cemagraphics

In the first five posts, I have looked at the macro numbers that drive global markets, from interest rates to risk premiums, but it is not my preferred habitat. I spend most of my time in the far less rarefied air of corporate finance and valuation, where businesses try to decide what projects to invest in, and investors attempt to estimate business value. A key tool in both endeavors is a hurdle rate – a rate of return that you determine as your required return for business and investment decisions. In this post, I will drill down to what it is that determines the hurdle rate for a business, bringing in what business it is in, how much debt it is burdened with and what geographies it operates in.

在前五篇文章中,我研究了驅動全球市場的宏觀數字,從利率到風險溢價,但這不是我偏好的領域。我大部分時間都花在公司財務和估值的較不稀薄的空氣中,企業試圖決定投資哪些項目,投資者則試圖估計企業價值。這兩項努力的關鍵工具是門檻率——你確定為企業和投資決策所需的回報率。在這篇文章中,我將深入探討決定企業門檻率的因素,包括企業所處的行業、其負擔的債務以及其運營的地理區域。

The Hurdle Rate - Intuition and Uses

You don't need to complete a corporate finance or valuation class to encounter hurdle rates in practice, usually taking the form of costs of equity and capital, but taking a finance class both deepens the acquaintance and ruins it. It deepens the acquaintance because you encounter hurdle rates in almost every aspect of finance, and it ruins it, by making these hurdle rates all about equations and models. A few years ago, I wrote a paper for practitioners on the cost of capital, where I described the cost of capital as the Swiss Army knife of finance, because of its many uses.

你不需要完成公司金融或估值課程就能在實踐中遇到障礙率,通常以股權成本和資本成本的形式出現,但參加金融課程既加深了對它的了解,也破壞了它。它加深了了解,因為你幾乎在金融的每個方面都會遇到障礙率,而它破壞了它,因為它讓這些障礙率變成了全是方程式和模型。幾年前,我為從業者寫了一篇關於資本成本的論文,在那裡我將資本成本描述為金融的瑞士軍刀,因為它的用途廣泛。

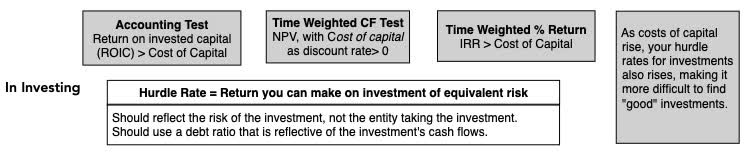

In my corporate finance class, where I look at the first principles of finance that govern how you run a business, the cost of capital shows up in every aspect of corporate financial analysis:

在我的公司財務課程中,我研究了財務的基本原則,這些原則決定了你如何經營一家企業,資本成本出現在公司財務分析的每個方面:

-

In business investing (capital budgeting and acquisition) decisions, it becomes a hurdle rate for investing, where you use it to decide whether and what to invest in, based on what you can earn on an investment, relative to the hurdle rate. In this role, the cost of capital is an opportunity cost, measuring returns you can earn on investments on equivalent risk.

在商業投資(資本預算和收購)決策中,它成為投資的門檻率,你用它來決定是否以及投資什麼,基於你能在投資中獲得的收益,相對於門檻率。在這個角色中,資本成本是一個機會成本,衡量你在同等風險的投資中可以獲得的回報。

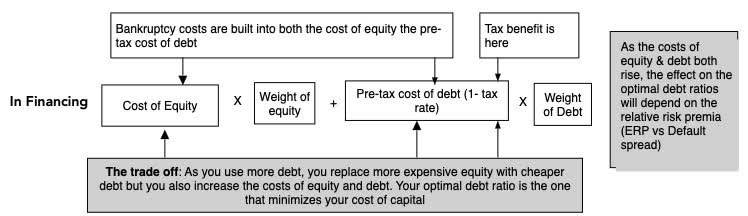

- In business financing decisions, the cost of capital becomes an optimizing tool, where businesses look for a mix of debt and equity that reduces the cost of capital, and where matching up the debt (in terms of currency and maturity) to the assets reduces default risk and the cost of capital. In this context, the cost of capital become a measure of the cost of funding a business:

在商業融資決策中,資本成本成為一個優化工具,企業尋找一種減少資本成本的債務和股權組合,並且將債務(在貨幣和期限方面)與資產匹配,以減少違約風險和資本成本。在這種情況下,資本成本成為衡量企業融資成本的指標:

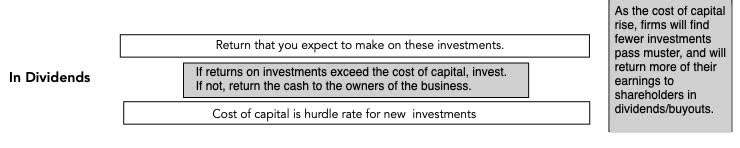

- In dividend decisions, i.e., the decisions of how much cash to return to owners and in what form (dividends or buybacks), the cost of capital is a divining rod. If the investments that a business is looking at earn less than the cost of capital, it is a trigger for returning more cash, and whether it should be in the form of dividends or buybacks is largely a function of what shareholders in that company prefer:

在股息決策中,即決定以何種形式(股息或回購)向所有者返還多少現金的決策中,資本成本是一個重要的指標。如果企業考慮的投資收益低於資本成本,這將成為返還更多現金的觸發因素,而應以股息還是回購的形式返還,很大程度上取決於該公司股東的偏好:

The end game in corporate finance is maximizing value, and in my valuation class, where I look at businesses from the outside (as a potential investor), the cost of capital reappears again as the risk-adjusted discount rate that you use estimate the intrinsic value of a business.

企業財務的最終目標是最大化價值,而在我的估值課程中,我從外部(作為潛在投資者)審視企業時,資本成本再次以風險調整後的折現率形式出現,用於估算企業的內在價值。

Much of the confusion in applying cost of capital comes from not recognizing that it morphs, depending on where it is being used. An investor looking at a company, looking at valuing the company, may attach one cost of capital to value the company, but within a company, but within a company, it may start as a funding cost, as the company seeks capital to fund its business, but when looking at investment, it becomes an opportunity cost, reflecting the risk of the investment being considered.

在應用資本成本時,許多混淆來自於未能認識到它會根據使用場合的不同而變化。投資者在評估一家公司時,可能會使用一個資本成本來估值,但在公司內部,它可能最初是作為融資成本出現,因為公司需要資本來資助其業務,但在考慮投資時,它則變成了機會成本,反映了所考慮投資的風險。

The Hurdle Rate - Ingredients

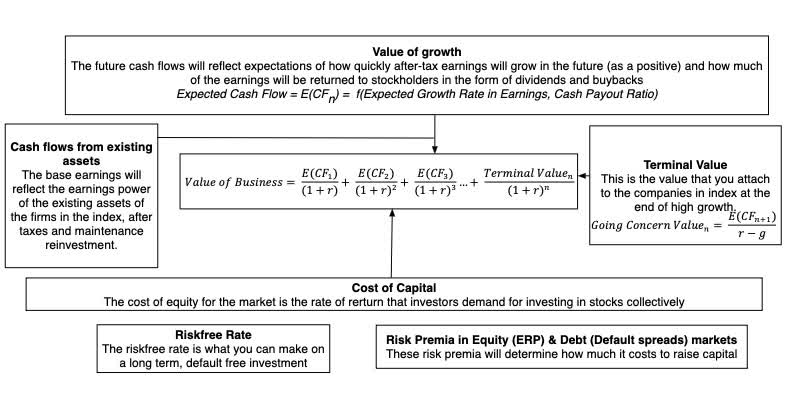

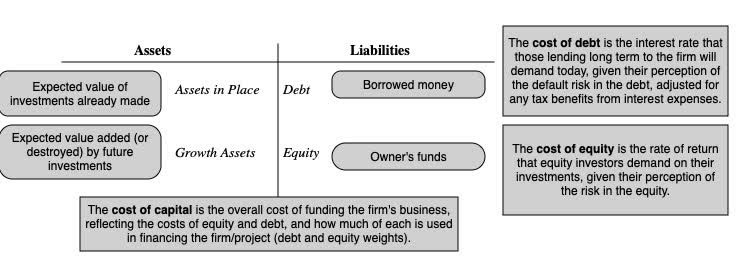

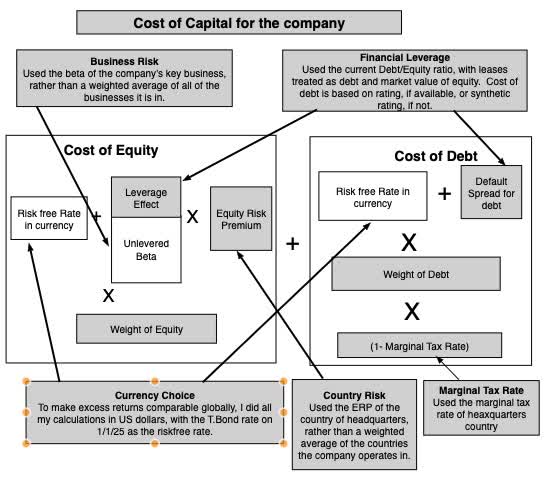

If the cost of capital is a driver of so much of what we do in corporate finance and valuation, it stands to reason that we should be clear about the ingredients that go into it. Using one of my favored structures for understanding financial decision making, a financial balance sheet, a cost of capital is composed of the cost of equity and the cost of debt, and I try to capture the essence of what we are trying to estimate with each one in the picture below:

如果資本成本是我們在公司財務和估值中所做許多事情的驅動力,那麼我們應該清楚其組成部分。使用我最喜歡的結構之一來理解財務決策,即財務資產負債表,資本成本由股權成本和債務成本組成,我試圖在下面的圖中捕捉我們試圖估計的每個要素的本質:

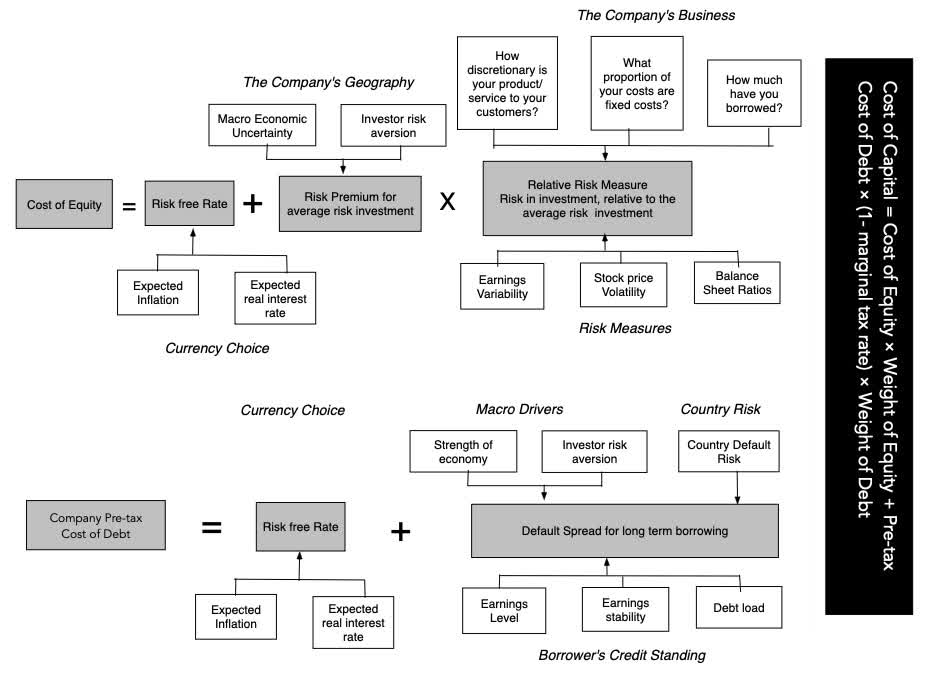

To go from abstractions about equity risk and default risk to actual costs, you have to break down the costs of equity and debt into parts, and I try to do so, in the picture below, with the factors that you underlie each piece:

要從關於股權風險和違約風險的抽象概念轉化為實際成本,你必須將股權和債務的成本分解成幾個部分,我試圖在下面的圖表中這樣做,並列出每個部分的基礎因素:

As you can see, most of the items in these calculations should be familiar, if you have read my first five data posts, since they are macro variables, having nothing to do with individual companies.

如你所見,這些計算中的大多數項目應該都很熟悉,如果你讀過我的前五篇數據文章,因為它們是宏觀變量,與個別公司無關。

- The first is, of course, the risk-free rate, a number that varies across time (as you saw in post on US treasury rates in data update 4) and across currencies (in my post on currencies in data update 5).

首先是無風險利率,這個數字隨著時間變化(如你在數據更新 4 中關於美國國債利率的帖子中所見)並隨著貨幣變化(如我在數據更新 5 中關於貨幣的帖子中所討論的)。 - The second set of inputs are prices of risk, in both the equity and debt markets, with the former measured by equity risk premiums, and the latter by default spreads. In data update 2, I looked at equity risk premiums in the United States, and expanded that discussion to equity risk premiums in the rest of the world in data update 5). In data update 4, I looked at movements in corporate default spreads during 2024.

第二組輸入是風險價格,包括股票市場和債務市場,前者以股票風險溢價衡量,後者以違約利差衡量。在數據更新 2 中,我研究了美國的股票風險溢價,並在數據更新 5 中將這一討論擴展到世界其他地區的股票風險溢價。在數據更新 4 中,我研究了 2024 年公司違約利差的變動。

There are three company-specific numbers that enter the calculation, all of which contribute to costs of capital varying across companies;

有三個公司特定的數字進入計算,這些都導致不同公司的資本成本有所不同;

-

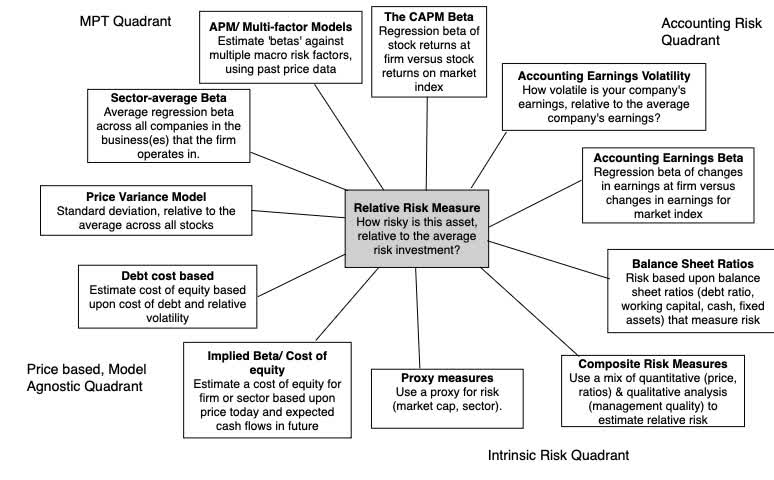

Relative Equity Risk, i.e., a measure of how risky a company's equity is, relative to the average company's equity. While much of the discussion of this measure gets mired in the capital asset pricing model, and the supposed adequacies and inadequacies of beta, I think that too much is made of it, and that the model is adaptable enough to allow for other measures of relative risk.

相對股權風險,即衡量一家公司的股權相對於平均公司股權的風險程度。雖然關於這一指標的討論大多陷入資本資產定價模型以及貝塔值的所謂充分性和不足之處,但我認為這被過分強調了,且該模型具有足夠的適應性,可以容納其他相對風險的衡量方式。

I am not a purist on this measure, and while I use betas in my computations, I am open to using alternate measures of relative equity risk.

我對這一衡量標準並非純粹主義者,雖然我在計算中使用貝塔值,但我對使用其他相對股權風險的衡量方法持開放態度。 - Corporate Default Risk, i.e, a measure of how much default risk there is in a company, with higher default risk translating into higher default spreads. For a fairly large subset of firms, a bond rating may stand in as this measure, but even in its absence, you have no choice but to estimate default risk. Adding to the estimation challenge is the fact that as a company borrows more money, it will play out in the default risk (increasing it), with consequences for both the cost of equity and debt (increasing both of those as well).

企業違約風險,即衡量一家公司存在多少違約風險的指標,違約風險越高,違約利差越大。對於相當大一部分公司而言,債券評級可作為此類衡量標準,但即便缺乏評級,您也別無選擇,只能估算違約風險。估算挑戰的加劇在於,隨著公司借款增加,這將反映在違約風險上(使其上升),並對股權成本和債務成本產生影響(兩者亦隨之增加)。 -

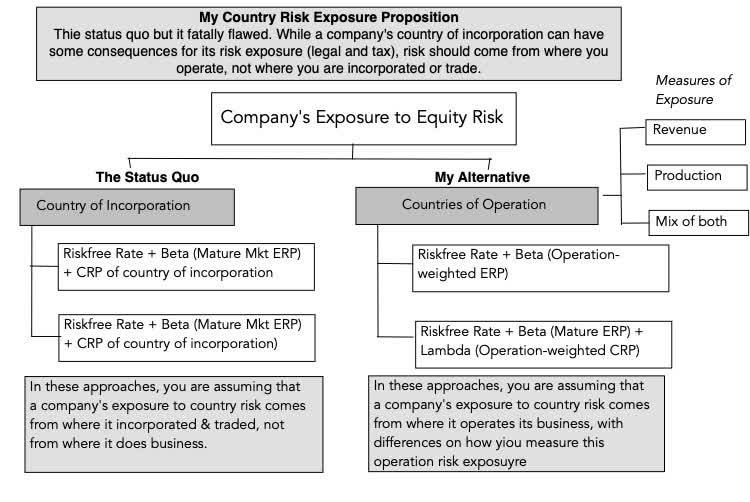

Operating geographies: The equity risk premium for a company does not come from where it is incorporated but from where it does business, both in terms of the production of its products and services and where it generates revenue. That said, the status quo in valuation in much of the world seems to be to base the equity risk premium entirely on the country of incorporation, and I vehemently disagree with that practice:

營運地理區域:公司的股權風險溢價並非來自其註冊地,而是來自其業務所在地,包括產品和服務的生產地以及收入產生地。話雖如此,全球許多地方的估值現狀似乎是完全基於註冊國來確定股權風險溢價,我強烈反對這種做法:

Again, I am flexible in how operating risk exposure is measured, basing it entirely on revenues for consumer product and business service companies, entirely on production for natural resource companies and a mix of revenues and production for manufacturing companies.

再次強調,我對於營運風險暴露的衡量方式持靈活態度,對於消費品和商業服務公司完全基於收入,對於自然資源公司完全基於產量,而對於製造業公司則基於收入和產量的混合。

As you can see, the elements that go into a cost of capital are dynamic and subjective, in the sense that there can be differences in how one goes about estimating them, but they cannot be figments of your imagination.

如你所見,資本成本的組成要素是動態且主觀的,因為在估算這些要素時可能存在差異,但它們不能是你想像中的虛構之物。

The Hurdle Rate - Estimation in 2025

With that long lead in, I will lay out the estimation choices I used to estimate the costs of equity, debt and capital for the close to 48,000 firms in my sample. In making these choices, I operated under the obvious constraint of the raw data that I had on individual companies and the ease with which I could convert that data into cost of capital inputs.

經過這麼長的鋪墊,我將列出我用來估算樣本中近 48,000 家公司的股權成本、債務成本和資本成本的估算選擇。在做出這些選擇時,我受到個別公司原始數據的明顯限制,以及將這些數據轉換為資本成本輸入的便利性的影響。

- Risk-free rate: To allow for comparisons and consolidation across companies that operate in different currencies, I chose to estimate the costs of capital for all companies in US dollars, with the US ten-year treasury rate on January 1, 2025, as the risk-free rate.

無風險利率:為了允許在不同貨幣運營的公司之間進行比較和整合,我選擇以美元估算所有公司的資本成本,並以 2025 年 1 月 1 日的美國十年期國債利率作為無風險利率。 - Equity Risk Premium: Much as I would have liked to compute the equity risk premium for every company, based upon its geographic operating exposure, the raw data did not lend itself easily to the computation. Consequently, I have used the equity risk premium of the country in which a company is headquartered to compute the equity risk premium for it.

股權風險溢價:儘管我很想根據每家公司的地理運營風險來計算股權風險溢價,但原始數據並不容易進行這種計算。因此,我使用了公司總部所在國家的股權風險溢價來計算其股權風險溢價。 - Relative Equity Risk: I stay with beta, notwithstanding the criticism of its effectiveness for two reasons. First, I use industry average betas, adjusted for leverage, rather than the company regression beta, because because the averages (I title them bottom up betas) are significantly better at explaining differences in returns across stocks. Second, and given my choice of industry average betas, none of the other relative risk measures come close, in terms of predictive ability. For individual companies, I do use the beta of their primary business as the beta of the company, because the raw data that I have does not allow for a breakdown into businesses.

相對股權風險:儘管對其有效性存在批評,我仍然堅持使用貝塔值,原因有兩個。首先,我使用行業平均貝塔值,並根據槓桿進行調整,而不是公司回歸貝塔值,因為這些平均值(我稱之為自下而上的貝塔值)在解釋股票回報差異方面表現得更好。其次,考慮到我選擇的行業平均貝塔值,其他相對風險指標在預測能力方面都無法與之相比。對於個別公司,我確實使用其主要業務的貝塔值作為公司的貝塔值,因為我擁有的原始數據不允許按業務進行細分。 - Corporate default risk: For the subset of the sample of companies with bond ratings, I use the S&P bond rating for the company to estimate the cost of debt. For the remaining companies, I use interest coverage ratios as a first measure to estimate synthetic ratings, and standard deviation in stock prices as back-up measure.

公司違約風險:對於具有債券評級的樣本公司子集,我使用標準普爾的債券評級來估計債務成本。對於其餘公司,我首先使用利息覆蓋率來估計合成評級,並使用股價的標準差作為備用指標。 - Debt mix: I used the market capitalization to measure the market value of equity, and stayed with total debt (including lease debt) to estimate debt to capital and debt to equity ratios

債務組合:我使用市值來衡量股權的市場價值,並使用總債務(包括租賃債務)來估計債務與資本比率和債務與股權比率

The picture below summarizes my choices:

下圖總結了我的選擇:

There are clearly approximations that I used in computing these global costs of capital that I would not use if I were computing a cost of capital for valuing an individual company, but this approach yields values that can yield valuable insights, especially when aggregated and averaged across groups.

在計算這些全球資本成本時,我顯然使用了一些近似值,這些近似值在計算個別公司估值所需的資本成本時不會使用,但這種方法得出的數值可以提供有價值的見解,尤其是在跨群體進行匯總和平均時。

a. Sectors and Industries

a. 行業與產業

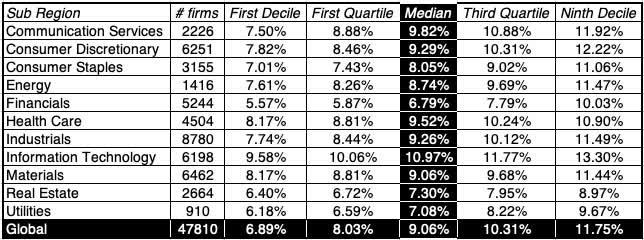

The risks of operating a business will vary widely across different sectors, and I will start by looking at the resulting differences in cost of capital, across sectors, for global companies:

經營企業的風險在不同行業之間會有很大差異,我將首先探討全球企業在不同行業中的資本成本差異:

There are few surprises here, with technology companies facing the highest costs of capital and financials the lowest, with the former pushed up by high operating risk and a resulting reliance on equity for capital, and the latter holding on because of regulatory protection.

這裡沒有太多意外,科技公司面臨最高的資本成本,而金融業則最低,前者因高營運風險和對股權資本的依賴而被推高,後者則因監管保護而得以維持。

Broken down into industries, and ranking industries from highest to lowest costs of capital, here is the list that emerges:

按行業細分,並從資本成本最高到最低排名,以下是出現的清單:

The numbers in these tables may be what you would expect to see, but there are a couple of powerful lessons in there that businesses ignore at their own peril. The first is that even a casual perusal of differences in costs of capital across industries indicates that they are highest in businesses with high growth potential and lowest in mature or declining businesses, bringing home again the linkage between danger and opportunity. The second is that multi-business companies should understand that the cost of capital will vary across businesses, and using one corporate cost of capital for all of them is a recipe for cross subsidization and value destruction.

這些表格中的數字可能是您預期會看到的,但其中有幾個強大的教訓,企業若忽視將自食其果。首先,即使隨意瀏覽不同行業的資本成本差異,也能看出高增長潛力的企業資本成本最高,而成熟或衰退的企業則最低,這再次凸顯了風險與機會之間的關聯。其次,多元化企業應理解到,不同業務的資本成本會有所不同,若對所有業務使用單一的企業資本成本,將導致交叉補貼和價值破壞。

b. Small versus Larger firms

b. 小型公司與大型公司

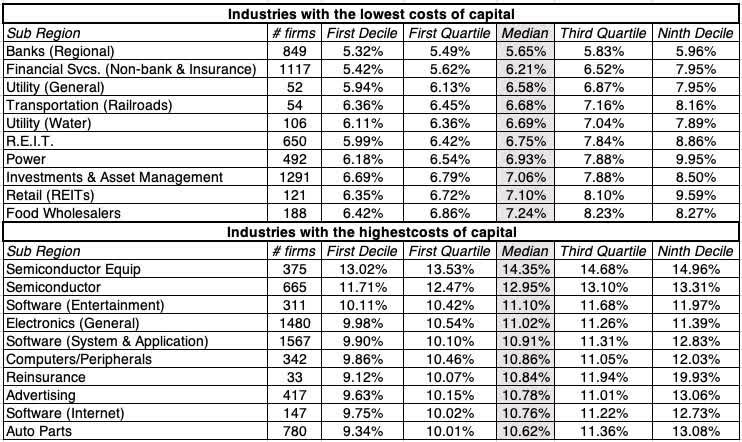

In my third data update for this year, I took a brief look at the small cap premium, i.e, the premium that small cap stocks have historically earned over large cap stocks of equivalent risk, and commented on its disappearance over the last four decades. I heard from a few small cap investors, who argued that small cap stocks are riskier than large cap stocks, and should earn higher returns to compensate for that risk. Perhaps, but that has no bearing on whether there is a small cap premium, since the premium is a return earned over and above what you would expect to earn given risk, but I remained curious as to whether the conventional wisdom that small cap companies face higher hurdle rates is true. To answer this question, I examine the relationship between risk and market cap, breaking companies down into market cap deciles at the start of 2025, and estimating the cost of capital for companies within each decile:

在我今年的第三次數據更新中,我簡要地看了一下小型股的溢價,即小型股歷史上相對於同等風險的大型股所獲得的溢價,並評論了它在過去四十年中的消失。我聽到一些小型股投資者認為,小型股比大型股風險更高,應該獲得更高的回報來補償這種風險。也許是這樣,但這與是否存在小型股溢價無關,因為溢價是在考慮風險後所獲得的額外回報,但我仍然好奇傳統觀點認為小型公司面臨更高的門檻利率是否屬實。為了解答這個問題,我研究了風險與市值之間的關係,將公司在 2025 年初按市值分為十分位,並估計每個十分位內公司的資本成本:

The results are mixed. Looking at the median costs of capital, there is no detectable pattern in the cost of capital, and the companies in the bottom decile have a lower median cost of capital (8.88%) than the median company in the sample (9.06%). That said, the safest companies in largest market cap decile have lower costs of capital than the safest companies in the smaller market capitalizations. As a generalization, if small companies are at a disadvantage when they compete against larger companies, that disadvantage is more likely to manifest in difficulties growing and a higher operating cost structure, not in a higher hurdle rate.

結果好壞參半。從資本成本的中位數來看,資本成本並無明顯規律,且位於最低十分位數的公司其中位數資本成本(8.88%)低於樣本中位數公司(9.06%)。話雖如此,市值最大十分位數中最安全的公司其資本成本低於市值較小的最安全公司。一般而言,若小型公司在與大型公司競爭時處於劣勢,這種劣勢更可能體現在成長困難和較高的營運成本結構上,而非較高的門檻利率。

c. Global Distribution c. 全球分佈

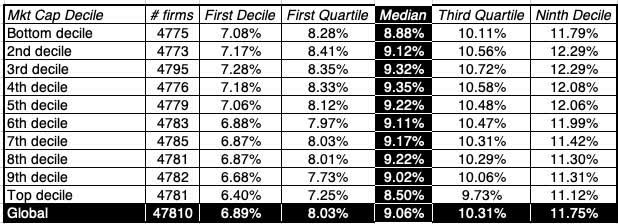

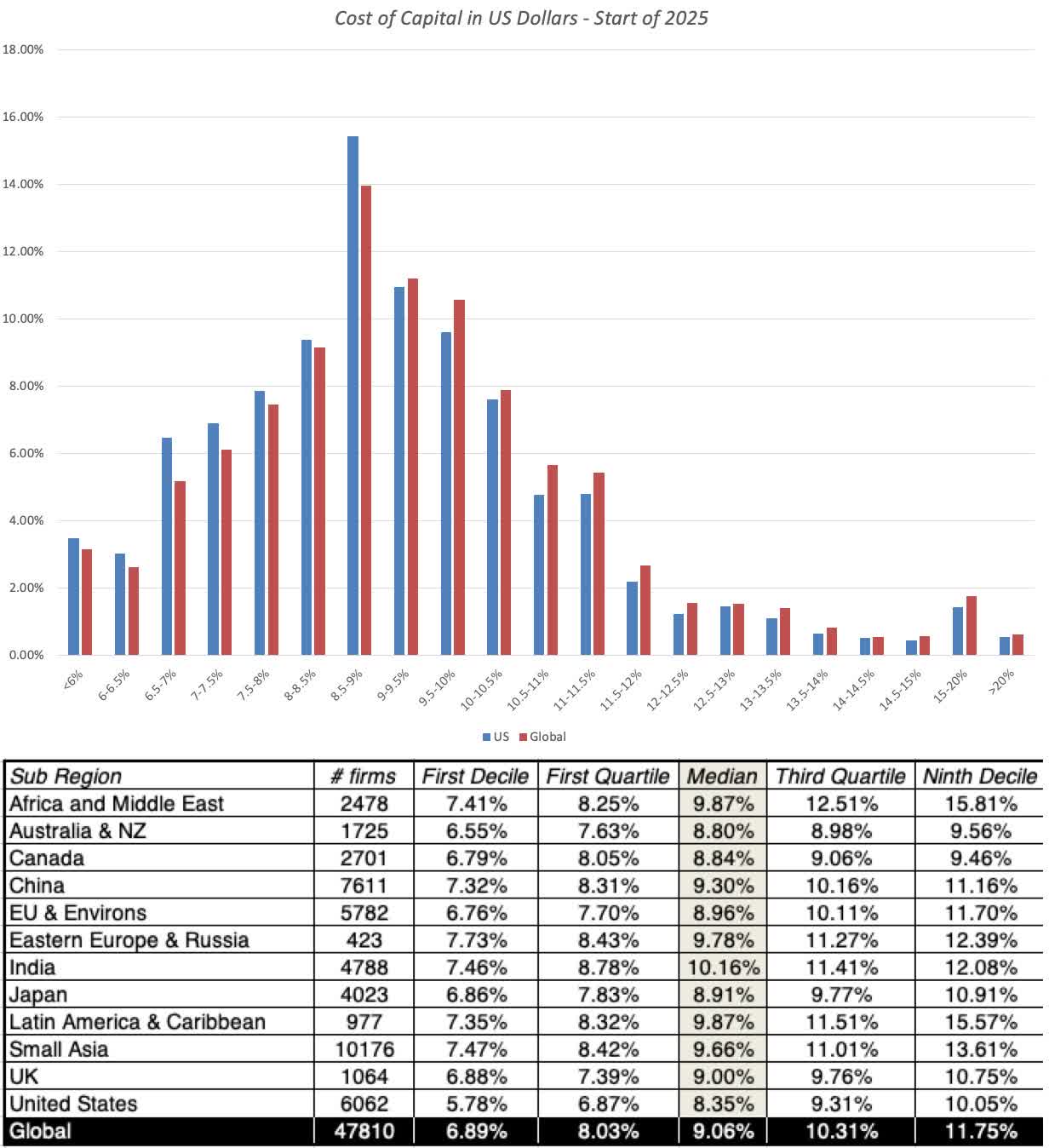

In the final part of this analysis, I looked at the costs of capital of all publicly traded firms and played some Moneyball, looking at the distribution of costs of capital across all firms. In the graph below,I present the histogram of cost of capital, in US dollar terms, of all global companies at the start of 2025, with a breakdown of costs of capital, by region, below:

在這份分析的最後部分,我查看了所有上市公司的資本成本,並進行了一些「魔球」分析,觀察所有公司的資本成本分佈。在下圖中,我展示了 2025 年初所有全球公司以美元計價的資本成本直方圖,並在下方按地區細分了資本成本:

I find this table to be one of the most useful pieces of data that I possess and I use it in almost every aspect of corporate finance and valuation:

我發現這張表格是我所擁有最有用的數據之一,我幾乎在企業財務和估值的每個方面都會使用它:

- Cost of capital calculation: The full cost of capital calculation is not complex, but it does require inputs about operating risk, leverage and default risk that can be hard to estimate or assess for young companies or companies with little history (operating and market). For those companies, I often use the distribution to estimate the cost of capital to use in valuing the company. Thus, when I valued Uber in June 2014, I used the cost of capital (12%) at the 90th percentile of US companies, in 2014, as Uber's cost of capital. Not only did that remove a time consuming task from my to-do list, but it also allowed me to focus on the much more important questions of revenue growth and margins for a young company. Drawing on my fifth data update, where I talk about differences across currencies, this table can be easily modified into the currency of your choice, by adding differential inflation. Thus, if you are valuing an Indian IPO, in rupees, and you believe it is risky, at the start of 2025, adding an extra 2% (for the inflation differential between rupees and dollars in 2025) to the ninth decile of Indian costs of capital (12.08% in US dollars) will give you a 14.08% Indian rupee cost of capital.

資本成本計算:完整的資本成本計算並不複雜,但它確實需要關於運營風險、槓桿和違約風險的輸入,這些對於年輕公司或歷史較短(運營和市場)的公司來說可能難以估計或評估。對於這些公司,我經常使用分佈來估計用於公司估值的資本成本。因此,當我在 2014 年 6 月對 Uber 進行估值時,我使用了 2014 年美國公司第 90 百分位的資本成本(12%)作為 Uber 的資本成本。這不僅從我的待辦事項清單中移除了一項耗時的任務,還使我能夠專注於年輕公司更重要的收入增長和利潤率問題。根據我的第五次數據更新,其中我談到了不同貨幣之間的差異,通過添加通脹差異,這個表格可以輕鬆修改為您選擇的貨幣。因此,如果您正在以盧比對印度 IPO 進行估值,並且您認為它在 2025 年初具有風險,那麼在印度資本成本的第九個十分位數(以美元計為 12.08%)上增加 2%(考慮到 2025 年盧比和美元之間的通脹差異),將為您提供 14.08%的印度盧比資本成本。 - Fantasy hurdle rates: In my experience, many investors and companies make up hurdle rates, the former to value companies and the latter to use in investment analysis. These hurdle rates are either hopeful thinking on the part of investors who want to make that return or reflect inertia, where they were set in stone decades ago and have never been revisited. In the context of checking to see whether a valuation passes the 3P test (Is it possible? Is it plausible? Is it probable?), I do check the cost of capital used in the valuation. A valuation in January 2025, in US dollars, that uses a 15% cost of capital for a publicly traded company that is mature is fantasy (since it is in well in excess of the 90th percentile), and the rest of the valuation becomes moot.

幻想中的門檻利率:根據我的經驗,許多投資者和公司會編造門檻利率,前者用於評估公司價值,後者用於投資分析。這些門檻利率要么是投資者希望實現回報的樂觀想法,要么反映了惰性,即它們在幾十年前就被固定下來,從未被重新審視。在檢查估值是否通過 3P 測試(是否可能?是否合理?是否可能?)的背景下,我確實會檢查估值中使用的資本成本。2025 年 1 月以美元計價的估值,對一家成熟的上市公司使用 15%的資本成本是幻想(因為它遠遠超過第 90 百分位),而估值的其餘部分就變得無關緊要了。 - Time-varying hurdle rates: When valuing companies, I believe in maintaining consistency, and one of the places I would expect it to show up is in hurdle rates that change over time, as the company's story changes. Thus, if you are valuing a money-losing and high growth company, you would expect its cost of capital to be high, at the start of the valuation, but as you build in expectations of lower growth and profitability in future years, I would expect the hurdle rate to decrease (from close to the ninth decile in the table above towards the median).

時變障礙率:在評估公司價值時,我相信保持一致性,而其中一個我期望能體現這一點的地方,就是隨著公司故事的變化而變化的障礙率。因此,如果你正在評估一家虧損且高增長的公司,你會預期其資本成本在評估初期會很高,但隨著你對未來幾年增長和盈利能力降低的預期,我預計障礙率會下降(從接近上表中的第九十分位數向中位數靠攏)。

It is worth emphasizing that since my risk-free rate is always the current rate, and my equity risk premiums are implied, i.e., they are backed out from how stocks are priced, my estimates of costs of capital represent market prices for risk, not theoretical models. Thus, if looking at the table, you decide that a number (median for your region, 90th percentile in US) look too low or too high, your issues are with the market, not with me (or my assumptions).

值得強調的是,由於我的無風險利率始終是當前利率,而我的股權風險溢價是隱含的,即它們是從股票定價方式中反推出來的,因此我對資本成本的估計代表了市場對風險的定價,而非理論模型。因此,如果你查看表格時認為某個數字(你所在區域的中位數,美國的第 90 百分位數)看起來過低或過高,那麼你的問題在於市場,而非我(或我的假設)。

Takeaways 要點

I am sorry that this post has gone on as long as it has, but to end, there are four takeaways from looking at the data:

我很抱歉這篇文章已經寫了這麼長,但最後,從數據中我們可以得出四個要點:

- Corporate hurdle rate: The notion that there is a corporate hurdle rate that can be used to assess investments across the company is a myth, and one with dangerous consequences. It plays out in all divisions in a multi-business company using the same (corporate) cost of capital and in acquisitions, where the acquiring firm's cost of capital is used to value the target firm. The consequences are predictable and damaging, since with this practice, safe businesses will subsidize risky businesses, and over time, making the company riskier and worse off over time.

企業門檻利率:認為有一個可以用來評估公司所有投資的企業門檻利率的想法是一個神話,並且具有危險的後果。這在多業務公司中表現為所有部門使用相同的(企業)資本成本,以及在收購中,收購公司的資本成本被用來評估目標公司。這種做法的後果是可預見且有害的,因為這樣做會使安全的業務補貼風險高的業務,隨著時間的推移,公司會變得更加風險高且狀況更糟。 - Reality check on hurdle rates: All too often, I have heard CFOs of companies, when confronted with a cost of capital calculated using market risk parameters and the company's risk profile, say that it looks too low, especially in the decade of low interest rates, or sometimes, too high, especially if they operate in an risky, high-interest rate environment. As I noted in the last section, making up hurdle rates (higher or lower than the market-conscious number) is almost never a good idea, since it violates the principle that you have live and operate in the world/market you are in, not the one you wished you were in.

對障礙利率的現實檢驗:我經常聽到公司的財務總監在面對使用市場風險參數和公司風險狀況計算出的資本成本時,表示這個數字看起來太低,特別是在低利率的十年間,或者有時看起來太高,尤其是如果他們在一個高風險、高利率的環境中運營。正如我在上一節中指出的,編造障礙利率(高於或低於市場意識的數字)幾乎從來不是一個好主意,因為這違背了你在現實世界/市場中生活和運營的原則,而不是你希望的那個世界。 - Hurdle rates are dynamic: In both corporate and investment settings, there is this almost desperate desire for stability in hurdle rates. I understand the pull of stability, since it is easier to run a business when hurdle rates are not volatile, but again, the market acts as a reality check. In a world of volatile interest rates and risk premia, using a cost of capital that is a constant is a sign of denial.

門檻利率是動態的:無論是在企業還是投資環境中,人們都對門檻利率的穩定性有著近乎迫切的渴望。我理解穩定的吸引力,因為當門檻利率不波動時,經營企業會更容易,但市場再次作為現實的檢驗。在利率和風險溢價波動的世界中,使用恆定的資本成本是一種否認的表現。 - Hurdle rates are not where business/valuation battles are won or lost: It is true that costs of capital are the D in a DCF, but they are not and should never be what makes or breaks a valuation. In my four decades of valuation, I have been badly mistaken many times, and the culprit almost always has been an error on forecasting growth, profitability or reinvestment (all of which lead into the cash flows), not the discount rate. In the same vein, I cannot think of a single great company that got to greatness because of its skill in finessing its cost of capital, and I know of plenty that are worth trillions of dollars, in spite of never having actively thought about how to optimize their costs of capital. It follows that if you are spending the bulk of your time in a capital budgeting or a valuation, estimating discount rates and debating risk premiums or betas, you have lost the script. If you are valuing a mature US company at the start of 2025, and you are in a hurry (and who isn't?), you would be well served using a cost of capital of 8.35% (the median for US companies at the start of 2025) and spending your time assessing its growth and profit prospects, and coming back to tweak the cost of capital at the end, if you have the time.

門檻利率並非決定商業/估值戰役勝負的關鍵:確實,資本成本是 DCF 中的 D,但它們並非也不應成為決定估值成敗的因素。在我四十年的估值生涯中,我曾多次犯下嚴重錯誤,而罪魁禍首幾乎總是對增長、盈利能力或再投資(這些都影響現金流)的預測錯誤,而非折現率。同樣地,我無法想到任何一家偉大的公司是因為擅長調整其資本成本而達到偉大的,而且我知道有許多公司價值數萬億美元,儘管它們從未積極考慮如何優化其資本成本。因此,如果你在資本預算或估值中花費大部分時間來估算折現率並討論風險溢價或貝塔值,那麼你就偏離了重點。如果你在 2025 年初為一家成熟的美國公司估值,並且你時間緊迫(誰不是呢?),使用 8.35%的資本成本(2025 年初美國公司的中位數)並將時間用於評估其增長和盈利前景,如果有時間,最後再回來調整資本成本,這將是一個明智的做法。

Data Updates for 2025 2025 年數據更新

- Data Update 1 for 2025: The Draw (and Danger) of Data!

2025 年數據更新 1:數據的吸引力(與危險)! - Data Update 2 for 2025: The Party continued for US Equities

2025 年數據更新 2:美國股市派對繼續 - Data Update 3 for 2025: The times they are a'changin'!

2025 年數據更新 3:時代正在改變! - Data Update 4 for 2025: Interest Rates, Inflation and Central Banks!

2025 年數據更新 4:利率、通脹與中央銀行! - Data Update 5 for 2025: It's a small world, after all!

2025 年數據更新 5:畢竟這是一個小世界! - Data Update 6 for 2025: From Macro to Micro - The Hurdle Rate Question!

2025 年數據更新 6:從宏觀到微觀——門檻利率問題!

Data Links 數據鏈接

- Cost of capital, by industry grouping: US, Global, Emerging Markets, Japan, Europe, India, China)

資本成本,按行業分組:美國、全球、新興市場、日本、歐洲、印度、中國 - Cost of capital distribution, by industry

資本成本分佈,按行業

Paper links 紙張連結

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

編輯註:本文的摘要點由 Seeking Alpha 編輯選擇。

Comments (1)

可能在 SA 上很少有人閱讀 Damodaran 教授不時在此發表的優秀作品,但它觸及了大多數 SA 參與者希望做的事情的核心,即通過投資獲得回報率,但在可接受的風險水平下(每位投資者可能對如何定義回報和風險以及什麼是滿意的結果有不同的看法)。他對這些概念的討論,以及維持應用這些概念所需的大量統計數據,非常有價值。

I have been extensively involved with these subjects ( my academic career, teaching as an adjunct professor and financial consultant, as an investment banker, as a corporate board director, but critically as a 70 years personal investor ).

我廣泛參與了這些領域(我的學術生涯、作為兼職教授和財務顧問的教學、作為投資銀行家、作為公司董事會成員,但最重要的是作為一名 70 年的個人投資者)。

I frequently have made the comment related to specific valuation opinions on SA that I deem unrealistically high that one of the reasons ( but not the only one ) for such results is unrealistically low discount rates ( too low WACC derived from the wrong inputs to the standard formulas ). The Professor's linked paper on cost of capital explores these issues in depth.

我經常在 SA 上對特定估值意見發表評論,認為這些意見高得不切實際,其中一個原因(但不是唯一的原因)是折現率低得不切實際(從標準公式的錯誤輸入中得出的 WACC 太低)。教授關於資本成本的連結論文深入探討了這些問題。