TMTB EOD Wrap

I will be traveling on the road traveling on Monday - TMTB will be back on Tuesday.

QQQs finished down 28bps after being up 1.6% at one point. Everyone was enjoying their nice ramp of a Friday until the White House came out around 1:30pm saying Trump Tariffs are on for Feb 1st instead of the rumored March 1st that was out pre-market. Bloomberg:

President Donald Trump intends to move ahead with plans on Saturday to impose 25% tariffs on Mexico and Canada and a 10% levy on China, the White House said, denying a report that he planned to delay the implementation by a month.

“I saw that report, and it is false,” White House Press Secretary Karoline Leavitt told reporters on Friday during the press briefing. “I was just with the President in the Oval Office, and I can confirm that tomorrow the Feb. 1 deadline that President Trump put into place” remains, she added.

Trump also added he will “absolutely” impose tariffs on the EU too. How do you like 2025 so far? Not only do we have Chinese LLMs, macro releases, and earnings to worry about, but add political and tariff risks on top of that. A lot different than last year. Good politico article around Trump and Tariffs if you want some nice romantic Friday night evening reading.

Chinese stocks -3.5% got dinged on the news after a week where we saw strength following Deepseek’s release. Treasuries were also sold with 2 year up 2bps and 10/30 yr yields up 6bps. BTC slumped 3%+, some pointing to the Elliott Crypto letter below getting passed around:

In AI semis, this week showed that bifurcation within the group and alpha stock picking will only pick up steam. This is a theme we’ve written about since the semi top in mid-July last year — in 2023/early 2024, everything AI went up. Investors have become increasingly selective about what to buy, which means winners are getting bid up more heavily — just check out CLS with a pretty stunning 50% rally in the last 4 days of this week getting back all of its Monday’s losses as investors look at it at one of cleanest ways to play ASICs with exposure to META’s MTIA rack biz and Open AI’s custom silicon.

NVDA -3% flows had to go somewhere today and large cap internet was the beneficiary - GOOGL +1.5% / AMZN +1.3% / META +30bps. NVDA was up early shaking off US probe of Singapore chips with some pointing to the Semi-analysis article’s argument for more compute (and also o3 release today) . Key quote from Semi-Analysis:

What we think will happen is an even faster version of leading edge fab dynamics. Rushing to the newest capability means continued pricing power (see ChatGPT Pro) and lagging capabilities means much lower pricing that mostly accrues to the infrastructure that serves the tokens.

…As long as you expand capability to drive new features which can create value on top of these features, then you deserve pricing power. If not – commoditization is the open model market just a generation behind.

What we described to you was a parallel for a hyperdrive version of chip manufacturing as an analogy, the most capital intensive industry known to man. Not a single industry spends more on R&D in the world, and yet the closest realized parallel means this is somehow bad for the chips that support the model companies…

In the beginning it wasn’t clear you could scale transistors smaller and smaller, and when it did become clear, the entire industry focused on scaling CMOS to the smallest possible dimension and built meaningful functions on top. We are in the early stages of putting together multiple CoT models and capabilities together. We are scaling models like we initially scaled transistors, and while that is likely to be a very hectic period in terms of technological progress, this is good for Nvidia.

Key Movers:

Clev was saying Tiktok spend down >30% in lasts 2 weeks, with biggest beneficiaries META/GOOGL YT with RDDT seeing outsized gains. META +30bps as Zuck told employees to “buckle up” for an “intense” year.

CVNA +1.5% as JPM raised PT to $350 from $300 saying CVNA calling out more estimate revisions and multiple expansion potential

TEAM +15% after much better print and cloud guide

APP +1% on better Edgewater checks pointing to strength in e-comm and Temu ad units ramping

OTAs weaker (ABNB/EXPE/BKNG -~50bps) despite some positive commentary from V:

“Travel volumes performed well across our regional corridors due to broader strength in both consumer and commercial spending. Outbound Europe and Asia-Pacific travel volume growth also benefited from solid performance of client portfolios. For the US, both outbound e-commerce and travel volume growth were also helped by the strong dollar … we're seeing strong travel results from across all the regions. And so again, we feel really good about that."

ADBE -2% as Chief strategy officer is leaving co to join A24 film studio

EBAY flat after announcing 35bps take rate increase on most categories, which would imply ~2% incremental rev growth

MU -1.4% as Samsung’s 8 layer HBM3E was cleared by NVDA

INTC - 3% - does anyone care any more?

AAPL -60bps sold off after some early strength

EA +3.5% as Moffet upgraded to Buy. Key quote:

Rush, the new 5v5 mode, has been

praised by fans as one of the best additions to the game in

years. But it may have been too popular, pulling attention

away from the cash cow that is Ultimate Team, catching

even EA off guard. If that is right, then it means EA can very likely fix the

dilutive impact, but more importantly, build out a

monetization pillar that is related, but more expansive than

Ultimate Team. We may look back on this shock and

conclude that it was a positive inflection point for the

franchise in the long run. A plausible explanation for why a

game with such famed visibility went haywire, in and of

itself, will have value.

AI Roundup:

OpenAI's Chief Product Officer Kevin Weil: ‘We have a new model coming soon that is head and shoulders above anything that's out there today... the more compute you apply, the more intelligent the model is’

What fully automated firms will look like - link:

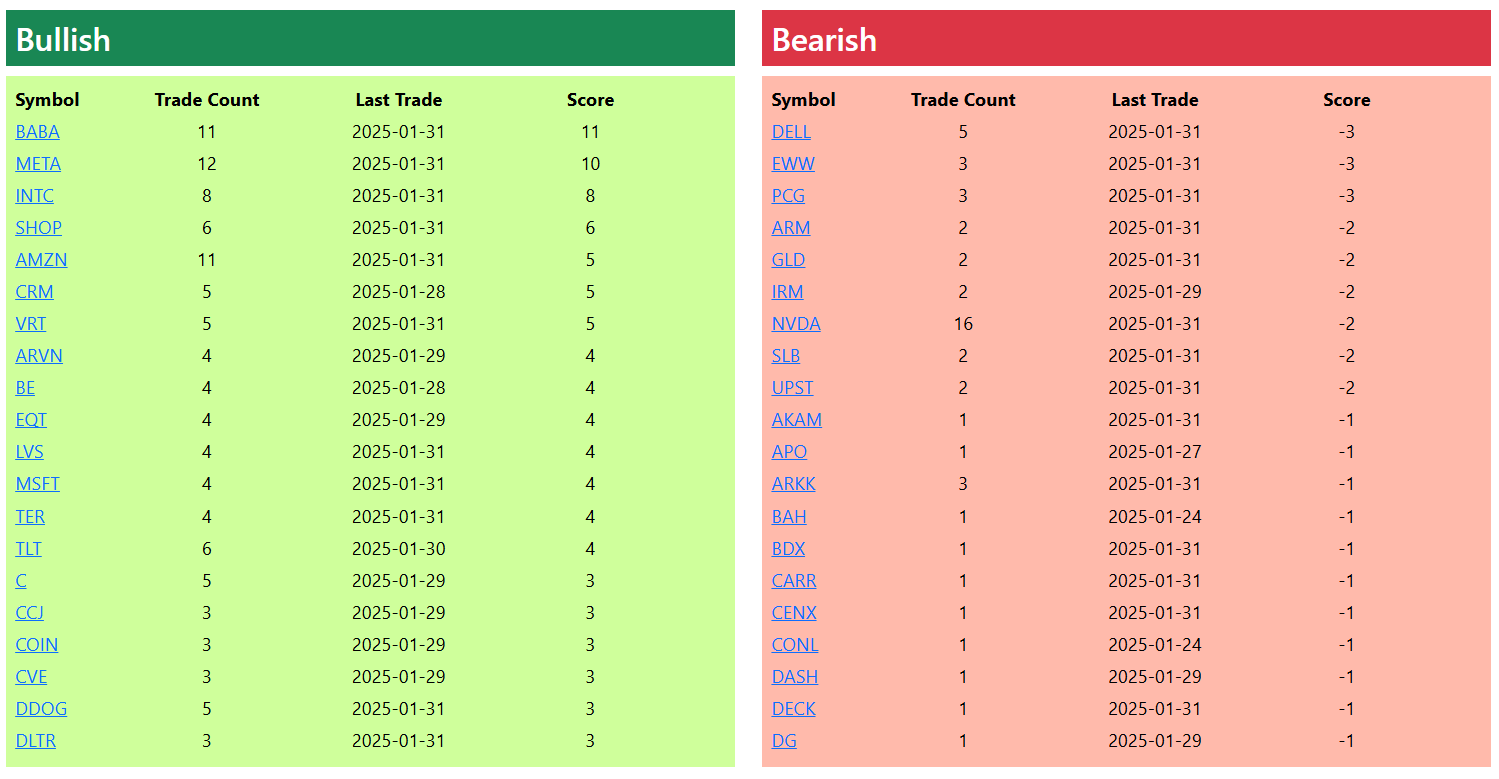

Bullish and Bearish Weekly Option Flow