ismagilov/iStock via Getty Images

Investment Thesis

Guidewire Software (NYSE:GWRE), the property and casualty insurer, is an underfollowed name. But that has not been an impediment to its stock more than doubling in the past 12 months.

Guidewire Software 被低估,但股價過去 12 個月翻倍。

What's more, with the stock jumping higher after its fiscal Q3 2025 earnings and solid guidance ahead, the stock appears unstoppable.

股價在 2025 財年 Q3 財報後上漲,強勁指引使其勢不可擋。

Moreover, they are raising their full-year outlook and expect to grow ARR in the high teens percentage-wise, which is strong.

全年展望預期 ARR 增長 15-20%,表現強勁。

However, as I appraise this name, I struggle to get overly comfortable with paying 67x forward free cash flow for this business.

然而,67 倍前瞻自由現金流估值過高,令人不安。

So, I'll stay neutral and wish the bulls good luck.

因此,我保持中立,祝多頭好運。

Guidewire Software's Near-Term Prospects

Guidewire makes software that helps insurance companies run better.

Guidewire 開發軟體幫助保險公司提升營運效率。

It's a large, high-tech platform that handles everything from processing claims to launching new insurance products. Their main selling point is Guidewire Cloud, a platform that's flexible and makes life way simpler for insurers compared to the old, legacy systems they used to rely on.

大型高科技平台,處理理賠到新產品發布。主打 Guidewire Cloud,靈活簡化操作,取代舊系統。

For insurers, that means a better customer experience and the ability to adapt quickly when things change, like rolling out a new product in days instead of months.

提升客戶體驗,快速適應變化,例如幾天內推出新產品。

And yet, Guidewire still faces the challenge of getting some slower-moving insurers to ditch their old systems and commit to big cloud transformations.

但仍面臨挑戰,說服緩慢保險公司放棄舊系統,進行雲端轉型。

Also, even though this business is now nearly 25 years old, they are showing investors that they still have what it takes to be innovative and deploy products at scale, particularly as AI becomes more of a factor in the insurance world.

儘管成立近 25 年,仍能創新和大規模部署產品,尤其 AI 在保險業日益重要。

Given that balanced background, let's now discuss its fundamentals.

基於此平衡背景,現在討論基本面。

Fiscal 2026 Could Grow at 14% to 17% Y/Y

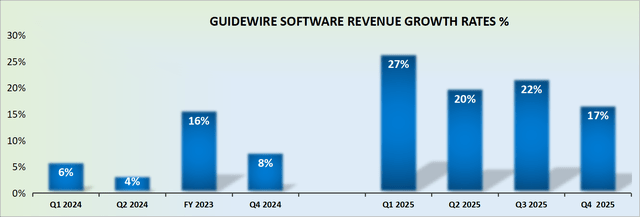

GWRE revenue growth rates

Guidewire Software delivered a solid revenue beat in what was its most challenging quarter of the year to beat.

在最挑戰季度,營收超預期強勁。

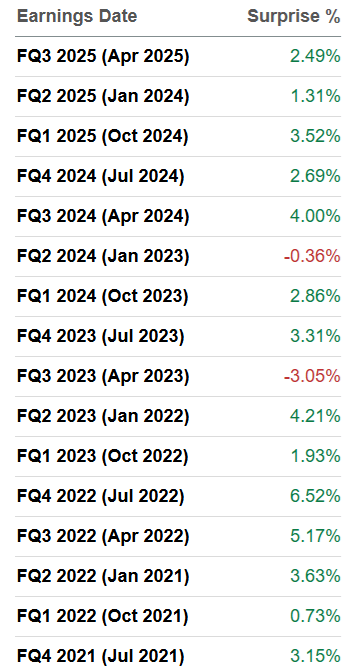

Indeed, looking back, Guidewire has rarely failed to deliver a beat against analysts' expectations.

回顧過去,Guidewire 很少讓分析師失望。

GWRE revenue beats

With this year practically concluded, the challenge now is to come up with some sort of revenue growth rate estimate for next fiscal year, which starts in August 2025.

今年結束,當前挑戰是估計下個財政年度(2025 年 8 月開始)的收入成長率。

On the one hand, the business is pointing towards high teens of ARR, see the quote from the earnings call to support this:

一方面,該業務的 ARR 正朝著高位發展,請參閱收益電話會議中的引述以支持這一點:

But kind of getting into that maintaining upper teens fully ramped ARR growth would be a tremendous outcome for us. To do that three years in a row, and that's the direction we're working towards.

On the other hand, the business does have very high and challenging comparable quarters to be up against. So, I believe that a lot needs to go right for the business to smash through the mid-teens analysts' expectations in fiscal 2026.

但企業面臨極高且具挑戰性的同期比較基準,需諸多有利條件方能突破分析師對 2026 財年 15%左右的增長預期。

Basically, we are probably looking at around 14% to 17% y/y revenue growth for the year ahead.

預計下一年度收入年同比增長 14%至 17%。

What about its valuation? That's what we'll discuss now.

那麼它的估值如何呢?這正是我們現在要討論的。

GWRE Stock Valuation—67x Forward Free Cash Flow

As an Inflection investor, I'm put off by Guidewire's balance. Not including its long-term investments, which could take some time to convert to cash, it has approximately $250 million in net cash. This means that about 1% of its market cap is made up of cash. As a reference point, I typically back companies with 5% net cash to market cap or higher.

作為投資者,Guidewire 的淨現金僅 2.5 億美元(不含變現緩慢的長期投資),現金佔市值比約 1%,低於我 5%的投資標準。

Moving on, I estimate that Guidewire Software's free cash flow this year will be around $25 million, up slightly from the $18 million deployed in fiscal 2024.

我估計 Guidewire Software 今年的自由現金流約為 2500 萬美元,比 2024 財年的 1800 萬美元略有上升。

If this estimate is roughly accurate, this will mean that its free cash flow this fiscal year could reach around $250 million.

若此估計大致準確,本財年自由現金流可能達約 2.5 億美元。

This would be about 40% higher than the free cash flow reported in the prior year. However, since this year is practically completed, it makes more sense to turn our focus to fiscal 2026.

此現金流將較前一年高約 40%,然因今年已近尾聲,更應轉向關注 2026 會計年度。

And assuming that its free cash flow continues to move up by a more moderate level, of say, 20% y/y, this could see Guidewire delivering $300 million of free cash flow.

若自由現金流持續以較溫和的 20%年增率成長,Guidewire 可能創造 3 億美元的自由現金流。

This means that GWRE is priced at 67x forward free cash flow, a figure that I am not completely sold on.

GWRE 定價為 67 倍遠期自由現金流,但我不完全認同。

Simply put, not only is the business delivering about mid-teen growth rates, but I'm also having to embrace a balance sheet that is weaker than I desire?

簡而言之,不僅業務實現了大約十五六倍的成長率,而且我還必須接受比我期望的更弱的資產負債表?

And on top of that, having to pay a hefty premium? That won't work for me, so I'll stay neutral on this name.

支付高昂溢價行不通,因此我保持中立。

Risk Factors to the Upside

Investors love backing companies that are accelerating their prospects. Particularly when it comes on the back of a strong year already on the books.

投資者偏好投資在強勁年份後加速前景的公司。

This often leads the multiple to trade at what I find elevated valuations. The fact that the stock is richly priced very often has no bearing on where the stock can go in the medium term.

這經常導致估值高估,但高價位通常不影響股票中期走勢。

So, even though I believe that it doesn't quite make the cut for my Deep Value Returns portfolio, this doesn't necessarily mean that I'm making the right call to remain neutral on this stock.

儘管我認為這隻股票不適合我的深度價值回報投資組合,但保持中立不一定正確。

On top of that, they just had one of their best sales quarters ever, with tons of new deals. Furthermore, their annual recurring revenue is pointing towards mid-teens growth, and pushing past $1 billion, which is a huge milestone that will attract institutions to hold the stock, thus making it less volatile and able to trade at a higher premium.

該公司迎來史上最佳銷售季度之一,新交易量激增。 其年度經常性收入預計增長 15%左右,首度突破 10 億美元大關。 此里程碑將吸引機構投資人持有股票,從而降低股價波動性並抬高溢價空間。

The Bottom Line

Look, I'll give credit where it's due—Guidewire is executing well.

Guidewire 執行良好

Strong ARR growth, an improving top line, and a platform that's clearly resonating with insurers.

ARR 增長強勁、收入提升、平台受保險公司歡迎

But when I zoom out and look at the financials, paying 67x forward free cash flow for mid-teen growth just doesn't sit right with me.

財務上,67 倍自由現金流支付中雙位數增長不合理

The balance sheet isn't as robust as I'd like, and the valuation leaves very little room for error.

資產負債表不夠穩健,估值誤差空間小

I'm not calling a top—far from it—but for my style, this one's priced for perfection. So while I'm impressed, I'll stay on the sidelines for now and cheer from afar.

我不認為這是頂點,但價格過高,不符我的風格,因此暫時旁觀。

Comments (1)

雷蒙詹姆斯目標價從 225 美元調升至 255 美元。

RBC raises target price to $290 from $230

RBC 上調目標價至 290 美元,原為 230 美元。

Excellent execution beat ALL analyst expectations.

執行表現卓越,超出所有分析師預期。

We continue to like the potential for a GWRE/VRSK merger which would benefit all shareholders.

持續看好 GWRE/VRSK 合併潛力,惠及所有股東。