TMTB EOD Wrap

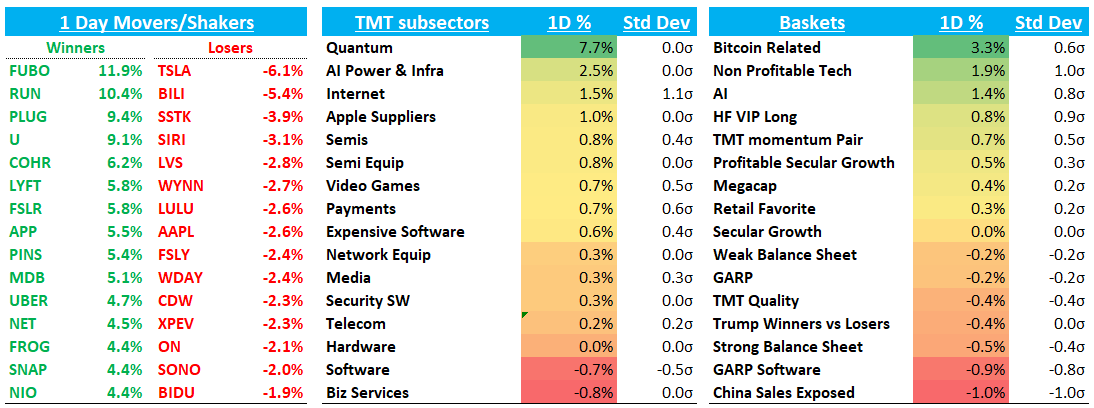

QQQs -20bps after quite a volatile first day of the year; QQQs were up 1%+ pre market, went dn 1% mid day, then finished the day close to flat. Treasuries didn’t do much and Fed expects stayed steady. SOX +1% led the way today as investors added to their favorite AI names ahead of CES. Internet +1.5% also outperformed. BTC +2.5% getting close to $100k. Still fairly low liquidity/volume as many still on vacation in this shortened week.

Let’s get to it…

Internet

UBER +4.7% / LYFT +5.8%: GS added Uber to conviction list citing expanding markets, improving profitability and platform synergies driving sustained growth - also shook off a JMP dg which didn’t have much new in it. LYFT strength attributed to TheInformation article predicting AMZN will buy LYFT in 2025. Both names likely helped by TSLA weakness as L TSLA has been a proxy for AV enthusiasm.

META +2.4% as JMP raised PT

GOOGL flat on JMP’s downgrade

PINS +5.5%: Gugg was out with a note saying December metrics improved: global audience accelerated to 11.6% vs 10.3% in Nov and domestic reach +6.5% vs 3.5% in Nov.

CVNA - 2% (dn as much as 8% at one point) as Hindenburg disclosed short position saying company’s recent turnaround is a “mirage” that is being propped up by unstable loans and accounting manipulation.

NFLX -50bps despite disclosing good squid game #s as majority of big catalysts behind them.

BABA flat despite FXI -2% as they announced sale of Sun Art.

W +4%

Semis

MU +3.7% as sentiment seems to be picking up after their miss in late Dec as GB300 has more HBM than GB200. We still like r/r here and lean +ve, but likely need to see some more positive pricing news flow to get stock sustainably working.

Other AI names strong ahead of CES: ARM +4%; VRT +4%; COHR +6^; NVDA +3%; MRVL +3%; TSM +2%…AVGO (flat) the standout laggard

Analog weaker: ON -2%; MCHP -80bps; NXPI - 80bps; ADI -50bps; TXN 30bps

ALAB +1.6% shaking off a Northland downgrade

Software:

FROG +4% as they raised prices on several products

U +9% on Roaring Kitty’s Rick James tweet

APP +5.5% starting the year strong

GARP-y names weak today, likely as a result of some shifting of $ back to semis to start the year: WDAY - 2.3%; CRM - 1%; SAP - 1.2%; MSFT - 70bps, PANW - 65bps; NOW - 55bps; ORCL -40bps

NET +4.5% on GS’ double upgrade

CYBR +75bps as WFS raised tgt and Rosenblatt out saying they could benefit from recent breach at Treasury

Elsewhere:

TSLA -6% after missing deliveries at 495k vs 505k. Jonas at MS saying miss reflects a “relatively aged product” and more competition. Tesla said energy storage deployments for 2024 were 31.4GWh, which means Q4 came in around 11M, solidly above the Street’s 8.85M forecast. Stock now well below previous breakout.

AAPL -2.4% after Reuters reported they cut prices in China as competition intensifies and UBS cut estimates below street on weaker iPhone sell-through data

HOOD +6% on better December data - crypto only declined 20% from November and beat estimates by 2x.

Other fintech strong: COIN +3.6%; AFRM +2.6%; SQ +2%; PYPL +1%

Green energy names strong after lagging initially post Trump win: RUN +10%; PLUG +9%; FSLR +6%; ENPH +4%

SIRI - 3% despite being added to tactical ideas list at Wells Fargo