TMTB Morning Wrap

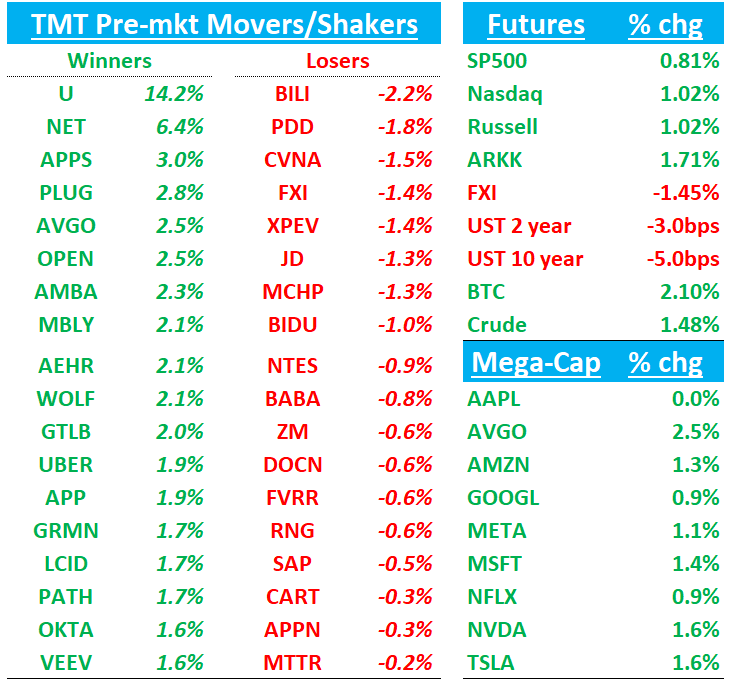

And we’re back! QQQs +1% shaking off some of the late December weakness this morning. BTC +2% starting off the year strong while China -2% faring less well on weaker mfg and retail sales numbers. Yields are ticking down 3-5bps across the curve.

TSLA deliveries will be out around 9am with bogeys a little over 500k. >515k would be viewed positively as would imply TSLA will hit their guide.

Good to be back. Let’s get straight to it…

AAPL: Apple offers iPhone discounts in China as competition intensifies

Apple is offering rare discounts of up to 500 yuan ($68.50) on its latest iPhone models in China, as the U.S. tech giant moves to defend its market share against rising competition from domestic rivals like Huawei.

The four-day promotion, running from Jan. 4-7, applies to several iPhone models when purchased using specific payment methods, according to its website.

The flagship iPhone 16 Pro with a starting price of 7,999 yuan and the iPhone 16 Pro Max with a starting price of 9,999 yuan will see the highest discount of 500 yuan. The iPhone 16 and iPhone 16 Plus will receive a 400 yuan reduction.

AAPL: UBS cuts estimates below street on iPhone data

UBS analyst David Vogt lowers iPhone estimates following weak sell-through data, with November's 8% Y/Y decline prompting December quarter unit forecast reduction to 74M from 77M ($67.2B from $69.7B revenue). UBS now projects 4% Y/Y revenue decline versus previous flat outlook and consensus +2%. UBS notes a slight offset from Services strength on AppStore performance but overall Q4 estimates reduced: revenue to $120.8B from $123.3B (below $124.9B consensus) and EPS to $2.25 from $2.31 (below $2.36 consensus). Maintains Neutral rating with $236 target.

NVDA: BAML reiterates Buy and $190 PT ahead of CES / Bernstein Asia analysts cautious / GB300 News

BAML reiterates Buy on NVIDIA (top sector pick) ahead of January 6 CES keynote. While major themes previewed in media, BAML views event as positive catalyst reinforcing platform leadership. Specifically, BAML expects updates across multiple areas: robotics strategy (Jetson Thor) and 'physical AI' development, RTX 50xx/Blackwell gaming cards with neural rendering and GDDR7, potential AI PC entry through partnership or CPU offering, and datacenter portfolio including current Blackwell (GB200/B200), upgraded H2 variants (GB300/B300 with 288GB HBM3E), and next-gen Rubin preview.

Bernstein Asia analyst out more cautious on shipments as she sees risks of decelerating hyperscale capex/slowing order growth in end-2025/early 2026 as co’s dial in on monetization and more cautious on Blackwell Ultra ramp given FB200 delays and sees potential of GB300 shipments pushed to 2026. She models approximately 28K GB200 NVL72-equivalent shipments for year versus buy-side expectations of 30-40K and notes investors reducing estimates based on supply chain checks suggesting only ~10K H1'25 shipments due to Blackwell ramp challenges.

Lots of News out on GB300 over the last few days. Key points: Expected announcement at March 17 GTC, featuring significant upgrades: increased memory to 288GB HBM3e (from 192GB), expanded 12-layer architecture, and new LPCAMM computing motherboard. Power consumption reaches 1,400 watts with networking speed doubled to 1.6 Tbps via ConnectX 8 upgrade. New design elements include revised slot configuration and capacitor tray (300+ supercapacitors at $20-25 each), optional $1,500 battery backup. Key performance improvement includes 50% FP4 boost versus GB200, optimizing AI inference through reduced precision and power consumption.

NFLX’s Squid Game season 2 racked up 68 million views in its premiere week (biggest debut ever.

U +9%: RoaringKitty tweeted a picture of Rick James, who has a song called “Unity”

Recalls this follows a previous tweet of Time Magazine Cover refercing Unity as well

UBER: JMP downgrades to Hold

JMP downgrades to Hold citing the industry's shift toward autonomous vehicles. They highlight Waymo's rapid scaling and strong capital position in the AV rideshare market, suggesting superior consumer experience. While Waymo's current impact remains minimal, JMP believes Uber's valuation will be constrained until it better addresses AV transition. The anticipated hybrid marketplace model (1P & 3P) introduces significant execution risk. With potential AV regulations favoring Tesla in 2025, JMP considers Uber shares fairly valued and awaits clarity on the company's technology transition strategy.

UBER: Uber added to US Conviction List at Goldman Sachs

Goldman Sachs added Uber to their US Conviction List, maintaining a Buy rating with a $96 target. Analysts believe Uber can deliver on its February 2024 investor commitments despite AV competition. They cite expanding markets, improving profitability, and platform synergies driving sustained growth, margins, and free cash flow.

META: JMP Raises PT to $750 (from $660)

JMP sees Meta's growth beyond 2025 driven by chatbot integration in messaging ads, Meta AI's search capabilities, and future XR potential. They expect Meta's stock to rerate as XR opportunities materialize, offsetting current investment-related headwinds. The firm raised its target price to $750 from $660, using 26x 2026E GAAP EPS (up from 23x) to reflect Reality Labs' potential despite current losses. This premium multiple is justified by Meta's leadership in AI, XR, and social engagement.

MRVL/AVGO: Jefferies Fubon discusses ASIC outlook

Jefferies ntoes Alchip's Trainium 3 design submitted to TSMC for samples, targeting April-May 2025 design completion. At $2,800 per chip with 10% turnkey fee, 70,000 CoWoS wafers could generate $2.1bn FY26 revenue. Jefferies notes AWS's CoWoS capacity mainly allocated to Marvell's Trainium 2 in 1H25, with Microsoft contribution in 2026. Jefferies also notes AVGO faces ASIC transition in 2025, with 1H25 sales decline expected before V6p project drives 2H25 recovery, targeting $15bn full-year AI sales.

GOOGL: JMP downgrades to Hold from Buy

JMP is downgrading Alphabet from Market Outperform to Market Perform, citing antitrust risks that could substantially impact Google's U.S. search distribution and revenue. With a ruling expected by August 2025, they see this legal uncertainty as a key investor focus that will constrain multiple expansion. Despite a likely lengthy appeals process, JMP anticipates a severe court decision, noting European regulators' past ineffectiveness. Even in a best-case scenario where Google faces restrictions on U.S. search distribution revenue sharing, JMP prefers to step aside after the stock's 37% gain in 2024, viewing shares as fairly valued until there's more legal clarity.

NET: Cloudflare double upgraded to Buy from Sell at Goldman Sachs

Goldman Sachs analyst Gabriela Borges upgraded Cloudflare to Buy from Sell, raising the price target to $140 from $77. She expects positive catalysts driving improved performance in 2025, citing enhanced go-to-market strategy under CRO Marc Boroditsky since spring 2023. Goldman anticipates benefits from increased sales productivity through 2025, while industry feedback indicates AI shifting toward inferencing use cases, aligning with Cloudflare's Q3 commentary.

CYBR: Wells Fargo raises PT to $410 from $350 / Rosenblatt says CYBR could benefit from recent breach at Treasury

Wells Fargo raised CyberArk's price target to $410 from $350, maintaining Overweight rating and adding it to Q1 2025 Tactical Idea List. They expect strong performance through 2025, citing company's position to exceed Q1 and full-year expectations.

Rosenblatt highlights CyberArk's opportunity following Treasury Department breach involving Beyond Trust's compromised digital key. Analyst maintains Buy rating, seeing potential for CYBR to replace Beyond Trust across Treasury, federal agencies, and other customers.

TSLA: Truist says latest Tesla FSD drive 'more impressive' with no interventions

Truist maintains Tesla Hold rating and $360 target. Recent FSD v.13 test showed improvement with no interventions, contrasting with prior reviews revealing "material weaknesses." Still notes clear imperfections, advises against use, and questions whether issues stem from AI or sensor limitations.

VEEV: Veeva added to Q1 'Tactical Ideas List' at Wells Fargo

Wells Fargo added Veeva to Q1 "Tactical Ideas List," maintaining Overweight rating and $285 target. They expect higher valuation driven by Vault CRM retention visibility and Q1 catalysts including FY26 guidance, data cloud adoption, AI products, and horizontal app strategy clarity.

ALAB: northland downgrades ALAB To Hold from Buy, $120 PT

The firm is downgrading based on valuation and anticipated profit-taking in early 2025. ALAB trades at 44x CY28 consensus EPS of $2.99. While AI market dynamics and connectivity spending shifts suggest consensus estimates may be conservative (current projections: 39% revenue CAGR, 42% EPS CAGR), even aggressive modeling (51% revenue growth, 53% earnings growth) reaches $4.00 EPS on $1.98B revenue. Higher growth scenarios face challenges, as maintaining 50%+ revenue growth over four years is rare in semiconductors. For comparison, NVIDIA's CY20-24 revenue CAGR is estimated at 67% during AI boom. CSP AI spending likely to moderate by CY28. After IPO at $36 in May and closing at $133.45 on December 31, profit-taking appears likely.

SIRI: Sirius XM added to Q1 'Tactical Ideas List' at Wells Fargo

Wells Fargo added Sirius XM to Q1 2025 "Tactical Ideas List" with Underweight rating and $16 target. They expect H1 2025 challenges as company refocuses on in-car strategy, with pressure on self-pay net adds. Long-term subscriber pressures could lead to EV/EBITDA multiple contraction.

HOOD: Robinhood December volumes better than expected, says Piper Sandler

Piper Sandler raised Robinhood Q4 EPS estimate to 47c from 33c on stronger December trading volumes. Crypto volumes showed resilience, declining only 20% from November and exceeding estimates by over 2x. Firm maintains Overweight rating and $54 target.

BABA: Announces sale of Sun Art

Alibaba announced the sale of its Sun Art stake (~73.66%) to DCP Capital, along with an additional 5.04% held by New Retail, giving DCP ~78.7% ownership. Following October 2024's initial announcement and December's Intime disposal, this move aligns with Alibaba's strategy to divest non-core assets, focus on core operations, and enhance shareholder returns.