TMTB Morning Wrap

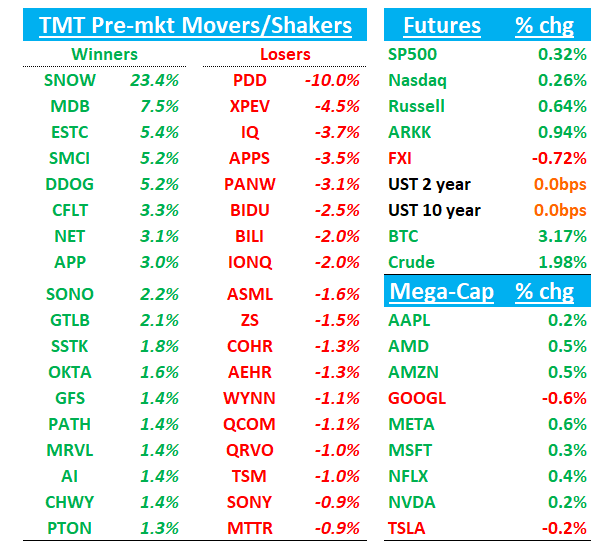

QQQs +30bps as NVDA crosses into the green. BTC +3% past $97k as it gets closer to $100k. We wrote up NVDA thoughts earlier - in your inbox. We’ll get to SNOW and PANW below. Cloud consumption names rallying in sympathy with SNOW. GOOGL remedies out. PDD whiffs. SMCI up as Jensen mentioned their name on the call. Let’s get to it.

SNOW +24%: Big product beat. Better margins. Accelerating product margins. Not much to dislike

Stellar q by SNOW in what had become a sneaky long among sw investors, but still well underowned by Long-onlys.

Product revenue growth of 29% Y/Y was significantly above the Street's 23% and bogeys of 27%, and RPO/cRPO bookings growth accelerated. RPO growth delivering the strongest sequential dollar addition in recent years, as a result of execution against the renewal cycle which included Snowflake closing three $50 Million-plus TCV deals. Product rev guide for next q implies 23% growth after just beating their guide this q by 5.5%. Assuming another similar beat we’ll get to a Q4 exit rate of 29%, which should leave bulls happy that product growth no longer decelerating and has potential to accelerate in 2025 as comps get slightly easier.

Databricks competition bear point doesn’t go away but now becomes an uphill battle for bears as rev growth is accelerating which means path of least resistance is up.

Other cloud names up early with b

SNOW GUIDANCE: Q4

- Guides product revenue $906M to $911M, EST $890.7M Bogey: $875M

- Guides ADJ operating margin 4%

RESULTS: Q3

- Revenue $942.1M, +28% y/y, EST $898.6M

- Product revenue $900.3M, +29% y/y, EST $856.6M; Bogey: $900M

- Professional services and other revenue $41.8M, +17% y/y, EST $40.8M

- Loss per share $0.98 vs. loss/shr $0.65 y/y

- Net revenue retention rate 127% vs. 135% y/y, EST 124.2%

- Current remaining performance obligation $5.7B, +54% y/y, EST $5.22B

- ADJ gross margin 73% vs. 75% y/y, EST 71.8%

- ADJ diluted EPS $0.20 vs. $0.25 y/y, EST $0.15

PANW -3%: Looks fine…NGS ARR and RPO better than street and inlineish with bogeys. NGS ARR Q2 guide better but RPO guide a bit light

Announced a 2 for 1 stock split on Dec 16

Overall call went well with mgmt sounding bullish on demand. Although not as important anymore, billings missed at -13% vs street close to +HSDs. Bulls will defend say ST billings was +9% which makes sense given PANW is shifting more towards annual billings. Bears will point to this billings miss and fairly big QRadar ARR contribution saying q wasn’t as good as RPO would suggest. Overall, some puts and takes but quarter seemed fine, mgmt sounded good on the call, and if you owned PANW before the q for security tailwinds you aren’t selling it today. Given high expects into the call not surprising to see it down a bit pre-market.

Couple sell-side snippets this morning as they all generally look the same…

Citi:

The company reported "solid" remaining performance obligation and annual recurring revenue ahead of expectations, the analyst tells investors in a research note. Citi says Palo Alto "check off necessary boxes for a respectable print." Citi believes a "more-constructive tone" on product, "robust" Cortex prospects and "meaty" renewal cycles in fiscal 2026 and 2027 "can comfortably underwrite durable positive estimate revisions."

Truist: Noted that the company's Q1 results were "solid" with annual recurring revenue - ARR - growth of 40% coming in above the guided 35%. The company also saw strength in its next-gen offerings, notably in Cortex and NetSec, also raising its ARR and revenue guidance for the year and maintaining its profitability outlook, adding that the business remains on track for its long-term goal of $15B in ARR by FY30.

Details:

Q1:

NGS ARR +40% y/y to $4.5B slightly light of Bogeys but slightly better than street

RPO +20% y/y to $12.6B vs street at $12.5B and inline with bogeys

Q2 Guide:

NGS ARR $4.7-$4.75B, inline with bogeys and above street at $4.65B

RPO: $12.9B-$13B vs street at $13B and bogeys a little higher

Revs: $2.22B - $22.25B

PDD -10%: Revs miss by 3% driven by transaction services. GMs also miss at 60% vs street at 62%.

Non-GAAP Diluted EPS: ¥18.59 (Est. ¥19.58)

Revenue: ¥99.35B (Est. ¥102.83B)

Non-GAAP Oper. Margin: 26.9% (Est. 27.4%)

Adj net income ¥27.46B, (EST ¥29.21B)

Transaction Services: ¥50.0B (Est. ¥53B)

Online Marketing Services & Others: ¥49.35B (Est. ¥49.06B)

Key points for the call: domestic market conditions, revenue trends across GMV and take rates, Temu's expansion plans, operational expenses particularly in marketing, Duoduo Grocery performance, and cash deployment strategy.

"We continue to invest consistently in our platform ecosystem while facing intensified competition and external challenges. These efforts aim to build a sustainable and healthy ecosystem, driving long-term impactful results."

3P Roundup:

AMZN: Hearing weekly AWS slightly uptick still tracking 1-2ppts above street

CVNA: Hearing Yip saying revs decelerated to ~31% from mid 40s last week. However, more recent 3p data showing revs have re-accel’d closer back to 50% in the last couple days. So read-through a bit mixed (also see RBC note below)

GOOGL: Google Should Be Forced to Sell Chrome Browser, Justice Department Says

Following catalysts expert report exchange and hearings in April 2025, followed by Judge Mehta's remedies decision in August 2025.

WSJ:

The Justice Department on Wednesday said Google should have to sell off its popular Chrome browser as part of a court-ordered fix to its monopolization of the online search market.

The request follows the government’s victory this year in an antitrust case against Google and is likely to kick off a heightened legal fight with wide-reaching implications for the tech giant’s core business.

Government lawyers said competition can only be restored if Google separates its search engine from products it has built to access the internet, such as Chrome and its Android mobile operating system. Chrome controls about two-thirds of the global browser market, according to the website Statcounter. Searches in the Chrome address bar go through Google unless a user changes the settings.

The Justice Department also requested that Google be prevented from giving preferential access to its search engine on devices that use its Android mobile operating system. If Google violated that rule in the future, it would have to divest Android as well under the government’s proposal.

CRM: Stifel and ISI posts notes following talking to CRM partners

Stifel says they spoke to 3 partners and commentary around q leaned positive but they were more excited to talk about what lies ahead with Agentforce as partners expressed a sense of rejuvenation around product development/future growth.

ISI says service use case shows strongest early traction due to clearer ROI metrics and straightforward pricing based on "conversations" as units of work. However, pricing models for Sales and Marketing agents remain less defined given harder-to-measure productivity gains. The analyst expects Agentforce to drive 1-2 percentage point revenue CAGR boost by CY26, but cautions against expecting meaningful impact before H2'25.

CVNA: RBC recaps takeaways from meeting with CFO yesterday

RBC says CVNA appears positioned to add volume while maintaining or improving profitability margins. Management indicates untapped GPU potential beyond Adesa and remains selective about demand, only pursuing profitable opportunities despite supply constraints. RBC notes that while marketing efforts have shown positive results with minimal spend, there's no rush to expand despite available inventory growth opportunities.

WDC: Bain-Backed Kioxia Plans Tokyo IPO at $4.8 Billion Valuation

The Kioxia IPO pricing provides a valuation benchmark for WDC's NAND spin-off, though likely lower than investors hoped. Bulls continue to think separating NAND and HDD businesses will unlock value, despite debate over optimal timing given NAND market conditions.

Kioxia Holdings Corp. plans to debut on the Tokyo Stock Exchange in mid-December at a value of about ¥750 billion ($4.8 billion), fast-tracking the move to stay relevant in the competitive memory sector.

The bourse is likely to approve the Bain-backed chipmaker's initial public offering on Friday, a person familiar with the matter said. The indicative price of the offering, which was first reported by Reuters, may change depending on market demand, said the person, who asked not to be identified discussing matters that are private.

Other News:

AAPL: Apple proposes Indonesian factory in bid to reverse iPhone 16 ban – FinancialTimes

BABA: Alibaba Revamps E-Commerce Businesses As Competition Intensifies - TheInformation

CMCSA: Comcast Spinoff Will Look to Buy Channels, Expand Into Streaming– Bloomberg

GLW: Chinese Premier Li is expected to meet top foreign execs (including from GLW) on Mon ahead of a supply chain expo in Beijing, with discussions likely cover a wide range of supply chain and trade flow issues (h/t BAML)

MSTR: MicroStrategy takes fundraising to $7bn for push into bitcoin – FT

Payments: Apple Pay, Other Tech Firms Come Under CFPB Regulatory Oversight– Bloomberg