TMTB Morning Wrap

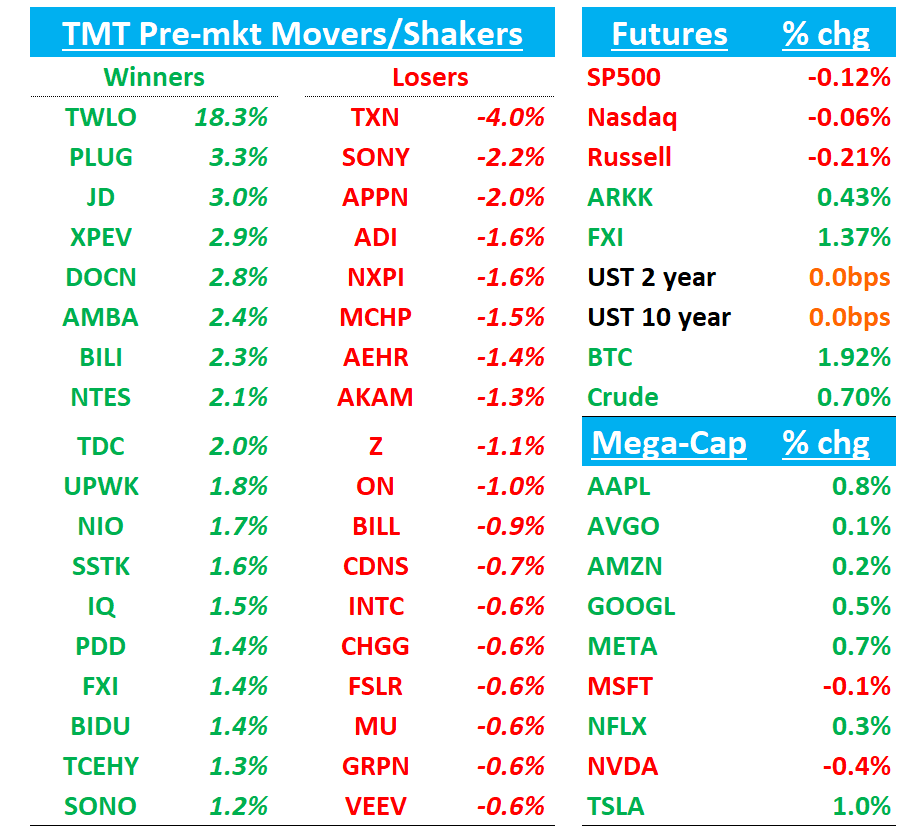

QQQs hovering near flat. BTC +2%. China +1.4%. Yields hovering near flat. Let’s get straight to it.

NFLX: Bernstein upgrades to Buy from neutral

Good deep-dive ug in typical Bernie fashion. Key takeaway here for me is Bernie put out a $36 EPS # for 2026, which is higher than most buyside at $32-$33 and higher than street at $30. If investors can believe the $36 #, means trading at 27x P/E for 30%+ EPS growth, which alleviates the valuation pushback.

Summary from Thefly:

Bernstein analyst Laurent Yoon upgraded Netflix to Outperform from Market Perform with a price target of $1,200, up from $975. The firm believes another year of double-digit subscriber growth is achievable in 2025, driven by international markets. There are numerous markets with healthy average revenue per membership that are still underpenetrated by Netflix, and recent penetration trends in these markets - fueled by the ad-tier and the company's deliberate growth initiatives - "indicate there are plenty of eyeballs left to entertain," the analyst tells investors in a research note. In addition, Bernstein says Netflix "has recently proven to be a credible destination" for live events.

Also gets a downgrade at Phillips to Reduce from Neutral —> basically another valuation dg and raises PT to $870 from $695

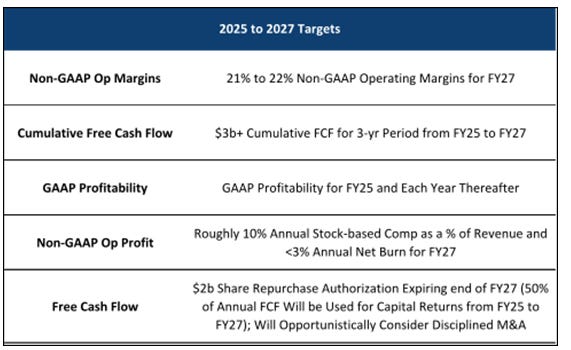

TWLO +18%: Positive Preannouncement at investor day with better Q4 #s, LT targets, and $2B buyback

Watch other SMB software names this morning…

Q4 rev guide at 11% vs street at 8%

‘25 Op inc of $825-$850 vs street at $820

$2B buyback

21-22% OM guide for FY2027 vs street at 19%

$3B of cum FCF ‘25-27

Stock well below 2020/21 highs despite already being up massive to start the year.

Street positive this morning:

JPM: PT $83→$130: "incrementally constructive on prospects for sustained profitable growth and emerging optimism over Twilio's gradual growth acceleration as it realizes recent initiatives to capture a broader market opportunity in the official intelligence-enriched customer experience as a service market

MS: PT $118→$144: "encouraged that the company could grow more profitably than expected," and sees multiple levers for upside remaining

UBS: PT $140→$145: “Twilio's Investor Day event instilled comfort in its growth durability, giving investors what they needed to hear to remain constructive, with the guidance, new $2B share repurchase authorization, financial disclosures and upbeat qualitative commentary all meeting or exceeding expectations”

etc etc etc

3P Roundup:

SHOP: Yip saying GMV tracking to 4% below street for q1 but doesn’t include any impact from recent PYPL partnership, so tough to gauge what that means….

EBAY: Yip out saying int’l and u.s. accel’d in first couple weeks of Jan after a decel to exit dec. Tracking well above street fxn for Q1. Called out big step up in trading cards gmv.

eBay:在 1 月份前两周,国际和美国的增长加速,在 12 月份减速后。第一季度跟踪表现远超市场预期。指出交易卡 GMV 大幅增长。

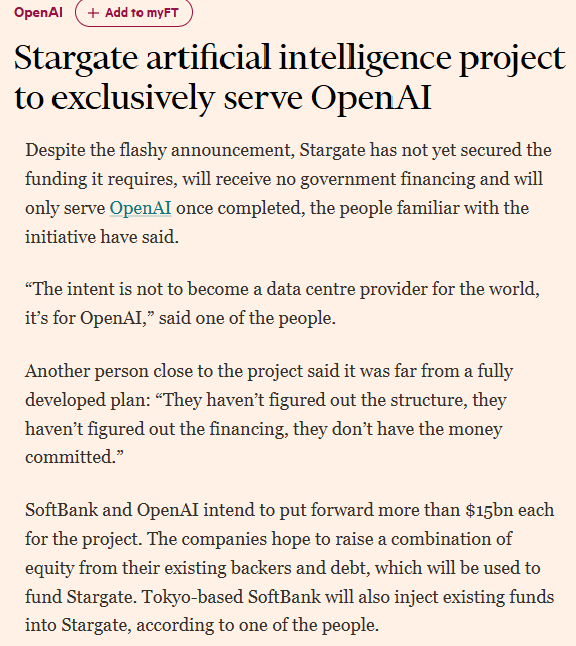

More Stargate Stuff…

Behind the OpenAI-Oracle Pact, an Elon Musk Threat Loomed

Lots of interesting tidbits in the article…

And at Microsoft, executives were studying whether building large data centers for OpenAI would even pay off in the long run, according to two people directly involved in the discussions between the companies. Microsoft’s cloud computing chief Scott Guthrie, for instance, instructed deputies to forecast future demand for such facilities from other AI customers who might use them after OpenAI did, to ensure they wouldn’t sit idle, one of these people said.

据两位直接参与公司间讨论的人士透露,在微软,高管们正在研究为 OpenAI 建设大型数据中心在长期内是否划算。例如,微软云计算负责人斯科特·古德里奇(Scott Guthrie)指示副手预测其他 AI 客户在 OpenAI 之后可能使用此类设施的未来需求,以确保它们不会闲置,其中一位人士表示。Altman also worried about getting enough AI server chips from Nvidia. The chipmaker produces a limited supply and has a vested interest in distributing chips to many AI developers to maintain a competitive market of chip customers. So Altman hired people to design a new AI server chip and began working on it with Broadcom, an established chip designer. The new chips wouldn’t be ready until 2026, but OpenAI would need to find its own data center to run them, as Microsoft and other cloud providers might not agree to use them in their facilities.

Altman 还担心从 Nvidia 获得足够的 AI 服务器芯片。芯片制造商产量有限,并在将芯片分发给众多 AI 开发者以维持芯片客户市场的竞争力方面有既得利益。因此,Altman 雇佣了人员设计新的 AI 服务器芯片,并与已建立的芯片设计公司 Broadcom 合作开始工作。新芯片要到 2026 年才能准备好,但 OpenAI 需要找到自己的数据中心来运行它们,因为微软和其他云服务提供商可能不会同意在他们的设施中使用它们。Around that time, Musk had started making progress with his own AI firm, xAI. In July, he loudly proclaimed that xAI had set up the world’s largest AI server cluster in Memphis, Tenn., in record time by retrofitting a manufacturing facility instead of working with an established cloud provider. The news prompted Altman to privately express his distress about relying on Microsoft, as the companies’ agreement required.

大约那时,马斯克在自己的 AI 公司 xAI 上取得了进展。7 月份,他大声宣称,xAI 通过改造一个制造设施,而不是与现有的云服务提供商合作,在短短时间内就在田纳西州孟菲斯建成了世界上最大的 AI 服务器集群。这则消息促使奥特曼私下表达了对依赖微软的担忧,因为公司之间的协议要求如此。Musk had previously talked to Oracle and a small data center developer, Crusoe, about designing a site in Abilene, Texas, for xAI, code-named Project Ludicrous, a reference from the film “Space Balls.” After Musk suddenly opted to build his own data center instead of working with Oracle, Altman pounced, according to three people who worked on the deal. Starting in June, Oracle began working with Crusoe on developing the site for OpenAI instead.

马斯克之前曾与甲骨文和一家小型数据中心开发商 Crusoe 讨论在德克萨斯州阿比林设计一个 xAI(代号“疯狂项目”,源自电影《太空球》)的场地。据三名参与该交易的人士透露,马斯克突然决定自己建造数据中心而不是与甲骨文合作后,阿尔特曼迅速行动。从 6 月开始,甲骨文开始与 Crusoe 合作开发为 OpenAI 的场地。Stargate aims to give OpenAI “a lot of cheap compute under our control” and would operate as a “kind of extension of OpenAI,” Altman said.

星门旨在为 OpenAI 提供“大量受我们控制的廉价计算资源”,并作为“OpenAI 的一种扩展”来运作,Altman 说。In recent weeks, Oracle signed a deal to lease the entire 1.2-gigawatt campus in Abilene, quadrupling the amount of capacity it can provide to OpenAI, according to two people working on the project. That amount of power could run a city the size of Austin, Texas. Crusoe wants to grow the site’s power capacity to 2 gigawatts by mid-2026; doing that and developing the facilities and servers to use it could cost $100 billion.

近期,据两位参与该项目的人士透露,甲骨文签署了一项租赁阿比林 1.2 吉瓦整个校园的协议,将其向 OpenAI 提供的容量翻了两番。这么多的电力可以供一个像德克萨斯州奥斯汀那样大小的城市使用。Crusoe 希望到 2026 年中将该地点的电力容量增加到 2 吉瓦;实现这一目标以及开发使用它的设施和服务器可能需要 1000 亿美元。

cracks in the bromance? rump’s key aides and allies reportedly furious at Elon Musk for talking down Stargate deal – Politico

Stargate artificial intelligence project to exclusively serve OpenAI more skepticism around funding after the FT quoted a person close to the project saying “they haven’t figured out the structure, they haven’t figured out the financing, they don’t have the money committed” – FT

OpenAI struggles to price Microsoft stake in deal to become for-profit company - FT

New Stargate? Billionaire Ambani is Building World’s Biggest Data Center

TikTok/META: Bloomberg notes Apple and Google still haven’t brought the app back to their app stores

TXN -4%: Decent Q4 results, but guides Q1’25 gross margins lower

Q1 GMs were guided down 300bps, well below street only modeling dn 10bps. Q1 was guided to $1.05 vs street at $1.16 due to lower gross margins. Lower guide due to lower than expected underutilization and higher depreciation. Q4 was actually fine - $4B vs street at $3.85B and top line guide for Q1 was only guided to down 3% q/q better than buyside down >5%, but GM guide weighing on it.

TEAM: Atlassian price target raised to $325 from $300 at Jefferies

Atlassian's price target was lifted to $325 from $300 at Jefferies, maintaining their Buy rating. Partner checks revealed strong performance from large enterprise renewals, continued cloud migration, and year-end budget spending. Given these findings and increased pricing, Jefferies expects Atlassian to surpass its fiscal Q2 guidance of 25.5% cloud growth and 27.5% datacenter growth.

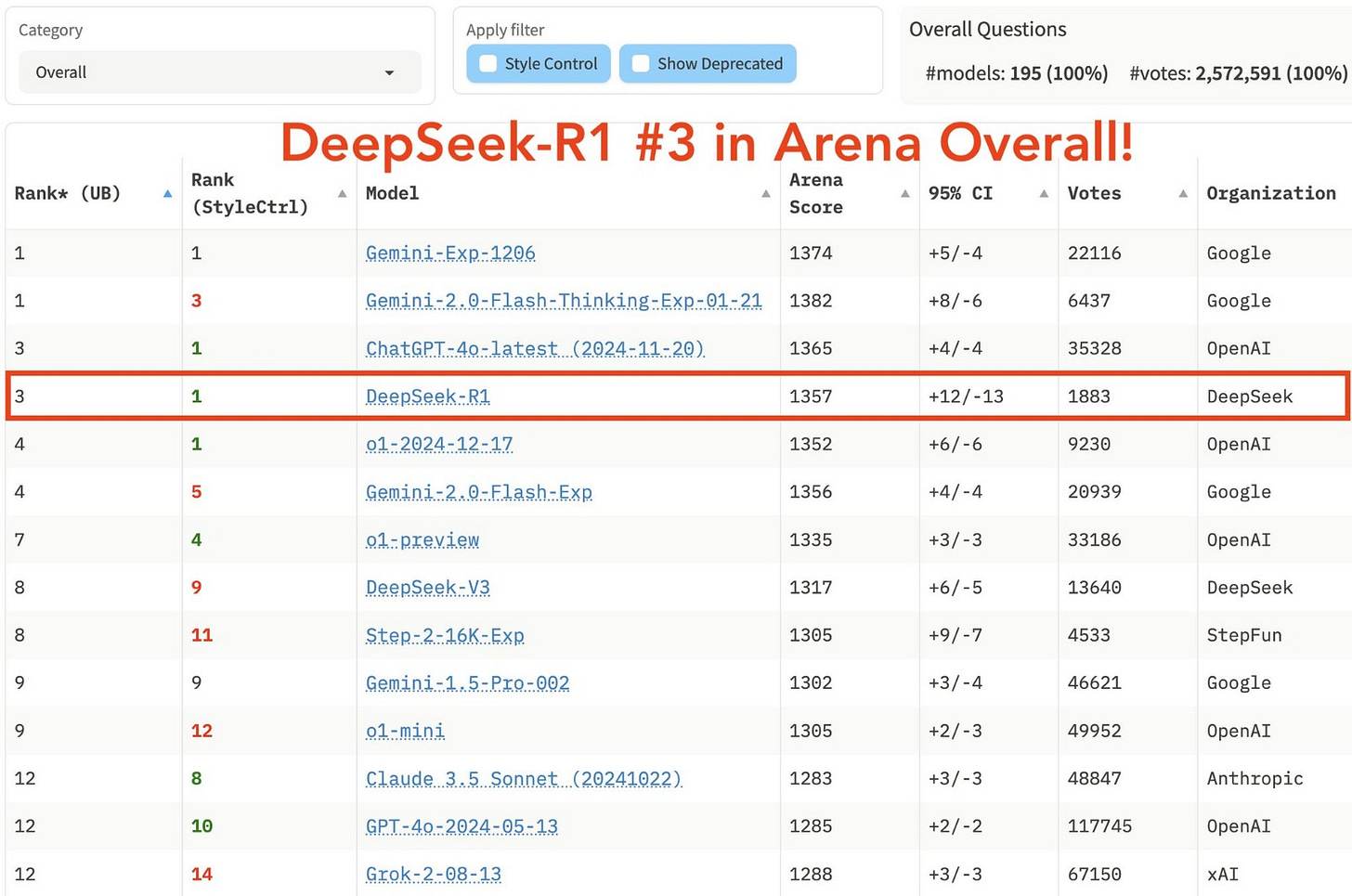

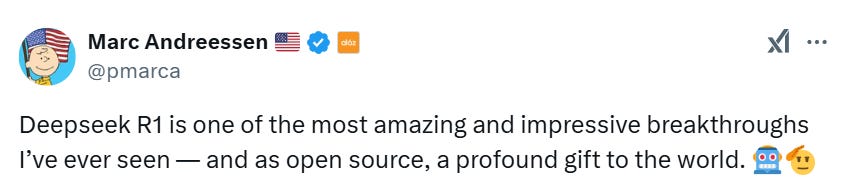

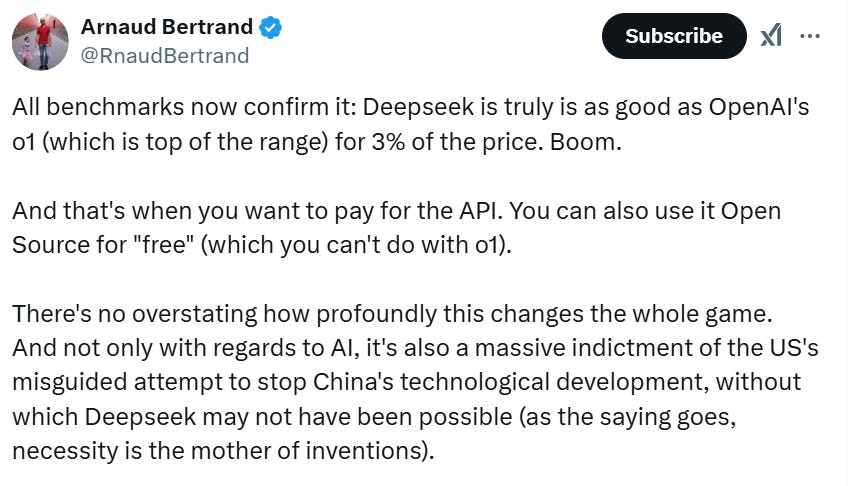

Deepseek R1 continues to get play - implications for NVDA/compute power

The day after Christmas, a small Chinese start-up called DeepSeek unveiled a new A.I. system that could match the capabilities of cutting-edge chatbots from companies like OpenAI and Google.

That alone would have been a milestone. But the team behind the system, called DeepSeek-V3, described an even bigger step. In a research paper explaining how they built the technology, DeepSeek’s engineers said they used only a fraction of the highly specialized computer chips that leading A.I. companies relied on to train their systems.

Beneath the embattled A.I. standoff is the U.S. government's effort to maintain the country’s lead in the global A.I. race, it is trying to limit the number of powerful chips, like those made by Silicon Valley firm Nvidia, that can be sold to China and other rivals.

But the performance of the DeepSeek model raises questions about the unintended consequences of the American government’s trade restrictions. The controls have forced researchers in China to get creative with a wide range of tools that are freely available on the internet.And it was created on the cheap, challenging the prevailing idea that only the tech industry’s biggest companies — all of them based in the United States — could afford to make the most advanced A.I. systems. The Chinese engineers said they needed only about $6 million in raw computing power to build their new system. That is about 10 times less than the tech giant Meta spent building its latest A.I. technology.

“The number of companies who have $6 million to spend is vastly greater than the number of companies who have $100 million or $1 billion to spend,” said Chris V. Nicholson, an investor with the venture capital firm Page One Ventures, who focuses on A.I. technologies.

The world’s leading A.I. companies train their chatbots using supercomputers that use as many as 16,000 chips, if not more. DeepSeek’s engineers, on the other hand, said they needed only about 2,000 specialized computer chips from Nvidia.

TSLA launches new Model Y in North America and Europe - link … came a bit earlier than expected

OKLO - Wedbush ups PT to $45 from $26

Wedbush boosted Oklo's price target to $45 from $26, keeping their Outperform rating. The AI revolution's datacenter expansion is gaining momentum under Trump, with Wedbush seeing Project Stargate as the beginning of a broader AI initiative in Washington. Nuclear power is positioned to be crucial for powering AI datacenters in this 4th Industrial Revolution, with Wedbush highlighting Oklo's potential as a key player alongside Altman's AI influence.

MSTR: MicroStrategy Suddenly Has a Tax Problem, and Needs Help From Trump’s IRS

WSJ:

If you think MicroStrategy’s business model is wild, wait until you see its tax issues.

After years of raising money through stock and debt offerings to buy bitcoin, MicroStrategy owns a stash worth about $47 billion, which includes $18 billion of unrealized gains. In an unusual twist, it could have to pay federal income taxes on those paper gains—even if it never sold a single bitcoin. The tax bill could total billions of dollars starting next year, according to a new disclosure this month by MicroStrategy that has received little attention.

Usually investment gains aren’t taxed until the assets are sold. But under the Inflation Reduction Act passed in 2022, Congress created a “corporate alternative minimum tax” in which MicroStrategy now finds itself ensnared. The tax rate would be 15%, based on an adjusted version of the earnings that MicroStrategy reports on its financial statements under generally accepted accounting principles. Its best hope is that the Internal Revenue Service adopts new rules that let MicroStrategy off the hook

AFRM: Locks in $750M in funding from Liberty Mutual’s asset mgmt arm

Liberty's commitment runs through 2027, adding to Affirm's recent financing deals with Sixth Street ($4B) and Prudential Financial ($500M). This shift reflects Affirm's reliance on private-credit investors as nonbank lenders like Affirm fill gaps left by traditional banks. Unlike credit cards, Affirm’s algorithm-driven loans charge no late fees and are repaid within a year, allowing Liberty's funding to cycle through $5B in purchases over the deal's duration.

Other News:

AAPL: UK's CMA sets a deadline of Feb 12 for interest parties to comment on its SMS investigations into Apple and Google’s mobile ecosystems

AMZN, BAH: Booz Allen and AWS expand partnership and strategic collaboration agreement to accelerate and improve technology for the U.S. government – press release

ERIC: down ~10% in European trading on an earnings miss driven by material weakness in enterprise

GRND: last night issued a pos pre, raising FY revs to $344M at midpoint (cons $338M)

OpenAI: yesterday launched a new tool (Operator) that can automate tasks like planning vacations, filling out forms, and making restaurant reservations; see BofA research takes below – NBC News

OpenAI: OpenAI in complex talks to become for-profit company as it struggles to price Microsoft's stake – FT

QCOM: yesterday launched Snapdragon 8 Elite (for Galaxy) – ijiwei