Market Memo: Markets Gone RF-Krazy

市场备忘录:市场变得疯狂

Medtech & Healthcare Basket Update

医疗技术与卫生保健篮子更新

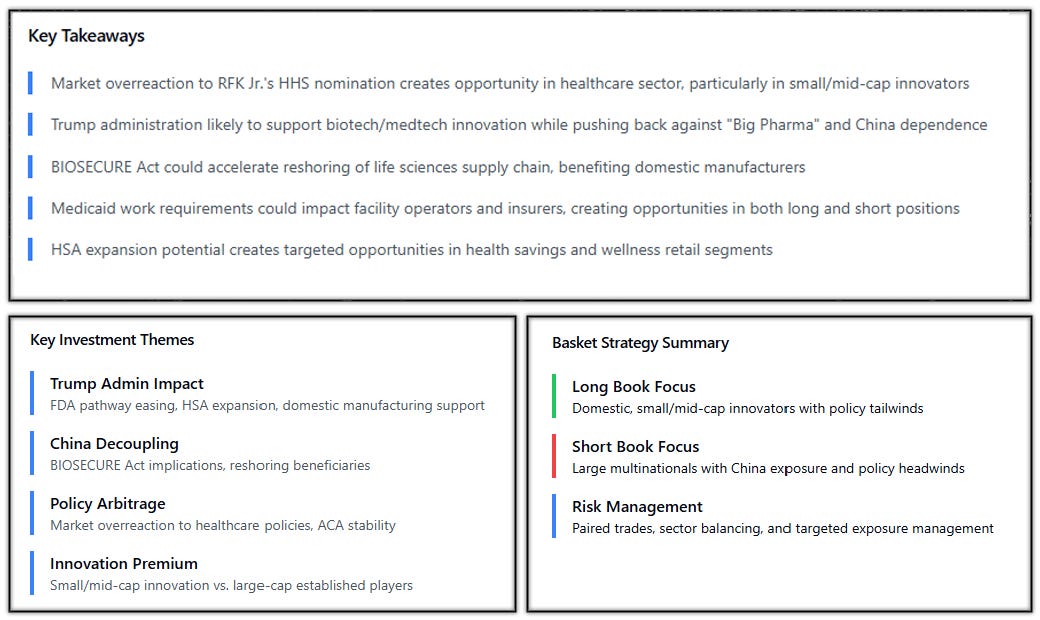

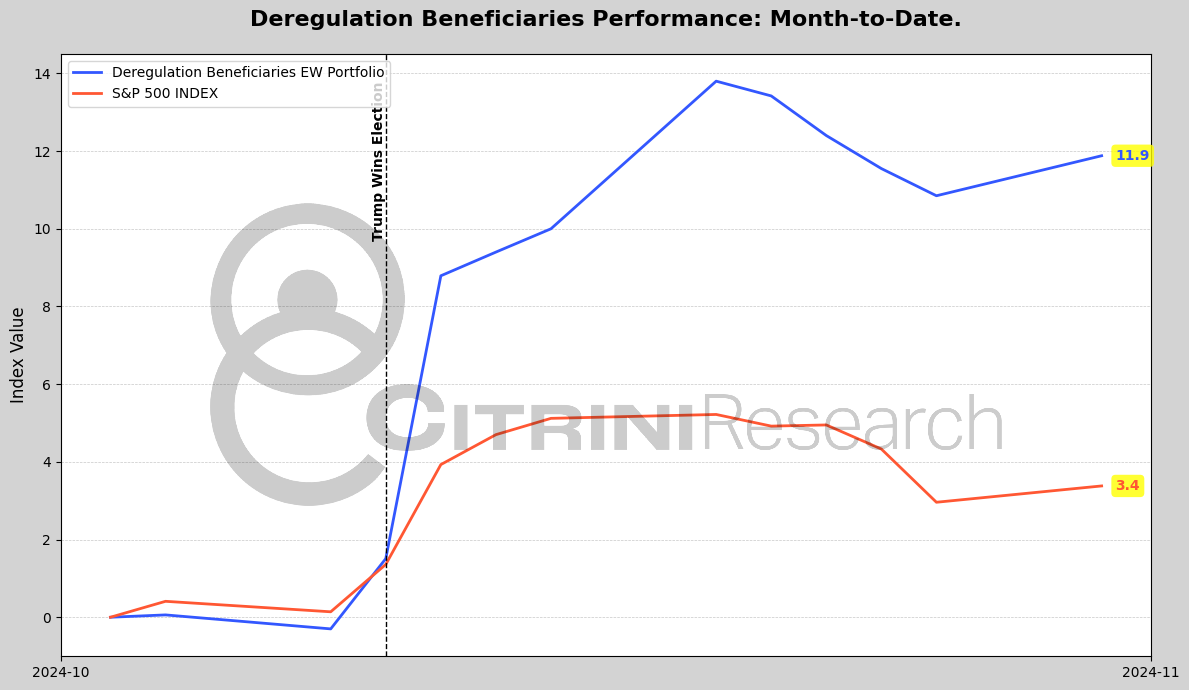

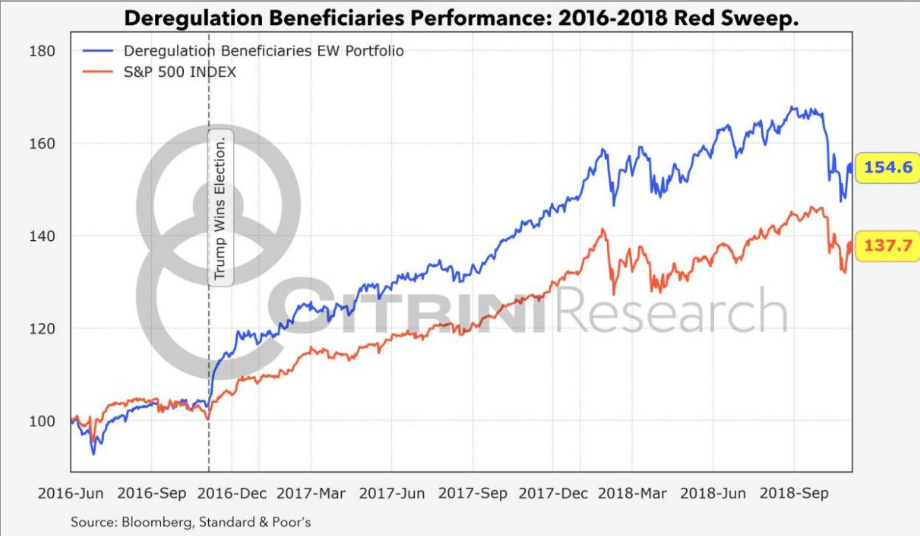

It is 2016 all over again – or at least it seems like it. The world has seemingly been shocked by a decisive Republican victory and “Red Sweep” (our readers, however, may have been slightly less shocked). The parallels don’t end there; markets have embarked on much the same trade that they loved last time. For example, look at how the CitriniResearch Deregulation Beneficiaries fared last time we had a red sweep, and how they’ve acted since the election…

2016 年再次重现 – 或至少看起来像是这样。世界似乎被震惊了,由于共和党在选举中取得了决定性胜利和“红色席卷”(然而,我们的读者可能感到的震惊要稍微少一些)。 相似之处并不止于此;市场开始了一场与上次他们喜欢的交易非常相似的交易。例如,看看 CitriniResearch 放松监管受益者在上次红色席卷时的表现,以及他们在选举后的表现……

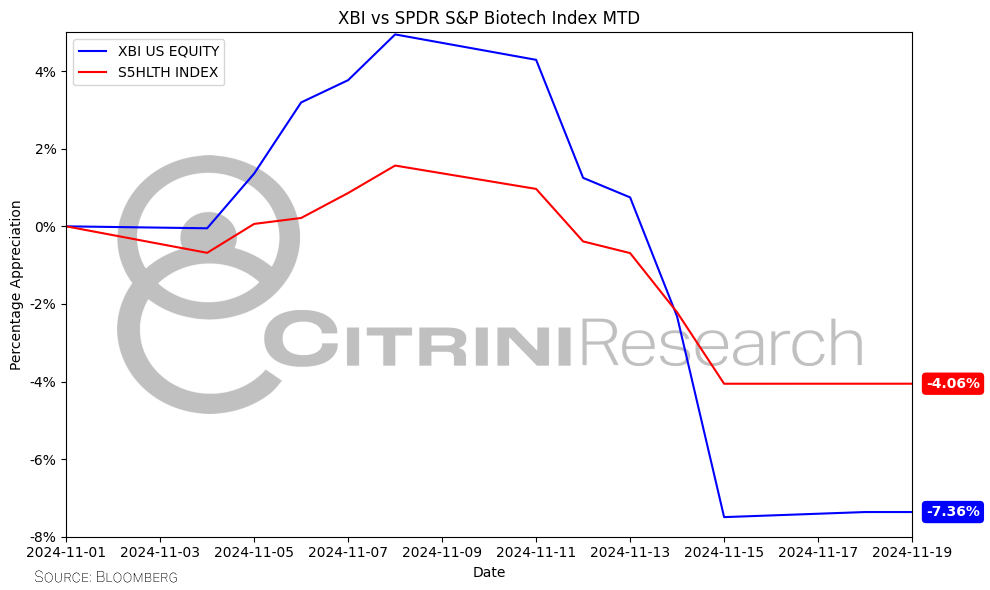

This is especially true in healthcare. In the immediate aftermath of the 2016 election, the biotech ETF (XBI) traded up 15% and the healthcare sub-index of the S&P500 (S5HLTH) gained 3%, but both of those indices gave back the entirety of the gains by yearend as the focus shifted to policy uncertainties. This time around, we saw a similar pop-and-fade dynamic, with the “fade” phase coming faster and stronger than the last time around. The culprit? Robert F. Kennedy Jr.

这在医疗保健领域尤其如此。在 2016 年选举的直接后果中,生物技术 ETF(XBI)上涨了 15%,而标准普尔 500 指数的医疗保健子指数(S5HLTH)上涨了 3%,但这两个指数在年底之前又回吐了全部涨幅,因为焦点转向了政策不确定性。这一次,我们看到了类似的涨跌动态,“跌”的阶段来得比上一次更快、更强烈。罪魁祸首?罗伯特·F·肯尼迪 Jr.

The eccentric former environmental lawyer who Trump has promised to let “go wild on health” is now the nominee to lead the Department of Health and Human Services (HHS). In this cabinet position, RFK would be one of the most powerful people overseeing the US healthcare system. Based primarily on his negative positions on COVID vaccines (and some other pseudo anti-vax statements), market participants seem to have jumped quickly to the conclusion that RFK will be negative for the healthcare sector overall, with both XBI and S5HLTH experiencing sharp drawdowns over the past week following the announcement of RFK’s appointment.

特朗普曾承诺让这位古怪的前环境律师“在健康问题上放手一搏”,现在他成为了领导卫生与公众服务部(HHS)的提名人。在这个内阁职位上,RFK 将成为监督美国医疗保健系统的最有权势的人之一。市场参与者主要基于他对 COVID 疫苗的消极立场(以及一些其他伪反疫苗言论),似乎迅速得出结论,认为 RFK 对整体医疗保健行业将是负面的,此后 XBI 和 S5HLTH 在 RFK 任命公告后的一周内都经历了大幅下跌。

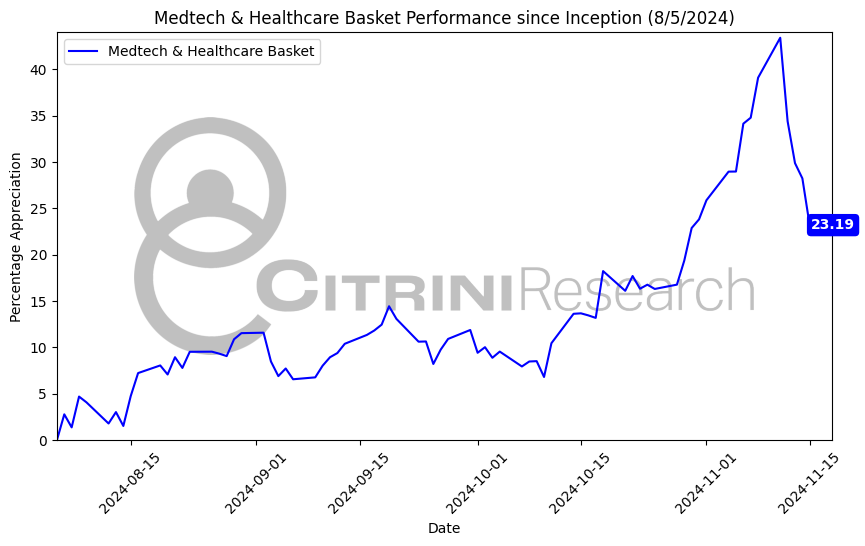

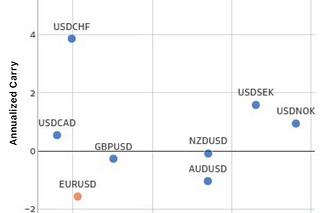

Our medtech/healthcare basket is up significantly since we began covering the theme in August, but has similarly taken a significant drawdown since the election.

自我们在八月开始关注这一主题以来,我们的医疗科技/医疗保健篮子已经显著上涨,但自选举以来也经历了显著的回落。

Source: Bloomberg 来源:彭博社

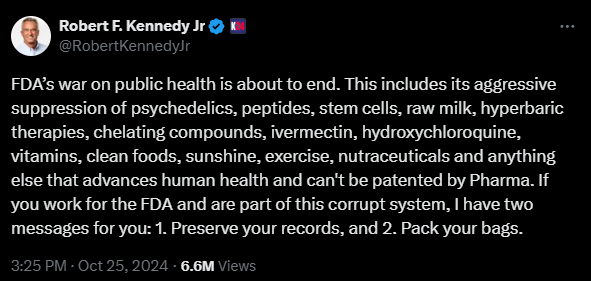

Market reactions notwithstanding, we know vanishingly little about RFK’s policy positions beyond his aforementioned disdain for COVID-19 vaccines, his vocal campaign against fluoride in water, and anything spelled out in his now infamous post on X:

尽管市场反应不容忽视,但我们对 RFK 的政策立场了解得微乎其微,除了他之前提到的对 COVID-19 疫苗的厌恶,他对水中氟化物的公开抵制,以及在他那篇臭名昭著的 X 帖中阐明的任何内容:

This combination of policy uncertainty and substantial price movements has created some significant mispricings. Subscribers will recall that we have held a bullish stance on the healthcare sector, driven by our view that both life sciences and medical technology were exiting cyclical downturns in their fundamental prospects and positioned to benefit from both a cyclical upswing and ongoing secular growth. That basket has been one of our best performers in recent months, even with the most recent pullback in the sector. And analyzing Trump’s prior term and the substantive comments of his advisors this time around lead us to believe that – RFK-led HHS or not – this Trump administration is likely to be a significant incremental positive for the companies we highlighted in life sciences and medical technology. This looks to be especially true for companies that are domestically-focused, small, and innovative – and these gains may come at the expense of big and established multinationals in the space. When we first published our primer, market sentiment on life sciences and medical technology was terrible, and we were calling the fundamental turn. From where we sit today, sentiment has deteriorated and is back to the lows, but we have already seen evidence that the turn is happening.

政策不确定性与重大价格波动的结合造成了一些显著的定价错误。订阅者会记得,我们对医疗保健行业持乐观态度,这源于我们认为生命科学和医疗技术正在走出周期性下滑,基本前景向好,并有望受益于周期性上升和持续的世俗增长。尽管该行业最近出现了回调,但这一篮子股票是我们最近几个月表现最好的投资之一。对特朗普之前任期的分析以及他顾问们此次实质性评论的分析使我们相信,无论是否由 RFK 领导的卫生与公共服务部,这一特朗普政府都可能对我们在生命科学和医疗技术领域所突出的公司产生显著的增量积极影响。这对于集中在国内的小型创新公司尤其适用,而这些收益可能会以空间内大而成熟的跨国公司的利益为代价。当我们首次发布我们的入门指南时,市场对生命科学和医疗技术的情绪非常糟糕,而我们当时正在呼唤基本面的转变。 从我们今天的位置来看,情绪已经恶化并回到了低点,但我们已经看到转变正在发生的证据。

In light of all of this, we are taking the opportunity provided by the market to update our research and reposition the basket ahead of an excellent opportunity set in the coming year.

鉴于这一切,我们正在利用市场提供的机会更新我们的研究,并在即将到来的优秀机会设置中重新调整投资组合。

By the way, the biotech and S&P Healthcare indices that faded post-election in 2016? They went on to trade +44% and +20%, respectively, in 2017.

顺便提一下,2016 年选举后下跌的生物技术和标准普尔医疗保健指数?它们在 2017 年分别上涨了 44%和 20%。

Life Science Supply Chain Update

生命科学供应链更新

The two primary concerns weighing on the life science supply chain appear to be: 1) RFK and the new Trump administration will hurt biotech innovation and 2) higher long-term interest rates generated by Trump’s policies will crimp R&D funding in healthcare. Both concerns are misplaced.

生命科学供应链上主要的两个担忧似乎是:1)RFK 和新的特朗普政府将会损害生物技术创新;2)特朗普政策导致的长期利率上升将会压缩医疗保健领域的研发资金。这两个担忧都是错误的。

While RFK’s views on biotech innovation are somewhat opaque—who knows where someone who dislikes vaccines but champions 'psychedelics, peptides, [and] stem cells' comes out on novel therapeutics—we have a great deal of information on how Trump’s prior administration and current advisors approach the issue. Based on this information, Trump is likely to be a forceful champion of innovation in healthcare.

虽然 RFK 对生物技术创新的看法有些模糊——谁知道一个不喜欢疫苗但倡导“迷幻药、肽和干细胞”的人对新疗法的态度如何——但我们对特朗普之前的政府和现任顾问如何看待这个问题有很多信息。基于这些信息,特朗普很可能会成为医疗保健创新的有力倡导者。

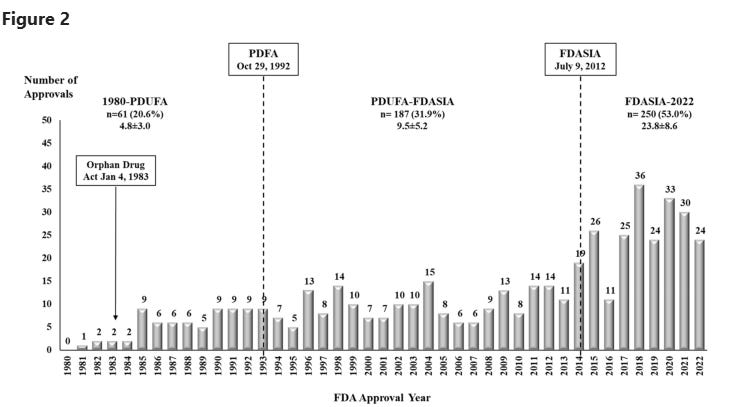

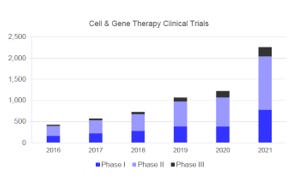

Trump campaigned in 2016 on the promise of “cutting the red tape at the FDA” in order to “speed the approval of life-saving medications”. In 2017, he told pharmaceutical executives at the Oval Office, “we have to get rid of a tremendous number of regulations” and promised that he would be “streamlining the process so that when you have a drug, you can actually get it approved – if it works – instead of waiting many, many years.” President Trump then used his first address to Congress as a platform to promise to “slash the restraints” on drug development imposed by the FDA and improve the “slow and burdensome approval process” for getting drugs approved. To make his point, he invited a young woman whose father had founded a company to develop a novel enzyme replacement therapy to treat her rare disease. Whether or not his administration deserved the credit, approvals of novel therapeutics did accelerate after he took office, as did clinical trials.

特朗普在 2016 年的竞选中承诺“削减 FDA 的繁文缛节”,以“加快救命药物的审批。2017 年,他在椭圆形办公室对制药高管说:“我们必须废除大量法规”,并承诺将“简化流程,以便当你有一款药物时,实际上可以获得批准——如果它有效——而不是等待许多年。”特朗普总统随后利用他第一次向国会的演讲作为平台,承诺“削减”FDA 对药物开发施加的限制,并改善获取药物批准的“缓慢繁重的审批过程”。为了说明这一点,他邀请了一位年轻女性,她的父亲创办了一家公司,以开发一种新型酶替代疗法来治疗她的罕见疾病。无论他的政府是否应该获得赞誉,新的治疗方法的审批确实在他上任后加速了,临床试验也是如此。

Source: https://www.nature.com/articles/s41598-024-53554-7

来源:https://www.nature.com/articles/s41598-024-53554-7

Source: Deutsche Bank 德意志银行

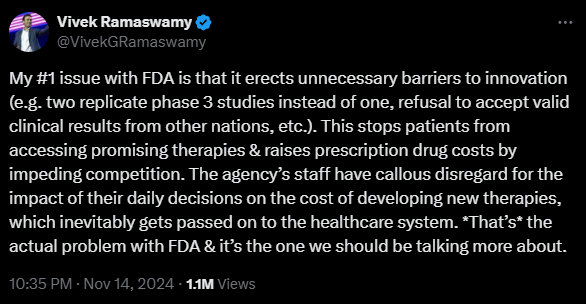

This time around, those in the Trump administration have been at least as vocal about supporting the biopharma industry in developing new drugs. President Trump’s former domestic policy advisor wrote just a couple of months ago about the need to “roll back key anti-innovation” policies imposed on the life sciences industry under President Biden, noting that “at a time when cancer deaths in adults cost more than $94 billion in lost earnings, and the direct cost of diabetes care exceeds $306 billion, promoting life sciences innovation is an economic imperative. Innovation is also a moral imperative.” More recently, Trump advisor (and biotech executive) Vivek Ramaswamy wrote on X:

这次,特朗普政府中那些人至少在支持生物制药行业开发新药方面同样积极发声。特朗普的前国内政策顾问就在几个月前写道,需要“撤回拜登总统对生命科学行业施加的主要反创新政策”,并指出“在成年人的癌症死亡导致超过 940 亿美元的收入损失,以及糖尿病护理的直接成本超过 3060 亿美元的情况下,促进生命科学创新是经济上的必要。创新也是道德上的必要。”最近,特朗普顾问(也是生物技术高管)维韦克·拉马斯瓦米在 X 上写道:

So, while RFK might decry COVID vaccines, it seems quite clear that the incoming Trump administration will be supportive of the biopharma supply chain and its goal of continuing to develop and commercialize new medicines.

所以,虽然 RFK 可能会谴责 COVID 疫苗,但很明显,即将上任的特朗普政府将支持生物制药供应链及其继续开发和商业化新药物的目标。

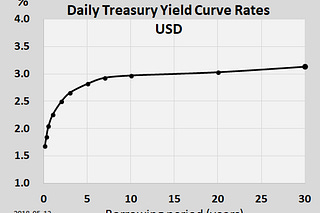

But is it possible that Trump’s other policies will be so inflationary – and otherwise fixed income negative – that surging interest rates will cut off the biopharma industry’s access to capital, similar to the rate-driven cyclical bust we outlined in our Healthcare Cyclical Inflection primer?

但特朗普的其他政策是否可能如此通货膨胀 – 以及其他固定收益负面 – 以至于激增的利率将切断生物制药行业对资本的获取,类似于我们在《医疗保健周期性拐点入门》中概述的由利率驱动的周期性萧条?

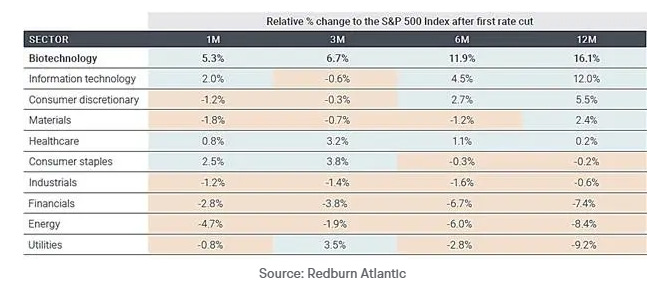

It seems unlikely. To the extent companies are dependent on the public equity markets for capital, history suggests that periods following the first Fed rate cut (which we got this fall) are overwhelmingly positive for the biotech sector.

这似乎不太可能。根据历史经验,当公司依赖公开股本市场融资时,接下来首次美联储降息的时期(我们在这个秋天得到了降息)对生物技术行业来说是压倒性积极的。

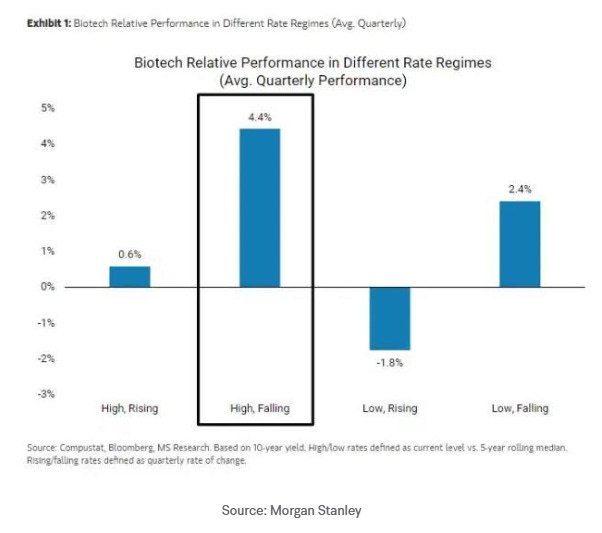

Even periods where interest rates are high and rising have been more favorable to biotech valuations than the period the industry just lived through (when rates were low and rising).

即使是利率高且上升的时期,对生物技术估值也比该行业刚经历的(当利率低且上升时)更为有利。

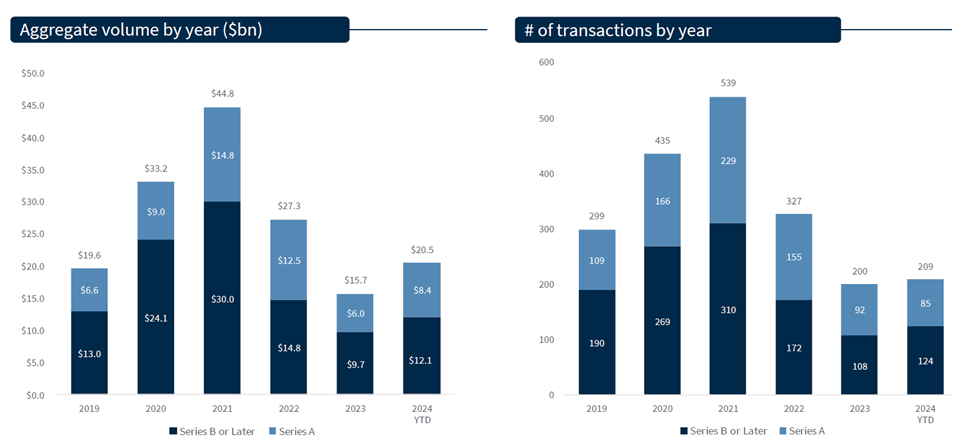

The bottom line: regardless of what XBI and interest rates are doing, we are already more than three quarters of the way through 2024 and total biotech funding has been rebounding.

底线是:无论 XBI 和利率如何,我们已经进入 2024 年的三分之三生物技术的整体融资正在反弹。

Source: Raymond James 雷蒙德·詹姆斯

Take into account the anticipated impact of Trump along with this data.

考虑到特朗普的预期影响以及这些数据。

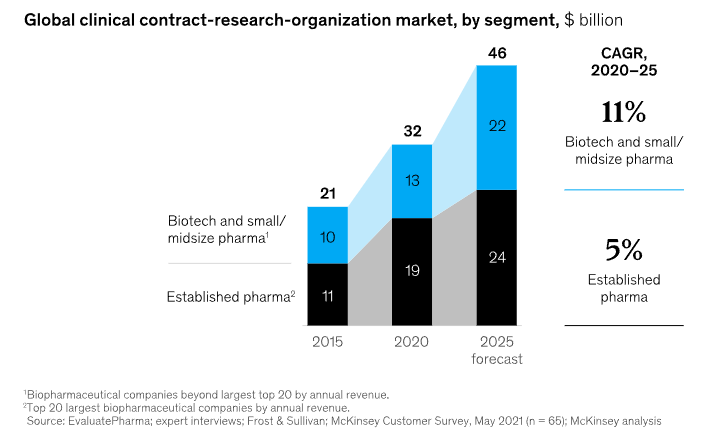

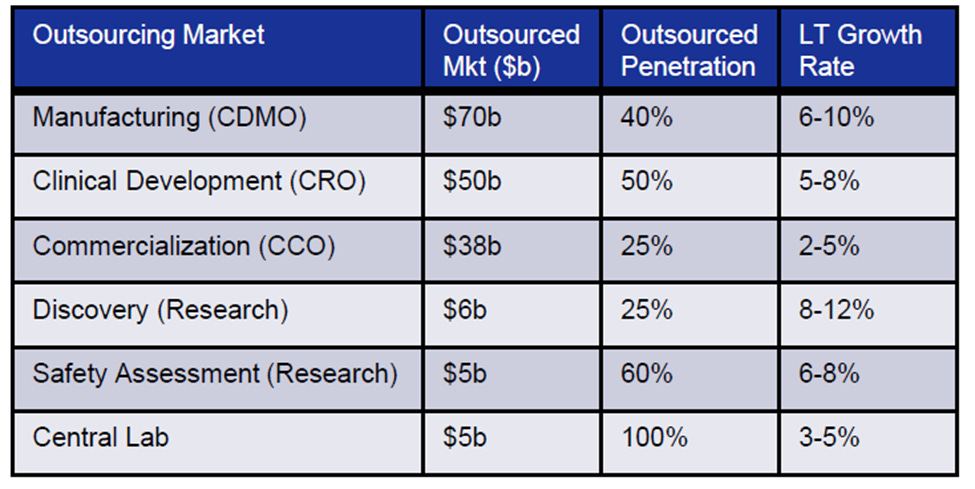

If drug approvals get easier, more novel therapies are approved, and balance sheets are robust enough to fund all of this, what could go wrong in life sciences? One thing on which RFK has been quite clear is his opposition to “Big Pharma”. That is not inconsistent with making it easier to research novel therapies and get them approved, however. In fact, most biotech innovation today is being driven by small- and medium-sized companies, which “Big Pharma” eventually looks to buy. The emergence of these smaller biopharma innovators has driven the rise of outsourcing in the industry, where drug developers rely on third parties to run trials and produce the drugs.

如果药物审批变得更容易,更多新疗法获得批准,且财务报表足够健全以资助所有这些,那么生命科学领域可能会出现什么问题?RFK 明确表明的一件事是他反对“大制药公司”。不过这与更容易研究新疗法并获得批准并不矛盾。实际上,今天大多数生物技术创新都是由中小型公司推动的,而“大制药公司”最终会寻求收购这些公司。小型生物制药创新者的出现推动了行业外包的兴起,药物开发者依赖第三方进行试验和生产药物。

Source: Deutsche Bank 德意志银行

Contract Research Organizations (CROs) and Contract Drug Manufacturing Organizations (CDMOs) have benefitted from this shift towards outsourcing. But that might not continue – at least for everyone in the industry. This outsourcing trend will almost certainly take on a different complexion under the Trump administration.

合同研究组织(CROs)和合同药物制造组织(CDMOs)从这种外包趋势中受益。但这种情况可能不会持续——至少对行业中的每一个人来说都是如此。在特朗普政府下,这种外包趋势几乎可以肯定会呈现出不同的面貌。

The BIOSECURE Act, which was introduced in January 2024, is essentially a life sciences trade war on steroids. The legislation blocks federal funding for US-based companies doing business with Chinese life sciences companies and also prohibits US government entities from doing business with those US-based companies. Under Trump, this legislation is very likely to pass.

生物安全法,该法案于 2024 年 1 月提出,本质上是生命科学领域的贸易战升级。该立法阻止了针对与中国生命科学公司开展业务的美国公司提供联邦资金,并禁止美国政府机构与这些美国公司进行业务往来。在特朗普任内,这项立法很可能会通过。

Almost three quarters of members of a US biotechnology trade group reported outsourcing preclinical and clinical development work to China, while nearly a third reported doing drug manufacturing in China according to a Reuters report. Indeed, surveys in recent years have indicated an increase in outsourcing drug trials and production to China. We are already hearing anecdotes of drug companies in the middle of clinical trials rushing to restructure their service providers and supply chains in a sharp reversal of this trend.

将近四分之三的美国生物技术贸易集团成员报告称将前临床和临床开发工作外包到中国,而近三分之一则报告在中国进行药物生产根据路透社的报道。事实上,近年来的调查表明,将药物试验和生产外包到中国的趋势正在增加。我们已经听到药物公司在进行临床试验的过程中匆忙重组他们的服务供应商和供应链,这与这一趋势形成了急剧的逆转。

So where does all this leave us? Is there a way for investors in the life sciences supply chain to position for more innovation, associated outsourcing, and onshoring? Is it possible to position for the nuances of a Trump Administration’s impact on biotechnology while insulating oneself from the negatives?

那么这一切把我们留在了哪里?生命科学供应链中的投资者有没有办法为更多的创新、相关的外包和本土化做好准备?在抵御负面影响的同时,有可能为特朗普政府对生物技术的影响的细微差别做好准备吗?

We believe we can have our cake and eat it too, and the market will realize we’re right as it learns to love nuance (because the market participants who don’t will be bankrupt within the first couple months of a new Trump Presidency).

我们相信我们可以两全其美,市场会意识到我们是对的,因为它将学会欣赏细微差别(因为那些不欣赏的市场参与者将在特朗普新总统任期的前几个月内破产)。

The opportunity lies in recognizing that while broad reshoring trends will create winners and losers, the market has not yet fully priced in the nuances of who falls into which category. Neither has the market appreciated that it is possible for RFK, if he is confirmed, to have negative impacts on certain areas while the broader environs of deregulation boost the outlook for innovation.

机会在于认识到,虽然广泛的回流趋势将创造赢家和输家,但市场尚未完全考虑到哪些人属于哪一类的细微差别。市场也没有意识到,如果 RFK 被确认,他可能对某些领域产生负面影响,而放松监管的更广泛环境则提升了对创新的前景。

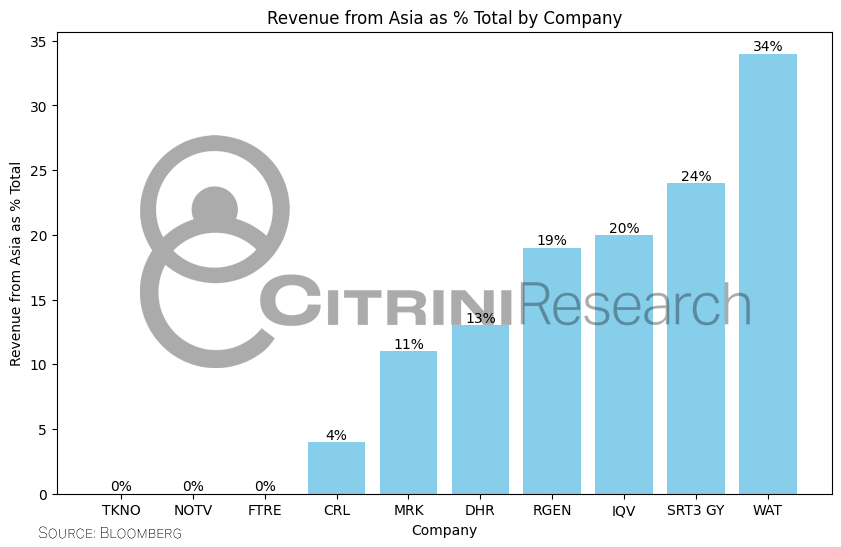

The set-up is very positive for the life sciences supply chain, provided one is looking in the right area. Throughout Q3 earnings season, we heard from virtually every company in the space that the cycle was bottoming and spending growth was returning. However, it tended to be the case that companies that were smaller and more US-centric sounded better.

生命科学供应链的设置相当积极,前提是您在正确的领域寻找。在第三季度的财报季中,我们几乎听到了该领域每个公司的观点,大家都认为周期在触底,支出增长正在回升。然而,倾向于较小和以美国为中心的公司听起来更好。

Case-in-point: TKNO. As we have covered previously, TKNO’s business is to provide customized reagents and drug substrates for drug production. They do so entirely from the US. And they recently launched a new product that generates more revenue and margin in response to meeting the needs of customers that require product in a rush, either because they are advancing in their research or commercial activities…or because they are replacing supply they previously sourced from China.

案例:TKNO。正如我们之前提到的,TKNO 的业务是提供定制试剂和药物底物用于药物生产。他们完全在美国进行此项业务。最近,他们推出了一款新产品,以响应需要快速产品的客户需求,从而产生更多的收入和利润,无论是因为他们在推进研究或商业活动...还是因为他们正在替换之前从中国采购的供应。

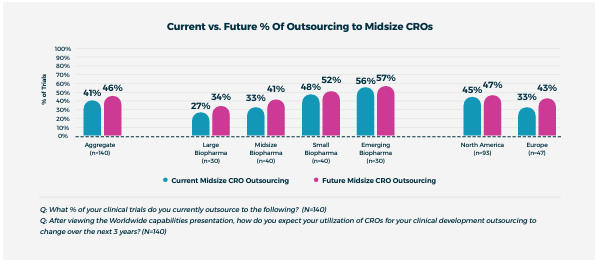

More generally, the trend favoring domestic suppliers of products and services for drug development should be best for smaller, niche providers. The market was heading in their direction anyway. Multiple surveys show market share shift toward smaller outsourced providers in order to secure more responsive or customized service.

更普遍地说,倾向于国内药物开发产品和服务供应商的趋势对较小的细分供应商来说应该是最好的。市场本来就是朝着他们的方向发展。多项调查显示,市场份额正在向较小的外包供应商转变,以获得更具响应性或定制化的服务。

Source: https://www.worldwide.com/wp-content/uploads/2024/01/Overview-Report-Shifting-Perceptions-Large-Versus-Mid-Size-CROs.pdf

来源:https://www.worldwide.com/wp-content/uploads/2024/01/Overview-Report-Shifting-Perceptions-Large-Versus-Mid-Size-CROs.pdf

Other than TKNO, there are precious few listed stocks that benefit from this trend towards outsourcing and onshoring. In fact, the number of beneficiaries available to investors is shrinking, with one of our other BIOSECURE beneficiaries, CDMO, recently being acquired. We view this as validation of the coming wave of demand for the domestic life sciences supply chain. Another way to play this which we have mentioned in passing is NOTV. NOTV is a CRO offering early stage research services primarily to smaller, more innovative biotech companies that require more white glove service. The company has been decimated by a controversy over animal models (primates used for testing drugs). The US government cracked down on sourcing of these models from non-approved sources, which put NOTV at a disadvantage providing animal research services. This caused NOTV to lose market share, especially to less scrupulous and less regulated Chinese competitors. More recently, the company has seen an uptick in demand, and we expect they will have an easier time sourcing models going forward, which they can use to win back business that is fleeing China.

除了 TKNO,受益于外包和回岸趋势的上市股票寥寥无几。事实上,可供投资者选择的受益者数量正在减少,我们的另一家 BIOSECURE 受益者 CDMO 最近被收购。我们认为这验证了国内生命科学供应链即将到来的需求浪潮。我们之前提到的另一种投资方式是 NOTV。NOTV 是一家为需要更多白手套服务的小型创新生物技术公司提供早期研究服务的 CRO。该公司因与动物模型(用于药物测试的灵长类动物)相关的争议而遭到重创。美国政府对从未经批准来源获取这些模型进行了打击,这使得 NOTV 在提供动物研究服务时处于不利地位。这导致 NOTV 失去了市场份额,尤其是对那些更加不拘一格和监管较少的中国竞争对手。最近,该公司的需求有所上升,我们预计他们将更容易获得模型,这些模型可以用来重新争取流失到中国的业务。

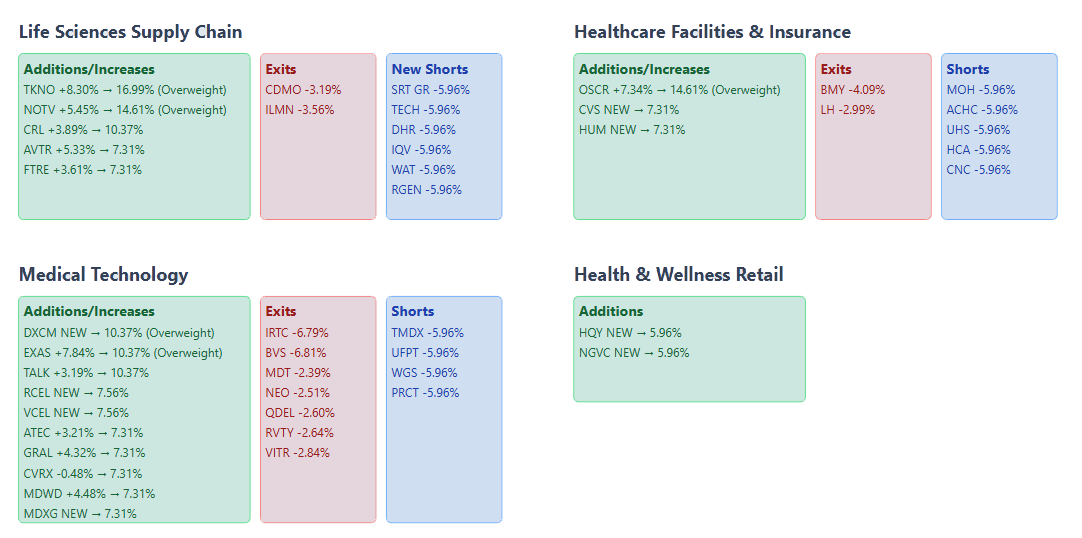

To take advantage of this, we will focus our long exposure on smaller supply chain players that are domestically focused – TKNO, NOTV, FTRE, CRL, and AVTR. In order to be able to get even more long, we will short some of the larger players that are reliant on business in China – SRT3GY, MRK, RGEN, WAT, TECH, DHR, and IQV. Because of their favorable near- and long-term prospects and depressed valuations, we maintain TKNO and NOTV as overweight longs.

为了利用这一点,我们将把我们的长期投资集中在一些专注于国内的小型供应链参与者上——TKNO、NOTV、FTRE、CRL 和 AVTR。为了能够进一步加大投资,我们将做空一些依赖中国业务的大型参与者——SRT3GY、MRK、RGEN、WAT、TECH、DHR 和 IQV。由于它们有利的短期和长期前景以及被压低的估值,我们将 TKNO 和 NOTV 维持为超配的长期投资。

Life Sciences Supply Chain

生命科学供应链

Long Positions (Total: ~56.59%)

多头头寸(总计:~56.59%)

Alpha Teknova (TKNO US): 16.99% (+8.30%) 🔵

Inotiv (NOTV US): 14.61% (+5.45%) 🔵

Charles River Labs (CRL US): 10.37% (+3.89%)

查尔斯河实验室 (CRL US): 10.37% (+3.89%)Avantor (AVTR US): 7.31% (+5.33%)

Fortrea Holdings (FTRE US): 7.31% (+3.61%)

Short Positions (Total: -35.76%)

空头头寸(总计:-35.76%)

Sartorius (SRT GR) -5.96% (New)

Bio-Techne (TECH US) -5.96% (New)

Danaher (DHR US) -5.96% (New)

Danaher (DHR US) -5.96% (新)IQVIA Holdings (IQV US) -5.96% (New)

IQVIA 控股 (IQV US) -5.96% (新)Waters Corp (WAT US) -5.96%

Repligen (RGEN US) -5.96% (New)

Segment Net Exposure: +20.83%

段净敞口:+20.83%

Medical Technology Update

医疗技术更新

While biopharma and its supporting infrastructure gets most of the attention and press in healthcare discussions, the reality is that healthcare services – doctors, buildings, equipment, and devices – is a much larger part of the healthcare ecosystem. The entire sector is selling off on concerns about policies impacting biotech, but there is a lot more going on.

虽然生物制药及其支持基础设施在医疗保健讨论中获得了大部分关注和媒体报道,但实际上医疗服务——医生、建筑、设备和器械——是医疗生态系统中更大的一部分。整个行业因对影响生物技术的政策的担忧而出售,但实际上还有更多事情正在发生。

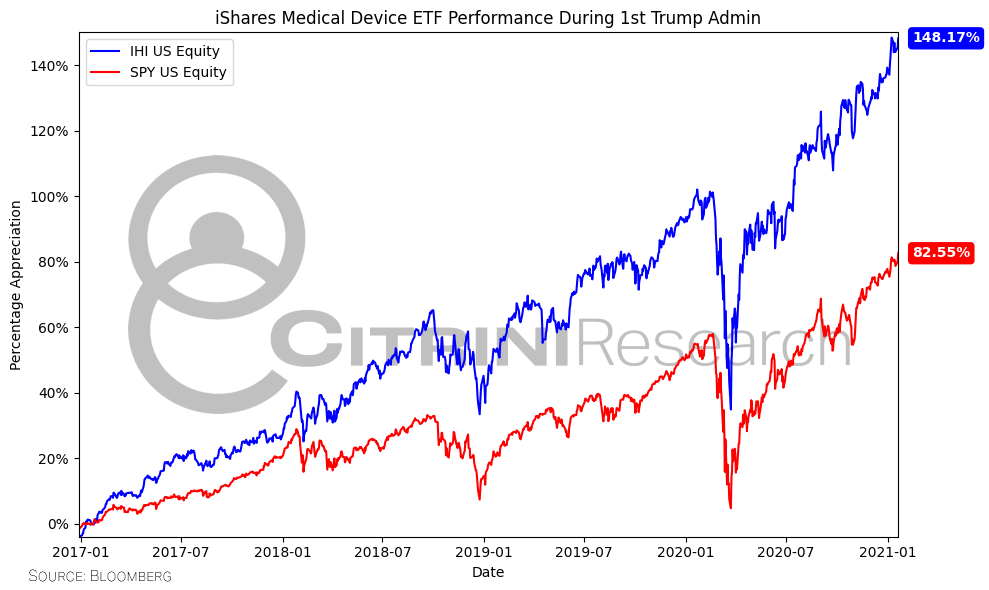

On the positive side, the upcoming Trump administration is likely to be as supportive of medical technology as it is of biotech. Under the first Trump administration, as one regulatory journalist noted, “the HHS stepped in to reclassify dozens of medical devices that had been subject to FDA oversight, thereby exempting devices from oversight under the agency’s premarket notification process and allowing them to be marketed without prior FDA review. HHS also decided to give the Office of the Assistant Secretary for Health (OASH) the authority to review certain Laboratory Developed Tests on a voluntary basis.” In layman’s terms: Trump made it a lot easier to bring new devices and diagnostics to market. But he did not stop there. Trump’s administration also instituted automatic coverage policies for breakthrough medical technology to ensure reimbursement for innovative products. Reflecting that the future is likely to be brighter than the past for companies that depend on these policies, the Biden administration actually walked back this policy of automatic coverage in 2021. This time around, team Trump is floating a co-founder of Levels, a company that makes glucose monitoring devices, as a candidate to run the FDA. With all of this in mind, no wonder Trump’s first term in office was the best four-year stretch on record for the medical device ETF, IHI, which appreciated by 145% and more than double the S&P500.

在积极的一面,即将到来的特朗普政府可能会像支持生物技术一样支持医疗技术。根据一位监管记者的说法指出,“卫生与公共服务部介入重新分类了数十种曾经受到 FDA 监督的医疗设备,从而使这些设备免于该机构的市场通知流程的监督,并允许在未经 FDA 审查的情况下上市。卫生与公共服务部还决定授予卫生助理秘书办公室(OASH)自愿审查某些实验室开发测试的权力。” 通俗来说:特朗普使得新设备和诊断工具更容易进入市场。但他并没有止步于此。特朗普的政府还实施了突破性医疗技术的自动涵盖政策,以确保对创新产品的报销。这反映出,依赖这些政策的公司未来可能会比过去更光明,拜登政府实际上在 2021 年回撤了这种自动涵盖政策。 这次,特朗普团队正在提名 Levels 公司的联合创始人,该公司制造葡萄糖监测设备,作为 FDA 的候选人。考虑到这一切,难怪特朗普的第一任期是医疗设备 ETF IHI 有史以来表现最好的四年,涨幅达到 145%,是标普 500 的两倍多。

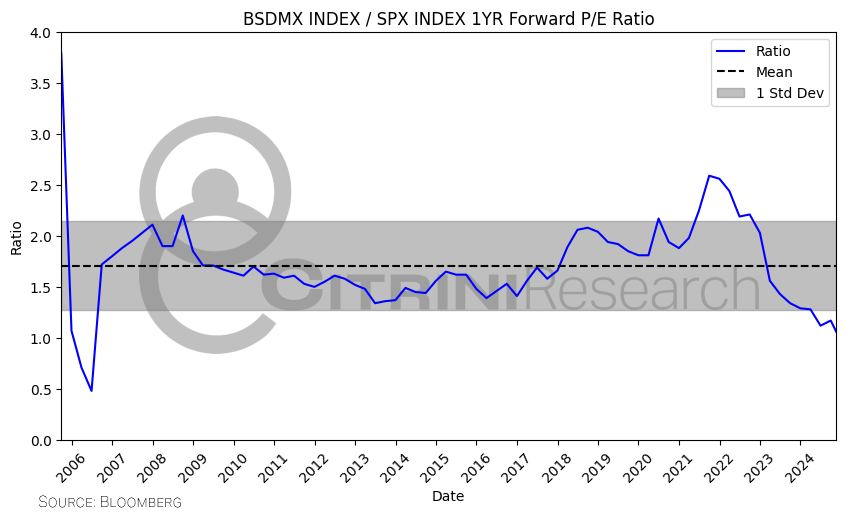

So given the positive fundamental drivers for medtech we covered in our Healthcare Cyclical Inflection primer, combined with a likely policy tailwinds, you would think these stocks are trading at sky-high valuations, right?

因此,考虑到我们在医疗技术周期性拐点入门中讨论的积极基本驱动因素,以及可能的政策顺风,您可能会认为这些股票的交易估值非常高,对吧?

Wrong. 错误。

Large cap medtech trades at the largest discount to the S&P of the last two decades. SMID cap medtech is even worse. What’s going on here?

大型资本医疗科技的交易对标准普尔指数的折扣是过去二十年来最大的。中小型资本医疗科技的情况更糟。这到底发生了什么?

We firmly believe the most significant driver is very much the same dynamic as we covered in our Payments primer.

我们坚信,最重要的驱动力与我们在支付基础知识中讨论的动态非常相似。

That is, the sector is perceived as being very rate-sensitive because of the high-growth nature of the companies. Even though interest rate levels and volatility have begun to normalize, capital has not flowed back to the sector.

也就是说,由于这些公司的高增长性质,该行业被认为对利率非常敏感。尽管利率水平和波动性已经开始正常化,资本仍未流回该行业。

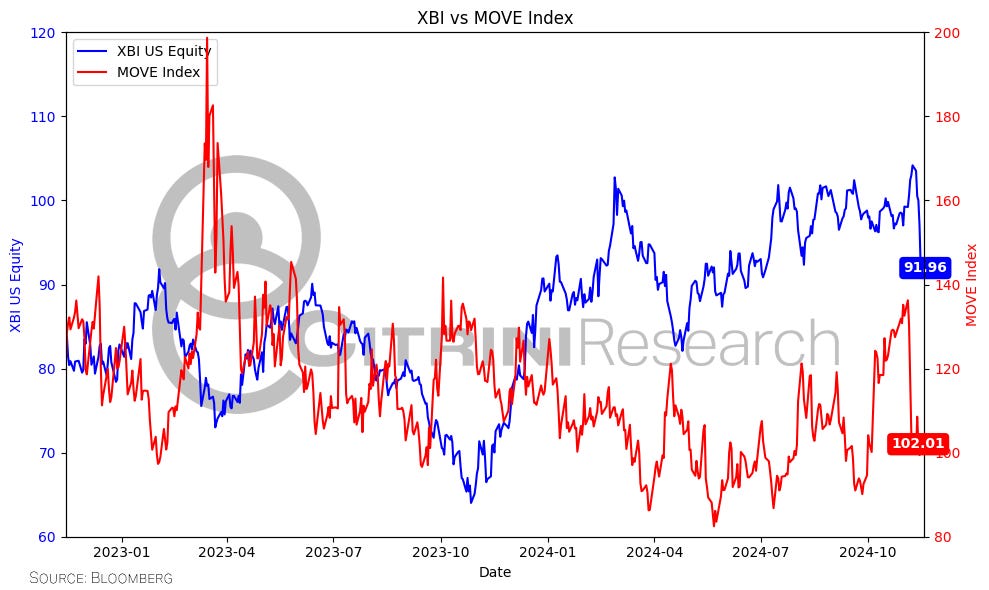

Biotech has always had a more significant negative impact from extended periods of rate volatility, which is different from the absolute level of rates and the direction. While it’s no secret that large increases in rates have a negative impact on capital intensive businesses, the fact is that the difference between 4% and 4.5% on the long bond is not the most significant aspect. No, that is the domain of uncertainty surrounding rates. The funding environment right now is less important than fears over a drastically worse cost of capital in the future. The best metric for that, perhaps, is volatility.

生物技术行业在长期的利率波动中始终受到更大的负面影响,这与利率的绝对水平和方向是不同的。虽然众所周知,利率的急剧上升对资本密集型企业有负面影响,但事实是,长期债券上 4%和 4.5%之间的差异并不是最重要的方面。不是的,最重要的是围绕利率的不确定性。目前的融资环境不如对未来资本成本急剧恶化的担忧重要。也许,衡量这一点的最佳指标是波动性。

Rate volatility has fallen off a cliff, however. Previously, during this cycle and others, that has been associated with large rallies in XBI despite elevated rates. It seems to us that this recent selloff is nearly entirely narrative driven on the election and much less a function of the impact on rates - although one may argue they’re one and the same. I believe it is currently unlikely for Trump to be as bad for interest rate volatility as feared, and that makes for a very enticing setup.

利率波动率已经大幅下降。然而,在本周期和其他周期中,这通常与 XBI 的巨大反弹相关,尽管利率较高。我们认为,这次近期的抛售几乎完全是由选举叙事驱动的,而与利率的影响关系不大——尽管有人可能会争辩说它们是同一回事。我相信特朗普目前不太可能像人们担心的那样对利率波动产生负面影响,这使得当前的情况非常诱人。

This dynamic has been exacerbated by a number of company-specific, idiosyncratic “blow-ups,” driven by misexecution and (at various points) concerns about the impact of GLP-1s on medtech.

这种动态因一些公司特有的、独特的“爆发”而加剧,这些“爆发”是由于执行不当以及(在不同阶段)对 GLP-1 对医疗技术影响的担忧所驱动的。

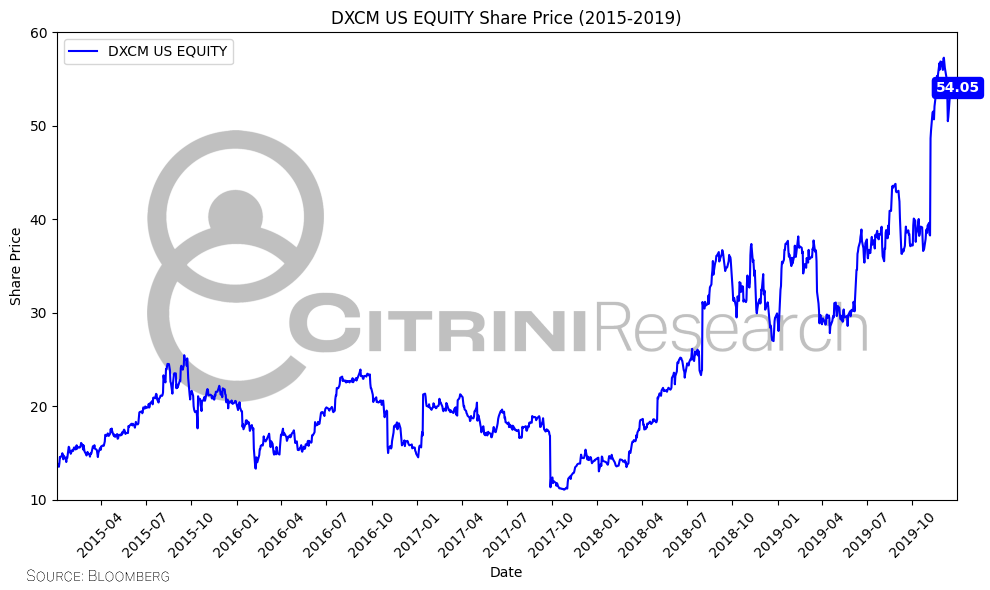

No stock is more representative of this dynamic than DXCM, which makes a continuous glucose monitor (CGM) for monitoring blood sugar. Recent sales channel issues and concerns about competition caused the stock to crater, generating one of the worst negative reactions to an earnings release in the company’s history. In fact, the negative earnings reaction is only rivaled by the same quarter in – wait for it – 2017. That “hiccup” in the first year of the first Trump administration was driven by similar factors…and from the day after that fateful earnings report in 2017, DXCM was the single best performing stock in the S&P over the next 3.5 years, appreciating 820%.

没有哪只股票比 DXCM 更能代表这种动态,它制造了一种连续血糖监测仪(CGM)用于监测血糖。最近的销售渠道问题和对竞争的担忧导致该股票暴跌,产生了公司历史上对财报发布的最糟糕的负面反应之一。事实上,这种负面财报反应仅次于——等一下——2017 年同一季度。特朗普政府第一年出现的那次“波动”是由类似因素驱动的……自 2017 年那个致命财报发布的第二天起,DXCM 在接下来的 3.5 年里成为标准普尔 500 指数中表现最好的股票,增值了 820%。

Maybe we are looking too hard for patterns, but we are making DXCM, along with EXAS, our two overweight longs in medtech.

也许我们对模式搜索得太用力,但我们将 DXCM 和 EXAS 作为我们在医疗科技领域的两个重仓看涨股。

We also keep CVRX, GRAL, STIM, MDWD, NARI, TALK, and ANGO, which should all benefit from a more favorable regulatory and reimbursement backdrop. Finally, we add BWAY to complement STIM – we believe both will be significant beneficiaries from a re-orientation of reimbursement for mental health services – along with RCEL, VCEL, and MDXG. In order to offset some of our duration exposure, we also include high-flier medtech shorts which we believe have fundamental problems, including TMDX, UFPT, WGS, and PRCT.

我们还持有 CVRX、GRAL、STIM、MDWD、NARI、TALK 和 ANGO,这些公司都应该从更有利的监管和报销环境中受益。最后,我们增加 BWAY 以补充 STIM——我们相信这两者都将显著受益于对心理健康服务报销的重新调整——以及 RCEL、VCEL 和 MDXG。为了抵消我们的利率风险,我们还包括一些我们认为存在基本问题的高飞医疗科技空头, 包括 TMDX、UFPT、WGS 和 PRCT。

Medical Technology 医疗技术

Long Positions (Total: ~91.72%)

长头寸(总计:~91.72%)

DexCom (DXCM US): 10.37% (New) 🔵

DexCom (DXCM US): 10.37% (新) 🔵Exact Sciences (EXAS US): 10.37% (+7.84%) 🔵

Talkspace (TALK US): 10.37% (+3.19%)

Avita Medical (RCEL US): 7.56% (New)

Avita Medical (RCEL US): 7.56% (新)Vericel (VCEL US): 7.56% (New)

Vericel (VCEL US): 7.56% (新)Alphatec Holdings (ATEC US): 7.31% (+3.21%)

GRAIL (GRAL US): 7.31% (+4.32%)

CVRX (CVRX US): 7.31% (-0.48%)

MediWound (MDWD US): 7.31% (+4.48%)

MiMedx Group (MDXG US): 7.31% (New)

MiMedx Group (MDXG US): 7.31% (新)Angiodynamics (ANGO US): 2.98% (+0.82%)

BrainWay (BWAY US): 2.98% (New)

Neuronetics (STIM US): 2.98% (+0.44%)

Short Positions (Total: -23.84%)

空头头寸(总计:-23.84%)

All positions -5.96% each:

所有职位 -5.96% 每个:

TransMedics (TMDX US) -5.96% (New)

UFP Technologies (UFPT US )-5.96% (New)

GeneD× Holdings (WGS US) -5.96% (New)

Procept BioRobotics (PRCT US) -5.96% (New)

Procept BioRobotics (PRCT US) -5.96% (新)

Segment Net Exposure: +67.88%

段净敞口:+67.88%

Healthcare Facilities and Insurance

医疗设施和保险

An additional potential overhang on medtech is concern about healthcare access and utilization. The Biden administration revoked Medicaid work requirements, which significantly expanded eligibility for and enrollment in the government-sponsored health insurance program for low-income people. Reinstituting these requirements is at the top of the Republican policy agenda. This will almost certainly be a headwind for overall volumes in the healthcare system. But it will primarily hit more commonplace procedures – which happens to be where many facility operators make most of their money. As a consequence, to allow us to be longer medtech, we are shorting MOH – a medicaid-weighted insurer – and adding to our facility operator short in ACHC with UHS and HCA.

医疗科技的一个额外潜在压力是对医疗保健获取和利用的担忧。拜登政府取消了医疗补助工作要求,这极大地扩大了低收入人群政府资助的健康保险项目的资格和入保人数。恢复这些要求是共和党的政策议程的首要任务。这几乎肯定会对整个医疗系统的总量形成阻力。但这主要会影响更常见的程序——正是这些程序让许多设施运营商赚取大部分收入。因此,为了让我们在医疗科技领域更持久,我们正在做空 MOH——一家以医疗补助为重点的保险公司——并且增加我们对 UHS 和 HCA 的设施运营商的做空。

An Insurance Long for the Trump Admin: Oscar Health (OSCR US)

特朗普政府的保险长:奥斯卡健康(OSCR US)

Finally, on the topic of insurers, OSCR strikes us as one of the most mispriced stocks in healthcare and is overweight in the basket.

最后,谈到保险公司,OSCR 给我们的印象是医疗保健中最被低估的股票之一,并在投资组合中占比过重。

They offer access to insurance plans through the ACA, with incredible customer satisfaction and stickiness (for an insurer). The stock trades at a highly depressed multiple of their long-term guidance, provided earlier this year, because of concerns that Trump will somehow rollback the ACA. The company is led by one of the most credible operators in the history of health insurance in Mark Bertolini, who came out of retirement at the age of 68 after running a much bigger business (Aetna) earlier in his career. We think there are various reasons why Trump will not be as bad for the ACA as the market believes, and recent heavy insider-buying at OSCR supports this.

他们通过《平价医疗法案》(ACA)提供保险计划,客户满意度和黏性都非常高(对于保险公司来说)。由于担心特朗普会以某种方式回滚 ACA,该股票的交易价格远低于其长期指导目标,早些时候提供的目标。该公司的领导人是健康保险历史上最值得信赖的运营者之一马克·贝尔托利,他在 68 岁时从退休中复出,此前在职业生涯早期曾管理过更大规模的公司(艾腾 Aetna)。我们认为有多种原因解释为什么特朗普不会对 ACA 造成市场认为的那样糟糕的影响,而 OSCR 最近的大量内部购股支持了这一观点。

Speaking of insider buying, a subtheme we have discussed prior in our March 2024 election primer positioning for better-than-expected chances of a Trump presidency was the impact of a relationship with either Donald Trump or his inner circle on a company’s ability to navigate the administration. One of the largest holders of Oscar Health’s stock is Thrive Capital - the founder of which is Joshua Kushner. This is someone who, you would expect, knows better about the Trump Administration’s impact on the company than you do.

说到内部购买,我们在 2024 年 3 月的选举指南中曾讨论过的一个子主题是,与唐纳德·特朗普或他的核心团队的关系对公司应对政府的能力的影响,而我们当时在为特朗普总统连任的意外机会做定位。Oscar Health 的最大股东之一是 Thrive Capital,而其创始人是约书亚·库什纳。可以预期的是,这个人对特朗普政府对公司的影响比你更了解。

In addition to OSCR, CVS should be a beneficiary of policy trends given their relative exposure to Medicare vs. Medicaid. CVS is a turnaround story which has been mismanaged and seen its margins nearly cut in half in recent years. However, the company is engaging with activist shareholders who have laid out a clear and credible path for improvement. With a single digit earnings multiple, the stock is extremely cheap and does not reflect the value of the company’s invaluable assets that go alongside its insurance operations, including a network of care centers that make them a low-cost operator in healthcare services.

除了 OSCR,考虑到 CVS 相对于医疗保险与医疗补助的相对曝光,CVS 应该是政策趋势的受益者。CVS 是一个经历了管理不善的重整故事,近年来其利润率几乎减半。然而,公司正在与激进的股东进行沟通,这些股东提出了一条清晰而可靠的改进路径。以单一数字的收益倍数,股票非常便宜,未能反映公司在其保险业务运营中不可估量资产的价值,包括一网络的护理中心,使其成为医疗服务领域的低成本运营商。

Healthcare Facilities & Insurance

医疗设施与保险

Long Positions (Total: ~29.23%)

多头头寸(总计:~29.23%)

Oscar Health (OSCR US): 14.61% (+7.34%) 🔵

CVS Health (CVS US): 7.31% (New)

CVS Health (CVS US):7.31%(新)Humana (HUM US): 7.31% (New)

Humana (HUM US): 7.31% (新)

Short Positions (Total: -29.80%)

空头头寸(总计:-29.80%)

All positions -5.96% each:

所有职位 -5.96% 每个:

Molina Healthcare (MOH US) -5.96% (New)

Molina Healthcare (MOH US) -5.96% (新)Acadia Healthcare (ACHC US) -5.96%

Universal Health Services (UHS US) -5.96% (New)

HCA Healthcare (HCA US)-5.96% (New)

HCA 医疗保健 (HCA 美国) -5.96% (新)Centene (CNC US)-5.96% (New)

Segment Net Exposure: -0.57%

段净敞口:-0.57%

Bonus Section (Not Tax Advice)

奖励部分(非税务建议)

You might not be expecting a tax discussion as part of a healthcare piece, but one policy that was a focus for the Trump administration in 2016 and remains so today is expanding access to Health Savings Accounts (HSAs). HSAs are tax-advantaged accounts that allow individuals and families to save for medical expenses. They are only available to people enrolled in high-deductible health plans, but they provide for tax-deductible contributions, tax-free growth through investment, and tax-free withdrawals for qualifying expenses. After age 65, HSAs can be used to supplement traditional retirement accounts.

您可能没有预料到在医疗保健的文章中会涉及税收讨论,但 2016 年特朗普政府关注的一项政策,至今仍然如此,就是扩大健康储蓄账户(HSA)的使用。HSA 是享有税收优惠的账户,允许个人和家庭为医疗费用储蓄。它们仅对参与高免赔额健康计划的人开放,但提供可扣税的缴款、通过投资免税增长以及用于合格费用的免税取款。65 岁后,HSA 可以用来补充传统退休账户。

The point is, these can be very attractive, and the Trump administration seems to want everyone to have one. One of the largest providers of HSAs, HQY, trades at the lowest multiple in its history, while potentially on the cusp of significant growth.

关键是,这些可能非常有吸引力,并且特朗普政府似乎想让每个人都有一个。HSAs 最大的提供商之一 HQY 在其历史上交易时以最低的倍数,尽管可能正处于显著增长的边缘。

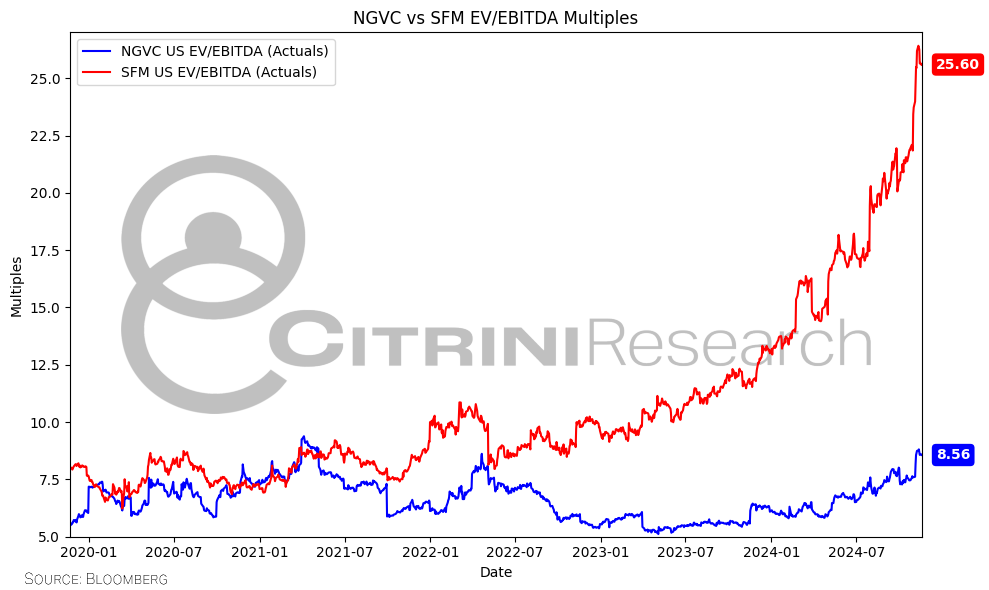

Meanwhile, NGVC is a family-owned grocer that focuses on healthy foods and supplements. It has been living in the shadow of its bigger and more expensive peer, SFM, over the last three years, as SFM has seen its multiple expand more than 150% while NGVC’s valuation remained flat. NGVC has similar growth prospects to SFM with higher margins. The margins are higher because NGVC stores sell lots of high margin nutritional supplements. Many of these supplements are “qualifying expenses” for people with HSAs.

同时,NGVC 是一家专注于健康食品和补充剂的家族企业。在过去三年里,它一直生活在更大、更昂贵的同行 SFM 的阴影下,因为 SFM 的市盈率扩大了超过 150%,而 NGVC 的估值保持平稳。NGVC 与 SFM 有类似的增长前景,但利润率更高。利润率更高是因为 NGVC 的商店销售大量高利润的营养补充剂。这些补充剂中的许多是拥有 HSA 的人的“合格费用”。

Health & Wellness Retail/Services

健康与保健零售/服务

Long Positions (Total: ~11.92%)

多头头寸(总计:~11.92%)

HealthEquity (HQY US): 5.96% (New)

Natural Grocers (NGVC US): 5.96% (New)

Short Positions 短仓

None 无

Segment Net Exposure: +11.92%

段净敞口:+11.92%

Healthcare Basket 医疗保健篮子

Most Recent Basket Composition: Here

最新的篮子组成:这里

Changes 变化

Portfolio Summary Statistics

投资组合摘要统计信息

Total Long Exposure: 189.4%

总长曝光:189.4%Total Short Exposure: -89.4%

总短期暴露:-89.4%Net Exposure: 100% 净敞口:100%

Number of Long Positions: 23

多头头寸数量:23Number of Short Positions: 15

空头头寸数量:15Overweight Positions (🔵): TKNO, NOTV, DXCM, EXAS, OSCR

超重头寸 (🔵): TKNO, NOTV, DXCM, EXAS, OSCR

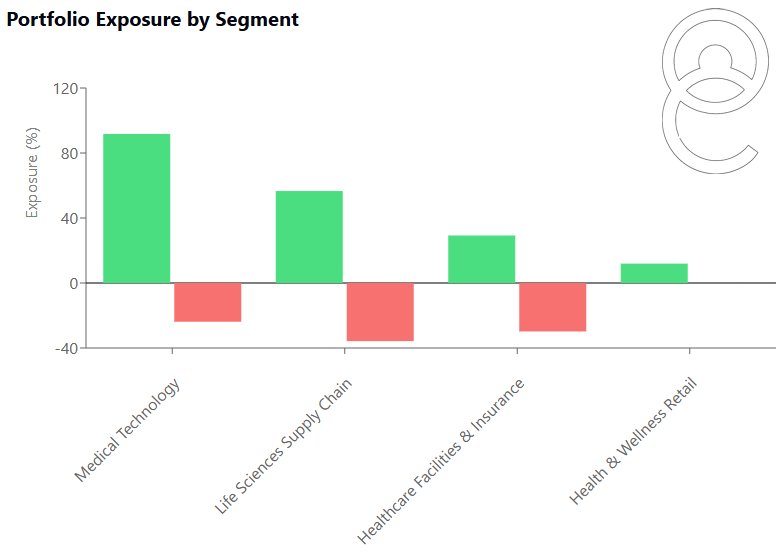

Segment Exposure Summary 段落曝光摘要

Medical Technology: +67.88% net

医疗技术:+67.88% 净值Life Sciences Supply Chain: +20.83% net

生命科学供应链:+20.83% 净值Health & Wellness Retail/Services: +11.92% net

健康与健康零售/服务:+11.92% 净值Healthcare Facilities & Insurance: -0.57% net

医疗设施和保险:-0.57% 净值

Key Features 关键特性

Largest gross and net exposure in Medical Technology, reflects positive policy tailwinds from Trump administration and general positive attitude towards innovation/deregulation

医疗技术领域最大的毛利和净敞口,反映出特朗普政府积极的政策顺风和对创新/放松管制的普遍积极态度Significant long bias in Life Sciences Supply Chain, positioned to benefit from BIOSECURE Act and reshoring trends with shorts focused on substantial China exposure

生命科学供应链中存在显著的长期偏见,预计将受益于生物安全法案和本土化趋势,而空头则集中于对中国的重大敞口Nearly market-neutral positioning in Healthcare Facilities & Insurance, positioned primarily for Trump Administration impact to cushion overall negative beta so far on the sector and more easily take advantage of obvious Trump overreactions [e.g. OSCR]

几乎是市场中性定位于医疗设施和保险,主要针对特朗普政府的影响,以缓冲到目前为止该行业整体的负贝塔,并更容易利用明显的特朗普过度反应 [例如 OSCR]Focused, long-only exposure to Health & Wellness Retail/Services

专注于健康与保健零售/服务的长期投资Emphasis on smaller, domestic companies in long book

强调对小型国内公司的关注在长书中Shorts concentrated in large, multinational companies

集中在大型跨国公司中的空头交易

See the Most Recent Medtech & Healthcare Basket Composition Here

查看最新的医疗技术和医疗保健篮子组成这里

I work in Pharma and we a quite big part of our Pipeline with Chinese companies where the development and clinical trials are currently happening there. And I can absolutely say: every Company is trying to get the processes out of China to European or US CDMOs

我在制药行业工作,我们的管道中与中国公司的合作占据了相当大的部分,目前正在那里进行开发和临床试验。我可以肯定地说:每家公司都在努力将流程转移出中国,前往欧洲或美国的合同开发和制造组织。

fantastic read & very clear analysis

精彩的阅读和非常清晰的分析