TMTB EOD Wrap

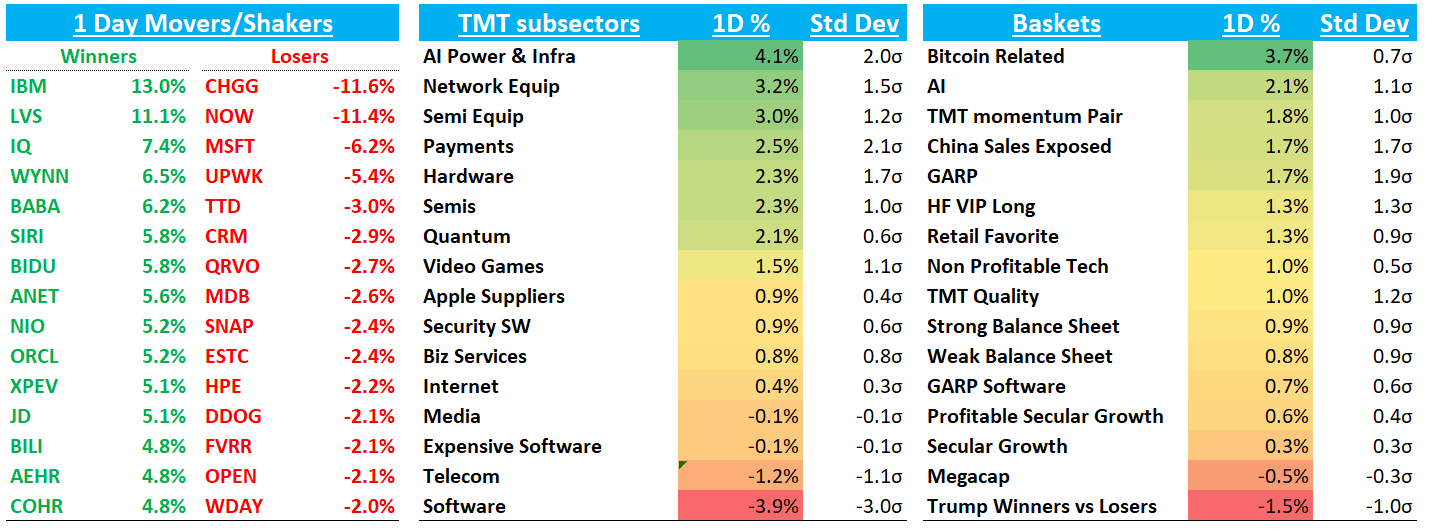

QQQs +43bps. Yields flat to down. BTC +1.4% to $105k. PCE on the docket tomorrow pre-mkt.

WSJ reporting this afternoon that OpenAI in talks for raising $ at valuation of up to $340B as Softbank would put in $15-$25. One has to wonder how much of these discussions happened before last weekend. Last round they raised was back in October at $157B so this is more than 2x that:

The funding will be used in part to help OpenAI fulfill its roughly $18 billion commitment to Stargate, a joint venture with SoftBank and others to finance the construction of new data centers in the U.S. powering OpenAI’s technology. The startup also expects to use the cash to fund its money-losing business operations.

Trump back to his Tariff proclamations, this time saying 25% tariff on Mexico and Canada (Reuters) and more talk re: China. At this point need to see something signed to believe it.

Some solid price actions from semis today - Leaders strong and NVDA +1%finished in the green after being down 4.5% at one point. MBLY +2% after being down 15% at one point in the post yesterday. TER -6% rallying off the lows. Software was weak on the back of NOW’s results, but likely acts better tomorrow following TEAM’s print.

Let’s get to the recap…

Internet

GOOGL +3% as Techcrunch reporting Google issues ‘voluntary exit’ program for Android, Chrome, and Pixel employees. Investors took this as a positive sign for margins going forward. Stock also helped in sympathy with META’s given their strong Q4 ad results.

The Platforms & Devices team is offering a voluntary exit program that provides US-based Googlers working on this team the ability to voluntarily leave the company with a severance package. This comes after we brought two large organizations together last year. There’s tremendous momentum on this team and with so much important work ahead, we want everyone to be deeply committed to our mission and focused on building great products, with speed and efficiency.

META +1.5% after some push and pull following the print last night — generally, investors willing to look through higher opex given rev trajectory is good despite buyside #s coming down a touch. Didn’t hear much pushback around r/r and META beginning to deserve a higher multiple going forward as print/zuck commentary just further cemented narrative of stock as one of cleanest ways to play AI

BABA/BIDU +5%: China AI complex continues to rip following Deepseek and BABA’s claims that their new model is better/cheaper than Deepseek (WSJ)

AMZN -1% on neg Azure read-through + Yip only tracking to <19% QTD for AWS

SHOP +2% / EBAY +2% / CHWY +2%

RBLX +2% continues to rock

SNAP -2.4% - I remember the good old days (just a couple years ago) when people thought SNAP and META’s revs were correlated

UBER -25bps / LYFT +1%: Decent px action here from both names, finishing well above lows despite TSLA moving up timeline for launching FSD in Texas

Semis:

In semis, the ASIC vs. Merchant GPU debate rages on as investors try to figure out near-term vs longer term trajectory. AVGO +4% / MRVL +2% outperformed NVDA +1% today as Zuck sounded bullish on the call saying they will continue to invest “hundreds of billions of dollars” over the long-term. He also said META is ramping up use of MTIA (Meta Training and Inference Accelerator Chip) for ranking and recommendation inference, and will replace GPU servers hitting EOL with MTIA. CLS also was out implying AVGO OpenAI biz as big as their GOOGL biz, as they said their new digital customer (ie OpenAI) will ramp in latter 2026 and “could achieve a level similar to our largest hyperscale customers today". To us, we tend to think the Merchant argument has an edge longer-term based on my current understanding: open-source innovation creates a dynamic market where flexibility is crucial which mean NVDA has an advantage here bc they can rapidly adapt, scale, and allocate resources efficiently. However, near-term hyperscalers + OpenAI continue to ramp up spend on custom silicon and ASICs don’t face much of the potential headwinds from export controls that NVDA faces (in addition to the BW ramp issues NVDA is currently facing)

Other AI names fared well: MU +4%; TSM +3%; ANET +6%; VST +13.5%; CLS +13.5% after their beat calling out OpenAI revs…

Software

ORCL +5% in sympathy with broader AI complex

MSFT -6%. Our thoughts from this morning:

Disappointing print, but expectations weren’t high going in given MSFT has significantly lagged the rest of software since July. The margin guide and Azure bookings will comfort bulls somewhat, but we think stock will remain a funding short until we get either 1) signs of Azure acceleration or 2) Greater co-pilot traction as we think both of those are required to change the narrative/sentiment around and help get investors comfortable that multiple expansion is possible, especially with stock still trading at 29x FY26.

NOW -11.4% after missing cRPO

IBM +13% after accelerating sw revs, good AI commentary/backlog, and raising FY guide well above street. Still don’t hear many investors talk about this one, but acts well on the up and didn’t pullback as much as the rest of sw earlier this year.

Enterprise down in sympathy with NOW, but likely get a bit of a bid tomorrow following TEAM’s blowout: CRM -3%; WDAY -2%; TEAM -1.6%

Cloud consumption weaker likely on MSFT Azure: SNOW -2% as TheInformation said they were looking to acquire Redpanda; MDB -2.6%; CFLT -2%

Elsewhere

HPE -2% as US Sues to Stop HPE $14 Billion Deal to Buy Juniper Networks (Bloomberg)

TSLA +3% as Elon did his best to bull investors up on FSD and Robotics opportunity

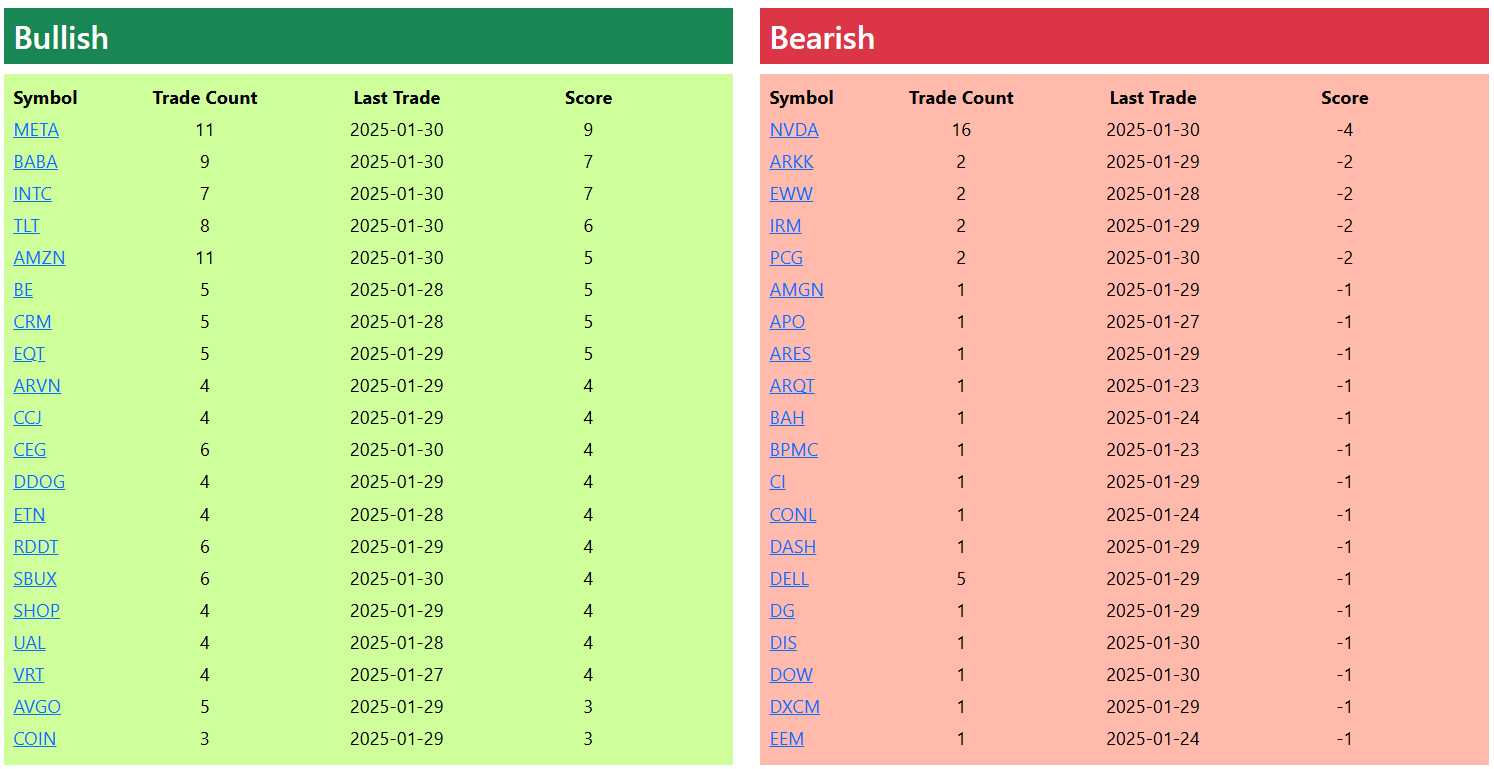

Bullish and Bearish Weekly Option Flow