TMTB Morning Wrap

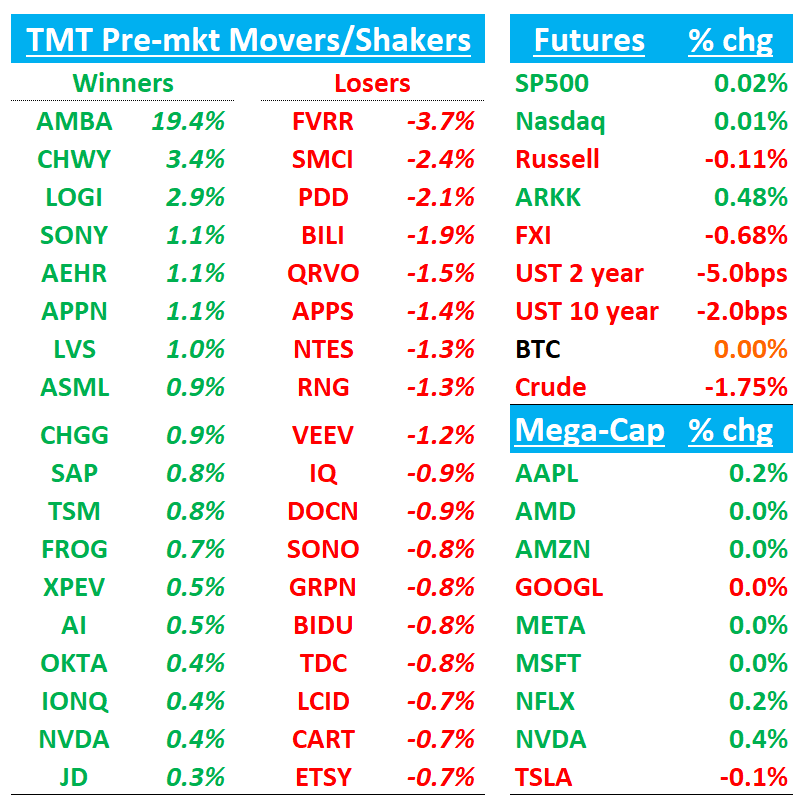

Happy NVDA EPS day. QQQs flattish, yields dipping slightly, BTC -3%. Slow late August morning as everyone awaits NVDA post-close. We’ll recap some earnings from CHWY, S, and AMBA then move onto to a few news/research items. Let’s get to it…

CHWY: Looks solid with inline revs and better net adds/GMs/EBITDA.

Revs inline and EBITDA slightly above buyside bogeys coming in at $145M vs $112M. Net adds were slightly positive better than street and roughly in line with bogeys. FY reiiterated while EBITDA margin raised

F3Q Net Sales GUIDE $2.84-$2.86bn vs. Street est. $2.867

FY25 Net Sales GUIDE $11.6bn-$11.8bn vs. Street est. $11.760bn

FY25 EBITDA GUIDE 4.5-4.7% vs. previous guide 4.1% - 4.3%

CHWY RESULTS: Q2

- Net sales $2.86B, EST $2.86B

- ADJ EBITDA $144.8M, EST $111.6M

- ADJ EBITDA margin 5.1%

- Number of active customers 20.00M, EST 19.97M

- Net sales per active customer $565, EST $564.45

- Gross margin 29.5%, EST 28.9%

- Net margin 10.5%, EST 0.31%

- SG&A expense $621.3M, EST $629.9M

- ADJ EPS $0.24, EST $0.17

S: Decent results with $2M+ upside to net new ARR but thing 84bps rev beat vs street vs prior quarters of 2%+

Overall, results roughly in inline with puts and takes on both sides. Small rev beat but raised FY guide more than the beat and strongly called out that net new ARR should accelerate in 2nd half after a weak first half. This was S’ first q of positive non-GAAP net income and noted the CRWD outage has led to higher win rates and a notable pick up in pipeline; however, outlook for net new ARR remains flattish. Management noted that demand in the quarter was broad based, and they expect new business growth trends to improve in the second half of the year driven by a strong pipeline, new product contributions, expanding go-to-market, and improved competitive positioning. FY EBIT guide remains unchanged at midpt and implies S is no longer targeting breakeven by Q4 allowing them to opportunistically in the wake of the CRWD outage. Bulls will saw share gains should continue, guide doesn’t imply any tailwinds from outage, and improving rev outlook sets company up for stable to increasing Rule of 40 in the coming years.

Details:

Q2 Revs of $199 vs street at $198

Q2 ARR $806M vs street at $804M

FY25 guide raised to $815M which is high end of prior $808M-$815M

AMBA +20%: Solid beat and raise as New CV Product Ramps Set the Stage for Revenue Growth

AMBA - GUIDANCE: Q3

- Guides revenue $77.0M to $81.0M, EST $69M

- Guides ADJ gross margin 62.5% to 64%, EST 62.5%

- Guides ADJ operating expenses $49.0M to $51.0M

RESULTS: Q2

- Revenue $63.7M, +2.6% y/y, EST $62M

- ADJ loss per share $0.13 vs. loss/shr $0.15 y/y, EST loss/shr $0.19

- ADJ gross margin 63.3% vs. 64.6% y/y, EST 63.3%

Despite macroeconomic headwinds from weak global auto production and mixed IoT spending, the team increased its revenue growth rate for FY25/CY24 (now expecting mid-to-high-teens YoY growth). This growth stems from multiple waves of new CV product ramps (CV5, CV7, and CV3 families) for both IoT and Automotive, with all new products coming with higher ASPs

Mgmt sounded positive saying: “Company specific drivers are more than offsetting the mixed global economic environment."

3P Roundup:

TSLA: Hearing Yip saying orders remain elevated last 2 weeks

CRM: JMP says mixed channel checks following similar JPM/Barclays mixed checks yesterday yesterday

JMP notes channel checks have been mixed overall, with the main positive being that Salesforce is exercising its pricing power, with five customers telling JMP about price increases that generally range from 10%-20%, while on the negative side, some customers are reducing seats or churning off all together in response to the pricing, and quota attainment seems to be challenging for many in the sales organization. The firm says that while CRM has matured and the environment remains challenging with deal scrutiny, it continues to like the shares for long-term capital appreciation.

SMCI: Supermicro short report 'largely void of details,' says JPMorgan

TheFly:

JPMorgan keeps an Overweight rating on Supermicro after Hindenburg Research released a short report alleging evidence of accounting manipulation, sibling self-dealing, and sanction evasion. However, the analyst believes there to be limited evidence of accounting mistreatments beyond revisiting the 2020 charges from the SEC, and sees limited new information relative to the "existing and already known" business relationship with related companies owned by the siblings of the founder of Supermicro. The allegations relative to sanction evasion are tough to verify, but it is still worth highlighting that the magnitude of revenues referenced in the report does not change the medium-term revenue opportunity for the company in relation to the addressable $275B artificial intelligence sever total addressable market in 2026 and 2027, the analyst tells investors in a research note. JPMorgan sees the short report as "largely void of details around alleged wrong doings from the company that change the medium-term outlook, and largely revisiting the already known areas for improvement in relation to corporate governance and transparency."

AMZN/WMT: Walmart to Offer Logistics Outside Its Own Marketplace Sales. The retailer’s new services for third-party sellers take a page from Amazon’s fulfillment operation

WSJ:

Walmart is extending its competition with Amazon.com deeper into the logistics arena by opening its fulfillment services to merchants who want to fill orders from customers on platforms outside the retailer’s own marketplace.

Walmart said third-party sellers will soon be able to use Walmart’s warehousing, delivery and returns services to fill orders placed on platforms beyond Walmart’s website, including Target, Etsy and even Amazon.

The country’s largest retailer by revenue said it would also start offering to handle imports on behalf of merchants from ports of origin in Asia to Walmart’s U.S. distribution centers, and will offer sellers access to less-than-truckload and full-truckload shipments at discounted rates.

MU: Mizuho comments after meetings with mgmt last week

Overall, Mizuho continues to see a constructive DRAM-NAND outlook into 2025E for MU, with HBM ramping and conventional DRAM market seeing improving pricing tailwinds. Mizuho takes an update on the HBM market as AI drives accelerated growth for HBM3e and as some major DRAM suppliers lag HBM3e qualifications. Mizuho is 1) Moderating its NovQ, inline with Company guidance, with weak PC/handset demand mostly in line with expectations, 2) Continue to see planar DRAM/HBM tailwinds into the FebQ, but 3) its Japan team is highlighting potential Samsung strategy change from profitability to market share could upset DRAM outlook.

W: Mizuho says developing a showroom-like network could unlock significant profit potential

Mizuho recently toured the two-level, ~150K square foot Wayfair branded store located outside of Chicago, IL and came away impressed by: 1) An expanded product set across both small-ticket decor and larger-ticket items 2) Several up-and-coming proprietary brands being showcased all prompting customers towards free and fast home delivery; and 3) Customers queuing up at the design desk/studio to use the company's complimentary service offering. In Mizuho's view, a growing physical footprint could widen Wayfair's reach and offer a new avenue for customer acquisition. Mizuho believes developing a 25-50 location showroom-like network could unlock significant profit potential and does not necessarily come with material inventory risk, given suppliers have fully funded any product investments to date

OpenAI: OpenAI Races to Launch ‘Strawberry’ Reasoning AI to Boost Chatbot Business

As OpenAI looks to raise more capital, its researchers are trying to launch a new artificial intelligence product they believe can reason through tough problems much better than its existing AI.

Researchers have aimed to launch the new AI, code-named Strawberry (previously called Q*, pronounced Q Star), as part of a chatbot—possibly within ChatGPT—as soon as this fall, said two people who have been involved in the effort. Strawberry can solve math problems it hasn't seen before—something today’s chatbots cannot reliably do—and also has been trained to solve problems involving programming. But it’s not limited to answering technical questions.

When given additional time to “think,” the Strawberry model can also answer customers’ questions about more subjective topics, such as product marketing strategies. To demonstrate Strawberry’s prowess with language-related tasks, OpenAI employees have shown their co-workers how Strawberry can, for example, solve New York Times Connections, a complex word puzzle.

Other News:

AAPL: Apple Cuts Jobs in Online Services Group as Priorities Shift - Bloomberg

AMZN/WMT: Walmart Takes on Amazon By Adding Pre-owned Watches, Collectibles to Marketplace– Bloomberg

Cybersecurity: Chinese hackers have penetrated deep inside US internet service providers to spy on their users – WaPo (h/t BAML)

INTC: Intel board member quit after differences over chipmaker's revival plan – Reuters

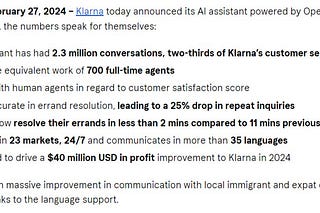

Klarna / Gen AI: Klarna aims to halve workforce with AI-driven gains – FinancialTimes

META: Meta Shuttering Augmented Reality Studio Amid Pivot to AI – Bloomberg

NVDA: Chip challengers try to break Nvidia’s grip on AI market – link

TSLA: Tesla Stock Is Rising. It’s Getting a Boost From This - Barrons

ZM / X: X is testing a video conferencing tool - TechCrunch