TMTB Morning Wrap

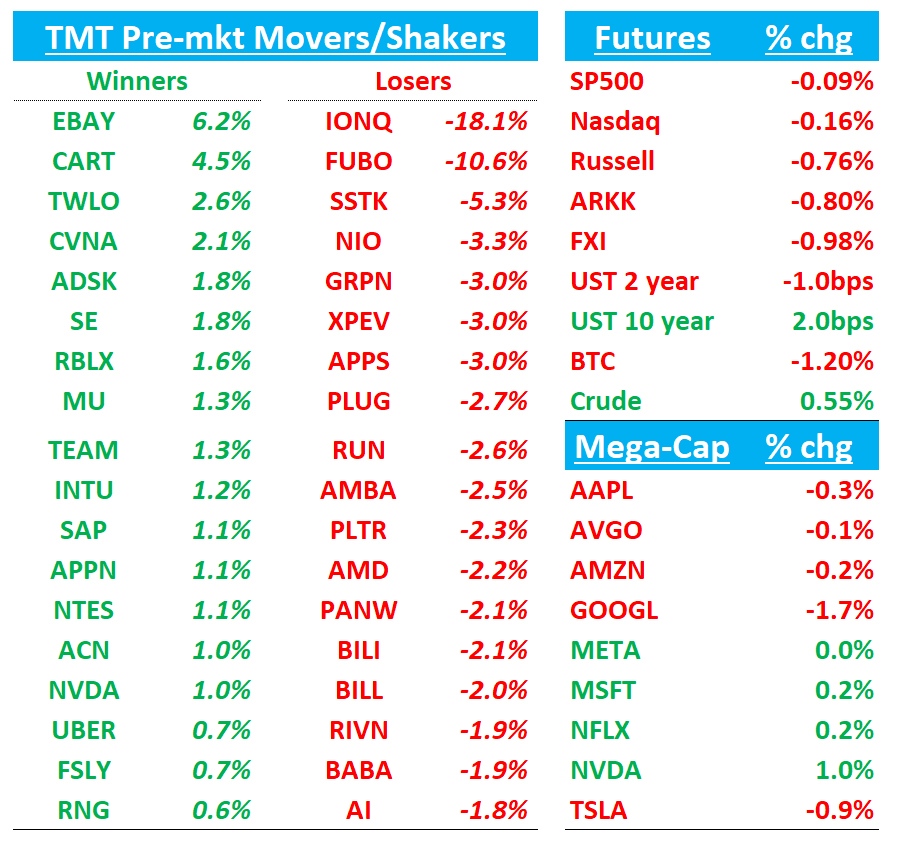

Good morning. QQQs -5bps bouncing around a bit this morning. Quantum names taking a hit on Jensen’s comments - another mo area which had been teflon getting hit. BTC -1.3%. Yields mixed - 2 year dn 1bp, 10yr +3bps. China -1%. Market closed tomorrow then NFP on Friday. Let’s get to it…

EBAY: Meta to test showing eBay listings on Facebook Marketplace

Meta said on Wednesday it would launch a test in Germany, France and the United States that will enable buyers to browse listings from eBay on Facebook Marketplace and then complete their transactions on eBay.

The European Commission had in November fined Meta $840 million over abusive practices benefiting Facebook Marketplace.

Meta said on Wednesday that while it continued to appeal the Commission’s decision on Facebook Marketplace, it was working on to address the points raised.

META has never put out GMV #s for Marketplace but some estimate at $30B+ vs EBAY at $70-$75. META has also said 1B people click on marketplace although most of those don’t transact vs EBAY at 130M MAUs…So potential for this to be a very big deal.

APP: Jefferies raises #s on pretty bullish note and raises PT to $425

Following Jefferies deep dive, they raise FY25/26 ad revenue forecasts 9%/11% above street estimates. Jefferies projects $1B run-rate by 2025 end (vs. street's $4.5B total ad rev). Jefferies notes Mobile gaming remains substantially under-monetized at a 76% discount to META/PINS/SNAP/TikTok. E-comm integration across 1.4B DAUs should close this gap. Jefferies notes early adoption shows promise, with customers allocating 10-20%+ budgets achieving META-comparable returns. Jefferies notes key 2025 catalysts include Audience+ launch, new ad formats, and major advertiser adoption, with Amazon, Wayfair, and Temu expected to join. While some concern exists over performance impact from new advertiser influx, Jefferies expect improved targeting and self-learning capabilities to mitigate this.

Jefferies outlines the bull case on APP perfectly. Stock got hit yesterday on some weak check at BAML on their IAP revs (20% of total revs), but story as always been about e-comm. This is the kind of note that likely would have moved APP high single digits+ in Nov/Dec, but last couple days have a bit of damper on mo stocks and factor can overwhelm. Will be curious how it reacts today..

3P Roundup:

RBLX: Msci is raising Q4 bookings again on strong trends, better prepaid card, and ads

TMTB: We’ve been writing about burgeoning narrative change on RBLX and now that 3p data turning for the better will help add some fuel. Stock has been acting extremely well even on down days.

ROKU: Hearing Yipit out saying revs tracking 5% above street. Their estimate has undershot actual revs each of the last 6 q’s so bodes well.

Trump is considering a national economic emergency declaration to allow for new tariff program, sources say

CNN:

President-elect Donald Trump is considering declaring a national economic emergency to provide legal justification for a large swath of universal tariffs on allies and adversaries, four sources familiar with the matter told CNN, as Trump seeks to reset the global balance of trade in his second term.

The declaration would allow Trump to construct a new tariff program by using the International Economic Emergency Powers Act, known as “IEEPA,” which unilaterally authorizes a president to manage imports during a national emergency.

Trump, one of the sources noted, has a fondness for the law, since it grants wide-ranging jurisdiction over how tariffs are implemented without strict requirements to prove the tariffs are needed on national security grounds.

Quantum names dn this morning as Jensen said this at Q&A yesterday:

“And so if you kind of said 15 years for very useful quantum computers, that would probably be on the early side. If you said 30, it's probably on the late side. But if you picked 20, I think a whole bunch of us would believe it. But what we're interested in is we want to help the industry get there as fast as possible and to create the computer of the future, and we'll be a very significant part of it.”

TWLO: Mizuho upgrades Twilio to Outperform into investor day

Mizuho upgraded Twilio to Outperform from Neutral, raising PT to $140 from $85 ahead of January 23 investor day. Firm expects sales stabilization, improved visibility, and potential double-digit growth acceleration in 2025+. Analyst anticipates management to guide 2025 non-GAAP operating margin above consensus and raise long-term target above 22%. Despite 50% share appreciation in 2024, firm sees further upside driven by sales stabilization clarity and refreshed growth outlook. Possible new share buyback announcement noted.

AMD: AMD downgraded to Reduce from Buy at HSBC

HSBC downgraded AMD to Reduce from Buy, cutting PT to $110 from $200. Analyst Frank Lee sees further downside despite recent 24% share decline (vs -12% SOX). Concerns focus on AI GPU competitiveness: expects weak 1H25 MI325 GPU demand due to Samsung's HBM3e production issues, and delayed AI rack solution competition with Nvidia's NVL platform until MI400 launch in late 2025/early 2026.

ADBE: Deutsche downgrades Adobe on lack of AI monetization

Deutsche Bank downgraded Adobe to Hold from Buy, lowering PT to $475 from $600. While positive on Firefly and Gen AI offerings, analyst expects shares to stay range-bound until financial impact materializes, noting disconnect between management's optimistic Firefly commentary and actual financial results.

TMTB: Not much new here.. Good discussion on the stock in TMTB chat yesterday.

ACN: Accenture upgraded to Outperform from Peer Perform at Wolfe Research

Wolfe upgraded Accenture to Outperform from Peer Perform, setting $425 PT. Analyst Darrin Peller sees upside to estimates from market share gains during discretionary spending recovery. Views FY25 guidance as conservative, with low-end assuming deterioration while high-end reflects stable conditions. Firm sees limited downside risk and expects improving discretionary demand.

CVNA: Citi upgrades Carvana to Buy on 'dislocation' post short report

Citi upgraded Carvana to Buy from Neutral, PT to $277 from $195. Analyst Ronald Josey sees efficient inventory expansion meeting growing demand, with website tracking suggesting sales 7% above consensus. After reviewing recent short report, firm believes post-2022 organizational changes strengthen positioning. Recommends buying 22% pullback from December 16 highs.

Follows RBC’s upgrade yesterday

NTES: NetEase upgraded to Overweight from Equal Weight at Morgan Stanley

Morgan Stanley upgraded NetEase to Overweight from Equal Weight, raising PT to $108 from $90. Analyst Alex Poon expects earnings turnaround driven by strong PC game pipeline, citing Blizzard games' record China performance. Notes Marvel Rivals international launch and potential Q1 FragPunk release as growth catalysts.

PANW: BTIG downgrades to Hold from Buy

After detailed analysis of Palo Alto Networks' core network security market position and NGS platform growth drivers, BTIG analyst Gray Powell downgraded the stock from Buy to Neutral, removing the prior price target. The firm no longer views PANW as capable of sustaining 15%+ growth, citing limited ARR upside potential this year. The analyst warns of accelerated deceleration risk in the NGS segment during FY26-27 as benefits from legacy firewall subscription attachments begin to taper off.

ADSK: Piper upgrades ADSK to Buy from Neutral

Piper Sandler upgraded Autodesk to Overweight from Neutral, raising the price target to $357 from $311. Analyst Clarke Jeffries notes the post-Q3 stock pullback creates an attractive entry point after shares appeared crowded through much of H2 2023. The firm sees 2025 outperformance driven more by company-specific margin initiatives rather than cyclical revenue growth recovery

SNOW: DB raises PT to $210 from $190

Deutsche Bank raised Snowflake's price target to $210 from $190, maintaining Buy rating. The firm expects software sector outperformance in 2025 driven by improving fundamentals, positive estimate revisions, and modest multiple expansion. Analyst sees strengthening demand and AI optimism outweighing slower generative AI adoption, high capex, and ongoing scaling-laws discussions.

RDDT: Reddit price target raised to $180 from $99 at BofA

BofA raised Reddit's PT to $180 from $99, maintaining Neutral rating. Channel checks indicate potential Q4 ad revenue acceleration above guidance, prompting 3% revenue and 8% EBITDA estimate increases. While AI sentiment may support near-term multiples, analyst warns of multiple compression risk based on peer sector history of slowing post-IPO ad growth.

HUBS: Scotia raises PT raised to $825 from $700 following partner discussions / Barclays hosted a reseller call yesterday

Scotia raises HUBS PT to $825 from $700, maintains Sector Outperform. Elite partner checks indicate strong Q4 with larger deals and multi-hub growth. CY25 outlook more optimistic with expanding pipelines and expected upmarket penetration. Breeze adoption feedback remains subdued.

Barclays notes HUBS reseller call signals strong Q4 with 35-40% organic revenue growth driven by post-election confidence boost and multi-hub adoption. Partner reports booked implementation pipeline through mid-February 2025, requiring selective focus on higher-value customers. Barclays notes partners said CRM offering gaining competitive ground against Salesforce, particularly in SMB space, with over half of business coming from Salesforce migrations. New pricing model seeing minimal resistance, with partner projecting 15-20% growth in 2025 split between new business (80%) and expansion (20%).

Samsung: In a press Q&A, Jensen sounded positive on Samsung’s ability to get HBM qualified

“They are working on it. They’re gonna succeed. No question. I have confidence that Samsung will succeed with HBM. I have confidence like, tomorrow is Wednesday.” – link.

Other News:

AAPL: Apple still barred from selling iPhone 16 in Indonesia despite investment deal, minister says– Reuters

ACN: acquires digital twin technology platform for banks; terms undisclosed

AMD: Will make $20M investment in drug discovery company Absci Corp

AMZN: Amazon's AWS to invest $11 bln in Georgia to boost AI infrastructure development – Reuters

AVGO: Rapidus to supply cutting-edge 2-nm chip samples to Broadcom – Nikkei

CART: to join S&P MidCap 400

Memory: US blacklists Chinese DRAM maker CXMT as warning rather than substantive measure – DigiTimes

Memory: SK Hynix to Boost HBM DRAM Production by 70% Amid Surging AI Demand – Businesskorea

META: Meta to End Fact-Checking Program in Shift Ahead of Trump Term– Business Insider

META: shelves fact-checking in policy reversal ahead of Trump administration – NY Times

MSFT: expected to soon launch a round of job cuts aimed at underperforming employees – Business Insider

Samsung: Samsung's preliminary Q4 profit falls far short of estimates as chip issues drag – Reuters

NVDA: Nvidia CEO says his AI chips are improving faster than Moore’s Law – TechCrunch

UBER, LYFT: Delta links its loyalty program to Uber, ending partnership with Lyft – CNBC