TMTB Morning Wrap

If you thought last week was exciting…

QQQs -4% as Deepseek fears took a very large step up over the weekend. We wrote our thoughts on it yesterday in our weekly.

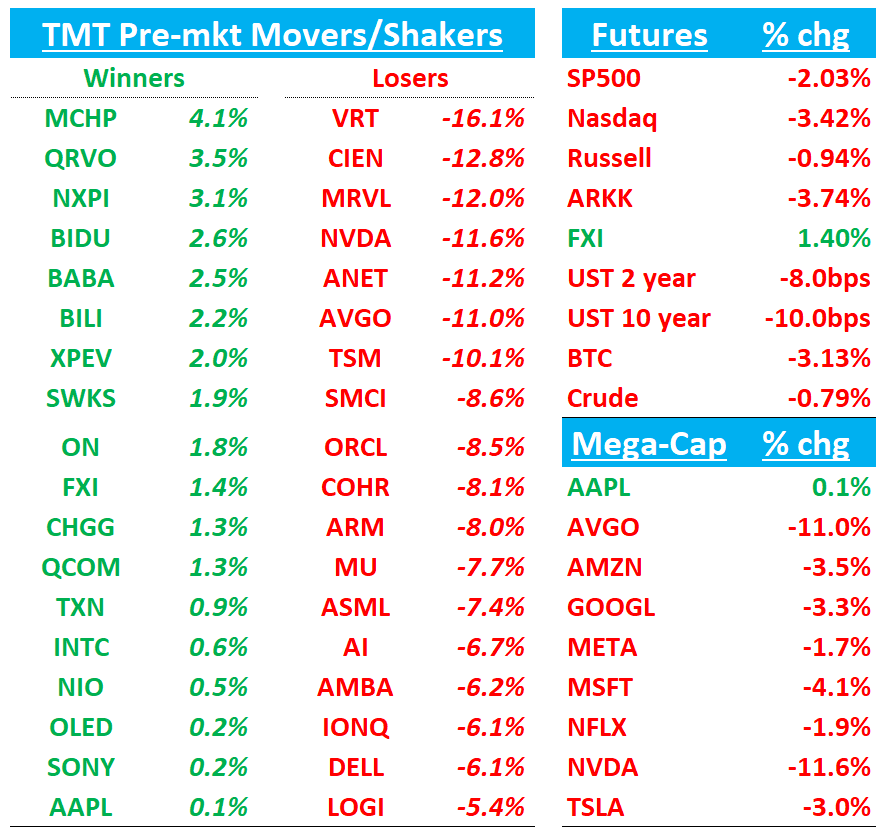

Anything AI capex related down big in the pre: NVDA -12%; AVGO -13%; VRT -16%; MRVL -14%; TSM - 10%; ANET -11%; MU -7%; OKLO -16%; NBIS -14% and so on…these are all names that are very well owned both by institutions and retail and could argue peak ownership came last week following Stargate announcement.

Software that trades as an AI proxy down: ORCL -8.5%; MSFT -4%; PLTR -6.5%

BTC -3%

Yields down 8-11 bps across the curve

Some interesting early movers:

BABA/BIDU +2% → Chinese beneficiaries

Analog names up: MCHP +4.5% / ON +2.7% / ADI +2%; TXN +1% → Long AI / Short Analog names unwinding. INTC +70bps also up early.

QCOM +1.2% / QRVO +2% / AAPL -50bps → Early outperformance from handset names as lower inference compute means future models will be able to run at the Edge

CRM -1.3% → software down early, but generally outperforming. In theory, this should be good for AI Agentic software and anything commercialization as lower inference costs/prices will drive greater demand.

IWM -1% as small caps outperforming early

Not surprisingly sell-side generally saying this is an overaction and defending AI semis - not much new in their notes you likely haven’t read already, so won’t bother posting those this morning.

Will we see some green on our screen today in names outside of AI semis as $’s flow into areas that are likely to benefit for lower compute/have no exposure to Deepseek? Or will the AI deleveraging lead further overeall market de-leveraging (remember % of americans holding assets in the stock market is at an all-time high and exposure leans towards Mag 7). My sense is the former but on a day like today it’s always good to remain open-minded.

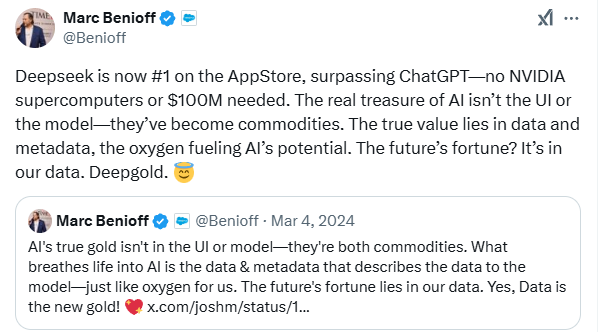

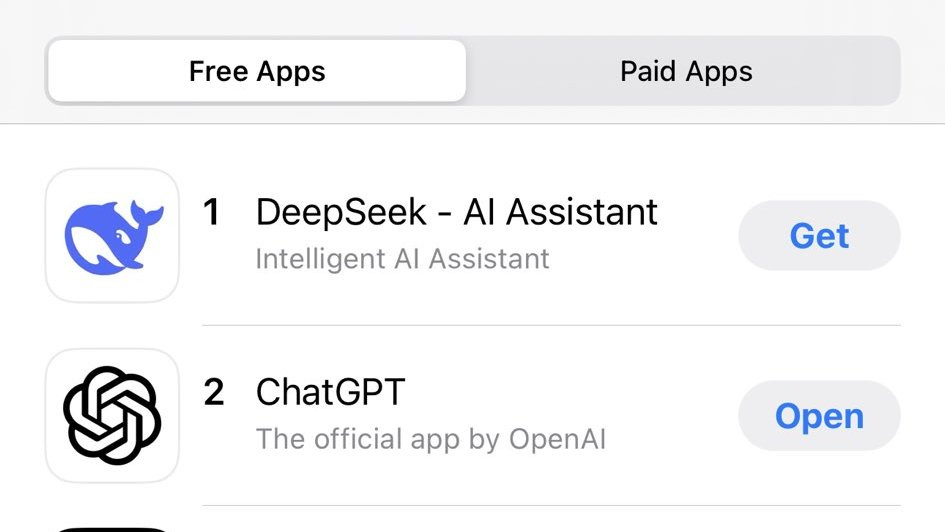

Meta Scrambles After Chinese AI Equals Its Own, Upending Silicon Valley

Good Article here from TheInformation…Some quotes I found interesting below

Managers and engineers from Meta’s generative AI group and infrastructure team have started four war rooms to learn how DeepSeek works. Two of the mobilized groups are trying to understand how High-Flyer lowered the cost of training and running DeepSeek. Meta wants to apply those techniques, a number of which a technical paper from High-Flyer outlined, to Llama, one of the employees said. A third Meta research group is trying to figure out what data High-Flyer might have used to train its models, according to one of the employees with direct knowledge.

Steve Hsu, a co-founder at enterprise AI agent developer SuperFocus, has been using the DeepSeek model released last month, DeepSeek-V3, and says it performs at a level similar to or better than that of OpenAI’s previous flagship model, GPT-4, which currently powers most of SuperFocus’ generative AI features.

His startup is likely to switch to DeepSeek in the upcoming weeks, he said. And because DeepSeek is available to download for free, SuperFocus can store and run it on its own servers, an important consideration for customers concerned about OpenAI having access to their corporate data, he said. OpenAI says it saves API queries for 30 days before deleting them.

Because the cloud API of DeepSeek V3 is sold at a fraction of the cost of GPT-4, it will also “increase our profit margins in the products we sell, or we can sell them more cheaply,” said Hsu.

T +2%: Looks decent with Solid Q4 and 2025 Guide reiterated

Fiber and phones beat, EBITDA inline and FCF ahead. Recent 2025 guide from Dec analyst day reiterated and co expecting DTV sale closing mid 2025.

Q4:

Revenue: $32.3B (vs. Street $32.0B)

EBITDA: $10.8B (in line)

EPS: $0.54 (vs. Street $0.50)

Capital Investment: $7.1B (vs. Street $6.5B)

Free Cash Flow (FCF): $4.8B (vs. Street $4.61B)

Postpaid phone net adds: +482K (vs. Street +425K)

Fiber net adds: +307K (vs. Street +260K)

Wireless service revenue growth: +3.3% (Q3 +4.0%, Street +3.2%)

2025 Guidance:

Wireless service revenue growth: +2-3% (unchanged)

Consumer fiber growth: Mid-teens (Street +16%)

EBITDA growth: 3%+ (unchanged)

EPS: $1.97-$2.07 (ex-DTV)

Capex: $22B (in line)

FCF: $16B+ (in line)

Exclusive: White House in talks to have Oracle and U.S. investors take over TikTok

Under the deal now being negotiated by the White House, TikTok's China-based owner ByteDance would retain a minority stake in the company, but the app's algorithm, data collection and software updates will be overseen by Oracle, which already provides the foundation of TikTok's web infrastructure.

The Trump administration is working on a plan to save TikTok that involves tapping software company Oracle and a group of outside investors to effectively take control of the app's global operations, according to two people with direct knowledge of the talks.

TWLO: Twilio upgraded to Buy from Neutral at Goldman Sachs

GS says Twilio is approaching an inflection point in both story and fundamentals following years of slowing growth and strategic shifts, leading Goldman Sachs to upgrade the stock to Buy with a $185 price target, raised significantly from $77. Their upgrade comes as Twilio's efficiency initiatives and cost-cutting efforts point to robust free cash flow ahead. Goldman believes current 2025 projections are conservative, setting up potential upward revisions to both revenue and earnings forecasts.

QRVO: Qorvo upgraded to Overweight from Neutral at Piper Sandler; PT to $110 from $85

With Starboard's activist involvement, Piper Sandler sees potential for significant operational improvements. Comparing Qorvo's expense structure to peer Skyworks, they estimate $250M-$300M in possible operating efficiencies, highlighting the opportunity for activist-driven operational and capital improvements.

EQIX: Equinix initiated with an Outperform at JMP Securities

JMP Securities initiated coverage of Equinix with an Outperform rating and $1,200 price target. The firm says "we are in the midst of the largest digital infrastructure spend since the creation of the internet." Over the course of the next five years, JPM expects well over $1.0 trillion in digital infrastructure spending that will become the backbone of artificial intelligence, cloud, and edge compute, and likely a wide variety of other applications. Elevated digital infrastructure spending for the next several years will likely lead to positive estimate revisions, as well as multiple expansion for the stocks in the digital infrastructure universe, the analyst tells investors in a research note. JMP imitated seven names in the digit infrastructure group with Outperform ratings.

TTWO: UBS upgrades to Buy

With increased conviction in GTA VI demand and a robust lineup of other titles, UBS expects bookings, profits and FCF to inflect over the next two yrs, lowering leverage and freeing capital for accretive investments. UBS forecast $8B+ of bookings annually and adj EPS of $7+/9+ in F26/27, aligning with bull case bogeys. UBS's views are supported by UBS Evidence Lab's recent Global Gaming survey, which pointed to significant purchase intent and pricing power for GTA VI. While release timing remains a variable (Fall '25 latest target), UBS believes any delay would be more a matter of months based on historical precedent and expect the hype to build in '25, fuelled by new announcements, trailers and gameplay. UBS believes this will drive sentiment, similar to the stock's historical outperformance ahead of major releases, and build confidence in TTWO's multi-year profit/FCF ramp.

RNG: RingCentral downgraded to Equal Weight from Overweight at Barclays

Barclays sees RingCentral potentially lagging other SaaS companies in 2025, triggering a downgrade to Equal Weight and a lower $37 target from $45. The collaboration market is likely to be deprioritized as economic conditions improve, limiting potential revenue upside. Channel feedback indicates weak demand for standalone RingCentral solutions, with customers increasingly favoring Microsoft Teams voice solutions through Operator Connect.

Other News

AMZN: Amazon’s Prime Video Shifts to Profits, Promoting Rival Streamers – The Information

Gen AI: small Chinese AI model DeepSeek challenges much higher-cost US models, sparking panic in Silicon Valley – FT

GOOGL: Alphabet Has an Nvidia-Like Business. It Could Be Worth Hundreds of Billions. – Barron’s

META: Meta’s Threads to Show Ads for the First Time in US, Japan – Bloomberg

PARA: Paramount Hit With Legal Letter to Consider Last-Minute $13.5 Billion Offer From Outside Investors Over Skydance Bid (EXCLUSIVE) – Variety

SPOT: Universal Music Group and Spotify strike a new multi-year agreement

Stargate: Softbank will seek funding for Stargate from large investment firms like Apollo and Brookfield – Nikkei