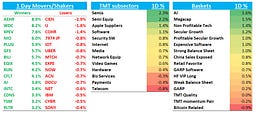

QQQs -2.5% with a rough day led lower by semis and large cap (META -4%; MSFT -6%). The semi weakness we saw yesterday became more pronounced as key AI leaders broke the levels we called out in our EOD wrap yesterday. Still unclear to me if this is part of a bigger pullback or semis just taking a breather, but we need to reclaim those previous 52wk high levels I called out yesterday in NVDA, MRVL, AVGO, TSM to get more excited about risk on environment here. Maybe just some de-risking ahead of the election? We’ll digest and see what happens tomorrow then have more thoughts over the weekend.

BTC -4%; China flat; yields down 1-3bps across the curve.

Let’s get to the recap…

Internet

META -4% — print seemed pretty down the fairway to me but expects were very high going in and stock most crowded in Internet so a -4% reaction on a day when QQQs dn 2.5% not a totally unsurprising result

RBLX +20% on a big Q3 bookings beat on the back of mixed 3p data/sentiment (short reports etc.) going into the print. DAUs and engagement also very strong. Let’s see if stock can finally hold $50 - the advertising narrative finally gaining some steam as we head into 2025

DASH +1% on a solid print with GOV inline with more bullish buyside estimates. Bull case stays intact here and stock looks comparatively better after UBER miss

UBER -9% after missing GBs despite a stronger FCF #. When you have a structural/secular bear case building (Autonomous/robotaxi), you need to keep beating to stay ahead of it and this print just emboldened bears.

CVNA +20% after another big GPU/EBITDA beat and guide

AMZN -3% ahead of the print

GOOGL - 2% as ChatGPT Search went live - you can now install it as a chrome extension and make it your native search bar. This is the reality with GOOGL in this environment - headline risks re: search any day of the week.

EBAY -8% after GMV miss

ROKU -17% after talking down 2025 accel and calling out weak M&E spend and headwinds despite numbers being relatively ok

RDDT +3% more follow through

Semis

ARM -8.5% on a valuation downgrade at Bernstein

Other AI names weren’t spared: NVDA -5%; MU -4% dipping under $100 again; MRVL -3%; ANET - 2.4%; TSM -2%

AVGO -4%:

SMCI -11% more follow through after yesterday’s debacle

Weakness in analog names too: NXPI -4.4%; ON - 4.2%; ADI -3%; TXN -1.6%

Software

MSFT - 6%: From our morning write up: After GCP, investors were hoping for something a little better for the Azure guide and a 2-3ppt decel for the guide is slightly higher than the 1-2ppt decel buyside was hoping for. So more expectations for hockey stick here which investors always have trouble underwriting, and stock likely stays as a funding short at pods until we get closer to C25 as Azure is key KPI.

PANW +23bps after winning $1B DoD contract…Other security names didn’t fare as well: CRWD - 3.4%; ZS - 3.2%

AI -5%; PLTR - 5% caught in the AI downdraft

Cloud related names weak after Azure guide: ORCL -4%; MDB - 4.6%; SNOW - 3.5%; DDOG - 2%

Large cap mixed: SAP/CRM -1.5%; NOW - 1.7%

CFLT +13.5% after better sub rev #s and better commentary