put 15% of search revenue at risk. Despite these concerns, maintains Equal Weight on Alphabet, expecting room for remedy negotiations.

JPM: DOJ's Google Search remedies 'more punitive than expected,'

JPMorgan's Anmuth sees DOJ's proposed Google Search remedies as more punitive than expected, particularly regarding consumer choice limitations and search data/ad syndication. Ban on Google offering value to distributors could push Apple to explore alternatives like Microsoft, OpenAI, or developing their own search capability. JPM says while this likely represents maximum severity, Google's December 20 counter-proposal should be significantly more modest, with judge's summer 2025 decision expected to strike middle ground. Maintains Overweight/$212 target on Alphabet.

Few other news items this morning re: GOOGL:

GOOGL: Google Will Survive AI and Break-up Calls. Why Alphabet Stock Could Gain 50%. – Barron’s

GOOGL: Why the US forced sale of Google's Chrome faces legal hurdles– Reuters

OpenAI Considers Taking on Google With Browser

The ChatGPT owner recently considered developing a web browser that it would combine with its chatbot, and it has separately discussed or struck deals to power search features for travel, food, real estate and retail websites, according to people who have seen prototypes or designs of the products. OpenAI has spoken about the search product with website and app developers such as Condé Nast, Redfin, Eventbrite and Priceline, these people said.

OpenAI also has discussed powering artificial intelligence features on devices made by Samsung, a key Google business partner, similar to a deal OpenAI recently struck with Apple, according to people who were briefed about the situation at OpenAI.

NVDA: Phillips downgrades to Accumulate from Buy

They cite recent rally in stock for the dg and they lower their margin #s due to mgmt’s guidance.

TMTB: Really not a lot of meat here and not really sure who Phillips is, but passing along…

DELL: BAML says their VAR survey shows an improving operating environment

BAML’s VAR survey indicates strengthening business environment with improving order trends, backlog, and lead times. BAML notes artner feedback shows sequential order improvement - 10% of VARs report 6-10% growth acceleration, while remaining 90% split evenly between modest growth (1-5%) and flat performance, further noting quarter performance tracked above plan (+1.9%), and storage outlook significantly improved with 55% of VARs projecting sustained demand through 2025, up from 25% in Q2.

CRM: Salesforce price target raised to $450 from $342 at JMP Securities

TheFly:

JMP says it has collected 15 data points on Salesforce, 10 positive and five negative, and that a Service Cloud Salesforce partner said its spend would be up as it expands its partnership, but also because it is demonstrating ROI to its largest customers, to the tune of $1.5M spend on Salesforce saving $10M in call center labor costs, the analyst tells investors in a research note.

CRM: Citi says they are intrigued by Agentforce its early

Citi's Salesforce Agentforce World Tour NY takeaways show positive early pilot feedback, with keynote examples highlighting productivity gains and partners reporting strong pipeline generation since Dreamforce. However, details remain limited on pricing and production implementations, while customers maintain strict ROI focus on spending. While impressed by Salesforce's investment and messaging around Agentforce, Citi seeks more evidence of successful commercial deployments before confirming this as a meaningful FY26/CY25 growth catalyst.

CRM: DB Previews the q, raising PT to $365

DBAB's checks on the core business for FQ3 were more mixed with signs of strength in Data Cloud, Einstein 1 Sales/Service offset by some signs of aggressiveness into quarter end. Given the run up in the stock (~12% outperformance vs IGV since Dreamforce) DBAB notes this could make the setup more challenging as the fundamentals will likely take some time to catch up with the narrative. Despite the more challenging setup from a sentiment perspective, DBAB continues to recommend CRM as it sees Agentforce at an inflection point, driving CIO's willingness to invest further into Salesforce (and justify budget) which should enable top-line growth north of 10%.

RDDT -7% trading lower after Bloomberg reported that shareholder Advance Magazine Publishers is seeking to establish a credit facility using its equity stake. Advance is offering 7.8M shares priced between $145.38 and $148.54, valuing the stake at up to $1.2B. Advanced is employing a derivatives strategy to maintain its ownership position while simultaneously creating a credit facility.

AAPL: Bloomberg reporting More Conversational LLM Siri coming in Spring 2026 - link

2026 would be a delay vs expectations given many expecting IP17 in Fall 2025 to be big upgrade cycle bc of AI features.

ARM: Wells Fargo initiates at Buy

Wells Fargo initiated coverage of Arm with an Overweight rating and $155 price target. The firm thinks Arm can deliver upside to consensus estimates, driven by a transition to v9 with higher royalty rates, coupled with modest share gains Arm-based CPUs. Arm's v9 lays the foundation for a compute subsystems adoption story, the analyst tells investors in a research note.

BIDU: Barclays downgrades Baidu on ad pressure from generative AI. PT to $83 from $115

Despite Baidu's leadership in Chinese search and AI, the firm faces an "innovator's dilemma" - Barclays notes that approximately 20% of search queries now return AI-generated results, which monetize at lower rates than traditional search. Barclays thinks this shift, combined with weak macro conditions in China's advertising market, likely to compress margins.

ROKU: Roku initiated with a Neutral at UBS

TheFly:

UBS initiated coverage of Roku with a Neutral rating and $73 price target. The firm sees Roku as a key enabler of the streaming ecosystem, positioning the company to capture ad spend migrating from traditional TV. However, the stock's risk/reward is balanced at current levels given competitive risks in the TV operating system market and rationalization efforts across the streaming ecosystem, the analyst tells investors in a research note.

AFRM: Affirm price target raised to $74 from $50 at BofA, saying company is firing on all cylinders with “enviable roster of merchants” including AMZN SHOP and WMT, and diversified loan products differentiating it from competitors. Thinks there is upside to estimates.

AMZN: Truist says card data shows NA rev tracking slightly ahead of street through 11/18

Truist sees Amazon's North American revenue tracking ahead of consensus through mid-November, at high end of e-commerce holiday forecasts. Card data indicates resilient consumer spending, supported by Amazon's value proposition and strength in advertising and AWS. Despite heavy investments in AI, AWS, logistics, and Project Kuiper, margin outlook remains strong. Truist favors AMZN among mega-caps entering 2025, citing improved merchant/shopper value proposition and broad exposure to key growth sectors (Cloud, AI, digital ads, logistics).

RBLX: Added to RJ favorites list

Raymond James added Roblox to the firm's Analyst Current Favorites List while keeping a Strong Buy rating on the shares with a $60 price target, saying RBLX is very well-positioned to continue expanding its reach within the interactive entertainment sector. RJ believes the combination of a "substantial outstanding user opportunity and plenty of room to increase monetization" of its users should lead to a long runway of 20%-plus annual sales growth.

RUN: Piper downgrades to Hold from Buy and $11 PT down from $23

Piper notes Sunrun could generate cash in 2025 with potential safe harbor benefits extending into 2026. However, post-IRA subsidy reversion would require significant cost reductions and pricing increases through 2030 to maintain levered cash generation. Piper remains skeptical about structural cash flow sustainability in a reduced tax credit environment, seeing limited upside catalysts beyond soft IRA transition or rapid rate cuts.

PINS: Barrons - Pinterest Stock Is Beaten Down Enough. It’s Time to Buy.

They needn’t worry. For starters, management often underpromises and overdelivers on sales. It reported better third-quarter growth than its earlier 17% midpoint guidance. Analysts cue off the guidance to arrive at their estimates, and the company has surpassed sales estimates in 18 out of the past 20 quarters, according to FactSet. Pinterest could be setting expectations low so it can deliver a pleasant surprise when it reports its fourth-quarter numbers in February.

Other News:

AAPL: Huawei’s Chip Advances Threaten Apple in China – WSJ

AI Server: per TrendForce, global AI server shipments are expected to grow >28% YoY and account for 15% of total server shipment in 2025, driven by strong demand from CSPs and sovereign clouds – link

AMZN: Amazon likely to face investigation under EU tech rules next year, sources say – Reuters

DirectTV: DirecTV spikes Dish deal over debt swap exchange – Axios