TMTB Morning Wrap

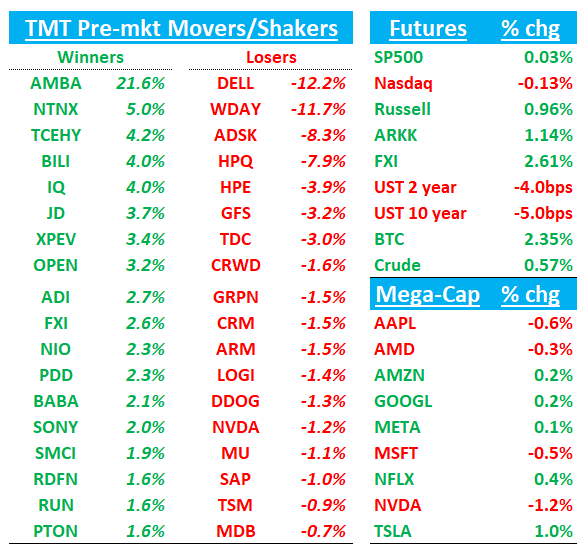

QQQs - 13bps on what will be one of slower volume days of the year. Still have some earnings to go over this morning (DELL, WDAY, CRWD, NTNX, HPQ, ADSK). We’ll go over those first then get to research/news. DELL/HPQ confirmed PC refresh cycle is on hold for now…DELL AI story seems intact but let’s see if we get Michael Dell and Silver selling post-q like we have seen the last few; WDAY lowered #s after just two months since analyst day; CRWD looked mixed but overall bull case intact there; ADSK seeing some selling driven by new CFO appt but #s overall looked ok.

China +2%; BTC +2.3. Treasuries have a bid this morning with yields down 4-5bps across the curve. Fed rate cut expectations have risen to 65%, likely helped by FOMC minutes on Tuesday.

This will be the last post for the week. Happy Thanksgiving! Grateful for all you readers and hope you have a great one!

Let’s get to it…

DELL: Q3 miss driven and Q4 revs guided $1B below street with mgmt citing delayed PC upgrade cycle and push-out in AI server deliveries due to BW. AI Backlog/ISG storage margins better however

Positioning leaned long heading into the print so the miss and guide down not a great look, despite AI orders and storage margins coming in better. Overall, #s disappointing given high expectations heading in, but key KPIs beat and commentary was positive which could keep 2025 AI story alive after a reset (Bulls hope SMCI share gains show up in Apr Q) although bull case on 2025 PC refresh takes a hit. Let’s also remember we’ve seen Michael Dell/Silverlake be in the market selling stock for a few weeks post-earnings the last several quarters which has pressured the stock:

More details:

Dell guided revs of $24.5B vs street $25.5B and EPS of $2.50 vs street $2.64, reflecting delayed PC recovery and Blackwell shipment timing impacts, although commentary on backlog and orders was positive. Storage and PCs drove the miss (ISG margins better / CSG margins worse due to higher commodity costs) and after the guide many will question whether Windows end-of-life will actually provide any PC uplift in 2025.

On AI servers, DELL showed 9% q/q decline due to expected Blackwell delays, with slight decline projected for Q4. However, underlying demand appears stronger than shipments suggest: AI server backlog reached $4.5B (+17% QoQ and above bogeys of $4B-$4.5B) while orders hit $3.5B (+11% QoQ). Tier 2 cloud providers leading order growth, though enterprise segment gaining share. Management highlighted GB200 as major component of backlog/orders, with AI pipeline growing over 50% QoQ to nearly $20B up from $11-$13B last q

Storage +1% QoQ growth (4% YoY), though trailing NetApp's 8% QoQ (6% YoY). Q4 storage guidance suggests low-teens growth, below typical 15% seasonality and NetApp's projected 2% QoQ increase. ISG margins improved significantly to 13.3% (+230bps QoQ, +70bps YoY and better than bogeys at +12%+) benefiting from higher server ASPs/content and operating expense management.

WDAY -11%: Inline Q3, but Q4 sub/cRPO guide worse as co lowers guide just a few months after setting targets. Never good.

Mgmt credibility here has taken another hit as Q4cRPO guide of 13.5-14.5% and F26 sub growth of +14%. Buyside expects here had been closer to 14.5% for cRPO and to reiiterate 15% for F26 (at worst, lower to 14.5%). Not a good look for mgmt as co had guided to 15% sub growth for F26/F27 just two months ago at their analyst day, a cut from 17-18% before that, and 20% before that. This will embolden bears who question the durability of WDAY’s growth and put another dent in mgmt’s cred. Bulls might want to say the bar is lowered sufficiently for F26 as we heard some of that argument going in, but when mgmt has lowered their targets multiple times and now just 2 months after guiding to 15%, that argument doesn’t really hold much water. In terms of macro, mgmt didn’t really downtick so this seems to be very co specific. Bulls will also try to hold their hat on the valuation argument (20x FCF for a 20s FCF grower) and hopes/prayers for a sp500 add next wk.

Gets a downgrade at Piper this morning who lowers their PT to $270, down from $285, and cites growth concerns, particularly "tepid" guidance showing fifth straight quarter of declining RPO growth to 14%. Piper says they lack confidence in near-term recovery given limited impact from key growth drivers - international expansion, new products, and partnerships.

More Details:

Q4 sub guide $2.02B vs street at $2.04B and OPMs of 25% vs street at 25.5%

Q3

- ADJ EPS $1.89 vs. $0.99 y/y, EST $1.75

- Revenue $2.16B, +16% y/y, EST $2.13B

- Subscription revenue $1.96B, +16% y/y, EST $1.96B

- Professional services revenue $201M, +15% y/y, EST $174.2M

- Backlog $22.19B, +20% y/y, EST $21.93B

- Product development expense $647M, +4.6% y/y

- ADJ operating margin 26.3% vs. 19.7% y/y, EST 25.3%

ADSK -8%: in line-ish results vs street but a bit light of buyside. CFO hire raises questions and hits the stock

Stock had run up a lot into the print over the last several months and pods leaned long; investors hoping for a bit better, but overall #s look fine to me although you can say they raised by less than they beat. Part of the move down this morning has to do with CFO hire. ADSK named Janesh Moojani, former ESTC CFO as new CFO. The sw investors I hear from all say this was one of, if the most disliked CFO among investors as he had a history of walking people off a cliff every other quarter on ESTC. So some of the selling has to do with that.

ADSK 2025 F/Y GUIDANCE

- Guides ADJ EPS $8.29 to $8.35, saw $8.18 to $8.31, EST $8.28

- Guides revenue $6.12B to $6.13B, saw $6.08B to $6.13B, EST $6.11B

- Guides billings $5.90B to $5.98B, saw $5.88B to $5.98B, EST $5.73B

- Guides ADJ operating margin 35.5% to 36%, saw 35% to 36%, EST 35.6%

- Guides free cash flow $1.47B to $1.50B, saw $1.45B to $1.50B, EST $1.48B

GUIDANCE: Q4

- Guides revenue $1.62B to $1.64B, EST $1.62B

RESULTS: Q3

- ADJ EPS $2.17 vs. $2.07 y/y, EST $2.13

- Net revenue $1.57B, +11% y/y, EST $1.56B

- Subscription net revenue $1.46B, +11% y/y, EST $1.46B

- Maintenance net revenue $9M, -25% y/y, EST $11.3M

- Other net revenue $104M, +18% y/y, EST $98.5M

- ADJ operating income $573M, +4.8% y/y, EST $565.5M

- ADJ operating margin 36% vs. 39% y/y, EST 36.1%

- Free cash flow $199M vs. $13M y/y, EST $199.8M

NTNX +6%: Looks solid with 3.3% rev beat, biggest in 5 quarters. GMs much better at 87.5% vs street at 86.1%. OPMs and FCF also beat.

20% operating margin beat vs 15% guidance, benefiting from revenue upside and one-time items. Key metrics show momentum: revenue +16% YoY, ARR reached $1.97B (+18%), and FCF strong at $152M. Go-to-market partnerships driving new logo growth despite slightly extended sales cycles.

The co raised FY25 operating margin (to 16.5%) and FCF guidance ($585M from $570M) while maintaining revenue outlook ($2.435-2.465B) despite Q1 beat and Q2 guide above consensus and bulls will say that’s conservative, especially if macro improves

Beats will nitpick ARR growth deceleration (18% vs prior 22% and 30%) due to longer sales cycles for large deals and weaker federal business expansion. Second-half margin guidance suggests meaningful deceleration from investments in R&D (AHV standalone, Gen AI), sales/marketing, and channel incentives. However, bulls will say numbers good enough and story of VMW share gains + DELL/CSCO/RHT partnerships driving accelerating growth in 2025 remains intact.

NTNX GUIDANCE: Q2

- Guides revenue $635M to $645M, EST $630.3M

2025 F/Y GUIDANCE

- Still sees revenue $2.44B to $2.47B, EST $2.45B

RESULTS: Q1

- ADJ EPS $0.42 vs. $0.29 y/y, EST $0.32

- Revenue $591.0M, +16% y/y, EST $571.8M

- Hardware revenue $1.1M, +83% y/y, EST $0.81M

- Subscription revenue $560.7M, +17% y/y, EST $542.3M

- ADJ gross margin 87.5% vs. 85.9% y/y, EST 86.1%

- Billings $591.4M, EST $637.1M

CRWD: Mixed numbers with ARR miss and commentary guiding down Q4 NNARR, but Q3 #s otherwise better

CRWD beat by 3% vs street, largest beat since 2022, and raised FY and Q4 guide above magnitude of beat. OPMs beat by 200bps. Subscription revenue rose 31% y/y to $963M vs street $934M. Q3 ARR of $153 missed bogeys of $160-$190M but they called out $26M fed contract that did not renew. However, stock trading down on two factors: potential $30M Q4 revenue impact from outage (up from $25M in Q3) and management suggesting sell-side models too aggressive in future quarters, talking down Q4 NNARR

Here’s what the CFO said:

the vast majority of analysts are modeling Q4 NNARR seasonality well above historical levels, we request that you keep historical sequential seasonality in mind when updating your model…we expect Q4 FCF to reflect a significantly more pronounced July 19th impact in comparison to Q3 due to collections … we do not expect to see sequential margin leverage in Q4

Bulls will look through near-term headwinds, saying company is recovering qucker than expected from outage and want to stay long cyber sw and waiting for NNARR acceleration in 2H FY26 driven by Flex, next-gen SIEM (+150% y/y) and burgeoning CFS. Bears will say valuation is stretched (18x Revs / 60x+ FCF) and that numbers coming down near-term.

HPQ -8%: Weaker PC drives guide cut

HP's Q4 showed slight revenue beat with in-line EPS, but Q1 guidance notably below street ($0.73 vs $0.86). Bulls hopes of a 2025 PC refresh cycle driven by end of life windows and AI refresh takes a ding especially after DELL confirmed weaker PCs. Bears will say FY25 guidance relies heavily on 2H strength, assuming sustained printer margins and PC upgrade momentum which is no guarantee. Bulls might point to improving printer supply sales that grew for first time in 13 quarters, but bears will say this happened bc of pricing and potential share gains rather than fundamental improvement, as shrinking installed base and lower usage trends will continue dominate.

Overall, 2H loaded guide likely keeps this in penalty box until we see meaningful uptick in PCs

HPQ GUIDANCE: Q1

- Guides ADJ EPS $0.70 to $0.76, EST $0.86

2025 F/Y GUIDANCE

- Guides ADJ EPS $3.45 to $3.75, EST $3.60

- Guides free cash flow $3.2B to $3.6B

RESULTS: Q4

- ADJ EPS $0.93 vs. $0.90 y/y, EST $0.93

- Net revenue $14.06B, +1.7% y/y, EST $14B

- Personal systems revenue $9.59B, +2.1% y/y, EST $9.74B

- Printing revenue $4.45B, +0.8% y/y, EST $4.25B

- ADJ operating margin 8.5% vs. 9% y/y, EST 8.66%

- Free cash flow $1.5B, -21% y/y, EST $1.56B

- Repurchase of common stock $900M

- Share repurchased 25.4M

AMD/QCOM/ARM: Reports suggest AMD may launch a new smartphone chip in 2026, leveraging TSMC’s 3nm process. The rumored move aims to expand AMD’s presence in mobile devices and could keep TSM 3nm production lines fully utilized, with order visibility already extending into late 2026. UDN

CRM: Citi raises PT to $368 from $290 but stays at Neutral

Citi notes Agentforce has become dominant narrative for Salesforce, evidenced by positive partner feedback driving 35% stock gain since Dreamforce. While checks indicate modestly improved demand ahead of December 3 earnings, Citi expects revenue and bookings growth to remain in high-single-digits, though sees current Q3/Q4 consensus estimates as reasonable.

DASH: Citi raises DASH PT to $211 from $155 and reiterates Buy

Citi cites all-time highs in user growth and order frequency, driven by service quality improvements, expanded selection, and marketplace efficiencies. Citi suggests momentum expected to continue into 2025 as newer verticals like grocery gain traction and service becomes more habitual and Citi views company as well-positioned with multiple growth drivers for both revenue and profitability.

EXPE: Baird initiates at Buy with $225 PT

Despite ongoing business model transformation and disruption, analyst Bellisario sees turnaround progressing. While acknowledging execution and competitive risks, Baird views valuation as attractive given low expectations and sees multiple expansion potential tied to growth acceleration and margin improvement.

BKNG: Baird initiates at Buy with $5,850 PT

Baird highlights Booking's advantages: strong international market positioning in less competitive, higher growth regions, proven management execution, and attractive earnings growth trajectory - particularly attractive given current robust global travel environment.

Other News:

AAPL: Apple Misses Out on Big 2024 Smartphone Market Rebound, IDC Says - Bloomberg

AAPL, China: Foreign smartphone sales in China drop 44.25% y/y in Oct, data shows – Reuters

China/Semis: China Is Bombarding Tech Talent With Job Offers. The West Is Freaking Out. – WSJ

China: US shifts China travel advisory to 'exercise increased caution'

DIS: ‘Moana’ Wasn’t a Big Hit. Now It’s the Biggest Movie in America. – WSJ

INFY, GenAI: Infosys chair bets companies will develop their own AI models – FinancialTimes

META/GOOGL: Black Friday: online marketing costs jump in bidding war with Temu and Shein – Reuters

MSFT: Microsoft, HP and Dell ramp up China parts output before Trump's return – Nikkei Asia;

MSFT: Microsoft bets on artificial intelligence to power a nuclear resurgence — and more AI - FinancialTimes

OpenAI, Softbank: SoftBank to boost OpenAI stake with up to $1.5bn investment – FT

PCs: Dell, HP Shares Slump on Weak Outlooks as PC Upgrades Slow to Materialize– WSJ

RBLX offering 25% more Robux to users that purchase on the website vs app store TechCrunch

Samsung: Samsung shakes up struggling chip business for second time this year – FT

X: X hasn’t been as poor an investment as it might seem thanks to a spike in valuation for xAI (which Twitter/X owns 25% of) - FT