TMTB EOD Wrap

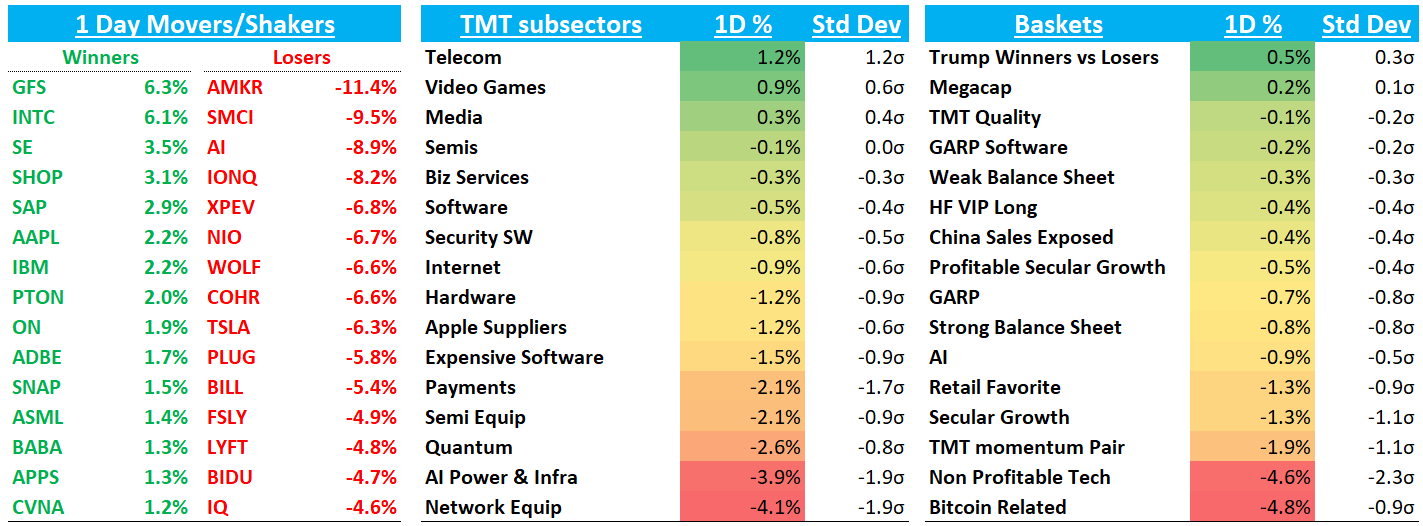

QQQs -22bps mainly held up by AAPL +2% as they announced plans with BABA +1.3% to develop AI for iPhones in China. Price action continues to be constructive post-earnings — not only from consumer facing companies but also from SMID Software. Today, it was SHOP +3% rallying from down 7% at one point shaking off a weaker Q1 FCF/GMV guide with a strong Q4 across the board. DASH and CFLT a couple of other ones this afternoon up on non-blow out prints (UPST +25% on a blow out). Regardless, lots of red on my screen today as ivnestors de-grossed ahead of the all important CPI print tomorrow morning (not META though - up 17 straight days!)

On the macro front, treasuries saw some selling pressure, w yields rising 1-4 bps across the curve as fed expects held steady pricing in ~36bps worth of cuts for the year.

Let’s get straight to it…

Internet

SHOP +3% on a very good Q4 with GMV +26%, revs +31% and FCF margin 22% although some nitpicked around Q1 GMV guide in mid 20s and FCF margin guide in mid teens vs street at ~18%.

BABA +1.3% on AAPL AI announcement / BIDU -4.7% as they had been speculated as an early partner but TheInformation reports they didn’t meet AAPL’s standards.

META +33bps: 17th straight day in the green

SNAP +1.5% despite Guggenheim’s downgrade

CHWY -1.4% despite some better 3coop data

AMZN -16bps / GOOGL -60bps / NFLX - 2% after Biz Insider announced they are eyeing video podcasts

RDDT - 5% ahead of earnings as expectations high heading into the print

Semis

ALAB -11% big beat and raise but lower GM # and higher opex hit the stock

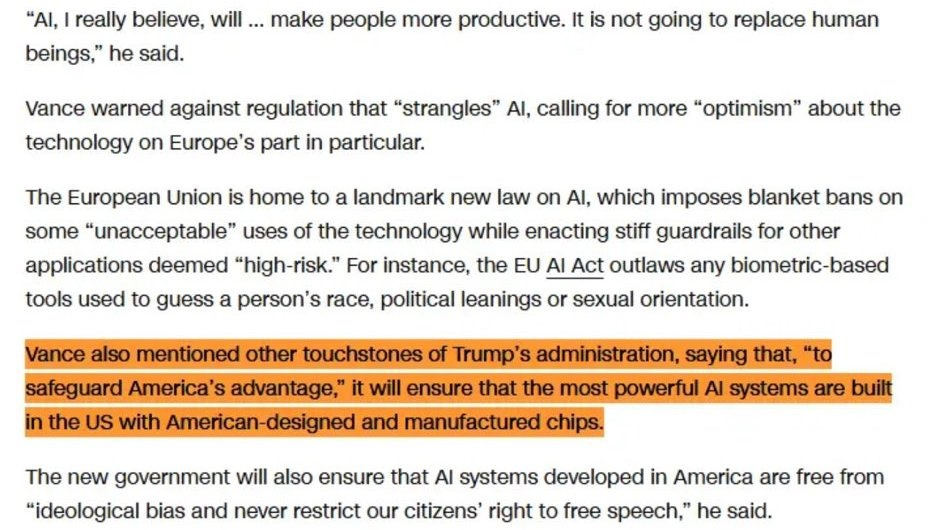

INTC +6% as most pointed to JD Vance’s comments from his speech today, promoting domestic AI chip production. GFS +6% in sympathy as well

AI names mixed: AMD +50bps; AVGO flat; NVDA - 60bps; MU - 2%; MRVL -3%; ANET - 3%

Analog names mixed: ON +2%; MCHP +1%; ADI -70bps; TXN -60bps

Software

Slow news day here…

SAP +3% to new ATHs

BILL -5% more follow through to the downside

ADBE +2% as investors are trying to warm up to the name here given strength in reasonably priced software names (ADBE trading at 20x) and SMB exposure. M-sci and Clev both positive trending checks this week. Bulls want to see CC NNARR stabilize in dd range and hear about some traction from FireFly / AI initiatives while bears continue to question ADBE’s position in an AI world and point to competition across various businesses.

HUBS -2.6% ahead of earnings this week

PLTR -3.5% finally a red day

Elsewhere

AAPL +2% as TheInformation said they were partnering with BABA on AI features in China and have submitted the features to China’s cyberspace regulator. China still an all important market for AAPL and sentiment has been subdued after last quarter’s miss (although they did call out better recent trends and Hon Hai called out better than expected momentum in iPhones in month of January this week) — this should help on that front as if you recall, Cook said iPhone outperformed in markets where AI was available by 3.5 ppts.

FSLR -80bps despite an upgrade at Mizuho

TSLA - 6% has lots most of its shine as Elon’s focuses has shifted elsewhere - Oppenheimer said increasing risk to street estimates given negative trends in registrations.

AI Links

Google Deepmind CEO at Paris AI on Youtube

Deepseek raises prices by 300% this week - Sina

JD Vance on AI at Paris AI Summit - X

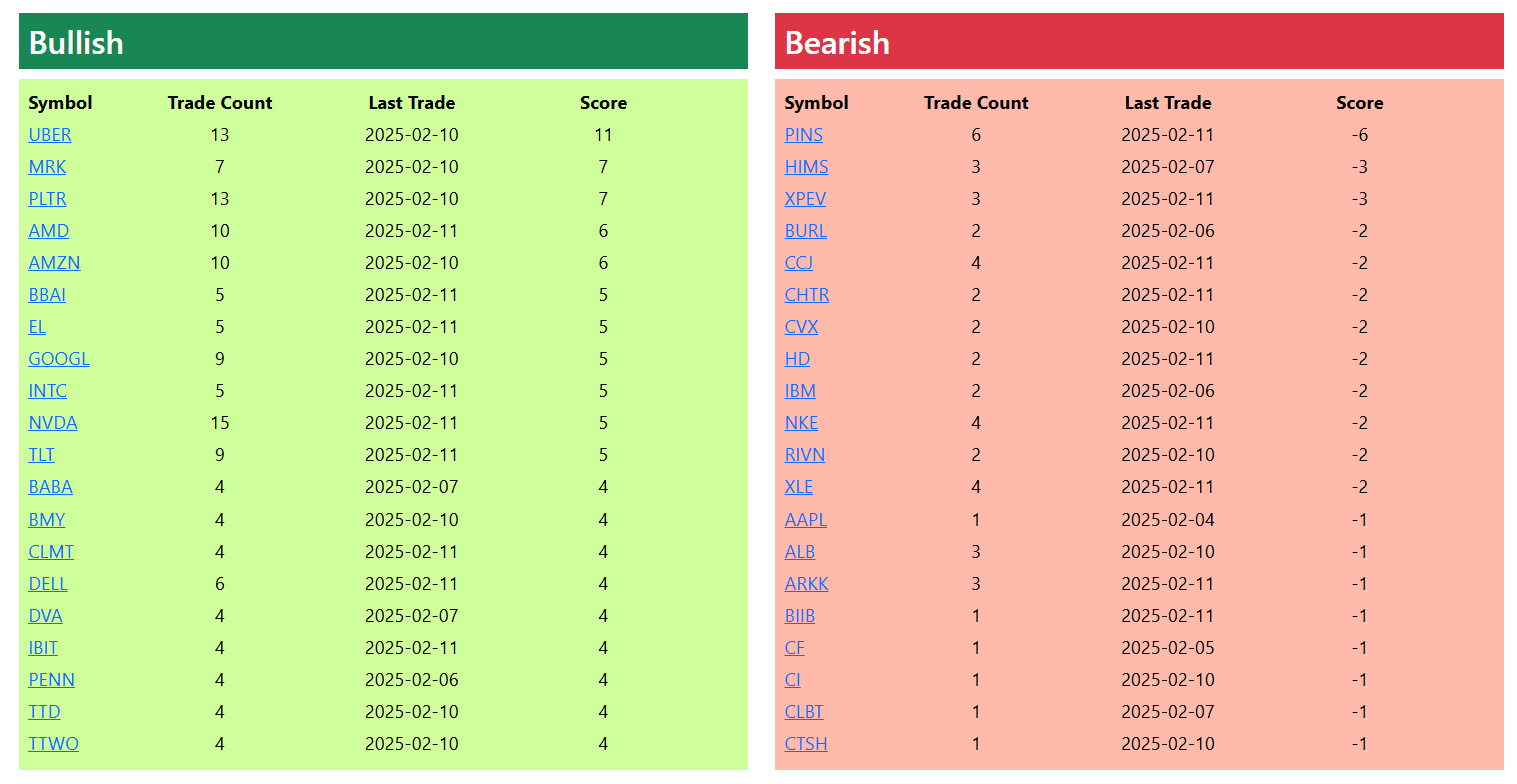

Bullish and Bearish Weekly Option Flow