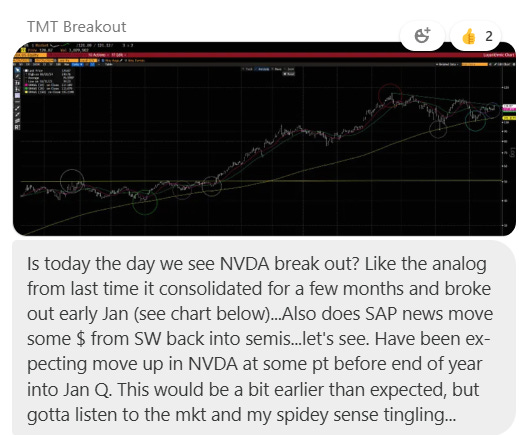

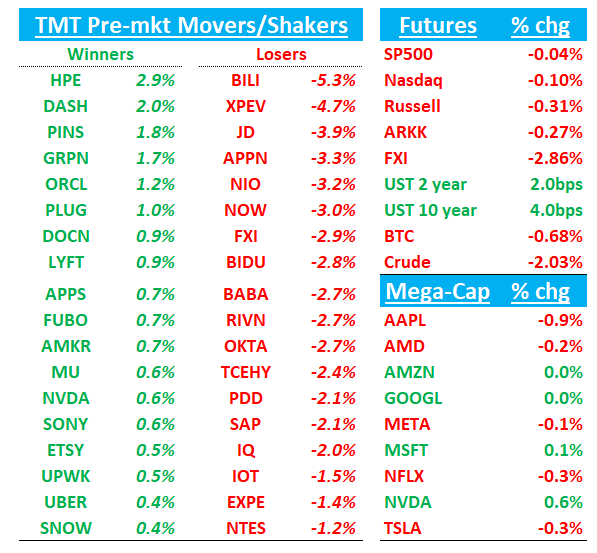

Good morning. QQQs -11bps. META Connect Keynote from Zuck at 1pm ET (full schedule here). China giving back some of yesterday’s gains. Watching NVDA closely here early…here’s what i posted in the chat this morning…

Let’s get to it…

AAPL: MS and UBS out neg on AAPL

TheFly:

Morgan Stanley says that iPhone 16 lead times as of September 24, or 11 days after pre-orders started, are following the same trajectory, but tracking lower, than the past three iPhone cycles. While supply is improved, and the firm hears anecdotes of positive iPhone 16 demand, Morgan Stanley still interpret these data points that are more negative than positive for the iPhone 16 cycle "more cautiously" as the firm argues "they still have little predictive power over the full cycle." The firm, which still expects any potential iPhone build revisions to come in early-to-mid October, keeps an Overweight rating and $273 price target on Apple shares.

UBS also says their checks are “increasingly concerning in our view, particularly at the high-end (...) if demand does not improve, the 6% iPhone revenue growth embedded in the VA Cons for the December quarter (with the market >6%) is at risk in our view.”

SAP: US Investigating SAP, Carahsoft for Potential Price-Fixing

German software developer SAP SE, product reseller Carahsoft Technology Corp. and other companies are being probed by US officials for potentially conspiring to overcharge government agencies over the course of a decade.

Since at least 2022, Justice Department lawyers have been looking at whether SAP — which makes accounting, human resources, supply chain and other business software used across the globe – illegally conspired with Carahsoft to fix prices on sales to the US military and other parts of the government, according to federal court records filed in Baltimore.

The civil investigation, which hasn’t previously been reported, poses a legal risk to a top technology vendor to the US government and to Germany’s most valuable company as its shares are soaring.

The review also shines an even greater light on Carahsoft, a powerful vendor of software whose offices in Virginia were raided on Tuesday by FBI agents and military investigators.

Piper notes that NOW and OKTA have the highest portion of federal contract dollars sourced through Carahsoft in its coverage. Rocha at Wells also reminds us of the abrupt exit of former NOW pres and COO in July for iolating company policy when he hired the former CIO of the US Army. Also lets remember Oct is Federal year end

DASH: KEYB upgrades to Buy after Q3 mobility survey with $177 PT

KeyBanc last night upgraded DoorDash to Overweight from Sector Weight with a $177 price target. The firm came away more confident from its Q3 mobility and delivery survey that DoorDash is gaining ground in its core and emerging verticals, which should sustain greater than 15% gross order volume growth and drive EBITDA of $3.5B by 2026, or 6% above consensus. KEYB notes their latest survey showed ongoing gains in food delivery usage and grocery and they believe DASH”s strong core business and ramp in new verticals should support its revised estimates.

HPE: Barclays upgrades to buy with $24PT

Barclays calls out HPE continuing to grow its artificial intelligence server revenues, improving in storage, and it likes the accretion from the JNPR deal. Barclays is seeing early signs of an enterprise recovery and believes HP Enterprise is one of the best ways to invest in this emerging trend "since the stock lacks an AI premium" versus other hardware names.

Barclays analyst also out with a server model update raising CY24/CY25 estimates driven by better AI and early signs of an enterprise server recovery. They note that while trad server remains weak, multiple companies called the bottom this last q. Barclays models rev growth of 37% and 22% in 24 and 25. For AI, they assumes 1.5M AI servers in 24 and 2.1M in 25 driven by DELL, HPE, SMCI, and NVDA.

3P Roundup:

PINS: Hearing Yip saying MAUs tracking ahead with Aug already at 540M vs street at 532M with new Pinner growth accelerating to 11% y/y in Aug from 2% prior month

CART: hearing 3p saying tracking near high end of guide for the q

UPST: Hearing Yip continues to see strength in loan count

EXPE: TD downgrades to Hold from Buy with PT of $150, up from $130

TD Cowen says Expedia's weak business-to-consumer business, which drove guidance cuts the past three quarters, may take longer than expected to turn around. The company also faces tough 2025 cost cut compares, the analyst tells investors in a research note. TD sees a balanced risk/reward on Expedia shares at current levels Weak B2c revs (GBV +1% in Q2) which drove guide cuts and Ad spend ramping to 50% of revs in 24E makes them less excited

UBER: Uber and WeRide announce partnership

WeRide, a global leading autonomous driving technology company, and Uber Technologies, announced a strategic partnership to bring WeRide's autonomous vehicles onto the Uber platform, beginning in the United Arab Emirates. The partnership is expected to launch first in Abu Dhabi later this year. A dedicated number of WeRide vehicles will be made available to consumers using the Uber app. After launch, when a rider requests a qualifying ride on the Uber app, they may be presented with the option to have their trip fulfilled by a WeRide autonomous vehicle. The partnership does not contemplate any launches in the United States or China. WeRide currently operates the largest robotaxi fleet in the UAE, where residents can access its robotaxi services through the TXAI app. In addition, in July 2023, WeRide was granted the UAE's first and only national license for self-driving vehicles, enabling it to test and operate its autonomous vehicles on public roads across the entire country.

RIVN: MS downgrades to Hold with PT to $13 down from $16

TheFly:

Morgan Stanley analyst Adam Jonas downgraded Rivian Automotive to Equal Weight from Overweight with a price target of $13, down from $16. The firm also downgraded its U.S. auto industry view to In-Line from Attractive. The downgrade is driven by a combination of international, domestic and strategic factors that may not be fully appreciated by investors, the analyst tells investors in a research note. The firm says U.S. auto inventories are on an upward slope with vehicle affordability still out of reach for many households. In addition, credit losses and delinquencies continue to trend upward for less-than-prime consumers, adds Morgan Stanley. Further, China's two-decade-long growth engine has reversed in terms of China profits flipping to losses and China producing nearly 9M units more than it sells locally, adds the firm. It believes Rivian's ability to drive competitive compute progress in a financially prudent way is limited. Morgan's projections for Rivian's 2024 total capex and research and development of $1.3B and $1.7B, respectively, differ from Tesla's artificial intelligence spend "by almost an order of magnitude." It questions whether investors are ready to support a new computing capex cycle.

GOOGL: Opp lowers PT to $185 from $210

TheFly:

Oppenheimer lowered the firm's price target on Alphabet (GOOG) to $185 from $210 and keeps an Outperform rating on the shares. The firm says that while ramifications from Google Search labeled a monopoly are unknown, investors now discounting the loss of Apple (AAPL) exclusivity, likely capping price to earnings at 20-times. Google generates 31% of gross search revenue via Apple devices and pays 36% to Apple for exclusivity, resulting in 19% of net ad exposure. However, Google would only need to retain 65% of Apple search activity, assuming no TAC payment or 75% assuming TAC drops to 15%, Oppenheimer adds

Other News:

AI: AI Market Will Surge to Near $1 Trillion by 2027, Bain Says - Bloomberg

Clean Energy/ AI: AI Demand Spurs Big Tech Scramble For Clean Energy -- WSJ

CRM to acquire data mgmt provider Zoomin; deal does not impact financial guidance

GOOGL RDDT: Reddit hires former Google ad executive in small-business push·

OpenAI: Said to have pitched the White House on a 'massive' data center build out - financial press

UBER/DASH/CART: US judge declares NY City law that requires food delivery firms to share customer data as 'unconsitutional'

Wiz: Wiz In Talks to Sell Shares at Valuation as High as $20 Billion - Bloomberg