TMT Breakout is opening up paid subs today after being closed most of the year

We send out 2x Daily emails: One in the morning recapping all important news/research/3p data releases and one post-close recapping all the important stock moves in TMT for the day.

Our Pro Tier includes a weekend email which includes trade ideas, positioning/sentiment write ups, macro view, post-call earnings takeaways + more. I have removed the paywall on some Weekly posts over the last several months if you want to check out the content.

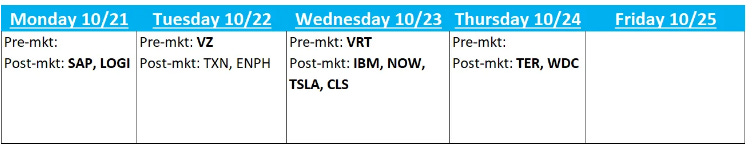

QQQs are down 60bps; Oil +2%, BTC -80bps. Yields ticking up again +4-5 bps across the curve. China -2% led lower by tech. Not a lot of news over the weekend on the macro front - China LPRs reduced by 25bps each, slightly larger than expected and Boeing strike settlement the main stories. Earnings season ramps slowly this week leading up to the bigger week next week:

Let’s get to it…

NOW: MS Downgrades to Hold on balanced r/r

Although MS notes that partner checks suggest stable demand, driven by healthy cross-sell activity and early Pro Plus excitement, and execution remains "encouraging," MS downgrades given lack of meaningful valuation upside, elevated expectations due to Pro Plus adoption, and recent leadership departures which offer a more balanced risk/reward. MS says cross-selling activity of non-ITSM workflows remains healthy while Pro Plus adoption continues to be garnering strong interest and is cited as a potential growth driver into 2025 by partners, although some customers have mentioned hesitancy around pricing for Pro Plus.

TMTB: We agree on the call here and mentioned in our weekly yesterday we were taking some profits on our long despite continuing to like the business/story. Company reports on Wednesday and bogeys are for 23.5-24% cRPO vs street at 22%.

DDOG -1.3%: Bernstein lowers PT to $151 from $157 lowering Q3 sales estimates

After checking in with their contacts, Bernstein believes their earlier hopes of GenAI projects ramping in 2H’24 have been “partially dashed” as non-tech enterprises continue to struggle, seeing lower success rates. Bernstein lowers their numbers and now believes DDOG’s Q3 decelerates to 25-25.5% y/y and Q4 will accelerate to 27.5%, continuing into 2025, although they also lower rate of incremental growth in 2025 as they assume continued lower success rate of GenAI/some budget displacement, while noting they believe this will normalize longer term.

AAPL: JPM says iPhone 16 lead times now tracking in line with iPhone 15 / Loop says Q3 iPhone shipments tracking stronger than expected

JPM says their week six of the firm's Apple product availability tracker shows delivery lead times for Pro models started to moderate glboally, after being stable for about four weeks, while lead times for base models increased modestly. Additionally, JPM notes that while average lead times for the iPhone 16 series have been tracking below iPhone 15 until week five, in week six the lead times are back to tracking in line with iPhone 15, providing JPM with more reassurance around recovery in demand momentum following the initial weeks post-launch.

Loop Capital raises Q3 iPhone revenue to $49.3B from $48.6B and unit sales estimate to 53.5M from 52.5M as their supply chain work suggests that iPhone shipments are tracking stronger than anticipated.

FTNT +1.7%: Named top pick at MS - PT to $105 from $69

MS is bullish on network security stocks in 2025 as they believe a stronger firewall refresh, higher software attach rates and improving margins (driven by AI automation) can drive significant upside to street estimates over next 2-3 years (MS notes network security is a top spending priority over the next 12 months according to their recent IT survey). MS’ refresh analysis suggest highest estimate vs upside for FTNT vs PANW which has a stronger platform position and sees 5-10% upside to product revs and 20-30% upside to street FCF estimates and 20% valuation discount to PANW despite similar FCF fwd growth estimates.

GTLB: Needham upgrades to Buy with $70 PT

Needham says GTLB has broadened its offering and anticipates sustained “Ultimate strength as a result of product innovation such as Duo Pro Enterprise and Dedicated.” Needham continues to see greater Ultimate adoption relative to Premium resulting from a “melt up” to greater Enterprise selling where budgets are larger/stronger and reflecting the premium placed on GTLB’s compliance/security capabilities. In addition, Needham thinks premium SKU pricing changes will continue to snowball into revneue tailwinds in FY26 and sees multiple scenario where GTLB will report rev upside to the Oct q, helped by continued strength in incremental margins and improvement in churn.

XPEV: JPM places XPeng on 'Positive Catalyst Watch'

TheFly:

JPMorgan analyst Nick Lai placed shares of XPeng on "Positive Catalyst Watch" while keeping an Overweight rating on the name with a $14 price target. The firm sees two important near-term events - the October 24 XPeng technology day where it anticipates various new initiatives and the late November Q3 results announcement where it expects a beat. XPeng's upcoming new product strategy, advancing inhouse technology and solid Q3 earnings as well as strength in Q4 vehicle delivery should altogether support its share price, the analyst tells investors in a research note.

HOOD: Piper raises PT to $30 from $27 at Piper

TheFly:

Piper Sandler raised the firm's price target on Robinhood to $30 from $27 and keeps an Overweight rating on the shares after the company hosted its first inaugural Robinhood Summit 2024 and introduced a number of new products to its customer base. In addition to the new web-based trading platform, Robinhood reiterated plans to launch index options and futures trading in the coming months and disclosed details on pricing.

KEYB also raised PT to $30 noting they remain positive on their LT opportunity to take share and increasing platform breadth via new product innovations

SIRI +3%: Berkshire Hathaway added to its holdings buying 1.6M shars for $42M and now holds 32% of the company

JD: Loop Capital upgrades JD to Buy from Hold with PT to $49 from $48

Loop believes JD will be one of the top beneficiaries from China's consumption stimulus and all Asia technology services stocks will continue to see valuation recovery from historic lows, while saying they think JD's Q3 estimates are achievable and expects higher spending in Q4.

GOOGL: Barrons - Google Search Dominance Is Under Siege. This AI Start-Up Is Taking Advantage

Not much new here, just talking up perplexity threat….

At the same time, Google is facing more competition. Its share of the U.S. search ad market is expected to drop below 50% next year for the first time in over a decade, according to research firm eMarketer. Evercore analysts who recently surveyed more than 1,300 people in the U.S. found 8% of the respondents chose OpenAI’s ChatGPT as their primary search engine, up from 1% in a previous survey in June, taking market share at the expense of Google.

That means it is a good time for AI-powered search start-up Perplexity to try to grab a bigger slice of the market. Perplexity has told investors it is looking to raise about $500 million in the new funding round at a valuation of around $8 billion, The Wall Street Journal reported Sunday, citing people familiar with the matter…Its annualized revenue is about $50 million up from a rate of just over $10 million in March, according to the Journal. In 2023, Google Search generated $175 billion in revenue. Perplexity’s consumer-facing search engine is getting about 15 million queries a day, compared with billions of queries for Google daily.

MSFT: Microsoft's Azure revenue lift from OpenAI offsets EPS hit, says UBS

TheFly:

Concurrent with OpenAI's latest funding round, a number of media articles related to OpenAI financials as well as its relationship with Microsoft have generated considerable interest, and while the EPS dilution and the CapEx requirements are sources of pressure, UBS believes that they're offset by OpenAI's lift to Azure growth and that a potential shift from an exclusive to a primary provider of compute infrastructure to OpenAI may be a good thing for Microsoft, UBS tells investors in a research note.

Other News:

AAPL: WSJ profiles TimCook….”Tim Cook on Why Apple’s Huge Bets Will Pay Off” - WSJ

AAPL: Apple’s top recruiting exec is leaving to become the chief people officer at Citadel

AMD: reportedly launched the 5th generation of EPYC processor and Instinct MI325X accelerator – Economic Daily

China: China's new capital stimulus for chip and tech sectors sparks overcapacity concerns – DigiTimes

China: China's SenseTime using 'a lot' of Huawei, other domestic AI chips – Nikkei Asia

China / Semis: Japan Pressed by US Lawmakers to Strengthen Chip Curbs on China - Bloomberg

EXPE: Expedia Is Ready to Catch Booking. Why It’s Time to Buy the Travel Stock. – Barron’s

Gen AI/MRVL: AI computing race too costly for most top chipmakers, says MRVL’s CTO – Nikkei

Gen AI, China: Chinese AI groups get creative to drive down cost of models– FT

Gen AI Power / Taiwan: Taiwan Signals Openness to Nuclear Power Amid Surging AI Demand – Bloomberg

GOOGL: Google granted request to pause order on Play store overhaul – Reuters

IBM: IBM releases new AI models for businesses as genAI competition heats up – Reuters

MSFT: Microsoft Goggles’ Cost Must Drop From $80,000 Each, Army Says– Bloomberg

MSFT, NVDA: Microsoft is expected to be the largest customers for GB200, as its 4Q24 order volume surpasses the total volume of others CSPs; Microsoft’s order volume for 4Q24 has increased to 1400-1500 racks and 70% of the orders is for GB200 NVL72 – Commercial Times

MSFT: Microsoft to let clients build AI agents for routine tasks from November – Reuters

NVDA: Nvidia reportedly plans to adopt socket design into its GPUs w/ mass production in the B300 series – Commercial Times

TSM: TSMC Says It Complies With Export Controls After Report of U.S. Probe– Barron’s

V: Visa Wanted a Vast Empire. First, It Had to Beat Back Its Foes - WSJ