PBOC Seen Delaying Reserve Ratio Cut After $233 Billion Cash Injection Last Month

中国人民银行预计在上个月注入 2330 亿美元现金后将推迟降低存款准备金率

- Central bank is expected to reserve RRR cut to counter tariffs

中央银行预计将保留存款准备金率下调以应对关税 - Currency, bond yield concerns likely contributed to the delay

货币、债券收益率的担忧可能导致了延迟

The People's Bank of China (PBOC) building in Beijing.

Source: Bloomberg

中国人民银行大楼位于北京。来源:彭博社

China’s central bank injected massive liquidity into the market at the end of 2024 without using high-profile stimulus, as officials preserve policy space before US President-elect Donald Trump returns to office.

中国央行在 2024 年底向市场注入了大量流动性,而没有使用高调的刺激措施,因为官员们在美国当选总统唐纳德·特朗普重返办公室之前保持政策空间。

The People’s Bank of China previously flagged it could free more cash for banks by cutting the reserve requirement ratio again one more time by the end of 2024. It’s now expected to make that move in the first quarter of this year, keeping officials’ powder dry on a closely-watched tool that could alleviate the negative impact from fresh US tariffs.

中国人民银行此前表示,到 2024 年底可能会再次下调存款准备金率,从而为银行释放更多现金。现在预计将在今年第一季度采取这一举措,保持官员们在这一备受关注的工具上的谨慎,以缓解新一轮美国关税带来的负面影响。

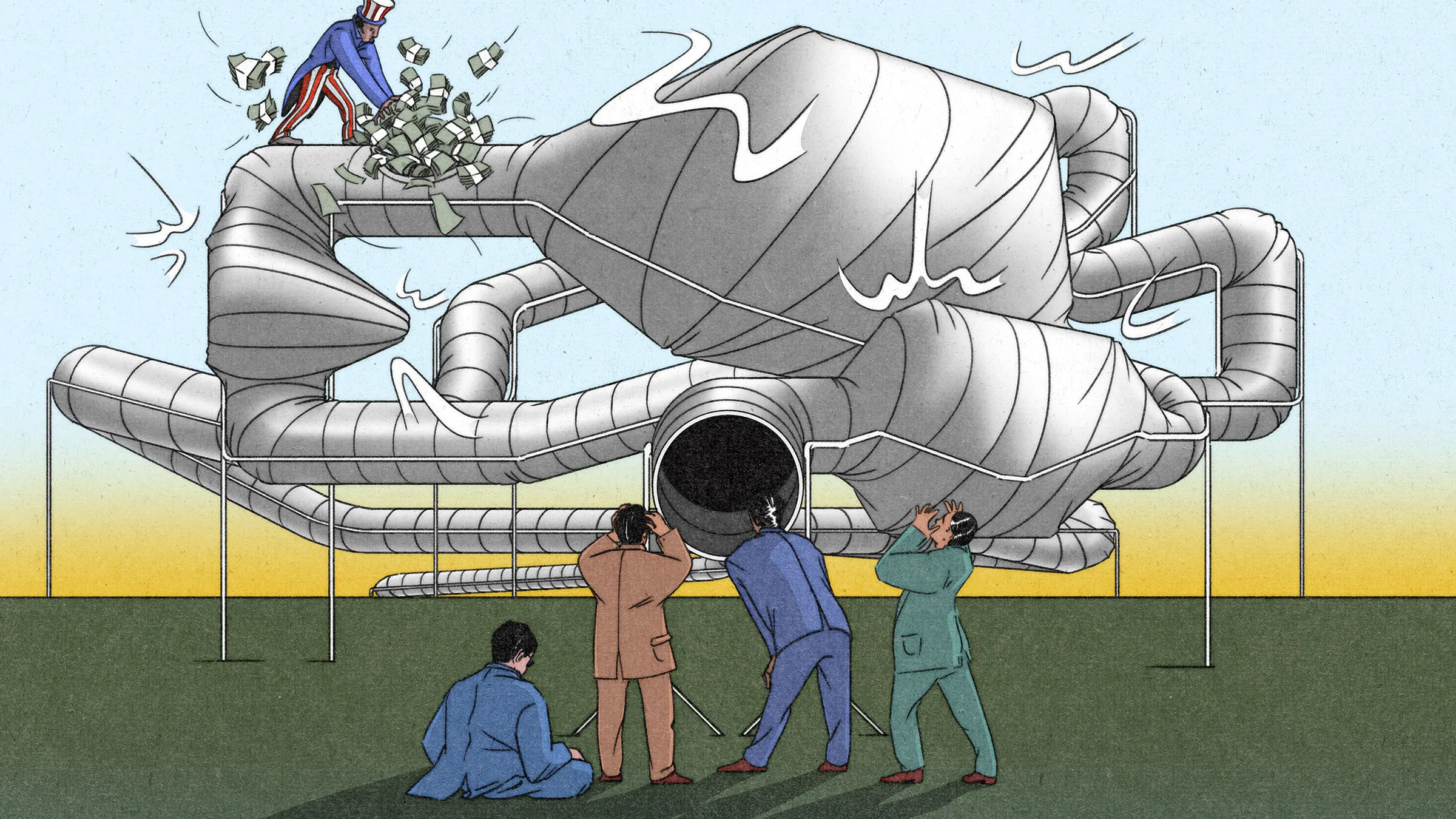

PBOC Seen Cutting RRR in 1Q 2025

中国人民银行预计将在 2025 年第一季度下调存款准备金率

A trim is seen delayed to prepare for external uncertainties

修剪被推迟以应对外部不确定性

Source: People's Bank of China, Bloomberg

来源:中华人民共和国人民银行,彭博社

To ensure the market has enough liquidity, the PBOC instead last month injected 1.7 trillion yuan ($233 billion) of cash to banks via the outright reverse repo and government bond purchases. That operation exceeded the largest amount of monthly one-year loans ever provided via the medium-term lending facility — previously the PBOC’s flagship tool for liquidity injections that’s now heading into retirement.

为了确保市场有足够的流动性,中国人民银行上个月通过公开逆回购和国债购买向银行注入了 1.7 万亿元人民币(2330 亿美元)的现金。这一操作超过了通过中期借贷便利提供的最大单月一年期贷款金额——此前这是中国人民银行用于流动性注入的旗舰工具,现在正逐步退役。

That move helped mitigate a record withdrawal of liquidity via the MLF last month, resulting in a net addition of cash of 550 billion yuan — equivalent to the impact of a 25-basis-point cut to the RRR, according to analysts.

这一举措帮助缓解了上个月通过中期借贷便利(MLF)创纪录的流动性撤回,导致现金净增加 5500 亿元人民币——相当于下调 25 个基点的存款准备金率(RRR)的影响,分析师表示。

“RRR cut has been assigned the role of countering tariff risks and stabilizing markets, so it will mostly likely be delayed until US imposes higher tariffs,” said Xing Zhaopeng, senior China strategist at Australia & New Zealand Banking Group Ltd., adding that he sees a potential window ahead of the Lunar New Year holiday, which starts on Jan. 28.

“降准被赋予了应对关税风险和稳定市场的角色,因此很可能会推迟到美国加征更高关税之后,”澳大利亚和新西兰银行集团有限公司的高级中国策略师邢兆鹏表示,并补充说,他认为在 1 月 28 日开始的春节假期之前有一个潜在的窗口。

China’s economy has shown signs of recovery after officials rolled out a broad package of stimulus since late September, but the growth outlook remains challenging due to a possible second trade war with the US. Top leaders have signaled a more supportive stance regarding liquidity in 2025, in order to ensure banks have enough money to lend to the economy. A rise in government bond sales in the coming years would also require cash in the market to absorb the notes.

中国经济在官员自九月底以来推出一系列刺激措施后,已显示出复苏迹象,但由于可能与美国爆发第二场贸易战,增长前景仍然充满挑战。高层领导人已表示将在 2025 年采取更支持流动性的立场,以确保银行有足够的资金向经济放贷。未来几年政府债券销售的增加也将需要市场上有现金来吸收这些票据。

Currency, Bond 货币,债券

The PBOC has several reasons to go slowly on lowering the amount of cash banks keep in reserve, including its need to stabilize the yuan and avoid fueling another rally in the government bond market.

中国人民银行在降低银行准备金的现金量方面有几个原因,包括需要稳定人民币,避免再次推动政府债券市场的上涨。

A RRR cut — which is typically used only sparingly — could add more pressure to the Chinese currency because it sends a strong signal of monetary easing. That could lead to a reduction in yuan assets’ yields compared with dollar assets and drive capital outflow.

一次 RRR 削减——通常只在有限的情况下使用——可能会对人民币施加更大压力,因为这发出了货币宽松的强烈信号。这可能导致人民币资产的收益率相较于美元资产下降,并推动资本外流。

If the Federal Reserve sends a more dovish signal in January, there could be greater space for China to cut the RRR ahead of the Lunar New Year, according to Bruce Pang, distinguished senior research fellow at the National Institution for Finance and Development, a think tank.

如果美联储在一月份发出更为鸽派的信号,国家金融与发展研究院的杰出高级研究员布鲁斯·庞表示,中国在农历新年前可能有更大的空间来下调存款准备金率。

The central bank has also signaled its discomfort with a record-setting sovereign bond rally after yields plummeted to historic lows. Adding too much liquidity could encourage investors to pile into the bonds.

中央银行也表示对创纪录的主权债券反弹感到不安,因为收益率已降至历史低点。过多的流动性可能会鼓励投资者涌入债券。

Liquidity often gets tight at the end of the first quarter, so that could be when the officials eventually decide to pull the trigger on another RRR cut, said Zhou Hao, chief economist at Guotai Junan International.

流动性通常在第一季度末变得紧张,因此这可能是官员们最终决定再次下调存款准备金率的时候,国泰君安国际首席经济学家周浩表示。

China’s top policymakers pledged to adopt a “moderately loose” monetary policy in 2025, moving away from a “prudent” stance that held for 14 years. The PBOC is also revamping its toolbox in order to influence markets more effectively and flexibly.

中国的高级决策者承诺在 2025 年采取“适度宽松”的货币政策,摆脱持续了 14 年的“审慎”立场。中国人民银行还在重新调整其工具箱,以便更有效和灵活地影响市场。

“Substantial action will be necessary to effectively stimulate demand in 2025,” said Carlos Casanova, senior Asia economist at Union Bancaire Privee. “In addition to sustained liquidity support, we expect the bank to expand its balance sheet significantly and won’t rule out the possibility of outright equity purchases.”

“为了有效刺激 2025 年的需求,将需要采取实质性行动,”瑞士联合银行高级亚洲经济学家卡洛斯·卡萨诺瓦表示。“除了持续的流动性支持,我们预计银行将显著扩大其资产负债表,并且不排除直接购买股票的可能性。”

美国期货在年末回撤后信号反弹:市场总结