TMTB EOD Wrap

QQQs +1.3% finished 1% from ATHs as AI semis/supply chain ripped following Project Stargate announcement. Questions and doubts around if $500B will ever come close to the actual # (see GavinBaker’s comment here) —

Unlikely it’s $500B — but even if its 25% of that still very big #s and at very least can’t argue it’s not an incremental positive to have more $’s flowing into the supply chain: ARM +15% the big winner given Softbank’s involvement; ANET +7% as their incumbents in MSFT and ORCL; CIEN +6% significant WDM supplier to both ORCL and MSFT: NVDA +4.5%; ORCL +7%; MSFT +4%. SOX now up 6 days in a row - hasn’t happened since June. MRVL ANET TSM ATHs. Things feeling better as it breaks range it’s been in since Oct:

Outside of that, NFLX +9.6% sold off a bit from its early highs but investors feeling a bit more confident heading into large cap earnings next week post their print: META +1.1% / AMZN +1.9%.

We’ve had a nice rally following CPI as no macro releases to upset bulls re-taking control - as we inch closer to the Fed next week and then PCE following, macro will begin to move back to the forefront.

Let’s get to the recap…

Internet

META +1.5% as investors feeling a little less fearful around fx headwinds following NFLX - Jefferies and DB also out with positive previews/checks.

AMZN +1.7% ATHs as Yipit put out a retail note saying int’l and us retail finished ~3 ppts above street in Q4 and US is tracking several ppts ahead in Q1. Cantor also reiterated top pick….a late pop in the last 5 minutes but didn’t see any news - we get AWS # tomorrow morning from Yipit

RDDT -3% on Roth’s downgrade calling out valuation, growth deceleration expected in 2025 despite strong 2024, user growth comps challenging after 2024's record adds (benefited from Google algo changes), and margins likely pressured as management reinvests upside

CVNA +1% underwhelming px action on better 3p data calling out an acceleration in the most recent week + ALLY results showed strength from auto loans

SPOT +1.4% on NFLX sympathy

Mid cap generally weak: CART -3.5%; PINS -1%; ROKU -20bps despite being up 4% early; RBLX -30bps

TTD - 3%: heard couple things regarding weakness: 1) NFLX moving to more 1P data on advertising and 2) Digiday article saying more advertisers using AMZN’s DSP as their primary DSP for programmatic buying

JD +1.7% / BABA +1% - good strength here despite FXI -1% — don’t see that often as investors feeling more positive into earnings given recent Chinese stimulus

Z +1.5% as Msci called out Primer Agent strength in Dec

Travel weak again: ABNB -40bps; EXPE - 3%; BKNG -1.4%….all I’ve heard past couple days is OpenAI agent release going to be able to make travel bookings

Semis

Stargate winners: ARM +15%; NVDA +4.4%; CLS +4.4%; ANET +7%; TSM +2%

QCOM +2% as KEYB previewed positively saying they see favorable r/r into earnings as upside likely driven by 1) greater share of the Samsung GS25 (100%); and 2) increased demand for China smartphones from the rollout of handset subsidies

MRVL +1% / AVGO +30 bps underperformed as not seen as a positive lateral from Stargate

MU flat as Clev called out weaker NT DRAM and NAND pricing (what’s new?)

Analog names generally strong: ON 675bps; ADI +1%; TXN +1%

Software

ORCL +7% after more Stargate optimism. Bulls will say this is a play on unlimited AI infra demand while bears push back is margins likely get hit on the buildout and its low margin revs.

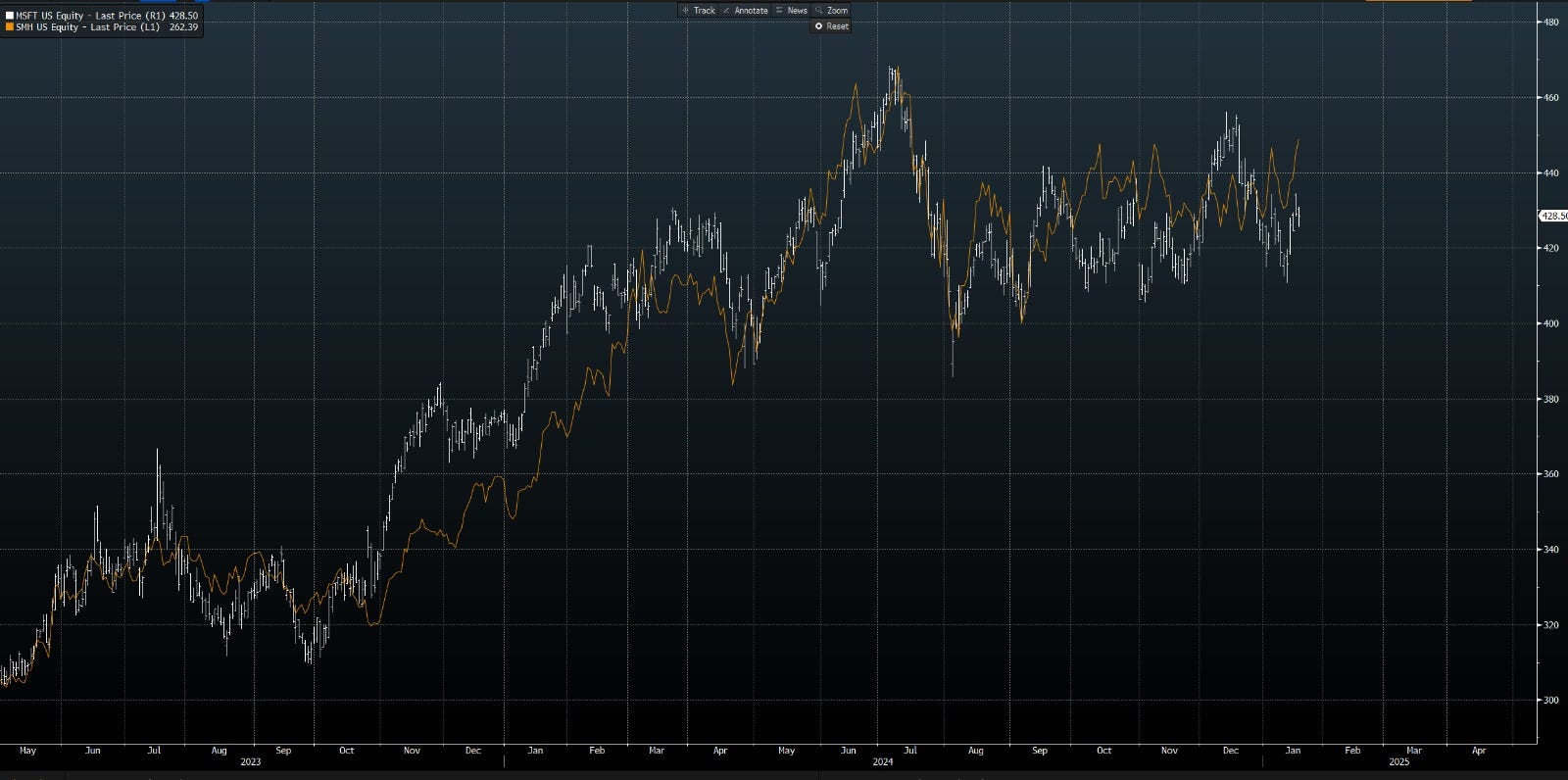

MSFT +4% as investors feeling good about amended OpenAI pact as it means capex burden likely lower. Definitely start of a narrative change as MSFT has been a funding short for a while and underperformed IGV — MSFT has actually traded pretty closely inline with semis over the last 3 years:

So capex fears alleviated - check. Now investors want to feel more comfortable around co-pilot and more importantly Azure trajectory in 2H. Investors want to own here so a good print will go a long way.

Other large cap strong: NOW +3%; PANW +2.5%; CRM +2%

FRSH -1% as Msci said billings and revs mixed despite churn improving slightly from Q4

APP - BAML hosted a bullish call this morning

PTLR +5% back to its old ways - likely getting some flows from Stargate announcement

DDOG +75bps as Gugg previewed upside to Q4/Q1 but sub consensus guide for FY25, which most on the buyside are expecting

Elsewhere

AAPL +50bps finally green

UPST +3% as Msci raised Q4 estimates driven by higher transaction volume

EA -60bps as Msci lowered bookings estimates on weak EA sports FC data through Dec…good call as stock -8% in the post following a cut to their bookings

TSLA - 2% - where was Elon in the Stargate announcement?

Stargate winners: DELL +4%; GLW +4.7%; CIEN +7%

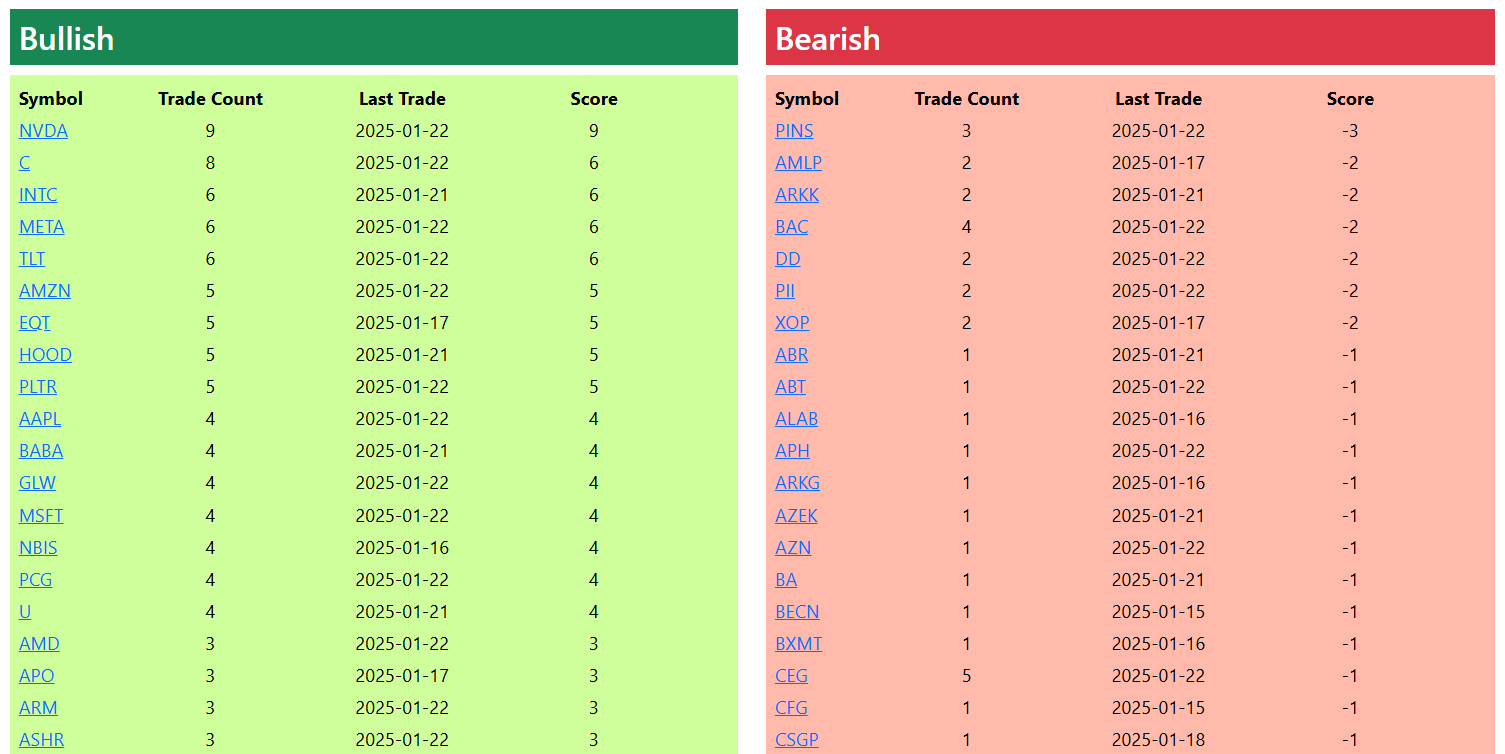

Bullish and Bearish Weekly Option Flow