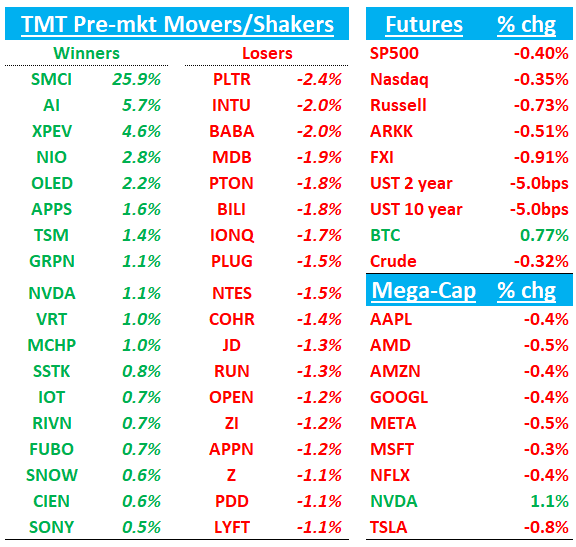

QQQs -40bps. Yields falling 5bps; BTC +30bps. We got MSFT CEO Keynote at Ignite at 9am est. and QCOM Investor Day at 2pm est. today. Let’s get to it…

NVDA +1%: Plenty to go over this morning ahead of earnings tomorrow

JPM comments after their Asia conf saying Taiwanese EMS/ODM addressed GB200 issues and noted it was in fact "very old information" and the "media mixed it without mentioning the actual date"; this clarifies that the NVL72 issue mentioned was actually from two quarters ago, and the units are now in their factories ready for December shipment after testing, maintaining the original schedule

Jefferies comments on overheating issues as well saying they discussed this important issue with our supply chain contacts and currently there is NO such overheating issue now. Everything is on track as planned. They also note FII and Wistron has started small volume compute board assembly production and ODMs expect to start small volume L7~L10 rack server assembly since late Nov, targeting to start small volume delivery of GB200 NVL 36 and NVL72.

KEYB believes NT upside in the q is likely to be negatively impacted by: 1) pushouts of H20 in China given increased pressure to utilize domestic AI solutions and some loss of share to AMD's MI308; 2) pushouts of H200 given the increased availability and ramp of Blackwell (B200); and 3) the recent decision by NVDA to replace MPWR with IFX as the primary PMIC vendor is likely to create NT supply constraints and limit the availability of GB200 NVL server racks in FQ4. Because of this, KEYB is trimming its FQ4 estimates to reflect these pushouts/constraints and are fine-tuning its FY26 revenue/EPS estimates, due to the pushout in Hopper revenues and PMIC supply constraints, which remain solidly above consensus at $218B/$5.04 vs consensus of $186B/$4.24.

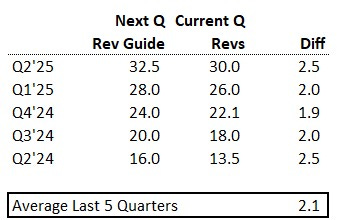

Jefferies comments on guidance saying they think US buyside is at $40-$41 for Jan Q and so thinks NVDA likely to guide $38-$39 at midpt. Jeff view these targets as potentially too aggressive. Important context: these represent expected achievement numbers, not guidance, which typically comes in $2B lower. Blayne's $38B forecast may better reflect likely guidance levels.

MS thinks JanQ guide at $37B makes sense in keeping with recent beat + raise patterns, but would drive the stock down moderately, while $38B would likely be a relief at this point, and $39-40B a clear positive

TMTB: On this point, I would note that NVDA has guided very tightly $2-$2.5B above what they just reported. So let's say they do buyside # of $34.5, even assuming $2.5B above that # = $37B, only inline with street. Obviously this is a unique q as we are likely going to get ~$5B in Blackwell revs so question is how conservative CFO wants to be….

Mizuho also tried to put #s around the guide yesterday saying based on KYEC testing output: 150k GPUs = 75k Bianca boards (2 GPU + 1 CPU) at $70-75k each = ~$5B revenue for the Jan Q. Additional revenue from NVLink, NIC, and full rack DGX systems. Q3 expected to beat $33.2B consensus, potentially hitting $34.5B. Q4 base case: $34.5B Hopper + $5B Blackwell = $39-40B

Wells recaps SC24 Special address saying NVDA specifically called out Foxconn’s production ramp in US, Mexico and Taiwan. They note NVDA’s presentation also highlighted Dell and SMCI in xAI’s 1st phase 100k GPU cluster deploy using Spectrum X Ethernet switching

GOOGL: DOJ Will Push Google to Sell Chrome to Break Search Monopoly

Top Justice Department antitrust officials have decided to ask a judge to force Alphabet Inc.'s Google to sell off its Chrome browser in what would be a historic crackdown on one of the world's biggest tech companies.

The department will ask the judge, who ruled in August that Google illegally monopolized the search market, to require measures related to artificial intelligence and its Android smartphone operating system, according to people familiar with the plans.

If Mehta accepts the proposals, they have the potential to reshape the online search market and the burgeoning AI industry. The case was filed under the first Trump administration and continued under President Joe Biden. It marks the most aggressive effort to rein in a technology company since Washington unsuccessfully sought to break up Microsoft Corp. two decades ago.

SMCI +26%: Announced they have engaged Auditor BDO (6th largest U.S. accounting firm) as an independent auditor effective immediately.

SMCI said it will be able to complete annual report for the year ended June 30 and quarterly report for period ended Sept. 30.

DASH: Hearing nice uptick in weekly GOV data at Yipit this morning

CRM: Salesforce upgraded to Buy at Erste Group on earnings growth potential

TheFly:

Salesforce is in a position to continuously increase its revenue and operating margin given its leading position in the areas of customer service, marketing automation and, in particular, data analysis using AI, the analyst tells investors. Earnings per share will increase at double-digit percentage rates in FY25 and FY26, but the stock is valued moderately lower than the sector average, the analyst added.

UBER: Jefferies defends the stock and keeps $100PT

JEFF notes that WaymoOne has ~6% market share in metros launched so far, but this still only represents 0.3% of US rideshare. At the Co's current growth rate, it would capture <1% of US rideshare by the end of '26. JEFF also believes autonomous vehicle developers will ultimately choose to partner with rideshare players to 1) maximize utilization; 2) optimize pricing; 3) address barriers to changing preferences; 4) provide fleet management expertise; and 5) help navigate local regulations. Further, JEFF estimate a scaled robotaxi fleet would have direct costs of $14.51 per ride if standalone and $11.19 if partnered, meaning there is limited flexibility to undercut on pricing in order to gain share.OKTA: Barclays initiates with equal weight

META: Meta's Instagram to let users 'reset' content recommendations

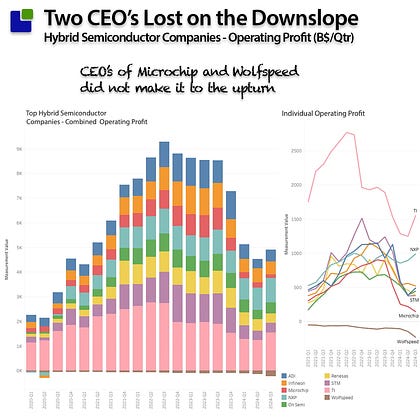

MCHP: CEO Ganesh Moorthy is retiring at the end of November and former CEO (1991 through 2021) and current Chair Steve Sanghi will be the interim CEO.

This coincides with his 65 birthday, Jefferies notes: When Steve Sanghi was CEO from 1991 through 2021 MCHP produced annualized returns of ~24% vs. the Nasdaq’s ~15%. During Ganesh’s tenure MCHP has return an annualized (3.5%) vs. the Nasdaq’s ~13%.”

UBER: BAML removes UBER from US 1 List

AMD: Chief Accounting Officer of her resignation

PR:

“Ms. Smith’s resignation is not the result of any dispute or disagreement with AMD, including with respect to any matters relating to AMD’s accounting practices or financial reporting.

NOW: Mizuho recaps meeting with CFO and raises PT to $1070 from $980

During Mizuho's discussion, management emphasized the strong customer demand underpinning the GenAI momentum for its Pro Plus SKU. Moreover, management was bullish on its new Workflow Data Fabric, which will power new workflows and AI agents, and drive additional monetization. More broadly, Mizuho continues to believe that NOW remains very well-positioned for high growth over the next few years, fueled by ongoing demand for workflow automation, strong cross-sell opportunities, and AI monetization.

ABNB: Bernstein recaps meeting with AirDNA economist

Bernstein notes AirDNA's economist noted strong demand trends, with Q4 nights booked up 14% YoY and particularly robust October performance, saying vacation rentals have regained market share to 14% of US lodging, while Airbnb continues to attract professional hosts, especially from Vrbo's platform. Bernstein notes quality metrics are improving despite 14% supply growth, with geographic diversification reducing top 25 markets to 12% of business from 23% in 2017. Interestingly, the economist highlighted NYC regulatory impact proved less severe than anticipated, with 50% nights lost but partial offset from Jersey/Newark gains, resulting in roughly $280m net loss (35bps of TTM bookings). Looking ahead, opportunities exist in off-peak pricing optimization and guest-focused services, including a potential Amazon Prime-style loyalty program, while events provide limited direct revenue but support regulatory relationships.

SE: Sea Limited downgraded to Reduce from Neutral at Phillip Securities

TheFly:

Phillip cites the recent rally in the shares for the downgrade. The company's "triple-sided growth" in SeaMoney, Shopee, and Garena "shows potential to deliver returns for long-term growth," the analyst tells investors in a research note.

OKTA: Barclays initiates at Hold

Barclays notes Okta competes in the fast-growing $20B+ identity/access management market, where top two players control 40% share. While Microsoft dominates the larger workforce segment, Okta leads in the smaller but faster-growing customer identity market. Barclays projects 6% FY26 revenue growth versus Street's 10%, citing lower net retention and new logo trends, with initial guidance expected at Q3 earnings (12/3). Despite recent underperformance, valuation looks reasonable at 16-17x FY27 FCF.

FTNT: Fortinet price target raised to $90 from $77 at Deutsche Bank

TheFly:

Deutsche Bank raised the firm's price target on Fortinet to $90 from $77 and keeps a Hold rating on the shares. The company's vision and strategy were well articulated at the analyst day, and it multiple inherent platform advantages in driving technology convergence to successfully prosecute a "massive" $284B market opportunity, the analyst tells investors in a research note. However, Deutsche remains on the sidelines, saying Fortinet's growth drivers remain a small part of the overall mix while there is ongoing risk that competition can pressure growth and margins.

VRT: Vertiv Holdings price target raised to $141 from $115 at TD Cowen

Cowen views its 2025 guide as conservative and sees potential for upside through 2025. However, the firm views its long-term guidance as the bull case as it implies no degradation in HSP demand for a 5-year period, to which they are currently skeptical.

INTU: Mizuho previews the q

Mizuho expects QB Online business to drive upside in FQ1 driven by IES adoption in mid-market with pricing tailwinds, offset by QB Desktop headwinds. Consumer segment faces a tough comp this FQ1, although only ~3-4% of FY24 consumer tax revenue comes in FQ1. For CK, consensus expectations appear conservative and CK will likely see modest upside in FQ1. However, op. margin will likely be in-line given the overlap of new hiring and layoffs in FQ1, but for FY24, Mizuho expects ~50-100bps margin expansion, ahead of consensus.

AMZN: Amazon held talks with Instacart, Uber, Ticketmaster, and others for help on its new AI-powered Alexa

Amazon's AI-powered Alexa upgrade could launch with several major partners handling specific tasks such as ride-hailing, grocery shopping, and restaurant reservations, Business Insider has learned.

The companies under consideration are Uber for ride-hailing, Ticketmaster for ticketing, Vagaro for local business booking, OpenTable for restaurant reservations, Grubhub for food ordering, Instacart for grocery shopping, Fodors for travel advice, and Thumbtack for home services, according to an internal document obtained by BI.

The partner companies would become the primary option for handling those specific tasks on the upgraded Alexa. These would be separate from existing Alexa Skills, which are third-party applications on the voice platform, according to the document. As with any partnership talks, such negotiations could end without final agreements being signed.

DIS: Piper notes Mixed Experiences Trends But Improving Total Advertising

Piper notes Parks admissions and parks food/merchandise saw customers decline mid-single digits Y/Y in October, while cruise line customers were also down year-over-year. However, Piper mentions essentially flattish sales growth across the experiences segment was supported by higher ARPU. In addition, app downloads were mixed year-over-year across the segments, as experiences and cruise app downloads saw the worst Y/Y declines since June 2024. Finally, Piper notes website traffic for Disney Cruises and Disney World were down significantly in October, with Disney Land showing a moderate increase in the month

HPE: HPE Met With Top DOJ Leaders to Save $14 Billion Juniper Deal

Hewlett Packard Enterprise Co. and Juniper Networks Inc. representatives met with Justice Department antitrust enforcers last week in a final effort to persuade the agency not to challenge their proposed $14 billion deal, according to people familiar with the matter.

The high-stakes meeting between the companies and the Justice Department's top antitrust officials typically occurs before the government decides whether to file a lawsuit. It's often referred to as a "last-rites" meeting.

DOJ officials are ready to challenge the deal if necessary and have made their concerns known to the company, but no final decision on whether to bring a lawsuit has been reached. The department could let HPE's purchase of Juniper proceed, potentially with some changes to address its competition concerns if the companies agree to revise the transaction.

Other News:

AAPL: Apple Offers $100 Million to Undo Indonesia iPhone 16 Ban – Bloomberg

ASML: TDutch minister: Chinese trade with Russia 'directly affecting' EU security – link

CART: Barclays hosting NDR with mgmt today and tomorrow

NVDA/GenAI/AI Semis: China’s Chip Advances Stall as US Curbs Hit Huawei AI Product – Bloomberg

GOOGL, Anthropic: UK's CMA decides Alphabet's partnership with Anthropic PBC does not qualify for a merger investigation

MSTR: after the closed announced a proposed private offering of $1.75B notes

NBIS: announces launch of its first GPU cluster in the United States

NVDA/GOOGL: Nvidia Is Helping Google Design Quantum Computing Processors – Bloomberg

Social Media: ~1 in 5 Americans get their news from social media influencers – CNBC

WMT/AMZN: beat and raise; ecomm grew +27%

MSFT: New Microsoft Billing Premium, Product Price Hikes: Five Things To Know - CRN