The Impact of the Ethereum ETF ETF - An analysis

以太坊 ETF ETF 的影响-分析

以太坊 ETF ETF 的影响-分析

The BTC ETFs opened the door for many new buyers to make bitcoin allocations within their portfolio. The impact of ETH ETFs is a lot less clear-cut.

BTC ETF 为许多新买家在其投资组合中进行比特币配置打开了大门。ETH ETF 的影响则不那么明确。

BTC ETF 为许多新买家在其投资组合中进行比特币配置打开了大门。ETH ETF 的影响则不那么明确。

I was vocally bullish for Bitcoin at $25k when the Blackrock ETF application was submitted and now since then, it has returned 2.6x, with ETH returning 2.1x. From the cycle bottom, BTC has returned 4.0x and ETH has returned a similar 4.0x. So how much upside would an ETH ETF Provide? I would argue not much unless Ethereum develops a compelling pathway to improve its economics

我在比特币价格达到 25,000 美元时对其持有乐观态度,当时贝莱德公司提交了 ETF 申请,自那时以来,比特币的回报率为 2.6 倍,以太坊的回报率为 2.1 倍。从周期底部算起,比特币的回报率为 4.0 倍,以太坊的回报率也为 4.0 倍。那么以太坊 ETF 还能提供多少上涨空间呢?我认为除非以太坊开发出一个引人注目的改善经济状况的途径,否则提供的上涨空间不会太大。

我在比特币价格达到 25,000 美元时对其持有乐观态度,当时贝莱德公司提交了 ETF 申请,自那时以来,比特币的回报率为 2.6 倍,以太坊的回报率为 2.1 倍。从周期底部算起,比特币的回报率为 4.0 倍,以太坊的回报率也为 4.0 倍。那么以太坊 ETF 还能提供多少上涨空间呢?我认为除非以太坊开发出一个引人注目的改善经济状况的途径,否则提供的上涨空间不会太大。

Blackrock filing for Bitcoin spot ETF with a 99.8% approval track record is the most positive news we've had in a while - potentially opening floodgates to 10's of billions of flows

Yet $BTC only up 6% from news

Feels like a mispricing

Blackrock 提交比特币现货 ETF,拥有 99.8%的批准记录,这是我们有过的最积极的消息 - 可能会打开数百亿资金流入的大门 然而 $BTC 仅从新闻中上涨了 6% 感觉像是一个错误定价

Blackrock 提交比特币现货 ETF,拥有 99.8%的批准记录,这是我们有过的最积极的消息 - 可能会打开数百亿资金流入的大门 然而 $BTC 仅从新闻中上涨了 6% 感觉像是一个错误定价

引用

Eric Balchunas

@EricBalchunas

Fun fact: BlackRock's record of getting ETFs approved by the SEC is 575-1. That's another reason this is so big, they don't play around. x.com/EricBalchunas/…

有趣的事实:BlackRock 在美国证券交易委员会获批 ETF 的记录是 575-1。这是一个重要原因,他们可不是闹着玩的。x.com/EricBalchunas/…

有趣的事实:BlackRock 在美国证券交易委员会获批 ETF 的记录是 575-1。这是一个重要原因,他们可不是闹着玩的。x.com/EricBalchunas/…

Flow Analysis

流量分析

流量分析

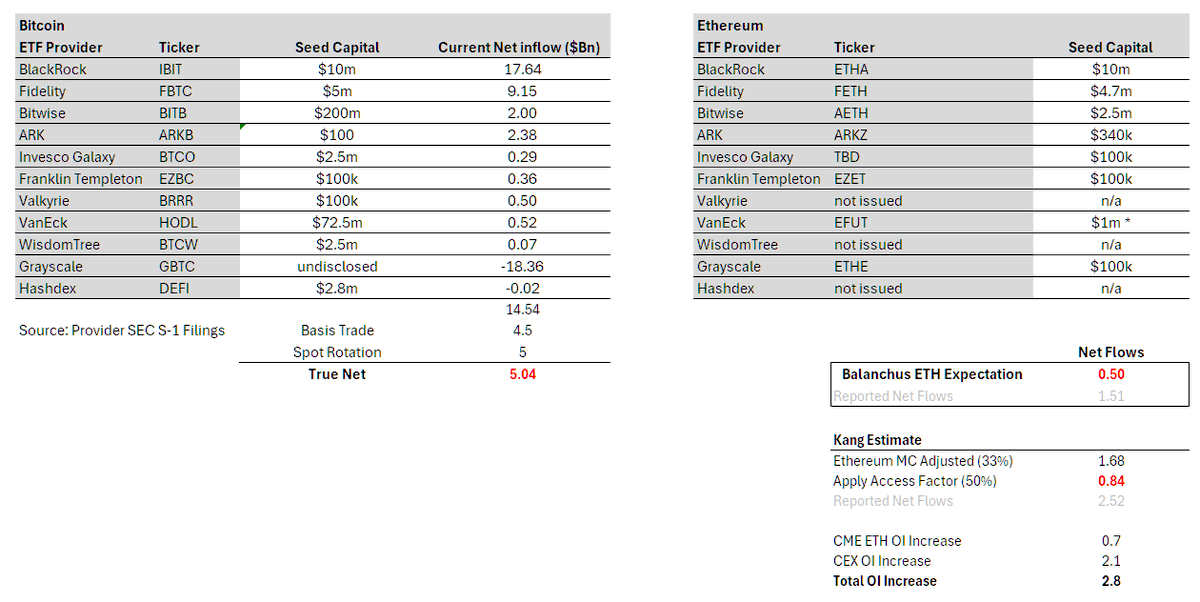

In total, Bitcoin ETFs have accumulated $50B AUM - an impressive amount. However, when you break down the net inflows since launch by isolating out pre-existing GBTC AUM and rotations, you have $14.5B net inflows. These are however not true inflows as there have been many delta neutral flows that need to be accounted for - namely Basis trade (sell futures, buy spot ETF) and spot rotation. Looking at CME data and an analysis of the ETF holders, I estimate roughly $4.5b of net flows can be attributed to the basis trade. ETF experts suggest that there is also significant conversion of spot BTC to ETF by large holders such as BlockOne, etc - roughly estimating $5b. Discounting these flows we arrive at true net buying of $5 billion from the bitcoin ETFs

总的来说,比特币 ETF 已经累积了 500 亿美元的资产管理规模-一个令人印象深刻的数字。然而,当你分析自推出以来的净流入,将现有的 GBTC 资产管理规模和轮换资金剥离出来后,你会得到 145 亿美元的净流入。然而,这些并不是真正的流入,因为存在许多需要考虑的达尔塔中性流动-即基差交易(卖出期货,买入现货 ETF)和现货轮换。通过查看 CME 数据和对 ETF 持有者的分析,我估计大约 45 亿美元的净流入可以归因于基差交易。ETF 专家表示,还有大量的现货比特币转换为 ETF,如 BlockOne 等大持有者-大约估计为 50 亿美元。扣除这些流入,我们得出比特币 ETF 的真正净购买额为 50 亿美元。

总的来说,比特币 ETF 已经累积了 500 亿美元的资产管理规模-一个令人印象深刻的数字。然而,当你分析自推出以来的净流入,将现有的 GBTC 资产管理规模和轮换资金剥离出来后,你会得到 145 亿美元的净流入。然而,这些并不是真正的流入,因为存在许多需要考虑的达尔塔中性流动-即基差交易(卖出期货,买入现货 ETF)和现货轮换。通过查看 CME 数据和对 ETF 持有者的分析,我估计大约 45 亿美元的净流入可以归因于基差交易。ETF 专家表示,还有大量的现货比特币转换为 ETF,如 BlockOne 等大持有者-大约估计为 50 亿美元。扣除这些流入,我们得出比特币 ETF 的真正净购买额为 50 亿美元。

From here we can simply extrapolate to Ethereum. estimates that ETH flows could be 10% of BTC. This puts true net buying flows at $0.5b within 6 months and reported net flows at $1.5b. Even though Balchunas was off on his approval odds, I believe his lack of interest/peccimism on the ETH ETF in his seat is informational and reflective of broader tradfi interest

Personally, my base case is 15%. Starting with the BTC $5B true net, adjusting for ETH market cap which is 33% of BTC and an access factor* of 0.5, we arrive at $0.84b true net buying and $2.52b reported net. There are some reasonable arguments that there is less ETHE overhand than with GBTC, so the optimistic scenario I would put at $1.5b true net and $4.5b reported net. This would be roughly 30% of BTC flows.

In either case, the true net buying is much lower than the derivative flows frontrunning the ETF which accounts to $2.8b and this does not include spot frontrunning. This implies that the ETF is more than priced in.

从这里我们可以简单地推断到以太坊。@EricBalchunas 估计 ETH 流动量可能是 BTC 的 10%。这将使真正的净购买流量在 6 个月内达到 50 亿美元,报告的净流量为 150 亿美元。尽管 Balchunas 在他的批准几率上有所偏差,但我认为他对以太坊 ETF 的兴趣缺乏/悲观态度在信息上反映了更广泛的传统金融兴趣。 就我个人而言,我的基本情况是 15%。从 BTC 的 50 亿美元真实净值开始,根据 ETH 市值为 BTC 的 33%和访问因子*为 0.5 进行调整,我们得出了 0.84 亿美元的真实净买入和 2.52 亿美元的报告净买入。有一些合理的论点认为,与 GBTC 相比,ETHE 的过量供应要少一些,因此我会将乐观情景设定为 15 亿美元的真实净买入和 45 亿美元的报告净买入。这大致相当于 BTC 流量的 30%。 无论哪种情况,真正的净购买量都远远低于领先交易 ETF 的衍生流量,达到 28 亿美元,这还不包括现货领先交易。这意味着 ETF 的价格已经超出了。

从这里我们可以简单地推断到以太坊。@EricBalchunas 估计 ETH 流动量可能是 BTC 的 10%。这将使真正的净购买流量在 6 个月内达到 50 亿美元,报告的净流量为 150 亿美元。尽管 Balchunas 在他的批准几率上有所偏差,但我认为他对以太坊 ETF 的兴趣缺乏/悲观态度在信息上反映了更广泛的传统金融兴趣。 就我个人而言,我的基本情况是 15%。从 BTC 的 50 亿美元真实净值开始,根据 ETH 市值为 BTC 的 33%和访问因子*为 0.5 进行调整,我们得出了 0.84 亿美元的真实净买入和 2.52 亿美元的报告净买入。有一些合理的论点认为,与 GBTC 相比,ETHE 的过量供应要少一些,因此我会将乐观情景设定为 15 亿美元的真实净买入和 45 亿美元的报告净买入。这大致相当于 BTC 流量的 30%。 无论哪种情况,真正的净购买量都远远低于领先交易 ETF 的衍生流量,达到 28 亿美元,这还不包括现货领先交易。这意味着 ETF 的价格已经超出了。

*Access factor adjusts for the flows that ETFs enable that distinctly benefit BTC more than ETH given the different holder bases. For example, BTC is a macro asset with more appeal to institutions with access issues - macro funds, pensions, endowments, SWFs. Whereas ETH is more of a tech asset that appeals to VCs, Crpyto funds, technologists, retail, etc that are not as restricted in accessing crypto. 50% is derived by comparing the CME OI to Market cap ratios of ETH vs BTC

Looking at CME data, ETH has significantly less OI than BTC before ETF launch. Roughly 0.30% of supply represented in OI vs BTC's 0.6% of supply. At first I saw this as a sign of "earliness", but one could also argue that it belies smart tradfi money's lack of interest in the ETH ETF. Traders on the street had a great trade with BTC and they have tend to have good information so if they are not repeating it for ETH then it must be good reason potentially implying weak flow intel

*访问因素调整了 ETF 使比特币受益更多的流动,而不是以太坊,考虑到不同的持有者基础。例如,比特币是一种宏观资产,更受机构的青睐,存在访问问题-宏观基金、养老金、捐赠基金、主权财富基金。而以太坊更像是一种科技资产,吸引风险投资、加密基金、技术专家、零售等,这些人在获取加密货币方面没有那么多限制。通过比较以太坊与比特币的芝商所持仓量与市值比率,得出 50%。 查看 CME 数据,ETH 在 ETF 推出前的 OI 明显少于 BTC。大约 0.30%的供应量在 OI 中表示,而 BTC 的供应量为 0.6%。起初,我将此视为“早期”的迹象,但也可以说这暗示了智能传统金融资金对 ETH ETF 缺乏兴趣。街头交易员与 BTC 有很好的交易,并且他们往往拥有良好的信息,因此如果他们不为 ETH 重复这一过程,那么可能有很好的理由,潜在地暗示着弱流动情报。

*访问因素调整了 ETF 使比特币受益更多的流动,而不是以太坊,考虑到不同的持有者基础。例如,比特币是一种宏观资产,更受机构的青睐,存在访问问题-宏观基金、养老金、捐赠基金、主权财富基金。而以太坊更像是一种科技资产,吸引风险投资、加密基金、技术专家、零售等,这些人在获取加密货币方面没有那么多限制。通过比较以太坊与比特币的芝商所持仓量与市值比率,得出 50%。 查看 CME 数据,ETH 在 ETF 推出前的 OI 明显少于 BTC。大约 0.30%的供应量在 OI 中表示,而 BTC 的供应量为 0.6%。起初,我将此视为“早期”的迹象,但也可以说这暗示了智能传统金融资金对 ETH ETF 缺乏兴趣。街头交易员与 BTC 有很好的交易,并且他们往往拥有良好的信息,因此如果他们不为 ETH 重复这一过程,那么可能有很好的理由,潜在地暗示着弱流动情报。

How did $5b bring BTC from $40k to $65k?

5b 美元是如何将 BTC 从 40,000 美元拉升到 65,000 美元的?

5b 美元是如何将 BTC 从 40,000 美元拉升到 65,000 美元的?

Short answer is that it didn't. There have been many other buyers in the spot markets. Bitcoin is an asset that has truly become validated globally as a key portfolio asset and has many structural accumulators- Saylor, Tether, family offices, HNWI retail, etc. ETH also has some structural accumulators but I believe at a magnitude less than BTC.

Remember that Bitcoin has gone to $69k / $1.2T+ BTC ownership before an ETF even existed. Market participants/institutions own a huge % of spot crypto. Coinbase has $193B under custody and $100b of that is from their institutional program. In 2021, Bitgo reported $60B in AUC, Binance custodies $100b+. After 6 months, ETFs custody 4% of the total bitcoin supply, it's meaningful, but only part of the demand equation.

简短回答是它没有。现货市场中有许多其他买家。比特币是一种真正被全球认可为关键投资组合资产的资产,并拥有许多结构性积累者- Saylor、Tether、家族办公室、高净值零售等。ETH 也有一些结构性积累者,但我相信数量比 BTC 少。 记住,比特币在 ETF 甚至存在之前就已经涨到了 69k 美元/1.2T+比特币所有权。市场参与者/机构拥有大量现货加密货币。Coinbase 托管了 1930 亿美元,其中 1000 亿美元来自他们的机构计划。2021 年,Bitgo 报告称 AUC 为 600 亿美元,币安托管了 1000 亿美元以上。6 个月后,ETF 托管了总比特币供应量的 4%,这是有意义的,但只是需求方程的一部分。

简短回答是它没有。现货市场中有许多其他买家。比特币是一种真正被全球认可为关键投资组合资产的资产,并拥有许多结构性积累者- Saylor、Tether、家族办公室、高净值零售等。ETH 也有一些结构性积累者,但我相信数量比 BTC 少。 记住,比特币在 ETF 甚至存在之前就已经涨到了 69k 美元/1.2T+比特币所有权。市场参与者/机构拥有大量现货加密货币。Coinbase 托管了 1930 亿美元,其中 1000 亿美元来自他们的机构计划。2021 年,Bitgo 报告称 AUC 为 600 亿美元,币安托管了 1000 亿美元以上。6 个月后,ETF 托管了总比特币供应量的 4%,这是有意义的,但只是需求方程的一部分。

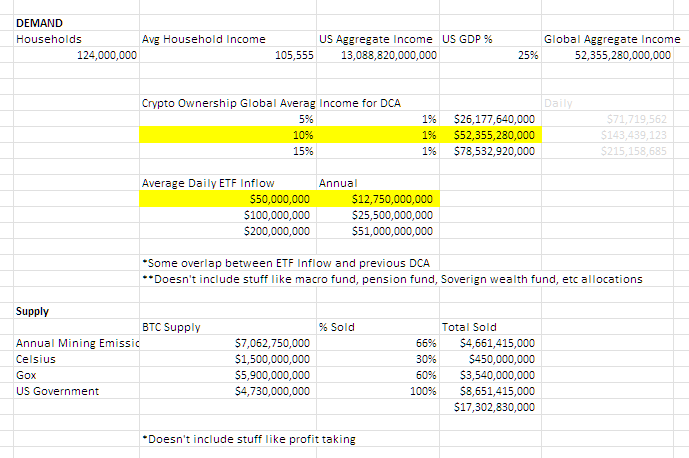

Long term $BTC demand flows this year I approximate to be $40-130B+

One of the most common cardinal sins of crypto investors/traders is underappreciating the amount of wealth/income/liquidity in the world and its spillover into crypto. We hear stats about the market cap of gold,

今年长期 $BTC 需求流量我估计为$40-130B+ 加密货币投资者/交易者最常见的致命错误之一是低估世界财富/收入/流动性及其对加密货币的溢出。我们听到有关黄金市值的统计数据,显示更多

今年长期 $BTC 需求流量我估计为$40-130B+ 加密货币投资者/交易者最常见的致命错误之一是低估世界财富/收入/流动性及其对加密货币的溢出。我们听到有关黄金市值的统计数据,显示更多

引用

Andrew Kang

安德鲁·康

安德鲁·康

@Rewkang

How to avoid getting BEAR HOLED and not miss epic rallies

We've all been there - be on the right side of a downturn and then getting stuck in a bearish bias that leaves you sidelined or short squeezed when the next rally comes

Most bear holes in crypto revolve around the mental

如何避免被“熊洞”困住,不错过史诗级的涨势 我们都经历过这种情况-在市场下跌时站对了队,然后陷入了一种悲观偏见,让你在下一波行情来临时被束手无策或被套牢 加密货币中的大多数熊洞都围绕着心理

如何避免被“熊洞”困住,不错过史诗级的涨势 我们都经历过这种情况-在市场下跌时站对了队,然后陷入了一种悲观偏见,让你在下一波行情来临时被束手无策或被套牢 加密货币中的大多数熊洞都围绕着心理

Between MSTR and Tether, you already have billions of additional buying, but not only that, you also had under positioning going into the ETF. It was quite a popular opinion at that the time that the ETF was a sell the news event/market top. So billions of short to medium to long term momentum had sold and needed to buy back (2x flow impact). On top of that we had shorts that needed to buy back once the ETF flows showed to be significant. Open interest actually went down going into the launch - pretty crazy to see.

在 MSTR 和 Tether 之间,你已经有数十亿的额外购买,但不仅如此,你还在 ETF 推出时处于低仓位。当时普遍认为 ETF 是一个卖出新闻事件/市场顶部。因此,数十亿的短期、中期和长期动量被卖出,需要回购(2 倍流动影响)。除此之外,我们还有空头需要在 ETF 流入显示出显著性时回购。实际上,开仓利息在推出前下降了-看到这一点真是相当疯狂。

在 MSTR 和 Tether 之间,你已经有数十亿的额外购买,但不仅如此,你还在 ETF 推出时处于低仓位。当时普遍认为 ETF 是一个卖出新闻事件/市场顶部。因此,数十亿的短期、中期和长期动量被卖出,需要回购(2 倍流动影响)。除此之外,我们还有空头需要在 ETF 流入显示出显著性时回购。实际上,开仓利息在推出前下降了-看到这一点真是相当疯狂。

The positioning for ETH ETF is very different. ETH is at 4x the lows vs BTC 2.75x before launch. Crypto native CEX OI increased by $2.1B bringing OI to near ATH levels. The market is (semi) efficient. Of course many crypto natives seeing the success of the bitcoin ETF expect the same for ETH and have positioned accordingly.

ETH ETF 的定位非常不同。ETH 的价格比 BTC 在推出前低 4 倍,而 BTC 只有 2.75 倍。加密原生 CEX OI 增加了 21 亿美元,使 OI 接近历史高位。市场是(半)有效的。当然,许多加密原生人士看到比特币 ETF 的成功,也期待 ETH 能有同样的表现,并相应地调整了位置。

ETH ETF 的定位非常不同。ETH 的价格比 BTC 在推出前低 4 倍,而 BTC 只有 2.75 倍。加密原生 CEX OI 增加了 21 亿美元,使 OI 接近历史高位。市场是(半)有效的。当然,许多加密原生人士看到比特币 ETF 的成功,也期待 ETH 能有同样的表现,并相应地调整了位置。

Personally, I believe that the expectations of crypto natives are overinflated and disconnected from the true preferences of tradfi allocators. It is natural that those deep in the crypto space have a relatively high mind share and buy in of Ethereum. In reality, it has much less buy in as a key portfolio allocation for many large groups of non crypto native capital.

One of the most common pitches to tradfi is Ethereum as a "tech asset". Global computer, Web3 app store, decentralized financial settlement layer, etc. It's a decent pitch, and I've previously bought into it in previous cycles, but it's a hard sell when you look at the actual numbers.

In the last cycle you could point to the growth rate of fees and point to DeFi and NFTs that would create more fees, cash flows etc and make a compelling case for this as a tech investment in a similar lens to tech stocks. But this cycle the quantification of fees is counterproductive. Most charts will show you flat or negative growth. Ethereum is a cash machine, but at $1.5B 30d annualized revenue, a 300x PS ratio, negative earnings/PE ratio after inflation, how will analysts justify this price to their daddy's family office or their macro fund boss?

就我个人而言,我认为加密原生人的期望过高,与传统金融分配者的真实偏好脱节。那些深入加密领域的人对以太坊有相对较高的认知和投入是自然的。实际上,对于许多大型非加密原生资本集团来说,以太坊作为主要投资组合配置的认可度要低得多。 以太坊作为“科技资产”是向传统金融界最常见的推销点之一。全球计算机、Web3 应用商店、去中心化金融结算层等等。这是一个不错的推销点,我之前在以往的周期中也投资过,但当你看实际数字时,这是一个难以推销的产品。 在上一个周期,你可以指出费用增长率,并指出 DeFi 和 NFT 将创造更多费用、现金流等,从而为这作为科技投资提供有力论据,类似于科技股。但在这个周期,费用的量化是适得其反的。大多数图表将显示出平稳或负增长。以太坊是一台赚钱机器,但在 15 亿美元的 30 天年收入、300 倍的 PS 比率、通货膨胀后的负收益/PE 比率下,分析师们将如何向他们的家族办公室老板或宏观基金老板证明这个价格?

就我个人而言,我认为加密原生人的期望过高,与传统金融分配者的真实偏好脱节。那些深入加密领域的人对以太坊有相对较高的认知和投入是自然的。实际上,对于许多大型非加密原生资本集团来说,以太坊作为主要投资组合配置的认可度要低得多。 以太坊作为“科技资产”是向传统金融界最常见的推销点之一。全球计算机、Web3 应用商店、去中心化金融结算层等等。这是一个不错的推销点,我之前在以往的周期中也投资过,但当你看实际数字时,这是一个难以推销的产品。 在上一个周期,你可以指出费用增长率,并指出 DeFi 和 NFT 将创造更多费用、现金流等,从而为这作为科技投资提供有力论据,类似于科技股。但在这个周期,费用的量化是适得其反的。大多数图表将显示出平稳或负增长。以太坊是一台赚钱机器,但在 15 亿美元的 30 天年收入、300 倍的 PS 比率、通货膨胀后的负收益/PE 比率下,分析师们将如何向他们的家族办公室老板或宏观基金老板证明这个价格?

I even expect the first few weeks of fugazi (delta neutral) flows to be lower for two reasons. The first being that the approval was a surprise and the issuers have much less time to pitch large holders to convert their ETH to ETF form. The second being that it is less attractive for holders to convert given that they will need to give up yield from staking or farming or utilizing the ETH as collateral in DeFi. But note that stake rate is only 25%

Does that mean ETH will go to zero? Of course not, at some price it will be be considered good value and when BTC goes up in the future, it will be dragged up with it to some extent. Before the ETF launch, I expect ETH to trade from $3,000 to $3,800. After the ETF launch my expectation is $2,400 to $3,000. However, If BTC moves to $100k in late Q4/Q1 2025, then that could drag ETH along to ATHs, but with ETHBTC lower. In the very long run, there are developments to be hopeful about and you have to believe that Blackrock/Fink are doing a lot of work to put some financial rails on blockchains & tokenized more assets. How much value this translates into for ETH and on what timeline is uncertain.

I Expect a continued downtrend for ETHBTC with the Ratio over the next year to range between 0.035 to 0.06. Even though we have a small sample size, we do see ETHBTC making lower highs each cycle, so this should be no surprise.

我甚至预计 fugazi(三角套利)流动的前几周会较低,原因有两个。首先,批准是一个惊喜,发行人没有太多时间说服大股东将他们的 ETH 转换为 ETF 形式。其次,持有者转换不那么有吸引力,因为他们将需要放弃从质押、农场或在 DeFi 中将 ETH 用作抵押品中获得的收益。但请注意,质押率仅为 25%。 这是否意味着 ETH 会跌至零?当然不会,某个价格时会被视为有价值,未来 BTC 上涨时,ETH 也会在一定程度上受到带动。ETF 推出前,我预计 ETH 的交易价格将在$3,000 至$3,800 之间。ETF 推出后,我的预期是$2,400 至$3,000。然而,如果 BTC 在 2025 年 Q4/Q1 末达到$100k,那可能会带动 ETH 达到历史最高点,但 ETHBTC 会较低。从长远来看,有一些令人期待的发展,你必须相信 Blackrock/Fink 正在努力为区块链和代币化更多资产奠定一些金融基础。这将为 ETH 带来多少价值,以及在什么时间轴上实现,目前还不确定。 我预计 ETHBTC 会继续下跌,比率在接下来的一年内将在 0.035 至 0.06 之间波动。尽管样本量较小,但我们确实看到 ETHBTC 在每个周期中创下更低的高点,所以这应该不足为奇。

我甚至预计 fugazi(三角套利)流动的前几周会较低,原因有两个。首先,批准是一个惊喜,发行人没有太多时间说服大股东将他们的 ETH 转换为 ETF 形式。其次,持有者转换不那么有吸引力,因为他们将需要放弃从质押、农场或在 DeFi 中将 ETH 用作抵押品中获得的收益。但请注意,质押率仅为 25%。 这是否意味着 ETH 会跌至零?当然不会,某个价格时会被视为有价值,未来 BTC 上涨时,ETH 也会在一定程度上受到带动。ETF 推出前,我预计 ETH 的交易价格将在$3,000 至$3,800 之间。ETF 推出后,我的预期是$2,400 至$3,000。然而,如果 BTC 在 2025 年 Q4/Q1 末达到$100k,那可能会带动 ETH 达到历史最高点,但 ETHBTC 会较低。从长远来看,有一些令人期待的发展,你必须相信 Blackrock/Fink 正在努力为区块链和代币化更多资产奠定一些金融基础。这将为 ETH 带来多少价值,以及在什么时间轴上实现,目前还不确定。 我预计 ETHBTC 会继续下跌,比率在接下来的一年内将在 0.035 至 0.06 之间波动。尽管样本量较小,但我们确实看到 ETHBTC 在每个周期中创下更低的高点,所以这应该不足为奇。

I'll leave you with the only thing I can see saving ETHBTC

我会把唯一能拯救 ETHBTC 的东西留给你

我会把唯一能拯救 ETHBTC 的东西留给你

想发布自己的文章?

升级为 Premium+