This Is The Worst Breadth All Time High In S&P History

这是标普历史上最糟糕的广度新高

With stocks finally breaking above 6,000 and accelerating to record highs two days in a row (and according to JPMorgan's trading desk, many more ATHs are to come), the bears have one by one been friendoed once again yet one recurring lament of caution remains, and it was voiced most accurately by Bank of America's Michael Hartnett in his latest Flow Show note (available to pro subs).

随着股票终于突破 6000 点,并连续两天加速创下历史新高(根据摩根大通的交易台,更多新高即将到来),空头们一次又一次地被击败,但一个反复出现的谨慎哀叹依然存在,这一点在美国银行的 Michael Hartnett 最新的 Flow Show 报告中表达得最为准确(该报告仅对专业订阅者开放)。

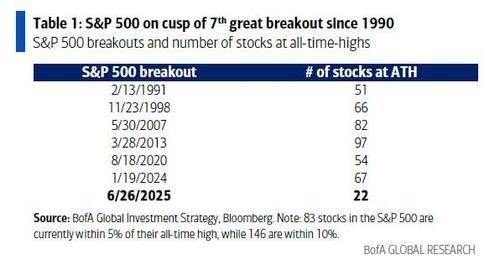

In the report, Hartnett first offers his congratulations to the S&P 500 which he says is "on the cusp of 7th great breakout since 1990" then quickly cautions that this latest breakout, as one would expect in a world dominated entirely by the Mag7, has had the smallest “breakout stock” participation, meaning that it is literally determined by a handful of stock. How many? Well, there are just 22 S&P stocks currently at all-time highs.... vs 67 in the January 24 breakout, 54 in August 2020, 97 in March 2013, 82 in May 2007, 66 in November 1998, and 51 in Feb 1991.

在报告中,Hartnett 首先向标普 500 指数表示祝贺,他称该指数“正处于自 1990 年以来第七次重大突破的边缘”,随后迅速提醒说,正如预期的那样,在完全由 Mag7 主导的世界中,这次最新的突破所涉及的“突破股票”参与度是最小的,这意味着突破实际上是由少数几只股票决定的。具体有多少?目前只有 22 只标普成分股创下历史新高……而在 2024 年 1 月 24 日的突破中有 67 只,2020 年 8 月有 54 只,2013 年 3 月有 97 只,2007 年 5 月有 82 只,1998 年 11 月有 66 只,1991 年 2 月有 51 只。

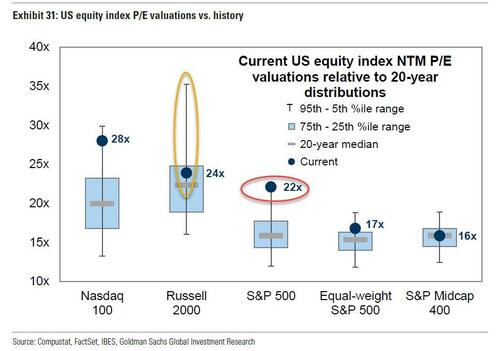

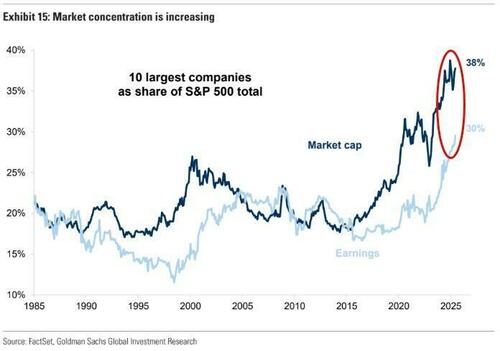

Tech back driving US equity bus, and has been the case for the past year, it remains the narrowest bull market in history... something which Goldman's Peter Oppenheimer discussed at length in his latest chartbook, where he showed that the top 10 companies now account for a record 38% of market cap and a record 30% of profits (see "Goldman Reignites Concentration Risk Concerns Amid Bad Breadth & Dollar Divergence").

科技股推动美国股市大巴前行,过去一年一直如此,这仍然是历史上最狭窄的牛市……高盛的 Peter Oppenheimer 在他最新的图表集里详细讨论了这一点,他展示了前十大公司现在占据了创纪录的 38%的市值和创纪录的 30%的利润(见“高盛在糟糕的市场广度和美元背离中重新点燃集中风险担忧”)。

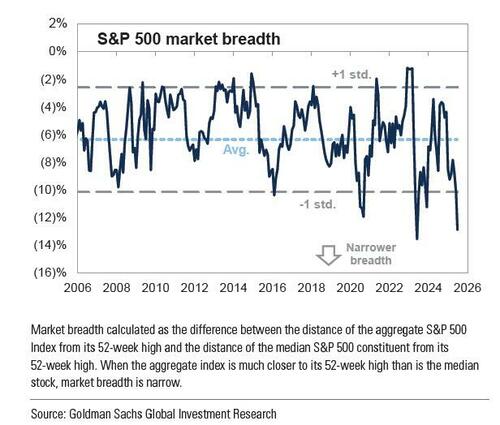

No wonder then that Peter's colleague David Kostin, who is Goldman's head of US equity strategy, just showed in his latest Weekly Kickstart report that the S&P market breadth - defined not by the number of breakout all time highs but by more conventional means (i.e., index vs constituent divergence) - is about to hit new all time lows.

难怪 Peter 的同事、美国股权策略主管 David Kostin 在他最新的《每周启动》报告中显示,标普市场广度——不是通过创历史新高的股票数量来定义,而是通过更传统的方式(即指数与成分股的背离)——即将达到新的历史最低点。

As Kostin puts it, "the S&P 500 rally has been defined by extremely narrow breadth that ranks as one of the most concentrated surges experienced during the past few decades."

正如 Kostin 所言,“标普 500 的反弹表现出极其狭窄的广度,这被认为是过去几十年中最集中的涨势之一。”

In their EOD wrap, Goldman's trading desk also harped on the unprecedented bad breadth of this market (full note available to pro subscribers), while also noting that as SPX and NDX have both retraced to the highs, it is worth highlighting the Russell 2k is still trading ~11% below its high print."

在他们的日终总结中,高盛的交易台也强调了这次市场广度的前所未有的疲弱(完整报告仅对专业订阅者开放),同时指出,尽管 SPX 和 NDX 均已回撤至高点,但值得注意的是,Russell 2000 指数仍比其高点低约 11%。

Kostin's conclusion: "the S&P 500 will return +5% over the next 12 months to reach 6500." Which is rather downbeat considering the current meltup has pushed the S&P almost 5% higher in just the past 2 weeks, and also considering that we are now entering the strongest month for the S&P historically, as July - which hasn't been red in the past decade - brings an average return of 1.67% looking back to 1928 and double that in the past decade (and in true patriotic spirit, July 3rd has brought the 2nd best single day return for the S&P historically at 48bps, only beat by October 20th at 57 bps).

Kostin 的结论是:“标普 500 将在未来 12 个月内回报+5%,达到 6500 点。”考虑到当前的快速上涨在过去两周内已推动标普上涨近 5%,以及我们正进入标普历史上表现最强劲的月份——7 月(过去十年未曾下跌)——这一预测显得相当悲观。回顾 1928 年以来,7 月的平均回报率为 1.67%,过去十年则翻倍增长(真正体现爱国精神的是,7 月 3 日是标普历史上第二好的单日回报,达到 48 个基点,仅次于 10 月 20 日的 57 个基点)。

On a historical basis, this is the best two-week period of the year, which is why Goldman's flow gurus said earlier that they "see the peak around the July 17th date followed by a leg lower" although they concede that July's "risk events" may bring this sooner.

从历史角度来看,这是全年表现最好的两周,这也是高盛的资金流动专家早些时候表示“他们预计 7 月 17 日左右见顶,随后将出现下跌阶段”的原因,尽管他们也承认 7 月的“风险事件”可能会使这一时间提前。

More in the full BofA Flow Show and Goldman reports (here, here, here) available to pro subs.

更多内容请参见完整的 BofA 资金流动报告和高盛报告(此处,此处,此处),仅向专业订阅者提供。

More markets stories on ZeroHedge

更多 ZeroHedge 市场报道

MIT Invents "Bubble Wrap" That Pulls Fresh Water From The Air...Even In The Driest Places In The World

麻省理工发明“气泡膜”,能从空气中提取淡水……即使在世界最干旱地区也能使用

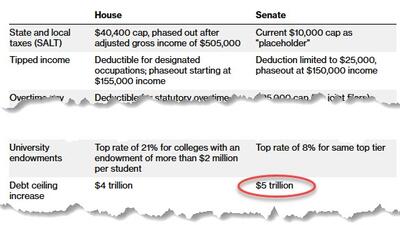

Senate Version Of Trump Tax Bill Adds $3.3 Trillion To Deficit, $500BN More Than The House; Debt Ceiling Raised By $5 Trillion

参议院版特朗普税改法案将赤字增加 3.3 万亿美元,比众议院多出 5000 亿美元;债务上限提高 5 万亿美元