Key Notes & Observations

Precious metals and miners remain resilient, an important tell for an eventual recovery in risk globally.

USDJPY remains a key clue that the current Equity selloff is not spiraling out of control. Remember Yen positioning is at historic levels, so lean to a higher USD in this pair in the coming months. This is strongly against consensus.

Other majors EUR and GBP are very extended, so lean towards these pulling back/consolidating and probably with them, local equities as well.

Have been and remain particularly concerned with Equities in China and EU for the last two weeks. China triggered sells essentially at the highs, while SX5E was stalling and forming a potential top, and now the last few days have essentially confirmed this in my view. Could be a while before there’s a setup to re-commit fresh capital to these regions. Avoiding losses is essential to being in a strong position later on. So that’s a potential win in my book, avoiding what could be an underperformance area moving forward.

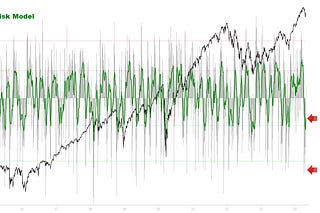

As for the U.S., models dropped again yesterday and are almost in position to tie the most oversold level since 2008, which occurred in February 2018 as discussed in our recent post. Think we’re on the cusp of a turn up, and with it, history suggests the possibility of a V-shaped rally could even be on the table. Wouldn’t be surprised if we saw 6k+ S&P into April, as this would be quite consistent with historical patterns, then reassess.

To emphasize, my view which has been largely supported by currencies, bonds, and metals is that what happened in equities was a purge of bad positioning, exacerbated by funds which were highly levered to momentum and unwound violently, many names down 30-50%. A classic positioning unwind by institutional funds and CTAs.

Tech earnings are still chugging along, and suspect this is what ultimately matters as we head into Q2, high quality names will likely get picked up again.

Sentiment-wise, the talk of “Europe is over” three months ago now “U.S. is over” is just noise... at the end of the day it’s all about flows. I spent most of November and December showing that no one had exposure outside of the U.S., and funds were record short EUR and near-record long USD vs. everything. Now they’re max long China and Europe again, flushed all U.S. positioning, and are (likely) net Short USD according to my models.

So the game continues — thinking one step ahead, what is the biggest surprise going forward into Q2? Perhaps the U.S. isn’t over after all, and the cash-minting giants are still doing quite well? Meanwhile we have the tailwinds of extreme oversold conditions in core areas such as Mag7 and supportive model signals, all pointing to what could be a sharp recovery rally which leaves everyone behind.

Again, no need to bet the farm on it, but could do quite well on a turn here, and I think we’re within days or maybe even hours of an initiation rally which could leave many in the dust. As for “are we in a new bear market” or the risk of a crash or recession, these are always risks for sure. But remember that even in bear markets, there are face-ripping rallies and 6k+ S&P could be in play even in the bear case.

As a historical example, core models triggered a “final sell” in late March 2022 as the S&P’s topping structure / right shoulder was finishing, right before the first big decline of that bear market, and thereafter was fairly consistent on signaling the bigger turns. So we’ll reassess as we go, because the swings and how the models get overbought again will then determine how best to react — and whether the bull market continues or something has changed.

This game is never easy. I was extremely worried about the Russell 2000 as it topped in November and everyone was all-in for the small-cap revival. Look what’s happened since then. I’ve avoided Semiconductor stocks since October. I was concerned about the Dollar in Dec-Jan as it reached major topping conditions, and it’s collapsed. We were buying Bonds in January, while narratives were for raging resurgence of inflation. We’ve been quietly accumulating Gold Miners and Silver since January, as the trend continues to point to a massive move just getting started. And now, we have the first potential Buy point for quality stocks in almost a year. Thus it has my full attention.

Every one of these decisions was tough to make, but we stuck to our process, were transparent about what we were seeing and kept a cool head despite the noise and narratives.

Avoiding enormous losses has always been an essential component of our strategy, and I think we’ve done ok in this regard.

Fast forward to today:

Leaning bullish is an extremely contrarian position to take, and there is no shortage of narratives against it.

Especially today, the consensus bearish view that the U.S. is now un-investable... something they were saying about China a year ago. Imagine telling someone in December that “the U.S. will be un-investable by March”. They’d tie you up and lock you in a crazy house.

Yet this is how far the pendulum has gone, in such a short period of time.

What I’m watching — and what most matters for me at this point is: (1) when the turn is confirmed, (2) what is leading the upside, and (3) if investors stay pessimistic (or get even more negative) as markets rip higher. IF we see a strong hand from the market and broad investor skepticism persists, then the wall of worry is intact and this could be a recovery rally for the history books.