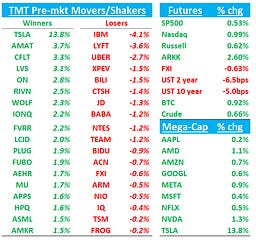

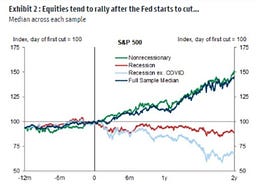

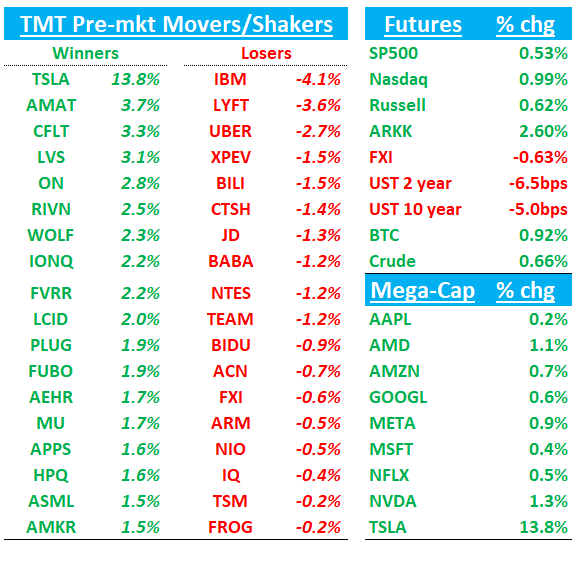

Good morning. QQQs +1% after solid earnings from TSLA, NOW, LRCX. Treasuries getting a bid today with yields down 3-6bps across the curve. Fed expectations aren’t shifting much – the market is pricing in ~42bp worth of cuts over the final two meetings of the year. China -60bps; BTC +1%…Let’s get straight to the recap

TSLA +13% as GM OP and FCF came in significantly above street and Elon back in top form

Strongest EBITDA margin since Q2’23 drive by record low COGS/unit ($35k).

TSLA guided to “slight unit growth” in FY24 which is ahead of street and 25% unit growth in FY25 at the midpoint vs street modeling low dd growth.

Going forward, TSLA spoke to difficulty sustaining similar margins in Q4 but overall GMs should continue to trend up

TSLA RESULTS: Q3

- ADJ EPS $0.72, EST $0.60

- EPS $0.62

- Revenue $25.18B, EST $25.43B

- Gross margin 19.8%, EST 16.8%

- Operating income $2.72B, EST $1.96B

- Free cash flow $2.74B, EST $1.61B

- Capital expenditure $3.51B, EST $2.56B

Bears like JPM will point to: “potentially unsustainable drivers of Q3's better earnings and cash flow performance, including near-record sales of 100% margin regulatory credits and atypically large working capital benefits.”

However, we think Elon was back in top form yesterday, bulling the street on all the key points of the TSLA bull case: Robotaxi, low-cost model launch next year, energy storage, delivery growth next year, and humanoid robots. I thought call sounded as positive as I’ve heard in a while from TSLA and now you got some nice catalysts in 2025. Transcript worth a read but here are the key quotes…

UBER/LYFT -2% on Elon’s comments around FSD. Elon talked up rideshare/FSD on the call yesterday saying it has 4 drivers in the bay area now accepting rides with the development app and that paid rides could start next year in CA and TX. Cybercar to reach volume production in ‘26 aiming for 2m cybercan units a year.

In terms of rollout timeline he said:

And we do expect to roll out the ride hailing in California and Texas next year to the public. But not the California has somewhat quite a long regulatory approval process. It shouldn't -- I think we should get approval next year, but it's continued upon regulatory approval. Texas is a lot faster so it's kind of -- I'd say, we'll definitely have it available in Texas and probably have it available in California subject to regulatory approval. ….And towards the end of the year, it will branch out beyond California and Texas.

On FSD:

every time we have a significant improvement in the software, we'll roll out another sort of 30-day trial, so to encourage people to try it again. And we are seeing a significant improvement in adoption. So the take rate for FSD has improved substantially, especially after the 10-10 event. Yeah. So there's no need to wait for Robotaxi or Cybercab for to experience full autonomy. We expect to achieve that next year with our existing vehicle end.

On humanoid robots:

And then with Optimus, we showed a massive improvement in Optimus' dexterity movement on October 10 and our next-gen handed form which is 22 degrees freedom, which doubles the prior handed form. It's extremely human-like and also has much better tactile sensing. It's really I feel confident in saying that we have most advanced humanoid robot by longshot. And we're moreover the only company that really has all of the ingredients necessary to scale humanoid robots. Because the things that what other companies are missing is that they're missing the AI brain that they're missing the ability to really scale to very-high volume production. So you sort of see some impressive video demos, but they're likely the localized AI and the ability to scale volume to very high numbers. As I've said on a few occasions before, I think Optimus will ultimately be the most valuable part and I think it has a good chance of being the most valuable product ever made.

Vehicle delivery growth next year:

So regarding the vehicle business, we are still on track to deliver more affordable models starting in the first half of 2025. You know, this is -- I think probably people are wondering what should they assume for vehicle -- vehicle sales growth next year. And at the risk of -- to take a bit of risk here, I do want to give some rough estimate, which is I think it's 20% to 30% vehicle growth next year. You know, notwithstanding negative external events, like if there's some portion mature events like some big war breaks out or interest rates go sky high or something like that, then we can't overcome massive force mature events. But I think with our lower-cost vehicles with the advent of autonomy, something like 20% to 30% growth next year is my best case.

NOW (flat): Missed some more bullish buyside bogeys but overall a pretty solid print. Bull case stays intact going forward

Q3 revs: $2.8B vs street at $2.75B…came in >180bps above the guide, second largest beat since 2021 and above <100bps the last two quarters

Q3 cRPO 23.5% cc vs buyside at 23.5%-24% vs street at 22.5%

Q3 OPM 31.1% above 29.5% guide and ATH

Q4 cRPO guide: 21.5% vs buyside at 22%

Q4 sub growth $2.875-$2.88B vs street at $2.86

Q4 OPM a bit weaker at 29% vs street at 30.6%

Bernstein: “While mgmt. spoke strongly about accelerating demand, they guided to CC 20.5% YoY growth in Q4, which holds their Q4 guidance flat vs. the implied level from Q2 earnings. This flatness is partially due to a large on-premise deal pulled one quarter early.

Mgmt talked up>$100MM ACV in Pro Plus deals already signed, including 44 at $1MM+, and of those 6 at $5MM+ and 2 at $10MM..Implied $86M in NOW Assist ACV

Hired new CEOO from GOOGL (Amit Zavery) and said “would only strengthen the relationship between GCP and ServiceNow

Bill played down Carahsoft impact:

“we didn’t see any impact in Q3, and we’re currently not involved in any issues regarding Carahsoft with the U S. Federal business. So you should just take that one off of any concern list that you might have.”

On IT Budgets:

“Within IT, GenAI is their number-one focus, and they are going to get the money from somewhere, and if they have to take it out of another line item to fuel this, they will. So, on top of IT, I think there will be money coming from other departments, especially back-office functions, that will be put to the front of the line around GenAI, and I also see a consolidation effect taking place.”

On Agents:

“Leaders see the risk that every vendor's bots and agents will scatter like hornets fleeing the nest. And they trust ServiceNow as the governance control tower, which is a privileged position for our platform.”

Overall, pretty down the fairway print with slight puts and takes, but nothing to worry bulls about.

IBM -4.5% missed topline driven by miss in consulting revs, missed FCF, and reiterated FY FCF guide

Revenues missed slightly and EPS was largely in line after adjusting for a net gain from the QRadar sale and higher than expected IP income. IBM reaffirmed its $12B+ FCF target for the year, but did not reaffirm its targeted ~4% revenue growth rate,

Co called out weaker consulting as revenues came in flat with signings down 4% despite strength in AI :

a pause in discretionary spending is impacting our consulting business due to economic uncertainty, which stems from several temporary factors, including issues upcoming elections, and the changing landscape of interest rates and inflation levels.

IBM RESULTS: Q3

- Revenue $14.97B, +1.5% y/y, EST $15.05B

- Software revenue $6.52B, +9.7% y/y, EST $6.37B

- Consulting segment revenue $5.15B, -0.5% y/y, EST $5.22B

- Infrastructure revenue $3.04B, -7% y/y, EST $3.24B

- Financing revenue $181M, -2.7% y/y, EST $175.6M

- Other revenue $68M, -60% y/y

- ADJ gross margin 57.5% vs. 55.5% y/y, EST 56.6%

- Operating EPS $2.30 vs. $2.20 y/y, EST $2.22

- Free cash flow $2.06B, +23% y/y, EST $2.08B

F/Y GUIDANCE

- Still sees free cash flow above $12B, EST $12.25B

LRCX +5% as numbers better than investors were expecting given de-risking that has happened since the ASML print.

Investors had generally de-risked ahead of the event given NAND WFE backdrop, INTC spend worries, and post-ASML print, but LRCX came through with a beat and raised Q4 by 3%.

Q3 revenue/GM/EPS of $4.17b/48.2%/$0.86 vs. Street $4.06b/47.1%/$0.81

Q4 guidance: revenue/GM/EPS of $4.30b/47.0%/$0.87 vs. Street $4.24b/46.8%/$0.84

China 37% of total vs 39% last q. GM strong at 48.2% a 100ps beat. Guided next q to only 30% which implies Chhina -16% q/q in Q4.

Key for investors is how 2025 will look like given fears around Samsung/INTC spend and LRCX said mid $90Bs for CY4 and CY25 WFE to grow off that base, which puts them somewhere likely in $100B+ range which is good enough although more bullish estimates closer to $110B. Full feets of CY25 coming on the Jan call

3P Roundup:

ABNB: Hearing uptick in weekly Yipit data

EA: Hearing M-sci incrementally less cautious on EA’s out q led by college football and adden

Data center semis: Hearing M-sci saying cloud instance deployments of all types in Oct materially higher than Sept so far

AMZN: Hearing Q4 NA retail now tracking a little less than 3 ppts above street at Yip now

Hynix guided Q4 HBM to reach 40% of DRAM revs and sounded positive on HBM going forward

TSV capacity is on track to more than double this year & overall guidance implies HBM revenue should grow by over 300%

Citied genAI developing into multi modal form and strong demand for Gen AI.

Sounded like they are treading very carefully on supply.

Bernstein: recaps further:

For conventional memory, 3Q24 was plagued by weak PC & mobile demand & bit shipment largely missed guidance & caused 3Q24 revenues to fall short of consensus. Fortunately, 4Q24 bit shipment was guided to recover, driven by HBM, server DRAM and eSSD. Into 2025, SK hynix expects the industry excess inventory of legacy products to normalize in 1H25 and the overall demand environment to be healthy, with bit demand growing High Teens % for DRAM and Mid Teens % for NAND

VZ: KeyBanc downgrades Verizon on limited room for EBITDA growth

TheFly:

The company's Q3 results were below expectations and there is limited room for EBITDA acceleration in 2025, the analyst tells investors in a research note. The firm sees likely declining free cash flow growth and says Verizon's potential acquisition of Frontier Communications (FYBR) is a poor capital allocation decision and limits a bull case of share repurchases. KeyBanc will look for a pullback in the stock's valuation or upside to expectations to become more constructive on the shares.

SIRI: Resumed with Sell at BAML

BAML believes subscriber growth will remain muted moving forward; that ARPU will be pressured on a mix shift towards streaming; that elevated satellite and non-satellite capex as well as higher interest will weigh on free cash flow for the rest of 2024 and 2025; and that higher leverage will constrain buybacks until 2026-27.

CRM: Opco raises PT to $330 from $300 after customer survey

Opco’s bottom line: While drivers for reaccelerating top-line growth look further out for Salesforce, the combination of a typical Q4 IT budget flush, the AgentForce and Data Cloud product cycles, lower interest rates, and moving past the US elections should stabilize the company's sales productivity and support better consistency in CRM's future quarterly reports.

ROKU: Jefferies previews raising PT but still see risks in 2025

JEFF is more positive on ROKU's N-T set-up given incremental ad demand coming from 3P partnerships, Olympics and recent streaming price hikes (E.G. DIS+). However, JEFF remains cautious on '25, as competition in ad-supported CTV should keep CPMs and fill rates depressed. JEFF raises its FY24 rev est by +1% and FY25. by +2% which would imply a 3% decel into '25. JEFF raises its PT to $60 on the improved outlook, but remain UNPF on '25 rev accel skepticism

Yipit also out today on ROKU calling for generally in line platform revs.

INTC: Intel left behind in A.I. chip boom due to missed opportunities - NYTimes

TheFly:

The story of how Intel (INTC) got left behind in A.I. represents the broader challenges the company faces, Steve Lohr and Don Clark of The New York Times reports. There were opportunities missed, wayward decisions, and poor executions, according to the Times' interviews with more than two dozen former Intel managers, board directors, and industry analysts. Back in 2005, Intel's CEO at the time, Paul Otellini, presented the board with the idea of buy Nvidia (NVDA) for as much as $20B, but the board resisted, two people familiar with the boardroom discussion told the Times. In more recent years, Intel stumbled into the AI market with the purchase of Nervana Systems. Its CEO Naveen Rao was named head of Intel's fledgling AI product unit and noted that while Nvidia steadily improved its offerings, Intel faced corporate curbs on hiring engineers, manufacturing troubles, and fierce competition.

Other News

AAPL: Apple will host an event next Wed (10/30) in LA for media/creators; note this follows the Apple Intelligence US release on Mon 10/28 (h/t BAML)

AAPL: demand for iPhone 16 expected to recover as lead times have extended and estimate the production volume at 63M units in 1H25 vs. 59M units of iPhone 15 in 1H24 – UDN

AAPL: Chinese smartphone brands trigger price hikes, iPhone stands out as a stable choice – Digitimes

MU: Micron anticipates AI demand boost as EUV-based DRAM enters production in 2025 – Digitimes

QCOM: “Qualcomm's extensive experience in automotive semiconductors positions it firmly ahead of industry rivals, though the impact of MediaTek and Nvidia's collaborative efforts remains uncertain” – Digitimes

TSM: TSMC Cuts Off Client After Discovering Chips Sent to Huawei – Bloomberg