TMTB EOD Wrap

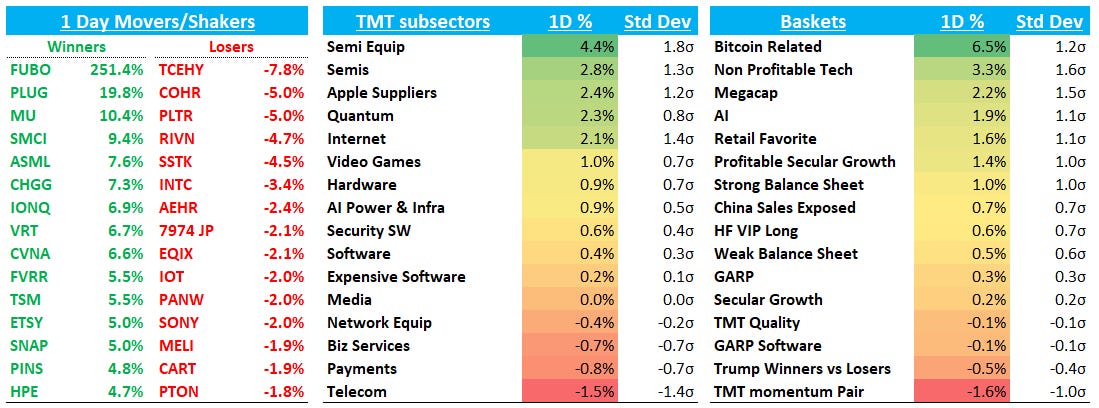

QQQs +1.15% as Semis +3% led the way higher as CES started today as AI sentiment back on fire and Altman on his blog talking about AGI around the corner. Jensen on the docket at 6pm at CES. Software lagged as investors shifted to Semis while Internet +2% held its own. Trump winners continue to lag losers in the new year and Laggards since Trump’s election now outperforming leaders by 1.6% over the first few days of the year.

Risk on back in full force as thematic stocks continue to rip. BTC +4%. Yields ticked up while Fed expects didn’t move much with market still pricing in 38bps worth of cuts this year. Barr’s decided to resign as Fed vice chair of bank supervision which is bullish outlook for bank regulations and capital rules.

Let’s get to it…

Internet

Ad names continue to get a bid ahead of Tiktok’s oral arguments at the Supreme Court on Friday and ahead of Jan 19th deadline for the ban. O’Leary on Fox saying he’s in negotiations to buy TikTok, but I don’t believe this guy says. All hinges on Supreme court decision any way.

PINS +5% led the way as Edgewater called out positive performance+ feedback driving improved CTR/CPCs. First significant positive datapoint we’ve gotten in the name in a while. Most buysiders (including us) had waiting for Q1 guide cut (street at 14%, bogeys 10-13%…i’ve heard as low as high single digits). A tough set up to try to game now - we’re still feeling it out.

SNAP +4.7%; META +4.3%; RDDT +80bps; ROKU ++3.5% TTD +4%

GOOGL +2.5% as Wedbush named top pick for 2024 and raised PT to $220

NFLX flat despite winning 7 golden globes yesterday, up from 5 in 2024. Think just profit-taking given bunch of catalysts played out in late 2024.

AMZN +1.4% despite slight AWS downtick at Yipit

UBER +2.6% on $1.5 accelerated share repurchase announcement and positive WSJ article

CHWY +3% to more new highs on Mizuho’s upgrade…Hearing 7M secondary priced at $38.07- $36.32 after the close from BC…thought they were locked up until post-earnings but guess I was wrong.

LYFT +80bps weak showing on upgrade at Benchmark

W +6% shaking off a downgrade at Wedbush

CVNA +6% bouncing back from last week’s performance following Hindenberg’s short report as the announced ALLY renewal.

RBLX +2.4% to new highs

DASH flat/ CART -2% underperformed

Travel continues to underperform to start the year: BKNG flat; ABNB -40bps; EXPE -60bps

SHOP +4.5% on Wedbush’s upgrade.

SPOT +50bps

FUBO +250% on DIS deal

Semis:

MU +10% attributed to Hynix strength overnight and Gavin Baker said on a podcast that HBM companies could be best performing asset as HBM is a bigger part of NVDA COGS than TSMC for GPUs and HBM content goes up with test-time compute. Despite 15%-20% move up, we still think r/r v intriguing below $100.

MRVL +70bps: CEO sounded pretty good at fireside chat with JPM reaffirming his confidence in outlook.

AI names ripping: NVDA +3.4%, now up 18% since late Dec and hitting new all time closing high; TSM +5.5%; VRT +6%; AMD +3.3%; AVGO +1.6%; ARM +4.5%

TER +7% on Northland upgrade

CRDO +6%/ ALAB +2%

Software:

PLTR: MS transferred coverage from Weiss to Singh with a $60 PT and sell rating. Obviously calls out valuation. Key quote in the report:

Part of what has made Palantir such an attractive partner, is the spread in terms of the relative capabilities/skillset that Palantir brings to bear with respect technology and human capital compared to the capabilities of its end customers, which in our view is at or near its peak in this stage of the cycle. While this scenario could sustain in 2025, over time we think the skills/capabilities of the enterprise with respect to building AI applications should likely improve, which may make it difficult for Palantir to sustain its current level of momentum, creating downside risk given the premium valuation of the shares.

We tend to agree. We were bullish on PLTR most of 2024 on accelerating growth one easier comps, but comps begin to get much tougher going fwd at the same time the aforementioned dynamics are playing out. Decelerating growth + decent narrative why rev growth should slow + high valuation = never a good combo for a long in tech in our view, even for one the kings of retail.

MDB +2.6% on Gugg’s upgrade

CRM -70bps PANW -2% on Gugg’s downgrade

ZI -1.5% on Piper’s downgrade citing aggressive competitor pricing

FTNT +50bps despite Piper upgrade

TEAM +1.8% as Opp raised PT to $300 and reitterated to pick

Elsewhere

COIN +4%/ HOOD +3% on BTC strength

Other fintech mixed: PYPL +2% as susq positive, but AFRM -2%; UPST -90bps; SQ - 25bps

TSLA +15bps despite New Street upgrade