What India’s Addition to JPMorgan’s Bond Index Means: QuickTake

Follow Bloomberg India on WhatsApp for exclusive content and analysis on what billionaires, businesses and markets are doing. Sign up here.

Global funds are piling into India’s $1 trillion sovereign-bond market ahead of the country’s addition to global debt indexes. JPMorgan Chase & Co. announced last year it will add Indian government debt to its benchmark emerging-market index starting in June, a milestone for Asia’s third-largest economy.

That gave overseas investors a compelling reason to put money into rupee-denominated Indian government debt, which has been offering some of the highest returns in emerging markets. The move also means JPMorgan will be able to tout greater diversification following the exclusion of Russia, and as concerns over US-China geopolitical tensions persist.

For India, this heralds greater connectivity between its domestic and global financial markets — and the potential for lower borrowing costs.

1. What’s the back story?

India began liberalizing its economy in 1991 but does all its borrowing locally in rupee bonds because it wants to avoid the kind of dollar dependence that provoked the Asian currency crisis and other meltdowns. But in late 2019, India started working to gain access to bond indexes in a bid to lower its borrowing costs by generating additional demand — and to tout its financial discipline. As Covid-19 was ravaging the economy and the government was borrowing at record levels to fund a multibillion-dollar stimulus package, it opened a swath of its sovereign bond market to overseas investors. At the time, however, global funds were selling emerging-market assets to hoard dollars. More recently, foreign investors held less than 2% of Indian sovereign debt at the end of last year, against a ceiling of 6%. That’s among the lowest for any big emerging market. New Delhi balked at tax changes for foreigners that would have facilitated the trading of Indian debt on international platforms such as Euroclear. There were also domestic political objections about granting tax exemptions to foreign investors. Those concerns, however, were overridden by investors’ need for more options in EM sovereign debt.

2. What happens now?

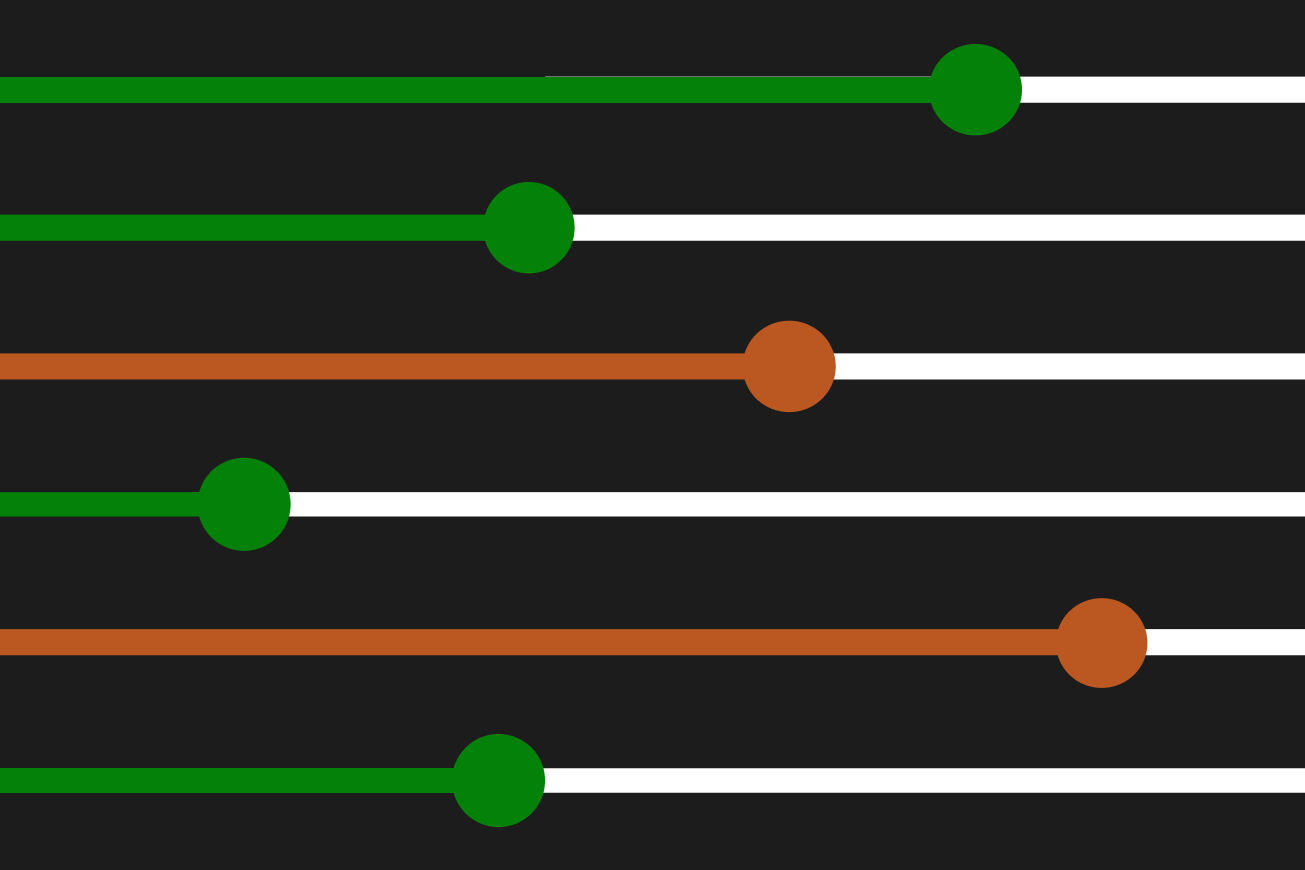

JPMorgan said that 23 bonds with a combined notional value of about $330 billion were eligible for its EM index when it announced India’s inclusion last September. Inclusion will be staggered over ten months at roughly 1% weight per month, up to a maximum weight of 10%. Following JPMorgan, Bloomberg Index Services Ltd. said earlier this year it will also add India’s Fully Accessible Route, or FAR bonds in its EM local currency index from January 2025. India has also been on the watchlist to get into FTSE Russell’s EM debt index since March 2021. Bloomberg LP is the parent company of Bloomberg Index Services Ltd, which administers indexes that compete with those from other providers.

India Will Get The Highest Possible Weight in the Index

Source: JP Morgan

3. Why expand the index?

Russia’s exclusion from JPMorgan’s EM gauges after the country invaded Ukraine in 2022 may have added incentives for the index compiler to fill the gap with Indian debt. Persistent geopolitical tensions between China and the US have put investors on the lookout for new opportunities in local currency EM debt. While foreigners play a small role in the Indian bond market, inflows have been picking up in recent years and the country’s assets have proven resilient to financial turbulence that has roiled other developing nations.

There's A Rush to Pick Up Bonds Before Inclusion in June

Source: Clearing Corporation of India

4. What are the potential benefits?

Investors will be able to diversify their portfolios and allocate money to a high-yielding market in the world’s fifth-largest economy. For India, it’s an opportunity to tap a larger pool of liquidity to meet growing needs. India’s bond market is likely see an additional inflow of as much as $30 billion after the inclusion, according to Standard Chartered Plc. That’s money India needs to finance its current-account deficit, which is at risk of expanding every time geopolitical tensions in the Middle East boil over, as higher crude oil prices could lead to a worsening trade balance for the net energy importer. Greater scrutiny from foreign investors, even though many of them will be tied to index decisions, could also re-energize Prime Minister Narendra Modi’s efforts to whittle down the fiscal deficit that exploded during the pandemic. For example, a pre-election budget at the start of this year delivered a positive surprise to bond traders with the government lowering its annual borrowing by about a trillion rupees ($15.6 billion).

5. What about the concerns?

The government and central bank remain concerned that foreign inflows will increase the volatility of local markets. Officials have in the past worried about the consequences of “hot money” sloshing in and out from offshore. The Reserve Bank of India’s monetary policy decisions may also need to ascribe greater weight to how foreign bond investors will respond. Money managers, meanwhile, point to the Euroclear issue, transaction efficiency and clarity on taxes as hurdles that haven’t gone away. For India to get the most out of index inclusion, making it easier for foreign investors to put their money in local bonds is crucial.

6. What’s the impact on markets?

At a time when global bond markets are in flux, the index news has kept Indian yields relatively steady. Benchmark 10-year yields have risen about ten basis points since last year, while similar-tenor US yields climbed over 100 basis points during the same period. In the long term, as foreign inflows rise, the nation may see structurally lower interest rates. The inclusion could also provide some relief for the rupee, which has been trading near a record low.

The Reference Shelf

- Abhishek Gupta from Bloomberg Economics gives his take on the bond inclusion and more.

- Bloomberg Opinion’s Andy Mukherjee on how foreign investors see India.

- India’s pension funds are wielding growing influence in the country’s financial markets, competing directly with major bond investors to secure debt sales

- More QuickTakes on India’s unemployment problem, its growing population, and its membership of BRICS.

— With assistance from Malavika Kaur Makol